Prime Development And Dividend Lengthy-Time period Shares For Mid-Yr 2024

Brad Sales space

Prime Development & Dividend Lengthy-Time period Shares For Mid-Yr 2024

The Prime Dividend Development inventory mannequin expands on my doctoral analysis evaluation on a number of discriminant evaluation (MDA) including new complexities with these prime picks. Analysis exhibits that the best frequency of enormous value breakout strikes is discovered amongst small-cap shares with low buying and selling volumes, providing no dividends and delivering greater than common danger ranges.

Moreover, just one inventory of the 15 largest Mega Cap shares available in the market producing huge common returns +61.5% YTD presents a dividend yield above 2%.

The problem with the Prime Dividend & Development mannequin is to ship a mix towards optimum complete return with traits like excessive dividends that sometimes cut back the frequency and magnitude of value breakouts however ship extra dependable progress components for greater profitability long run.

Present Market Circumstances

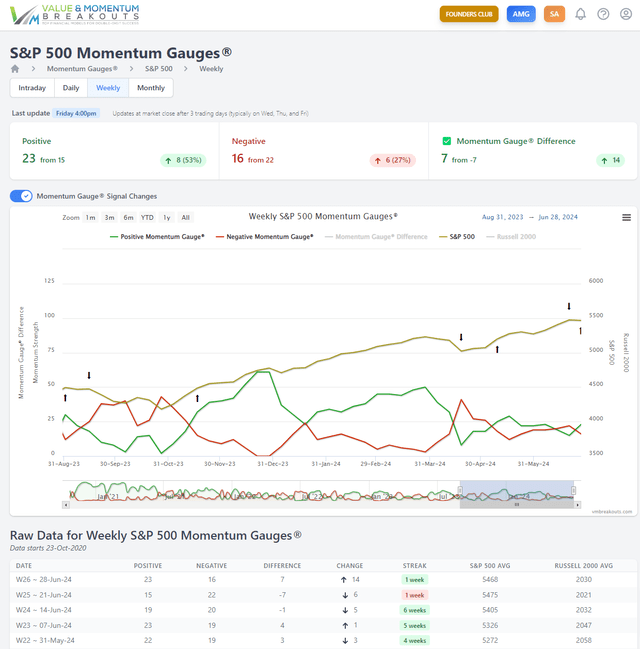

A fast assessment of the present market circumstances exhibits the Weekly Market Gauges of seven,500+ shares nonetheless in a destructive sign for two consecutive weeks, whereas the big cap S&P 500 weekly gauges have turned constructive once more. Warning indicators are quite a few because the Fed retains charges unchanged on the highest ranges in over 22 years. The market returns proceed skewed at file ranges, favoring the most important mega caps shares, whereas the small-cap Russell 2000 index briefly dipped destructive for the 12 months this previous week. I’ve revealed a number of current sign articles cautioning readers:

The S&P 500 weekly gauges turned destructive within the prior week as NVIDIA (NVDA) pulled again -12% from all-time highs. This mega cap big continues to significantly skew the main indices as the most important and most closely weighted inventory on the earth with the quickest trillion greenback market cap features ever.

vmbreakouts.com

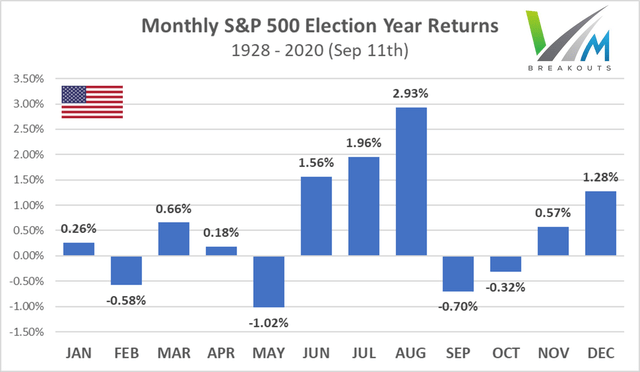

The cyclical sample for the S&P 500 throughout election years since 1928 exhibits that the summer season months have on common been the perfect months of the 12 months. In fact, yearly has its personal distinctive financial circumstances, and 2024 is in contrast to any 12 months earlier than it.

