Silver Ring Worth Companions Q3 2024 Letter

maxsattana/iStock by way of Getty Photos

Pricey Companions:

I hope that you’re doing properly and am trying ahead to seeing you on the upcoming Annual Partnership Assembly on Friday, November fifteenth. The method enhancements that I’ve made during the last yr are beginning to bear fruit. I made a number of adjustments to the portfolio, planting new seeds that I imagine will produce leads to years to come back. I’m additionally in varied levels of researching a number of promising long-term investments that, in the event that they clear the hurdle for inclusion in our portfolio, will make it much more engaging.

In contrast with a yr in the past, our portfolio is extra undervalued and higher balanced. I imagine it would serve us properly in pursuing our purpose of safely compounding capital over the long-term.

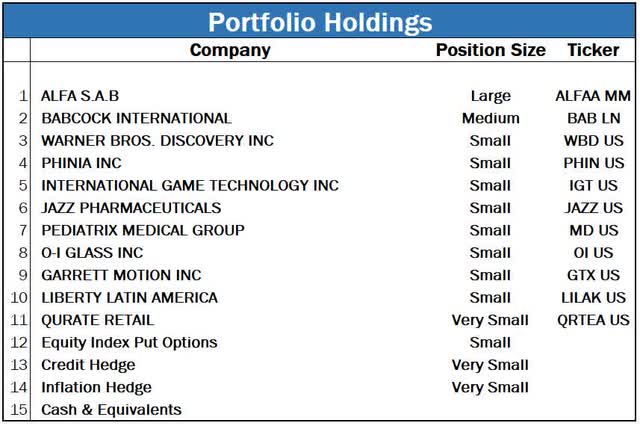

The market atmosphere stays as difficult because it has been in recent times. The herd continues to march in a single path, rising ever extra assured in its perception of a really brilliant future for firms, resulting in very optimistic valuation ranges. You possibly can see this in lots of locations available in the market, from credit score spreads not removed from historic lows to fairness valuations close to historic highs.

Most market contributors are likely to over-extrapolate what has been occurring lately into the distant future. Thus, if safety costs have been steadily climbing ever greater, to them that’s proof that there’s not a lot to fret about and that they’ll proceed to take action sooner or later.

That’s the actual reverse of a rational long-term strategy to the market. In spite of everything, markets are discounting mechanisms the place more and more optimistic expectations concerning the future embedded in safety costs portend decrease relatively than greater future returns.

In 1962, psychology researcher Solomon Asch carried out the well-known elevator experiment. In it he had a gaggle of actors pretending to be common individuals stroll into an elevator along with the unaware topic. All of the actors would face the again of the elevator, versus the standard follow of dealing with the door. The topic then succumbed to the silent peer stress and would additionally face the again to evolve to the group.

The present markets are working in a lot the identical manner. As an increasing number of contributors face the proverbial again of the elevator, others really feel an immense stress to evolve. The longer this goes on and the less individuals there are remaining who’re nonetheless dealing with the entrance, the higher the stress. And since being proper is regularly outlined by the herd as whether or not current market value actions have validated an investor’s stance, the dwindling group of individuals appearing rationally within the markets seems to be an increasing number of fallacious and out of contact with actuality merely on the premise that the rising majority has adopted a unique view for an growing size of time.

In easy phrases, the extra optimistic the market sentiment and elevated the safety costs, the extra that you must train further warning and to protect towards everlasting loss. Simply when it looks like there may be little or no to fret about is one of the best time to fret.

There have been a whole lot of questions on what has modified within the markets in recent times. Does worth investing nonetheless work on this new period? Will AI and different applied sciences result in a productiveness growth that justifies abnormally excessive valuations? And so forth – all some model of the age-old most harmful phrase in investing: “It is totally different this time.”

Let me share with you what hasn’t modified. The human thoughts. That may take 1000’s of years of evolution, not a decade or two.

