Williams-Sonoma Inventory: Constructive Prospects (NYSE:WSM)

tupungato

Williams-Sonoma (NYSE:WSM) was final coated in 2022. At that time, dangers from close to time period macro challenges appeared fairly excessive and the inventory was assigned a maintain score. The inventory has practically tripled since then. Regardless of this appreciation, the inventory seems pretty valued and might be considered as a maintain or purchase.

Firm Overview

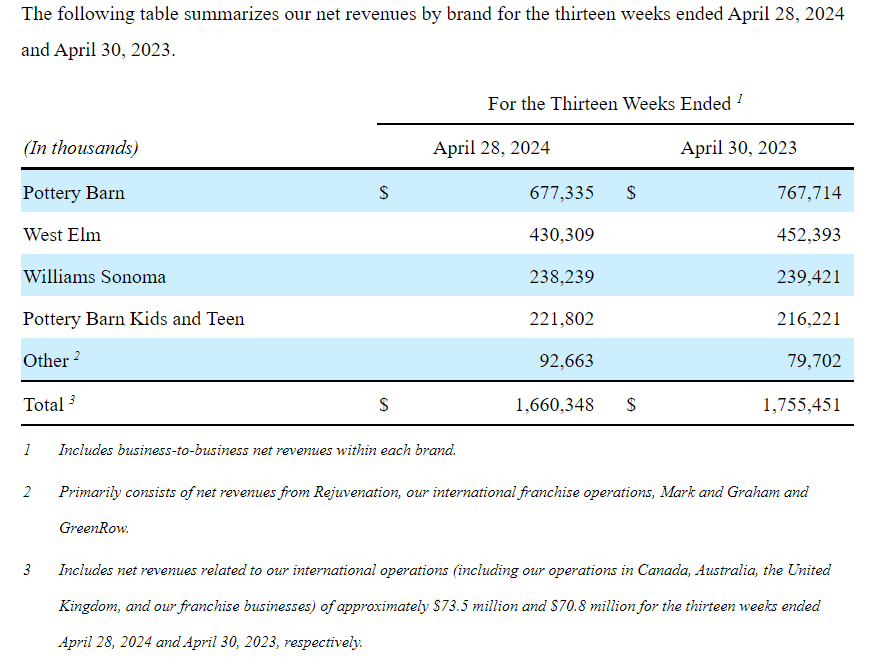

Williams-Sonoma is an American house furnishings retailer. The corporate’s flagship model Williams-Sonoma sells house furnishings, however is skewed in direction of kitchenware and gourmand meals, and primarily positioned as a way of life model catering to the prosperous phase. West Elm sells furnishings and is on the worth finish whereas Pottery Barn sits within the center. These manufacturers are bought via their very own impartial on-line and offline retail shops in addition to via shops of affiliate manufacturers owned by Williams-Sonoma as a part of a cross-selling technique. Mixed, these three manufacturers (together with Pottery Barn Youngsters and Teen) account for over 90% of revenues.

Smaller manufacturers embrace Rejuvenation (which sells house furnishings however is extra targeted on lighting, and is acknowledged for classic/heritage designs), Mark & Graham (targeted on baggage and equipment), and GreenRow (house furnishings made with sustainable supplies and manufacturing practices).

Williams-Sonoma Kind 10-Q, Q1 2024

Background and newest efficiency

The house furnishings business largely is determined by new house gross sales to drive progress however home shopping for exercise has been declining within the U.S. because of numerous causes together with excessive rates of interest and excessive home costs. New house gross sales dropped to a seven-month low in June, persevering with on final 12 months’s downward trajectory when house gross sales dropped to its lowest stage in 30 years. This in flip contributed to sluggish top-line progress for many American furnishings retailers.

|

Annual income progress YoY % |

YoY progress % (monetary 12 months in brackets) |

|

Williams-Sonoma |

-11% (FY ended Jan 2024) |

|

RH (RH) |

-16% (FY ended February 2024) |

|

Ethan Allen (ETD) |

-3% (FY ended June 2023), -20% (TTM) |

|

Arhaus (ARHS) |

5% (FY ended December 2023) |

|

Wayfair (W) |

-2% (FY ended December 2023) |

The corporate’s profitability and money movement era nonetheless has remained stable, enabling administration to proceed returning money again to shareholders. WSM’s FCF of over $1.4 billion final 12 months amply coated dividend funds of $237 million and share repurchases of $192 million.