vmbreakouts.com

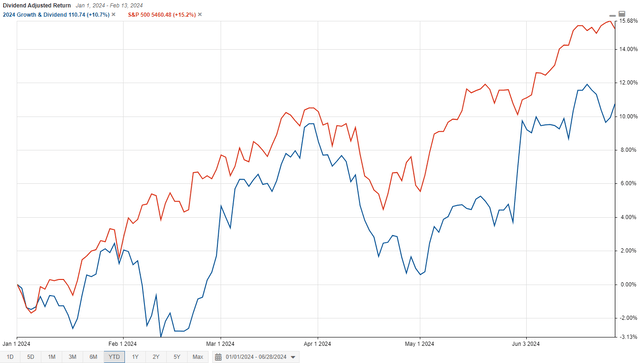

January Dividend Adjusted Returns vs. S&P 500

Moreover, the 2024 January Development & Dividend portfolio is up 10.7% YTD adjusted for dividends, with the S&P 500 up 15.2% proven beneath. Take into account that many of the mega cap expertise giants skewing the market to file highs don’t supply giant dividends or any dividends in lots of instances and should not eligible for this portfolio. Just one inventory (JPM) among the many 15 largest Mega Cap shares available in the market presents dividends above 2%.

StockRover.com

Directions: readers are free to purchase/maintain any shares for the one-year and two-year measurement interval of every portfolio. It’s possible you’ll maintain longer, comply with the Momentum Gauge indicators, or replace your Development & Dividend portfolios with newer choices. You’ll be able to contemplate every January portfolio as the principle annual choice, however I additionally launch 5 bi-monthly bonus choices in 2024 so that you can contemplate all year long to refresh your portfolio.

Choices: Every month-to-month choice portfolio consists of 5 shares above a minimal $10 billion market cap, $2/share value, 500k common each day quantity and a minimal 2% dividend yield. The inhabitants of this distinctive mega cap phase is roughly 330 shares out of over 7,800 shares throughout the US inventory exchanges. Whereas these shares signify lower than 5% of accessible shares, their market cap exceeds $19 trillion out of the roughly $33 trillion (57.6%) of the US inventory exchanges. Efforts are made to optimize complete returns on the important thing MDA value progress components (elementary, technical, sentiment) for the perfect outcomes beneath these giant cap constraints with excessive priorities for dividend progress and dividend yield.

Prime Development & Dividend Inventory For July 2024

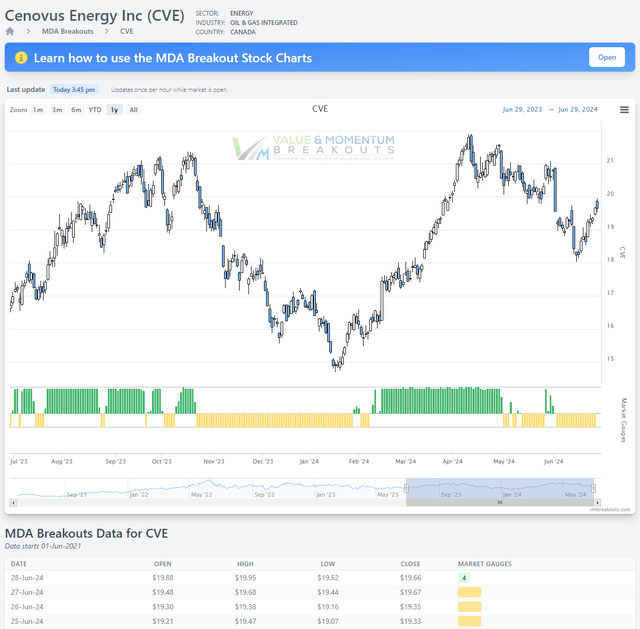

Cenovus Power emerges from the discriminant evaluation of elementary variables and dividend evaluation as one of many prime dividend shares from the July choice portfolio for robust long-term features based on a mix of the MDA worth and momentum variables.

