Neglect The Panic, Embrace The Potential: Why Albemarle Is Nonetheless A Winner (NYSE:ALB)

jroballo

Introduction

On April 8, I wrote an article titled “Grime Low cost: Why Albemarle Is My Favourite EV Inventory In A Horrible Market.”

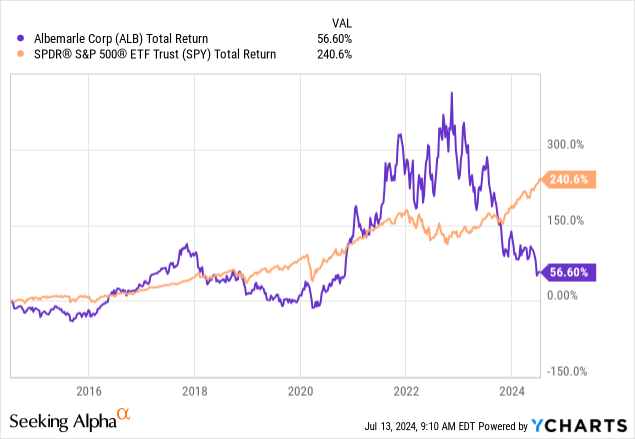

Because it seems, the Albemarle Company (NYSE:ALB) has gotten even cheaper, falling 25% since then. The continued downtrend is so dangerous that it has pushed the inventory under its 2018 highs.

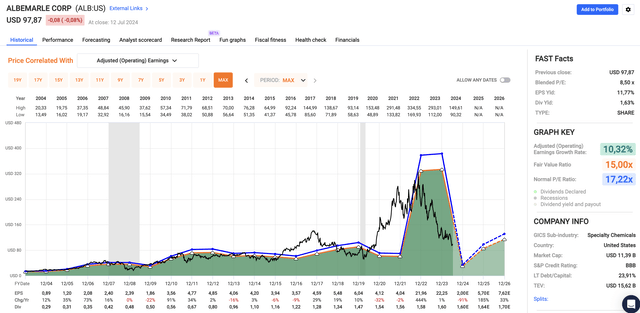

Whereas ALB has nonetheless returned 10.5% yearly since January 2004, it has returned simply 57% over the previous ten years – a horrible return, given the volatility traders needed to undergo.

On the whole, whereas I’m very pleased with the way in which issues are going (generally), I used to be useless unsuitable about lithium and uncommon earth metals this yr. I can’t sugarcoat that.

Though I follow my name that miners are a greater guess than particular person automobile firms within the EV house, I used to be very unsuitable in regards to the timing of the restoration.

Because it turned out, lithium remains to be in a troublesome spot.

On this article, I am going to elaborate on this and clarify what I make of the chance/reward going ahead.

So, let’s get to it!