|

Margins and FCF (monetary 12 months in brackets) |

Gross margin % |

Working margin % |

Free money movement (after stock-based compensation) |

|

Williams-Sonoma (FY ended Jan 2024) |

43% |

16% |

$1.4 billion |

|

RH (FY ended February 2024) |

46% |

13% |

-$107 million |

|

Ethan Allen (FY ended June 2024) |

61% |

17% |

$85 million |

|

Arhaus (FY ended December 2023) |

48% |

13% |

$67 million |

|

Wayfair (FY ended December 2023) |

31% |

-6% |

$404 million |

With home shopping for exercise persevering with to sluggish within the U,S, which accounts for over 90% of revenues, Williams-Sonoma’s quarterly efficiency has continued to say no this 12 months, just like business rivals.

|

Quarterly income progress YoY % |

Earlier quarter |

Most up-to-date quarter |

|

Williams-Sonoma |

-7% (Jan 2024) |

-5% (Apr 2024) |

|

RH |

-4% (Feb 2024) |

-2% (Could 2024) |

|

Ethan Allen |

-18% (Dec 2023) |

-21% (March 2024) |

|

Arhaus |

-3.5% (Dec 2023) |

-3% (March 2024) |

|

Wayfair |

0.5% (Dec 2023) |

-1.6% (March 2024) |

Profitability metrics proceed to stay constructive, helped by administration’s technique of lowering site-wide promotions.

|

Gross margin % |

Earlier quarter |

Most up-to-date quarter |

|

Williams-Sonoma |

46% (Jan 2024) |

48% (Apr 2024) |

|

RH |

44% (Feb 2024) |

44% (Could 2024) |

|

Ethan Allen |

60% (Dec 2023) |

61% (March 2024) |

|

Arhaus |

46% (Dec 2023) |

46% (March 2024) |

|

Wayfair |

30% (Dec 2023) |

30% (March 2024) |

|

Working margin % |

Earlier quarter |

Most up-to-date quarter |

|

Williams-Sonoma |

20% (Jan 2024) |

20% (Apr 2024) |

|

RH |

9% (Feb 2024) |

8% (Could 2024) |

|

Ethan Allen |

13% (Dec 2023) |

10% (March 2024) |

|

Arhaus |

12% (Dec 2023) |

6% (March 2024) |

|

Wayfair |

-6% (Dec 2023) |

-6% (March 2024) |

The corporate continues to take care of a stable steadiness sheet with zero debt, and free money movement era stays regular (FCF of $800 million over the previous two quarters is up 27% YoY over the identical interval final 12 months).

Prospects

Close to time period progress prospects may stay difficult amid weak home shopping for setting

It stays to be seen when charge cuts would happen. Administration’s technique to navigate close to time period macro challenges embrace specializing in reworking exercise in addition to specializing in smaller purchases which couldn’t solely assist gross sales and drive buyer acquisition in a budget-conscious setting but additionally may encourage repeat purchases long run. Particularly, administration famous West Elm, their second-largest model accounting for round 1 / 4 of revenues, has predominantly been a big-furniture enterprise however going ahead there will likely be higher concentrate on growing the share of smaller gadgets inside the model’s portfolio.

These initiatives nonetheless could assist cushion however not totally offset the affect of a slowing house furnishings market (house patrons are sometimes greater spenders on furnishings, home equipment and even reworking than present house homeowners), and thus if rates of interest stay elevated, close to time period progress may stay destructive or muted.

Medium time period housing market may stabilize and recuperate

Whereas excessive rates of interest could hinder home shopping for exercise close to time period, elementary demand traits may assist residential property shopping for exercise long run. Simply 51% of millennials within the U.S. are owners and the U.S. at present has a scarcity of homes estimated at between 4-7 million. As housing provide step by step will increase (housing begins have been on a constant uptrend over the previous a number of years regardless of seasonal fluctuations) and mortgage charges decline (mortgage charges have been on a promising downward trajectory over the previous few months), home shopping for exercise is anticipated to recuperate which in flip ought to spur spending on family furnishings.

Enterprise mannequin positions them properly to profitably seize market share in fragmented furnishings market long run

The furnishings business is fragmented however Williams-Sonoma might be amongst these higher positioned to achieve share. The corporate’s multi-brand portfolio positions them to properly seize pockets share from numerous buyer demographics (via cross-selling alternatives in addition to via their loyalty program The Key which rewards members for purchases throughout all of Williams-Sonoma’s household of manufacturers), leaning on which the corporate could also be higher positioned to introduce new manufacturers (GreenRow was launched final 12 months) and scale manufacturers and thereby additional broaden the market share. Rejuvenation has grown by double digits over the previous two quarters, and Mark & Graham has grown by single digits in Q1 2024 after rising by double digits final 12 months. Administration talked about of their This autumn 2023 earnings name that they’re optimistic Rejuvenation may turn out to be their subsequent billion greenback model. In the meantime with the corporate’s a number of manufacturers sharing company sources, such growth might be extra value environment friendly in comparison with single-brand rivals.