And that human thoughts has had the identical conduct in safety markets rooted in human nature going again to the start of markets. Extremes of optimism are adopted by manic bouts of pessimism. Perception that the whole lot will likely be nice eternally is quickly adopted by worry that issues won’t ever be good once more. Hope that new expertise (steam engine, radio, vehicles, aviation, PCs, web, cloud, electrical automobiles, AI) will result in unfathomable boosts to firms’ fortunes is adopted by extreme busts because the hype offers approach to a extra subdued actuality.

None of this can be a motive to time the market or pay undue heed to the macro atmosphere on the expense of our micro-economic concentrate on particular person firms and their securities. Nevertheless, it will be silly to suppose that the boom-bust sample of markets is abolished – it’s not. We will not know when or why however relaxation assured that identical to the change of seasons there’ll once more come a change within the prevailing market sentiment.

So, the extra excited concerning the future most market contributors are, the extra cautious we must be in our strategy, and the extra emphasis we must always place on not shedding our cash.

Funding Exercise

- Began a brand new Small place in Jazz Prescribed drugs (JAZZ)

- Began a brand new Small place in Pediatrix Medical Group (MD)

- Began a brand new Very Small place in Qurate Retail (QRTEA)

- Elevated our Babcock Worldwide Group (OTCPK:BCKIF, BAB LN) place from Small to Medium

- Decreased our Liberty Latin America (LILAK) place from Medium to Small

- Participated within the rights providing of our largest funding, ALFA S.A.B. (ALFFF, ALFAA MM)

|

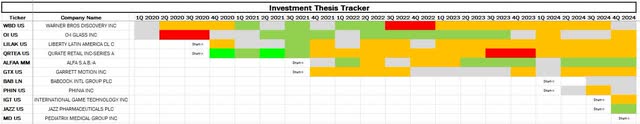

● Gentle Grey: thesis is monitoring roughly in-line with my base case ● Orange: thesis is monitoring considerably beneath my base case ● Pink: thesis is monitoring considerably beneath my base case ● Boring Inexperienced: thesis is monitoring considerably higher than my base case ● Brilliant Inexperienced: thesis is monitoring considerably higher than my base case ● White: No knowledge |

|

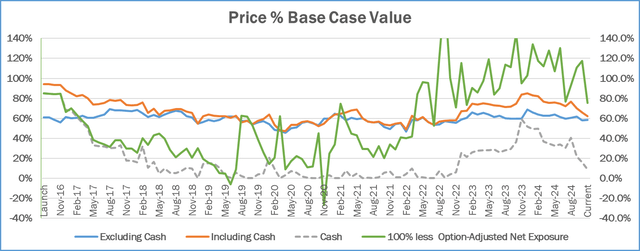

● Excluding money the investments within the portfolio have been priced at 59% of Base Case Worth, and at 62% when together with money. ● Money and equivalents have been 9% of the portfolio and have been a bottom-up residual of the funding course of utilized to the present alternative set. |

Portfolio Replace: Funding Setting

Whereas I spend most of my time researching particular person funding alternatives, it is helpful to know the market atmosphere. The present market is filled with optimism and outright hypothesis. Costs are excessive, greed is widespread and there may be little or no worry concerning the future. Whereas there may be all the time a chance that “it is totally different this time,” likelihood is it isn’t.

Credit score spreads, as you’ll be able to see within the chart beneath displaying U.S. “excessive” yield bond spreads are close to historic lows.

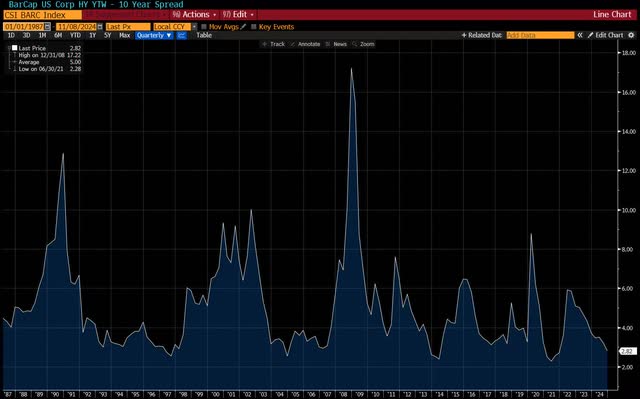

Fairness valuations are close to historic highs. The chart beneath exhibits the trailing Worth to Earnings (P/E) ratio for each the S&P 500 (SP500, SPX) and the S&P 500 Equal-weighted. Whereas the previous’s valuation is far nearer to an excessive pushed by the well-known small handful of firms dominating the index, even on an equal-weighted foundation valuations are excessive by historic requirements. There are many different measures that time in the identical path, together with the ratio of market capitalization to GDP and Shiller’s cyclically adjusted P/E.

