The 1-Minute Market Report August 25, 2024

SlavkoSereda/iStock by way of Getty Photographs

The 1-Minute Market Report August 25, 2024

On this temporary market report, we take a look at the varied asset courses, sectors, fairness classes, exchange-traded funds (ETFs), and shares that moved the market greater and the market segments that defied the pattern by transferring decrease.

Figuring out the pockets of power and weak point permits us to see the path of serious cash flows and their origin.

The rebound continues

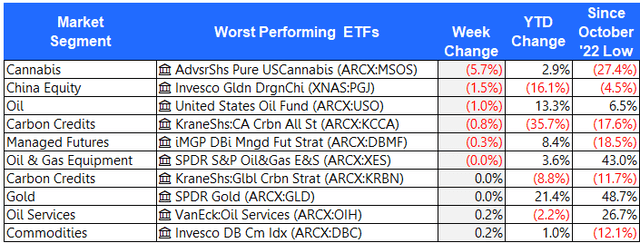

The S&P 500 took a critical hit firstly of August however has since rebounded properly. The proximate trigger for the selloff was the weak jobs report which rekindled fears of recession. The final two weeks have been sturdy, bringing us again to inside 0.6% of the all-time excessive. This is a take a look at the final 4 weeks.

ZenInvestor.org

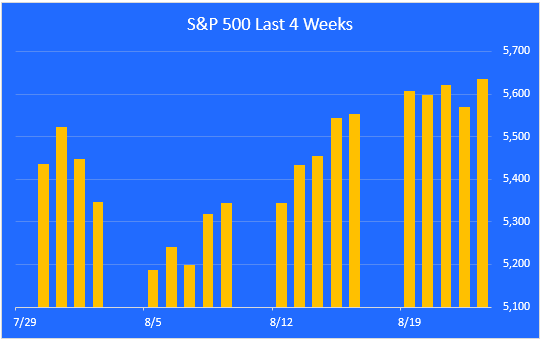

A take a look at month-to-month returns.

This chart exhibits the month-to-month returns for the previous yr. August obtained off to a shaky begin however is now solidly within the inexperienced. Keep in mind that pullbacks of 5% or so are frequent throughout bull markets.

ZenInvestor.org

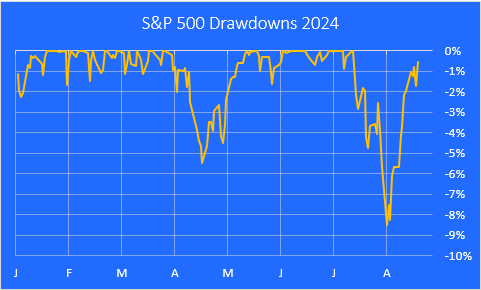

A take a look at the July-August selloff.

Here’s a nearer take a look at the July-August decline, utilizing a drawdown chart. The utmost drawdown to date was 8.5% from the height on July 16.

ZenInvestor.org

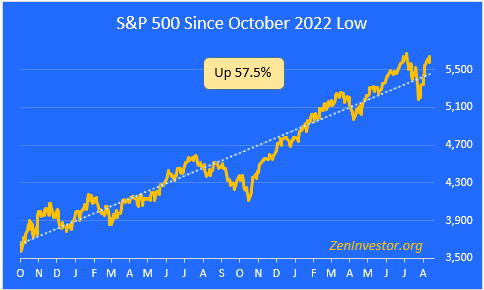

A take a look at the bull run because it started final October.

This chart highlights the 57.5% achieve within the S&P 500 from the October 2022 low via Friday’s shut. We dipped under the trendline briefly, and it appears to be like like we could also be headed for an additional file excessive this week.

ZenInvestor.org

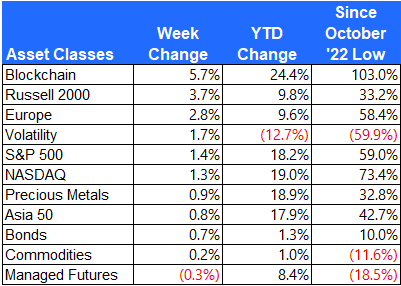

Main asset class efficiency.

Here’s a take a look at the efficiency of the foremost asset courses, sorted by final week’s returns. I additionally included the returns for the reason that October 12, 2022 low for extra context.

One of the best performer final week was the Blockchain Index. The worst performer was Managed Futures, which are inclined to favor the draw back. Small caps had one other huge week.

ZenInvestor.org

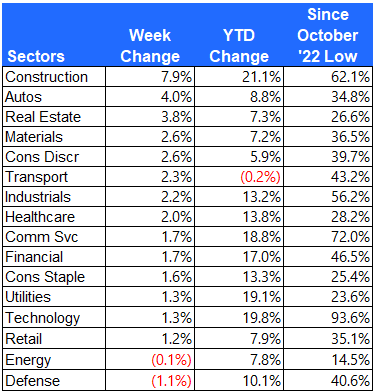

Fairness sector efficiency

For this report, I take advantage of the expanded sectors as revealed by Zacks. They use 16 sectors quite than the usual 11. This provides us added granularity as we survey the winners and losers.

New residence building had a great week. Auto shares outperformed after an upbeat retail gross sales report. Actual Property lastly caught a bid as traders anticipate falling bond yields.