As well as, their huge product assortment and vertically built-in operations (which spans sourcing, design and distribution) positions them properly to seize share in America’s giant and fragmented B2B house, a market administration sees as a major progress alternative. WSM’s B2B enterprise, on observe to surpass a billion {dollars}, grew 10% YoY in Q1 2024, accelerating from 5% YoY the earlier quarter.

Innovation, advertising and marketing and worldwide growth to assist progress

Williams-Sonoma continues to spend money on innovation and advertising and marketing to drive gross sales. Newest efforts embrace expertise from Salesforce to achieve a 360 diploma view of consumers throughout all their manufacturers, AI to ship customized advertising and marketing messages, in addition to collaborations with Netlfix and Shondaland (which yielded a Bridgerton themed assortment final 12 months), and Indian celebrity Deepika Padukone.

Williams-Sonoma has been strategically increasing into a number of worldwide areas together with Canada, Mexico, India, and the UK. India specifically stands out for the sheer measurement of the chance. About 70% of Indians personal a house, which is a excessive quantity in comparison with America (65%), nonetheless a lot of that is owned by rural Indians (95% possession charge). Housing demand outstrips provide in city India and the nation’s burgeoning center class (estimated at over 400 million individuals at present and projected to develop to over 700 million by 2030 which might be greater than double the complete inhabitants of the U.S.) specifically are eager to improve, presenting huge alternatives for India’s house furnishings market. Pottery Barn at present has simply 3 areas within the nation and West Elm has 4 (for perspective Pottery Barn and West Elm have over 150 and over 100 areas within the U.S. respectively).

Provide chain initiatives may assist margin growth and money movement

Williams-Sonoma has been aggressively investing in provide chain upgrades and enhancements over the previous few years together with taking extra management over their provide chain. For 2024, Williams-Sonoma administration expects CAPEX of $225 million, 75% of which might be invested into provide chain and eCommerce expertise developments. Administration famous of their Q3 2023 earnings name that provide chain investments are flowing via their revenue assertion with decrease provide chain prices and better gross sales margins boosting income. WSM’s gross margins have improved sequentially over the previous few quarters, rising from 41.2% in January 2023 to 48% in April 2024 (their most up-to-date quarter).

There may be nonetheless room for additional enchancment in delivery prices; CEO Laura Alber mentioned of their Q1 2024 earnings name that there’s “nonetheless much more to do” to ship the “good order” i.e., orders which are damage-free and on-time and mentioned that the corporate is taking a look at lowering return charges and damages, saying “We’re digging into and root-causing each single incident that we’ve to make it possible for that isn’t taking place once more, and that’s going to proceed to go all year long and past.”

Moreover, eCommerce penetration for the furnishings business is beneath 50% within the U.S. so provide chain enhancements couldn’t solely be probably margin accretive however may assist drive top-line progress via elevated on-line gross sales as properly.

Valuation

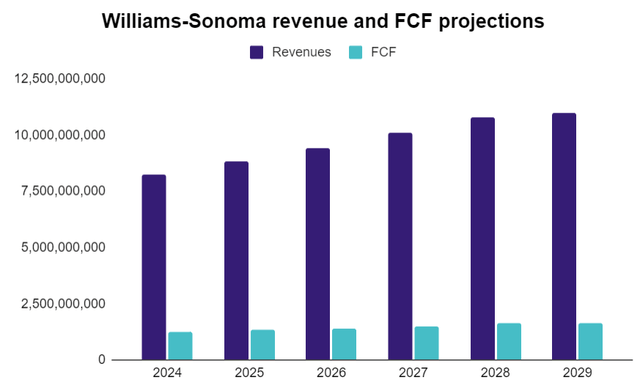

Williams-Sonoma generated revenues of $7.7 billion in FY 2023. Over 90% of revenues are generated within the U.S. which suggests America is more likely to stay a significant progress driver medium time period. Whereas America’s housing market is within the doldrums because of excessive borrowing prices, long run prospects are probably extra constructive as structural demand traits drive home shopping for exercise and subsequently house furnishings gross sales. WSM has to date bought off to a powerful begin with Q1 2024 revenues down 5.4% YoY, enhancing from -7.2% the identical interval final 12 months, which can presumably counsel the market is on the trail in direction of stabilization. Analysis projections forecast a mid-single digit progress charge in America’s furnishings business medium time period.

