Apple Inventory: Buffett Is Educating The Market A Lesson (Score Downgrade) (NASDAQ:AAPL)

ozgurdonmaz

Apple (NASDAQ:AAPL) submitted a strong earnings sheet for the third fiscal quarter, that resulted, regardless of weak progress within the firm’s largest {hardware} class iPhones, in a large prime line and backside line beat. Providers revenues additionally reached a brand new all-time excessive, indicating that the corporate’s transition away from hardware-related revenues is constant. Moreover, Warren Buffett, a significant investor in Apple, drastically in the reduction of its funding within the iPhone maker within the second-quarter, creating promoting strain for the expertise firm. Since shares have reached my honest worth estimate and I anticipate sentiment headwinds associated to Buffett’s inventory gross sales, I consider the danger profile has deteriorated right here.

Earlier score

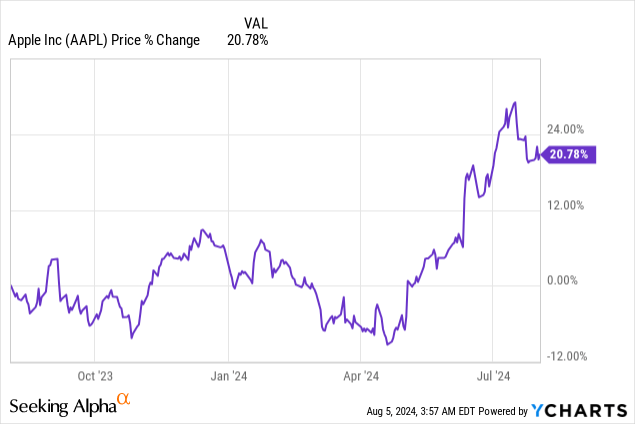

I rated shares of Apple a robust purchase in early Might, within the mid-$180 value vary, on account of what I noticed was a state of affairs of probably accelerating capital returns. The expertise firm noticed robust product uptake within the Providers enterprise within the final quarter, resulting in a file 28% income share on this class. Nonetheless, Apple is seeing no progress within the largest income class and shares are actually the costliest within the Large-5 tech business group whereas providing the bottom anticipated EPS progress. With Buffett’s drastic discount in its Apple funding within the second-quarter additionally creating uncertainty, I’m altering my score to carry.

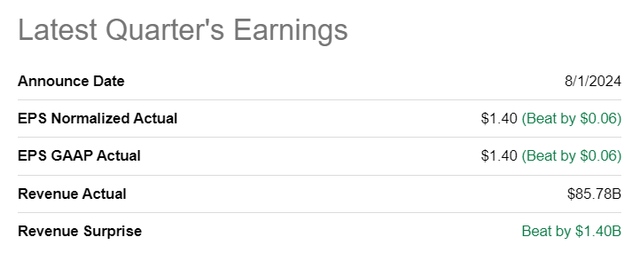

Apple beat earnings estimates

Apple beat common Wall Road estimates for Q3 revenues and earnings by first rate margins. The expertise firm reported adjusted earnings of $1.40 per-share, which beat the consensus estimate by $0.06 per-share. Income got here in at $85.8B, a June-quarter file, and beat the common prediction by a big $1.4B, mainly on account of energy in Providers.

Apple’s prime line image progress stays weak, however Providers stay a brilliant spot