Lithium Can’t Catch A Break

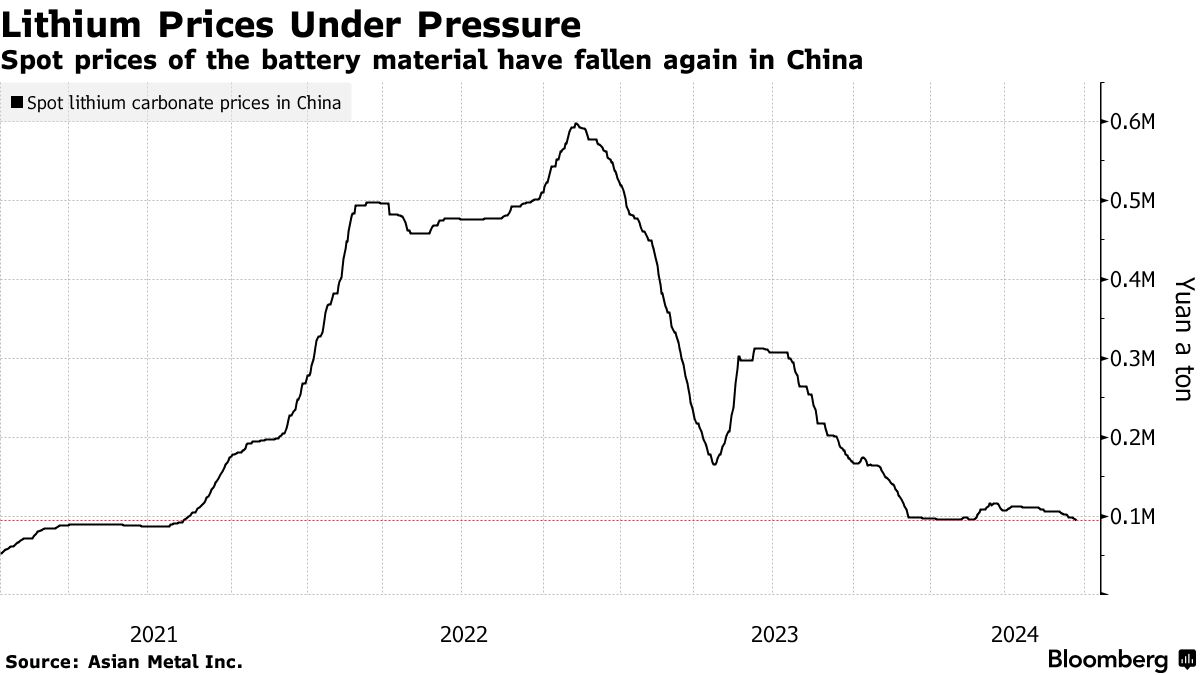

On June 24, Bloomberg wrote an article on the huge decline in lithium costs.

Lithium carbonate costs in China, the largest EV producer on planet Earth, have dropped to the bottom worth since August 2021, erasing the whole post-COVID surge.

Bloomberg

In line with the article, the present decline comes after an 80% worth drop in 2023 because of a provide glut and slowing demand progress.

Furthermore, though costs have stabilized a bit, producers are nonetheless clearing inventories, which hurts demand.

Rising lithium manufacturing and expectations of a summer season lull are weighing on costs, based on Susan Zou, an analyst at researcher Rystad Vitality. Regardless of the transient rebound earlier this yr — underpinned by decrease provide round China’s Lunar New Yr vacation interval and merchants’ speculative shopping for — upward drivers have “largely disappeared,” she mentioned. – Bloomberg

In the meantime, earlier this month, The Wall Road Journal got here out making the case that as a result of lithium is so necessary in clean-energy applied sciences, there was an excessive amount of concentrate on provide, inflicting an imbalance available in the market.

In reality, this is quite common when new applied sciences/tendencies emerge. As soon as everybody jumps on board, the chance/reward is “ruined.”

In China’s Qinghai Province, the place producers extract lithium from salt lakes, output is experiencing a seasonal increase, including to stress on costs. Evaporation charges on the brine ponds are extra favorable through the hotter months, mentioned Daisy Jennings-Grey, head of costs at Benchmark Mineral Intelligence.

In western Australia, Liontown’s personal large new mine is because of begin producing a uncooked type of lithium, known as spodumene, by the tip of this month. – The Wall Road Journal

These developments have resulted in decrease anticipated provide progress, which is an efficient signal for the market.

It additionally brings me to Albemarle.

It is Unhealthy – However There’s Hope

On June 25, the information dropped that Lithium costs don’t justify investments in new crops for America’s largest lithium producer, Albemarle.

The present worth of the important thing battery ingredient is “regarding” and traders shouldn’t put cash into lithium amenities at these market ranges, Eric Norris, president of power storage, mentioned Tuesday at an business convention in Las Vegas. – Bloomberg

Though bottoms take time, these developments normally happen close to bottoms as a substitute of peaks.

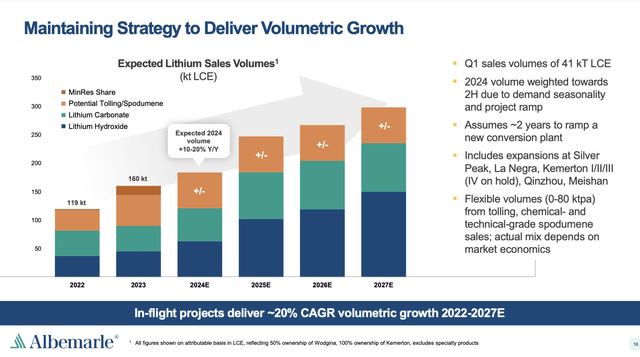

To this point, volumes have been a tailwind for Albemarle.