That is notably true since earnings for company America are at or close to cyclical highs. When firms are valued at excessive multiples of abnormally excessive earnings, the hazard of each of these measures reverting to extra regular ranges is especially acute. No one can let you know when the cycle will flip, both in sentiment or within the financial system, or what is going to trigger that to occur. Nevertheless, each of these issues will occur, and if historical past is any information, it would not normally take too lengthy for that reversion to the imply to happen.

Maybe I’m notably biased as a result of I’m scripting this shortly after Bitcoin went up roughly 10% in a single day pushed by the euphoria following U.S. election outcomes. I’m going to sidestep the talk about whether or not Bitcoin is the brand new digital gold or a figment of the speculators’ creativeness. As a substitute, beneath is the chart of Dogecoin (pronounced “Canine E-coin”), which I imagine was initially launched as a joke.

Whereas maybe one important digital “foreign money” broadly accepted by others may turn into an alternate type of cash, a tiny offshoot isn’t going to. And but, as of this time its market worth is roughly $50B. If that does not persuade you that the market is filled with hypothesis and speculators, not a lot will.

New Funding: Jazz Prescribed drugs (JAZZ)

Jazz Prescribed drugs is a specialty pharma firm that matches the funding sample of “excessive uncertainty with low threat.” Whereas it has a number of vital merchandise in the marketplace, its largest is the sleep franchise. Inside it the first-generation drug, Xyrem, has gone off patent, and the corporate is transitioning sufferers to the improved model, Xywav. The latter is a low-sodium model which has decrease cardiac dangers however comparable efficacy.

Whereas the adoption of Xywav has been good, there may be uncertainty round competitors and the sustainability of that transition. For instance, a competitor has a aggressive drug to Xyrem which is taken as soon as an evening versus Xyrem’s twice an evening routine, which is extra handy for sufferers. Nevertheless, that drug remains to be the high-sodium model and subsequently carries comparable cardiovascular dangers.

Administration is robust in my opinion, with CEO/Co-Founder Bruce Cozadd proudly owning $50M+ in shares and presiding over a historical past of worth creation over the course of his 13+ years on the helm. The stability sheet is strong, with Web Debt/EBITDA at beneath 3x and solely $1B due between now and 2029, which is lower than one yr of the corporate’s Free Money Move. Capital allocation has been a mixture of acquisitions and share buybacks. Given the administration’s monitor report I’m comfortable for that blend to proceed and imagine that the corporate will train self-discipline within the value it pays for each.

Whereas there may be some uncertainty dealing with the corporate, I imagine the worth we paid makes the danger low. I purchased the inventory at what I estimate to be properly beneath 50% of my Base Case internet current worth which assumes some share loss for Xywav.

Much more importantly, given the low value we paid the draw back to a Worst Case situation by which Xywav falls off a cliff within the subsequent couple of years and the pipeline would not generate any income was very modest. Since I made the funding the corporate has reported robust monetary outcomes with good gross sales progress for the important thing medication and had some promising research knowledge launched on its key pipeline product. Whereas the inventory has moved up some since our buy it stays deeply undervalued at these ranges and I’m comfortable to proceed to personal our shares.

New Funding: Pediatrix Medical Group (MD)

We owned Pediatrix Medical Group prior to now. Since we exited, the corporate has been going by means of a simplification and turnaround course of that I’ve been following. As chances are you’ll recall, a long time of expertise have taught me that the easiest way to spend money on turnarounds is to attend for indications that the enterprise is popping, even when meaning foregoing the preliminary transfer within the inventory value. The reason being easy: most turnaround makes an attempt do not succeed, and those who start to show normally proceed to take action.