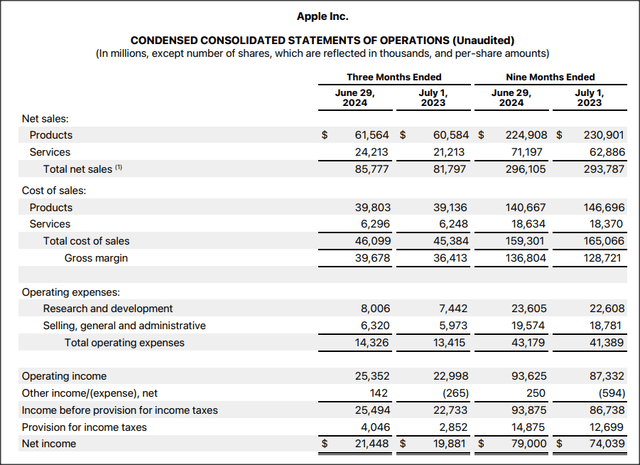

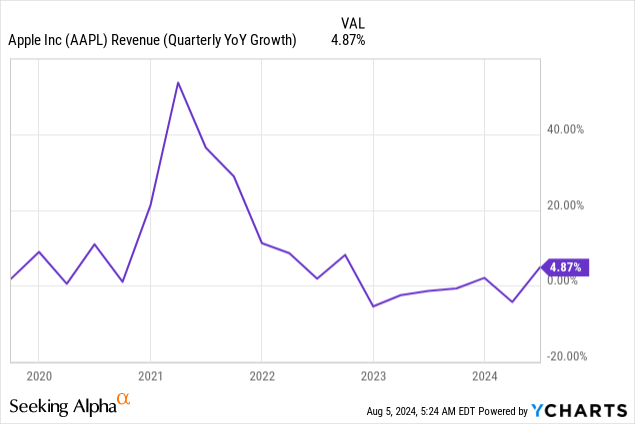

Within the third-quarter, Apple’s returned to optimistic prime line progress as its revenues reached $85.8B, exhibiting 5% 12 months over 12 months progress. Within the earlier quarter, weak iPhone gross sales truly brought about Apple’s consolidated revenues to fall 4% 12 months over 12 months.

Whereas iPhone revenues continued to say no in Q3’24 (they had been down 1% 12 months over 12 months to $39.7B), Apple has once more offset weak spot in its largest {hardware} class with progress in Providers. Actually, Providers reached a brand new all-time income excessive of $24.2B within the third-quarter, leading to a phase prime line progress fee of +14% Y/Y. Providers embody AppleCare, Apple One, Apple TV+, iCloud, Apple Music, Apple Pay and different non-hardware associated income streams and have been a brilliant spot for Apple. With rising product uptake in Providers, the phase represented a income share of 28% in Q3’24 in contrast towards a income share of 26% within the year-earlier interval. Solely iPads had a quicker income progress fee from a class standpoint than Providers (+24% Y/Y) within the third-quarter.

Not solely does Providers see the second-fastest class income progress inside Apple’s portfolio, however Providers can also be turning into extra vital as a income contributor on a consolidated foundation. In the long run, I see Apple’s Providers contribute at the least one-third of whole revenues.

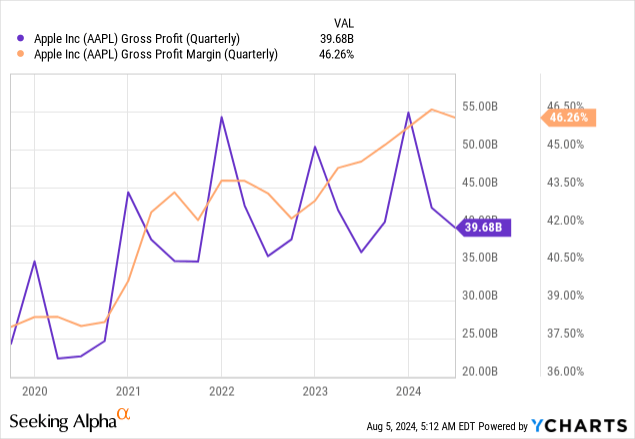

Apple did stay extensively worthwhile, nevertheless, as was anticipated. The high-margin Providers enterprise has pushed an growth in Apple’s gross margin within the final a number of years: in Q3’24, Apple’s gross margin reached 46.3%, exhibiting a strong 1.7 PP margin acquire 12 months over 12 months. Whereas the Providers enterprise stole the present as soon as once more in Apple’s Q3 earnings launch, it was additionally simply reported that Warren Buffett drastically minimize its stake within the expertise firm, probably due to Apple’s weak prime line progress prospects.

Implications of Buffett’s Q2 Apple sale

Warren Buffett’s Berkshire Hathaway simply disclosed in a regulatory submitting that it minimize its funding in Apple by about half within the second-quarter. Berkshire Hathaway bought 390 million shares of Apple in Q2, following a sale of 115 million shares within the earlier quarter. Berkshire Hathaway nonetheless owned shares valued at $84.2B on the finish of the second-quarter, nevertheless. Apple has been the one largest inventory place in Berkshire Hathaway’s portfolio in 2016.

Warren Buffett’s Q2 Apple sale is ready so as to add some strain on the expertise firm’s inventory, in my view, and it raises questions as to why the famed investor bought. One motive could also be Apple’s lack of fabric hardware-related progress, indicating that the investor would not anticipate a reinvigoration of the corporate’s prime line given the absence of any main new product launches. Apple has not produced any important progress in its prime line for years as iPhone gross sales began to taper off after the pandemic.

One more reason could also be Apple’s now stretched valuation. Since Berkshire Hathaway began to purchase into Apple in 2016, at a a lot lower cost, the funding firm booked severe capital positive factors from its latest gross sales. Within the brief time period, I anticipate Apple to undergo from detrimental sentiment cling, and I’d not be shocked to see Apple inventory gross sales within the Berkshire Hathaway portfolio in Q3.