ZenInvestor.org

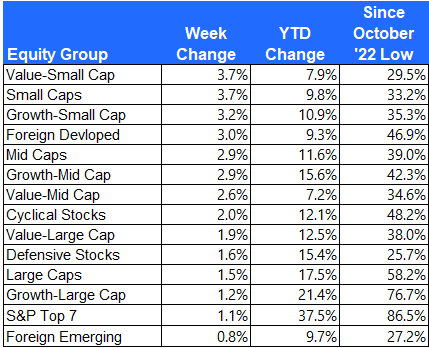

Fairness group efficiency

For the teams, I separate the shares within the S&P 1500 Composite Index by shared traits like development, worth, dimension, cyclical, defensive, and home vs. overseas.

The highest three teams final week have been the Small Caps as they staged a powerful comeback rally. International Developed markets outperformed the U.S. however Rising Markets have been held again by the weak point in Asia.

ZenInvestor.org

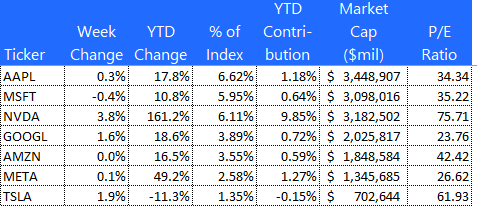

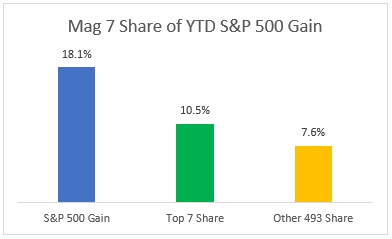

The S&P Magazine 7

Here’s a take a look at the seven mega-cap shares which have been main the market over the previous yr. These seven shares account for 58% of the overall YTD achieve within the S&P 500. That is down from 87% firstly of the yr, offering proof that participation within the bull market is broadening. Tesla (TSLA) was the massive winner whereas Microsoft (MSFT) struggled.

ZenInvestor.org

The S&P Prime 7 dominance is fading

ZenInvestor.org

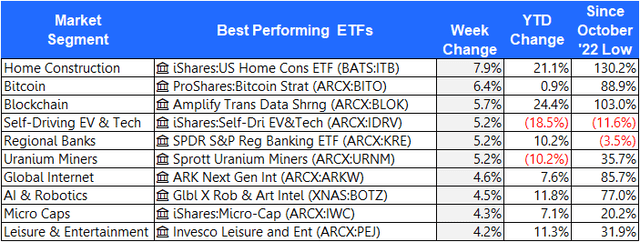

The ten best-performing ETFs from final week

House Development and Bitcoin surged greater final week.

The ten worst-performing ETFs from final week

Growers and entrepreneurs of Hashish had a tough week, YTD, and full cycle. This surprises and disappoints me. There was a lot hype about these shares as weed turned authorized in a rising checklist of states, however someway these firms cannot appear to determine the best way to make a revenue.

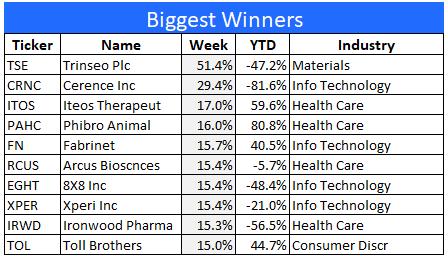

The ten best-performing shares from final week

Listed below are the ten best-performing shares within the S&P 1500 final week. Emergent

Trinseo (TSE) bounced from a low base on the information that the insiders have been shopping for huge stakes.

ZenInvestor.org

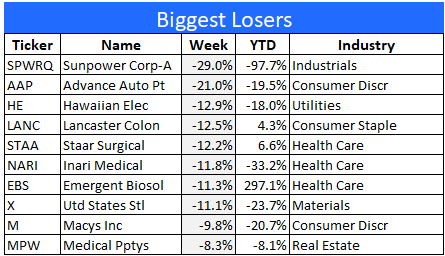

The ten worst-performing shares from final week

Listed below are the ten worst-performing shares within the S&P 1500 final week.

Sunpower (OTC:SPWRQ) appears to be like headed for the mud bin.

ZenInvestor.org

Closing ideas

Small Caps have been the celebs of the present final week, whereas the Magazine 7 struggled to maintain up. All eyes can be on Nvidia subsequent week as they announce their earnings on Wednesday. The bar is about excessive for Nvidia, and if they continue to be true to kind they may blow previous their numbers with ease.

However what in the event that they miss their numbers, or current a disappointing forecast for subsequent quarter? I believe the market will react with a fierce selloff, since Nvidia is the highest inventory within the prime trade and the market as a complete.

With a lot driving on Nvidia’s earnings report, it is little marvel that traders are a bit skittish. Final week the market was up, however many of the achieve got here on Friday. Monday was an up day, Tuesday was down, Wednesday again up once more, Thursday down, and a powerful end on Friday. Traders are nervous.

Not solely are they apprehensive about Nvidia’s earnings, however they’re additionally involved that the Fed could have overplayed its hand by maintaining charges too excessive for too lengthy. A coverage mistake like that would spell hassle, particularly as we strategy the historically weak month of September.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.