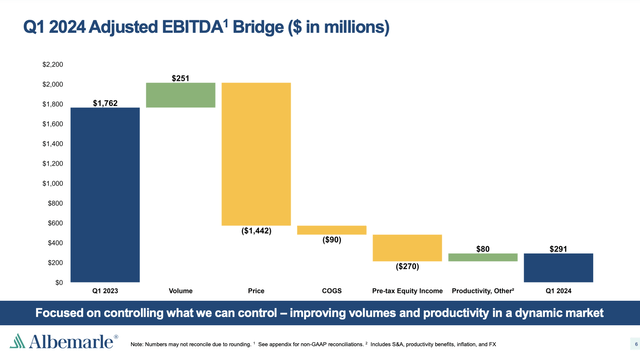

In 1Q24, for instance, the corporate reported $1.4 billion in gross sales and $291 million in adjusted EBITDA. The EBITDA result’s down 83% in comparison with 1Q23.

With pricing being the largest headwind, it noticed tailwinds from productiveness positive factors and better volumes, as we are able to see within the overview under.

Relating to price financial savings, the corporate achieved greater than $90 million in productiveness and restructuring price financial savings within the first quarter alone and has a goal of over $280 million in productiveness enhancements for the total yr.

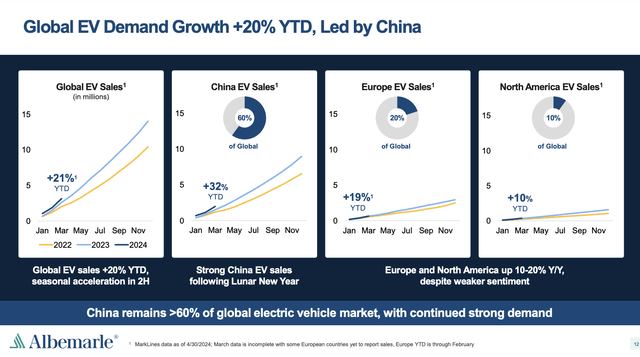

It additionally made the case that the long-term outlook for lithium demand stays robust, pushed by the worldwide transition to electrical automobiles.

The North Carolina-based firm expects a 2.5x enhance in lithium demand from 2024 to 2030. Again in 1Q24, it made the case that this gives the necessity for brand new mining tasks.

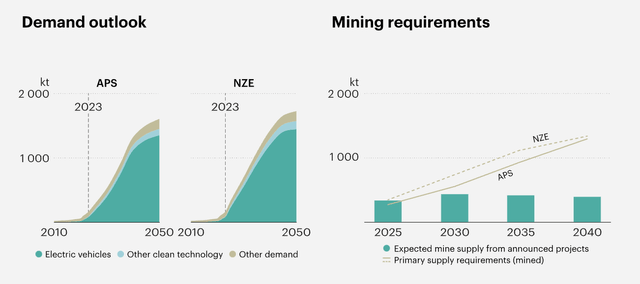

That is backed by analysis from the Worldwide Vitality Company, which wrote in a 282-page report in Might that provide is unlikely to maintain up with hovering demand if investments comply with present local weather tips.

In line with the report (emphasis added):

Evaluation of introduced tasks signifies that lithium uncooked materials provide grows to 450 kt Li round 2030 within the base case, once more greater than doubling the present manufacturing, and reaching 5 instances the manufacturing of 2020. Within the excessive manufacturing case, an extra 70 kt Li of uncooked materials provide could possibly be made out there available on the market. If introduced tasks come on-line as deliberate, this quantity approaches the necessities within the STEPS in addition to within the APS in 2030, however is inadequate to remain on the 1.5 °C pathway. Past 2030, all situations require an additional funding in new provides to maintain tempo with the demand progress.

[…] There are various tasks within the pipeline at their early levels of growth, however worth volatility could delay the tasks arising, notably these exterior of incumbent nation producers, with implications for long-term provide and diversification.

The report additionally makes the case that lithium has the very best worth volatility amongst energy-transition minerals, which is sensible, given present developments.