The lesson right here is that Buffett possible expects a recession, or at the least a significant correction within the inventory market… which, given yesterday’s market stoop, is a priority many buyers could now share as properly. Since expertise firms have achieved extraordinarily properly within the final two years, particularly Apple, the tech phase could also be particularly weak to a valuation draw-down. With Buffett scaling again its tech publicity, buyers could need to consider whether or not they’re additionally chubby high-priced, low-growth investments like Apple which can be weak to profit-taking.

Apple’s valuation

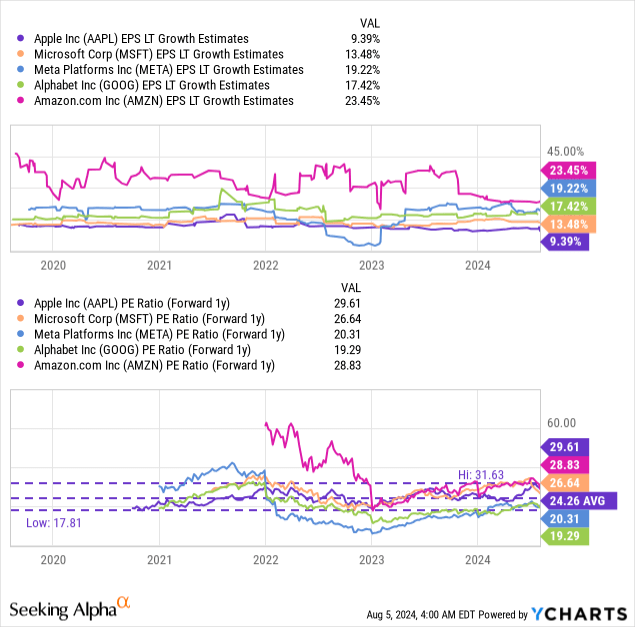

Apple’s shares are priced at a P/E ratio of 29.6X which makes the corporate the costliest expertise funding within the top-5 large-cap tech business group. The common P/E ratio within the business group is 24.9X whereas Apple’s long run P/E ratio is 24.3X (implying a 22% premium). Amazon (AMZN) is buying and selling at a 21% low cost to its 3-year common P/E ratio, Microsoft (MSFT) at a 6% low cost, Alphabet (GOOG) at a 7% low cost and Meta Platforms (META) at a 14% premium.

Additionally it is noteworthy that on account of headwinds within the iPhone class, Apple is anticipated to see the weakest long-term earnings per-share progress of solely 9.4%. In different phrases, Apple is the costliest tech firm within the business group right here whereas providing buyers the slowest EPS progress. For my part, Alphabet gives buyers the finest bang for his or her bucks proper now, whereas Meta Platforms can also be a purchase, based mostly off of valuation and free money movement.

In my final work on Apple in Might I argued that I noticed a good worth for Apple’s shares of $215 (which implied a 30X ahead P/E ratio). This honest worth was based mostly off of rising Providers income share and potential for inventory buybacks as a method for the corporate to return a big portion of its working earnings and free money movement to shareholders. Since Apple has reached my inventory value goal — shares are presently buying and selling at $220 — I’m altering my score to carry. What provides to my maintain score is the truth that Berkshire Hathaway has drastically decreased its stake within the expertise firm, which could possibly be seen as a lack of confidence in Apple’s progress prospects.

Apple’s dangers

Apple remains to be overly concentrated in hardware-related income streams, which collectively represented 72% of the agency’s consolidated prime line within the third-quarter. What additional provides to the corporate’s dangers, in my view, is that Apple is concentrated mainly on the patron electronics market which tends to be cyclical and which subsequently creates earnings and free money movement headwinds for Apple throughout a downturn. Inside the {hardware} class, Apple is seeing slowing progress for the corporate’s flagship product iPhones which Apple has not but been in a position to change with one other {hardware} product.

Closing ideas

Apple is a well-run expertise firm with appreciable momentum in Providers which has resulted in robust gross margin positive factors in the previous few years. Providers now characterize 28% of consolidated revenues. Nonetheless, the {hardware} class, particularly iPhones, is turning into a drag on Apple’s progress. I consider the dangers inherent within the {hardware} class are counterbalanced by continuous momentum in Providers, however Apple’s shares have now reached my honest worth goal, triggering a change in score to carry. I additionally consider that Buffett’s sale of Apple in Q2 may have deep implications for buyers from a sentiment perspective and will restrict any additional upside, particularly on condition that Apple is now buying and selling at a excessive 30X P/E ratio. With shares reaching my inventory value goal and Buffett’s actions doubtlessly creating detrimental sentiment overhang, I’m down-grading Apple to carry.