That is what we’ve right here with Pediatrix. The corporate has simplified its enterprise to the core enterprise of staffing NICU physicians and associated specialists for hospitals. It has a robust aggressive benefit on this area of interest with a really sticky enterprise with excessive switching prices.

Prior administration additionally stumbled in switching to an exterior income cycle administration supplier, which led to inner billing points. That has now been addressed by way of a mixture of a brand new exterior supplier and an inner back-up resolution and seems to be functioning easily.

The corporate has been lately exceeding earnings expectations, and I imagine that estimates of earnings are nonetheless too low. Administration is strong and has been promoted from inside with an extended historical past of expertise on the firm. The stability sheet is clear with Web Debt/EBITDA of round 2X for a enterprise with low cyclicality. We purchased the inventory barely beneath 10x earnings, which I imagine represents a great margin of security for a competitively advantaged, reasonably rising enterprise.

New Funding: Qurate Retail (QRTEA)

I’ve been following Qurate since we exited our funding. Let me get the apparent out of the way in which: the enterprise is clearly challenged and there’s a not-insignificant threat of the fairness being price $0. So why make investments? I’ll handle this each on the degree of the person funding and from the attitude of the portfolio.

On the firm degree, I imagine that there’s a good chance that the enterprise has stabilized, particularly amongst present clients, and should even be shifting in the precise path. We are able to see that in metrics similar to retention of the corporate’s “finest” clients that purchase 20+ objects per yr, and the amount bought by present clients. I’ve additionally finished analysis calls with former workers which have led me to higher perceive the corporate and acquire incremental consolation that there’s a useful and largely secure core to what the corporate does.

Let me even be clear – there are each cyclical and secular challenges dealing with the corporate. Regardless of the stabilization that I’ve noticed in addition to the brand new CEO’s cost-cutting efforts, it might nonetheless fail beneath exterior pressures and its substantial debt load. Nevertheless, on the current value for the fairness of round 50c, it’s principally buying and selling as a name choice and not using a fastened expiration date. I estimate the upside to a profitable turnaround to be about 15x from these ranges. The market is implying a 90%+ likelihood of the enterprise going zero, which my evaluation suggests is far too excessive.

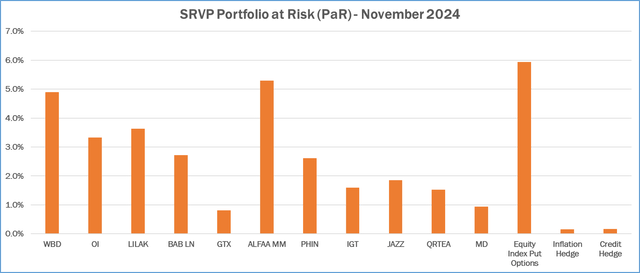

With that mentioned, even when I’m appropriate that we’ve a optimistic anticipated worth at these ranges, there are nonetheless many situations the place we lose all our cash on this funding. Due to that, I sized the place within the “Very Small” class (suppose low single-digit p.c of the portfolio) and don’t intend so as to add to the place past this level. The portfolio-at-risk (PaR) for this place is just like that of a number of the different positions the place the scale is greater, however the proportion draw back is far smaller.

Moreover, this is among the only a few investments that we’ve with such giant draw back. A lot of the portfolio is in investments with low draw back and robust stability sheets. We even have fairness hedges in the marketplace which may repay in a number of the situations, similar to a recession, which might trigger Qurate to fail.

I might not need to have a significant a part of the portfolio in investments just like Qurate. Nevertheless, within the context of our total portfolio a really small place with excessive optimistic anticipated worth however a big chance of a small loss to the portfolio is smart.

Firm Updates

Alfa S.A.B. (ALFAA MM)

In my final letter I profiled Alfa and defined why I made it a big place when the inventory hit the current lows of round 10 pesos. A giant a part of the explanation was the company reorganization the place the corporate was going to separate its final remaining non-core enterprise, the chemical firm Alpek (ticker: ALPEKA MM) of which it owns 82%. This made me imagine that the time horizon for closing the big hole between value and worth was shortened by a catalyst.

