Ford: Purchase The Pullback And Its Safe Dividend Funding Thesis (NYSE:F)

CiydemImages

F’s Funding Thesis Is Presently Supported By Its Wealthy Ahead Dividend Yields

We beforehand lined Ford Motor (NYSE:F) in Could 2024, discussing why we had maintained our Purchase ranking then, with its dividend funding thesis nonetheless strong and secure because of the administration’s raised FY2024 Free Money Stream steering.

With the legacy automaker’s diversified platform choices persevering with to carry out properly in an inherently cyclical market, we believed that it remained properly positioned to outlive the sluggish however certain electrification transition over the following decade.

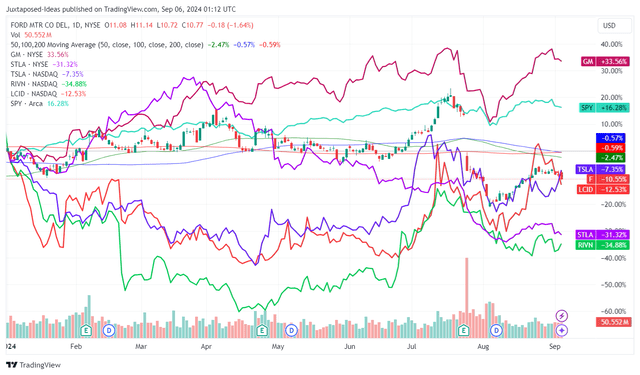

F YTD Inventory Worth

Buying and selling View

Since then, F has already charted a formidable rally to retest its July 2023 tops, solely to be drastically moderated after the double high/ bottom-line misses within the FQ2’24 efficiency regardless of the (but once more) raised FY2024 Free Money Stream steering.

Even so, we’re reiterating our Purchase ranking right here, with the pullback triggering an expanded ahead dividend yields, considerably aided by the rising Hybrid gross sales.

We will additional talk about.

1. F’s Dividend Yields Is Getting More and more Wealthy

For now, F has raised its FY2024 adj Free Money Stream technology steering to $8B on the midpoint (+25% YoY) within the latest FQ2’24 earnings name, up from the unique steering of $6.5B on the midpoint (-4.4% YoY) provided within the FQ4’23 earnings name.

Whereas the administration has opted to keep up its fastened dividends paid out per share at $0.15, we consider that readers could look ahead to a slightly wealthy supplemental dividends normally introduced in FQ4 earnings calls certainly, because it has at $0.65 in FQ4’22 and $0.18 in FQ4’23.

Based mostly on F’s dividend coverage of returning 40% to 50% of its Free Money Stream to shareholders, we may even see FQ4’24 convey forth supplemental dividends per share of between $0.19 and $0.39.

That is based mostly on $599M of quarterly fastened dividends paid out and the steady shares excellent at ~4,022M over the following two quarters, with it additional supporting the legacy automaker’s strong funding thesis.

These projections will not be overly aggressive both, since F has beforehand generated wealthy Free Money Stream of $9.08B in FY2022 (+97.8% YoY) and $6.8B in FY2023 (-25.1% YoY) – with the historic payouts (fastened and supplemental dividends) implying strong shareholder returns at 54.9% and 45.9%, respectively.

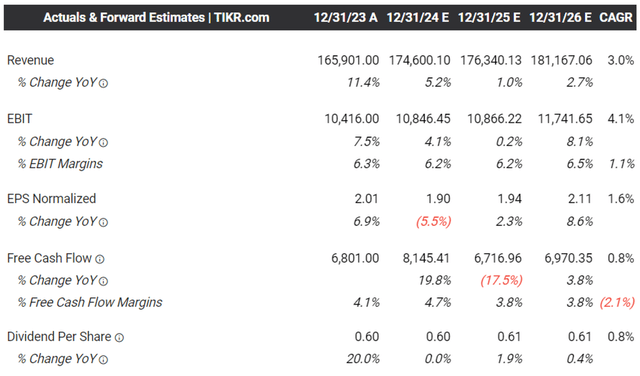

The Consensus Ahead Estimates

Tikr Terminal

Because of F’s constantly raised steering, it’s unsurprising that the consensus have reasonably raised their ahead estimates, with the automaker anticipated to generate an expanded Free Money Stream technology at a CAGR of +0.8% by FY2026.

That is in comparison with the earlier estimates of -0.3% and the normalized progress of -8.6% between FY2016 and FY2023, with it implying the market’s quiet confidence concerning the automaker’s capability to constantly pay out dividends.

The identical has been noticed in F’s bettering TTM Dividend Protection Ratio of seven.26%, in comparison with the 1.23% noticed by the top of 2023 and the sector median of two.66%, with it additional underscoring why buyers could merely stay affected person in the course of the slightly unstable fluctuation of the buyer automotive pattern.