For causes outlined earlier WSM may drive natural progress via market share good points, significantly for smaller manufacturers with a protracted progress runway within the U.S. reminiscent of Rejuvenation which has been rising by double digits currently and which administration anticipates might be their subsequent billion-dollar model. At practically $370 million final 12 months, these rising manufacturers (lumped into an “Different” class) collectively account for beneath 5% of revenues, and thus regardless of double digit progress could however have a comparatively small contribution to progress medium time period. In the meantime continued investments in provide chain efficiencies may assist margin growth from the mid teenagers at present. Taking all these elements under consideration, administration’s long run progress goal of mid-to-high single digit annual income progress and working margins within the mid to excessive teenagers doesn’t look overly optimistic.

Subsequently, taking the next assumptions under consideration suggests WSM is value roughly $21 billion, barely above their $19 billion market cap at present. Given the inherently cyclical nature of the house furnishings business, forecasting WSM’s DCF on a yearly foundation could have restricted utility, as a substitute I’ve approached it on an annual foundation over a five-year interval.

|

Income progress YoY % |

7% yearly over the subsequent 5 years (based mostly on the mid-point of administration’s long run progress goal which for causes outlined earlier seem believable. For perspective, WSM’s revenues rose from $5 billion in FY 2016 to $7.7 billion in FY2023 translating into an annual progress charge of round 6.5%) |

|

Terminal progress charge YoY % |

2% |

|

Internet margin % |

15% (conservatively based mostly on administration’s long run goal, for perspective the corporate’s internet margin TTM = 13.8%) |

|

Depreciation (% of revenues) |

4% |

|

CAPEX (% of revenues) |

4% |

|

Low cost charge % |

8.5% (based mostly on WSM’s WACC) |

On a relative foundation Williams-Sonoma is buying and selling at a slight premium with their ahead P/E of 18.6 being larger than the sector median of 15 and their five-year common of 13 nonetheless this might be justified by the corporate’s above common profitability metrics.

|

ROE % (TTM) |

|

|

Williams-Sonoma |

58% |

|

RH |

30% |

|

Ethan Allen |

15.2% |

|

Arhaus |

40% |

|

Wayfair |

– |

Dangers

Execution dangers

Strategic missteps round model constructing, advertising and marketing, provide chain improvement, and response to altering buyer traits may lead to progress charges and margins falling behind projections.

Extended housing market slowdown

America remains to be the primary progress driver of WSM’s monetary efficiency. If the market fails to stabilize or the present downturn worsens, WSM’s progress and margin may fall in need of projections or may see a chronic interval of sharply destructive progress which may have a major affect on the inventory’s valuation.

Conclusion

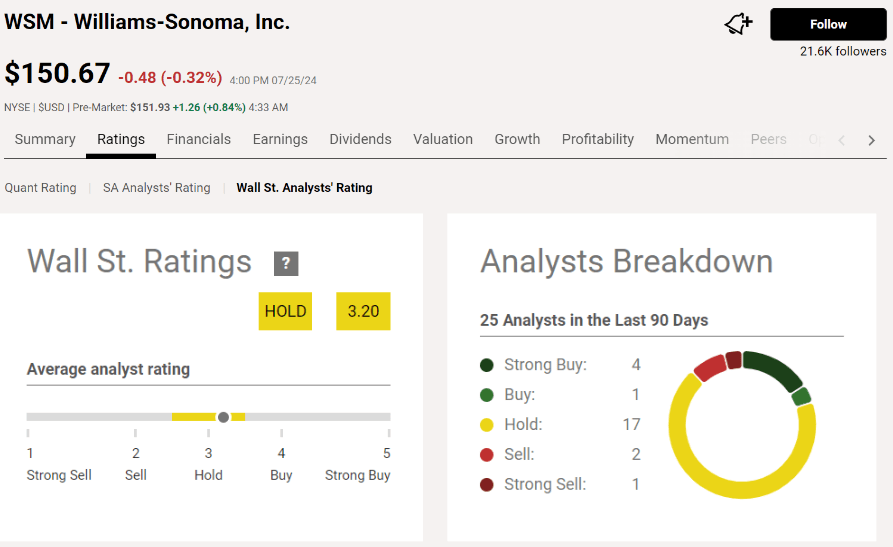

Williams-Sonoma has a maintain analyst consensus score. Whereas close to time period prospects might be difficult given a sluggish housing market, there are indicators of stabilization and the corporate’s enterprise fundamentals are engaging with good long run prospects, stable financials, and a valuation that seems truthful. The inventory might be considered as a maintain or purchase.

Looking for Alpha