Since I final wrote to you, the corporate introduced a rights providing designed to speed up the spinoff course of. The providing, in an quantity of roughly $400M, will likely be used to scale back debt to ranges enough for the remaining branded meals enterprise, Sigma, to take care of its investment-grade ranking post-spin.

The rights providing was profitable with robust investor demand, and we have been in a position to obtain our full shares plus an extra oversubscription quantity at a value of 10.75 pesos. That’s properly beneath the present value of 15+ pesos and a couple of third of my estimate of Base Case intrinsic worth.

An extra good thing about accelerating the spin-off is that doing it now lowers the tax invoice. In Mexico, a spin-off is taken into account a taxable transaction primarily based in the marketplace value of the spin-off. With Alpek buying and selling at cyclically depressed ranges, the corporate was in a position to lock-in a low value and scale back the quantity topic to the tax. This, taken together with the corporate’s tax loss property leads administration to imagine there will likely be no tax implication from this transaction.

Shareholders have permitted the spin-off in late October, and it’s slated for 2025. Whereas the precise timing is unsure and is dependent upon authorities approvals, the final two spins the corporate did had a timeline of 4.5 months and 11 months from an analogous level within the course of.

Alfa additionally reported robust outcomes since my final letter. The Alpek chemical enterprise is displaying indicators of enchancment from a cyclical low level. The core Sigma branded meals enterprise had good natural progress and margins exceeding my expectations. Regardless of the inventory being up round 50% from once I made it a big place, one may argue that it’s pretty much as good or higher funding now, with enhancing fundamentals and a significantly better outlined and shortened timeframe to the occasion which has a great likelihood to speed up the unlocking of worth. With the inventory nonetheless at ~ 50% of my Base Case intrinsic worth, I’m holding on to our shares and intend to make particular person choices on every bit of the corporate as soon as the separation is full.

Babcock Worldwide (BAB LN)

Babcock’s inventory slid decrease in the course of the quarter for no obvious motive. Whereas I all the time enable for the likelihood that the market is aware of one thing that I don’t, on this case that appeared much less probably given the strong progress on the turnaround that administration has been making and its lately reiterated steerage.

Whereas the corporate was displaying good basic progress, the worth to worth hole widened. It additionally has one of many higher scores on my Psychological Fashions Scorecard that I had launched in prior letters. With these info in thoughts, I assumed it acceptable to extend the place measurement from Small to Medium.

Liberty Latin America (LILAK)

LILAK has been a poor funding for the partnership. I had been too optimistic in believing in administration’s plans, which it has repeatedly come up quick on over time. Following the failure of the Chilean enterprise, the difficulty has now been centered on the corporate’s Puerto Rico operations the place it has been integrating its AT&T acquisition.

I took a tough have a look at the place, which had been a Medium place measurement, in the course of the quarter by means of the lens of the Psychological Mannequin Scorecard. LILAK had one of many decrease scores, and regardless of the inventory’s cheapness now not merited to be such an enormous place. With that in thoughts, I lowered the place measurement considerably to a Small place.

After I diminished the place, the corporate reported one other disappointing quarter with execution points in Puerto Rico persevering with. Whereas it is nonetheless fairly probably that they’ll salvage that enterprise and switch it round, the chance of that’s beginning to decline. The substantial debt load on the Puerto Rico subsidiary additionally raises the potential of it following the Chilean enterprise into having no fairness worth to the corporate.

The discount in place measurement helped us keep away from the brunt of the impression of the inventory’s decline following the information. Nevertheless, simply as Churchill cautioned after the evacuation from Dunkirk throughout World Conflict II, we don’t need to confuse this with victory. This has actually been a mistake on my half and one which I’ve realized and improved from.

With the inventory value now a lot decrease and certain beneath what the companies excluding Puerto Rico are price, I’m at this level going to carry on to our small place. Nevertheless, insecurity in administration’s execution and the challenges dealing with this enterprise make this a candidate for substitute if there are not any indicators of progress in an inexpensive timeframe.