2. Rising Hybrids Underscore F’s Nicely Diversified Automotive Choices

As mentioned in our final article, F has had a extremely strategic automotive choices throughout Hybrid, ICE, and EV platforms – permitting the legacy automaker to modify its progress levers relying on the cyclical market demand.

The identical has been noticed by August 2024, the place the automaker studies 16.39K gross sales of Hybrids models (-2.5% MoM/ +49.8% YoY) and 125.46K models on a YTD foundation (+49.2% YoY), with the accelerating YoY progress properly exceeding ICE YTD gross sales at -0.5% YoY and to a lesser extent, EVs YTD gross sales at +63.9% YoY.

That is in comparison with a yr in the past, with Hybrid YTD gross sales of +11.9% YoY, ICE at +8.3% YoY, and EVs at +6.5% YoY.

And that is additionally why we proceed to consider that the F inventory has been in a position to carry out properly on a YTD foundation (apart from the affect of the FQ2’24 misses), with it constructing upon the strong electrification developments noticed within the business markets and the increasing Ford E-transit van YTD gross sales to eight.07K (+75.8% YoY).

With the administration already suspending a lot of their EV investments whereas focusing on a +40% YoY progress in its FY2024 world hybrid portfolios, we consider that the automaker’s hybrid gross sales could proceed to speed up in the course of the stalling electrification pattern.

So, Is F Inventory A Purchase, Promote, or Maintain?

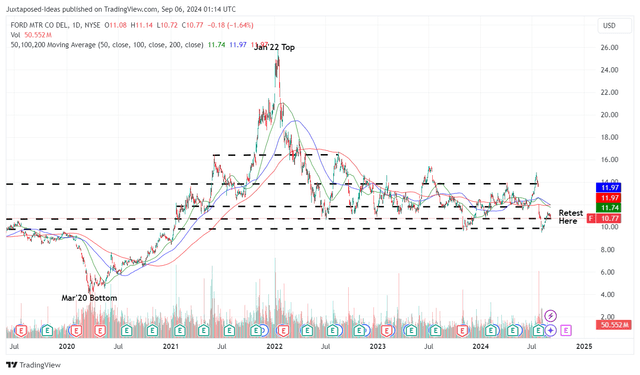

F 5Y Inventory Worth

Buying and selling View

Because of the latest pullback and the inventory buying and selling properly beneath its 50/ 100/ 200 day transferring averages, F’s dividend funding thesis is much more engaging with an expanded ahead dividend yield of seven.12%, in comparison with its 4Y common of 4.44% and the sector median of two.39%.

That is particularly because the Fed is projected to pivot by 25 foundation factors within the upcoming September 2024 FOMC assembly, which has additionally resulted within the moderating US Treasury Yields of between 3.53% and 5.04%, in comparison with the height of 4.95% and 5.51% noticed in October 2023.

With F being slightly unstable in its value actions, merchants could contemplate doing swing trades as properly, based mostly on the established assist ranges of $9.90 and resistance ranges of $13.80 – with it permitting buyers to make the most of its minimal progress alternatives throughout an unsure macroeconomic outlook.

In consequence, we’re reiterating our Purchase ranking right here.

Threat Warning

It’s no secret that F has had quite a few recall points over the previous few years, one which the administration has additionally commented on in the course of the FQ2’24 earnings: “We did see guarantee value enhance in 2Q, after all, tied to new applied sciences, FSAs and inflationary pressures for the price of restore.”

If something, the recall quantity has been comparatively excessive at:

- 90.73K Bronco/ F-150/ Edge/ Explorer/ Lincoln/ Nautilus/ Lincoln Aviator models with defective engine consumption valves in August 2024,

- practically 40K Bronco Sport/ Escape SUVs with defective gas injectors in April 2024,

- 1.9M Explorers SUVs on account of threat of flying trim items in January 2024, and

- 112.96K F-150 vehicles over rear axle bolt points in January 2024.

It goes with out saying that F’s recollects seem like outpacing its total bought volumes at 1.4M automobiles on a YTD foundation within the US (+4.4% YoY).

Given these headwinds, it’s also unsurprising that the administration has reported the bottom-line miss within the FQ2’24 earnings name, with guarantee/ recall prices totaling $2.3B (+53.3% QoQ/ +43.7% YoY) and the legacy automaker remaining the “most-recalled automaker for the third straight yr.”

Mixed with the estimated future Guarantee and Discipline Service Actions greater at $12.55B in H1’24 (+26.8% YoY), we consider that F’s prospects are prone to stay combined till the standard points are resolved and consequently, revenue margins enhance.

In consequence, buyers could wish to mood their near-term expectations, with the one silver lining being its increasing Free Money Stream technology and wealthy dividends in the course of the ongoing turnaround.