Cenovus Power (CVE)

FinViz.com

A number of Discriminant Evaluation MDA chart of extra 75 variables

Cenovus is displaying early breakout circumstances with Section 6 constructive acceleration sign on Friday for the primary time in practically a month. You’ll be able to study extra about my analysis within the SA webinar.

VMBreakouts.com

(Supply: Firm Assets)

Cenovus Power, Inc. is a Canadian-based built-in power firm, which engages within the provision of fuel and oil. It operates by the next segments: Upstream, Downstream, and Company and Eliminations. The Upstream phase refers to operations of oil sands, typical, and offshore. The Downstream phase operates the Canadian and U.S. refining. The Company and Eliminations phase consists of the corporates prices for normal and administrative.

Prior Returns 2020 to 2024 YTD

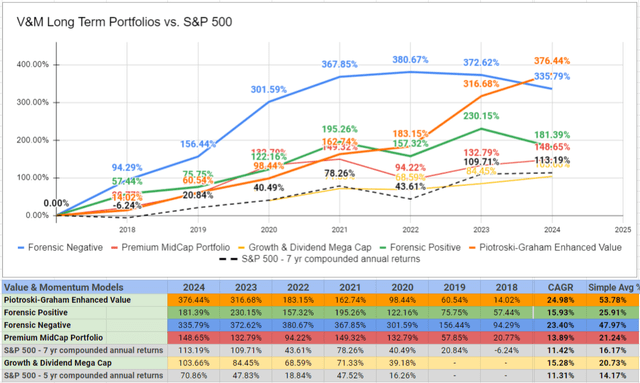

These giant cap dividend choices are closely affected by Federal Reserve fund charges, company dividend choices, and the competing yields within the treasury markets. The January Development & Dividend choices are beating all the main Hedge Fund averages since inception. Returns may be enhanced by following the Momentum Gauge indicators and avoiding main downturns.

vmbreakouts.com

*Returns to this point on the Development & Dividend choice mannequin should not adjusted for the big dividends from every inventory.

Prior Lengthy-Time period Gainers to Take into account

This part is a quick assessment of robust prior choices which have delivered on the long-term progress forecast. Many of those shares are in multiple month-to-month choice portfolio, because the excessive standards requirements typically produces a small pool of robust candidates with frequent overlap.

These 10 prior choices are considerably outperforming in the long run with robust dividends. Extra particulars can be found of their authentic choice articles.

| Image | Firm | Value | Return from Choice |

| (LLY) | Eli Lilly And Co | 905.38 | 552.67% |

| (KLAC) | KLA Corp | 824.51 | 473.61% |

| (TSM) | Taiwan Semiconductor Mfg. Co. Ltd. | 173.81 | 222.83% |

| (AMP) | Ameriprise Monetary, Inc. | 427.19 | 204.98% |

| (COP) | ConocoPhillips | 114.38 | 171.69% |

| (VST) | Vistra Corp. | 85.98 | 162.78% |

| (TRGP) | Targa Assets Corp. | 128.78 | 122.23% |

| (INFY) | Infosys Ltd ADR | 18.62 | 101.73% |

| (HPQ) | HP Inc. | 35.02 | 100.92% |

| (GRMN) | Garmin Ltd. | 162.92 | 100.74% |

There may be overlap since 2020 amongst totally different month-to-month portfolios. The recurrence of choice could also be a powerful indicator of long-term success.

*Returns to this point on the Development & Dividend choice mannequin should not adjusted for the big dividends from every inventory.

Conclusion

These shares proceed a stay forward-testing of the breakout choice algorithms from my doctoral analysis utilized to giant cap, robust dividend progress shares. Not one of the returns listed above embody the excessive dividend yields as a part of the efficiency, and would additional improve complete returns for every inventory. These month-to-month prime Development & Dividend shares are supposed to ship wonderful long-term complete return methods, leveraging key components within the MDA breakout fashions used within the small-cap weekly breakout choices.

These choices are being tracked on the V&M Dashboard Spreadsheet for members and enhancements will proceed to optimize dividend, progress, and better breakout frequency variables all year long.

All the easiest to you!!

JD Henning, PhD, MBA, CFE, CAMS

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.