Your Questions

As I’ve dedicated to do within the Proprietor’s Handbook, I’ll use these letters to offer solutions to questions that I obtain once I imagine the solutions to be of curiosity to all the companions. With the Annual Partnership Assembly scheduled for Friday, November 15 th, I plan to reply all questions there. Please be at liberty to both ask them on the assembly or submit them to me prematurely.

Portfolio Metrics

I monitor a variety of metrics for the portfolio to assist me higher perceive it and handle threat. I monitor these each at a given cut-off date, and as a time collection to investigate how the portfolio has modified over time to ensure that it’s invested in the way in which that I intend for it to be. Beneath I share a variety of these metrics, what every means, and what it will possibly inform us concerning the portfolio. As time passes, you must be capable of refer to those charts and graphs that will help you acquire deeper perception into how I’m making use of my course of.

Worth % Base Case Worth

This metric tracks the portfolio’s weighted common ratio between market value and my Base Case intrinsic worth estimate of every safety. This ratio is offered each together with money and equivalents, that are valued at a Worth to Worth of 100%, and excluding these. All else being equal, the decrease these numbers are, the higher. Excluding money and equivalents, a degree above 100% can be a pink flag, indicating that the portfolio is buying and selling above my estimate of intrinsic worth. Ranges between 90% and 100% I might characterize as a yellow flag, suggesting that the portfolio may be very near my estimate of worth. Ranges between 75% and 90% are lukewarm, whereas ranges beneath 75% are engaging.

High quality Quintiles

As outlined within the Proprietor’s Handbook, I consider the standard of the Enterprise, the Administration and the Steadiness Sheet as a part of my evaluation of every firm. I grade every on a 5-point scale with 1 that means Glorious, 2 Above Common, 3 Common, 4 Beneath Common and 5 Horrible. The chart that follows presents the weighted common for every of the three metrics for the securities within the portfolio.

Portfolio at Threat (PaR)

I estimate the Portfolio at Threat (PaR) of every place by multiplying the load of every place within the portfolio by the p.c draw back from the present value to the Worst Case estimate of intrinsic worth. This helps me handle the danger of everlasting capital loss and measurement positions appropriately, in order that no single safety may cause such a fabric everlasting capital loss that the remainder of the portfolio, at affordable charges of return, wouldn’t be capable of overcome. I sometimes measurement positions at buy to have PaR ranges of 5% or decrease, and a PaR worth of 10% or extra at any time can be a pink flag. The chart beneath depicts the PaR values for the securities within the portfolio as of the top of the quarter. Positions are offered together with choices when relevant.

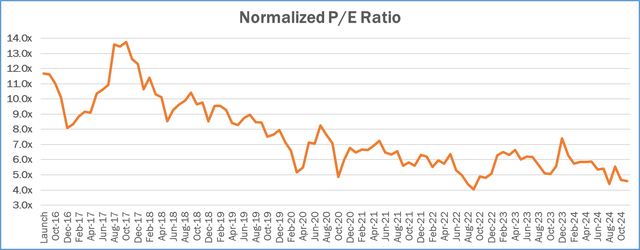

Normalized Worth-to-Earnings (P/E) Ratio

I complement my intrinsic worth estimates, that are primarily based on Discounted Money Move (‘DCF’) evaluation, with a variety of different metrics that I exploit to ensure that my worth estimates make sense. One of many extra helpful ones is the Normalized P/E ratio. The denominator is my estimate of earnings over the subsequent 12 months, adjusted for any one-time/unsustainable components, and if obligatory adjusted for the cyclical nature of the enterprise to mirror a mid-cycle financial atmosphere. The numerator is adjusted for any extra property (e.g. extra money) not used to generate my estimate of normalized earnings. One approach to interpret this quantity is that its inverse represents the speed of return we might obtain on our buy value if earnings remained completely flat. So a normalized P/E of 10x can be in keeping with an expectation of a ten% return. Whereas the longer term is unsure, it’s sometimes my purpose to spend money on companies whose worth is growing over time. If I’m appropriate in my evaluation, our return ought to exceed the inverse of the normalized P/E ratio over an extended time frame. The graph beneath represents the weighted common normalized P/E for the equities within the portfolio.

Conclusion

Whereas I stay very cautious concerning the funding atmosphere for the explanations that I outlined, that’s not the place I’m centered. I imagine a nimble partnership similar to ours can and will be capable of discover alternatives in most markets. So, my focus stays on doing the work on particular person firms whereas making use of the enhancements that I’ve made to my funding course of to assemble a greater, extra balanced portfolio.

I’ll neither rush to make investments simply to report back to you that I’ve finished so, nor will I shrink back from making them when my evaluation means that I ought to. I’ve already been placing the hard-earned classes of the previous few years to good use by enhancing my portfolio building course of, with tangible outcomes talked about earlier on this letter.

Because the portfolio transformation course of progresses, I anticipate us to maneuver nearer to a portfolio that’s higher balanced between firms with a long-term trajectory of worth progress, undervalued firms with a transparent catalyst and deeply undervalued firms. In doing so, not solely do I not plan on sacrificing margin of security, however I imagine that the insights that led to those course of enhancements will enable me to assemble an undervalued and much less dangerous portfolio.

In investing, blind contrarianism – doing the alternative of the group — doesn’t work. What does work is unbiased, first-principles primarily based pondering primarily based on a sound funding philosophy and course of. That’s what I imagine I’m doing, and that’s what I decide to you I’ll proceed to do. Bringing it again to Solomon Asch’s Elevator Experiment that I discussed at first of this letter, I plan on dealing with the entrance no matter whether or not the group faces the again, the facet or another path.

I admire your belief and assist. If I can reply any questions, please do not hesitate to achieve out.

Thanks prematurely,

Gary Mishuris, CFA | Managing Companion, Chief Funding Officer | Silver Ring Worth Companions Restricted Partnership

|

IMPORTANT DISCLOSURE AND DISCLAIMERS The data contained herein is confidential and is meant solely for the particular person to whom it has been delivered. It isn’t to be reproduced, used, distributed or disclosed, in complete or partly, to 3rd events with out the prior written consent of Silver Ring Worth Companions Restricted Partnership (“SRVP”). The data contained herein is offered solely for informational and dialogue functions solely and isn’t, and is probably not relied on in any method as authorized, tax or funding recommendation or as a proposal to promote or a solicitation of a proposal to purchase an curiosity in any fund or car managed or suggested by SRVP or its associates. The data contained herein isn’t funding recommendation or a suggestion to purchase or promote any particular safety. The views expressed herein are the opinions and projections of SRVP as of November thirteenth, 2024, and are topic to vary primarily based on market and different circumstances. SRVP doesn’t signify that any opinion or projection will likely be realized. The data offered herein, together with, however not restricted to, SRVP’s funding views, returns or efficiency, funding methods, market alternative, portfolio building, expectations and positions might contain SRVP’s views, estimates, assumptions, info and knowledge from different sources which can be believed to be correct and dependable as of the date this data is presented-any of which can change with out discover. SRVP has no obligation (specific or implied) to replace any or all the data contained herein or to advise you of any adjustments; nor does SRVP make any specific or implied warranties or representations as to the completeness or accuracy or settle for accountability for errors. The data offered is for illustrative functions solely and doesn’t represent an exhaustive rationalization of the funding course of, funding methods or threat administration. The analyses and conclusions of SRVP contained on this data embrace sure statements, assumptions, estimates and projections that mirror varied assumptions by SRVP and anticipated outcomes which can be inherently topic to important financial, aggressive, and different uncertainties and contingencies and have been included solely for illustrative functions. As with every funding technique, there may be potential for revenue in addition to the potential of loss. SRVP doesn’t assure any minimal degree of funding efficiency or the success of any portfolio or funding technique. All investments contain threat and funding suggestions is not going to all the time be worthwhile. Previous efficiency is not any assure of future outcomes. Funding returns and principal values of an funding will fluctuate in order that an investor’s funding could also be price roughly than its unique worth. |

Editor’s Word: The abstract bullets for this text have been chosen by Looking for Alpha editors.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.