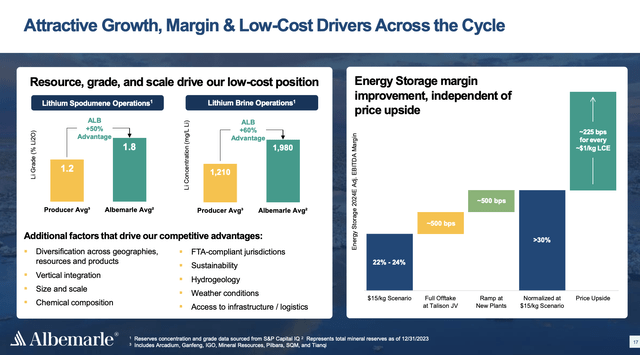

What helps is that Albemarle is sitting on high-quality reserves, offering robust margins and progress alternatives.

Though it must be seen how the corporate’s progress plans have modified because of this difficult setting, the corporate has a number of progress tasks, together with the Kemerton I and II amenities in Australia and the Meishan facility in China.

Within the first quarter earnings name, the corporate reported that Kemerton I had achieved the milestone of fifty% working charges for battery-grade merchandise. Meishan reached a 50% working price for battery-grade materials.

Technically talking, the corporate might ramp up manufacturing to nearly 300 kilotons of lithium carbonate equal (“LCE”) by 2027.

It additionally advantages from above-average lithium grades, which give draw back safety and pricing energy – particularly if demand comes again.

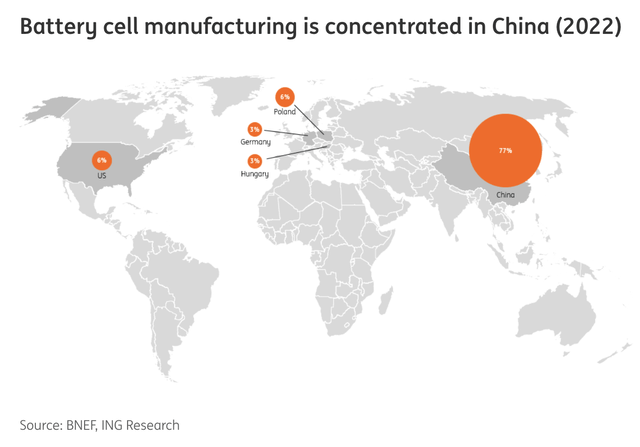

The corporate additionally has main manufacturing amenities in low-risk jurisdictions, which is more and more necessary in gentle of worldwide geopolitical challenges.

As China at present dominates the EV provide chain, Albemarle has secular tailwinds to de-risk provide threat for Western producers.

It additionally helps that the corporate has at all times stored monetary well being a precedence. The corporate has an investment-grade credit standing of BBB, $3.7 billion in liquidity, and a long-term guess debt goal of two.5x EBITDA.

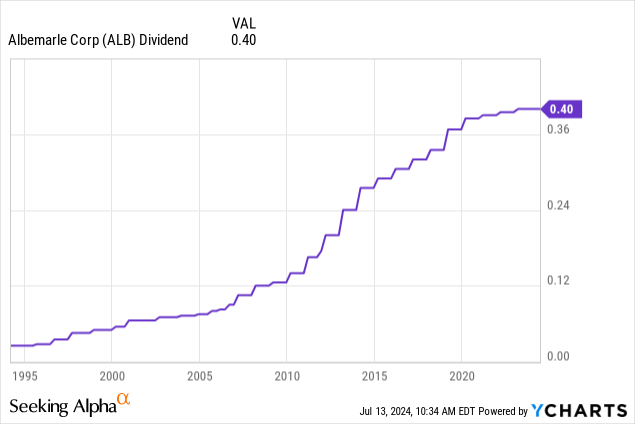

On high of that, it has a 1.6% dividend yield, which comes with a payout ratio of simply 13.1%. Whereas its five-year CAGR is simply 2.6%, it has Dividend Aristocrat standing with 29 consecutive annual dividend hikes.

The second lithium costs backside, I anticipate dividend progress to speed up. I see no threat of dividend cuts within the years forward – even when the lithium worth decline continues.

The place’s The Worth?

The FAST Graphs chart under contains FactSet EPS expectations.

To offer you an concept of what modified in comparison with my prior article, the desk under reveals what expectations seemed like on April 5 and what they seem like now.

| Yr | EPS (Present) | EPS (April 5) | Y/Y Change (Present) |

| 2024E | $2.00 | $3.53 | -91% |

| 2025E | $5.70 | $8.04 | +185% |

| 2026E | $7.62 | $9.44 | +33% |

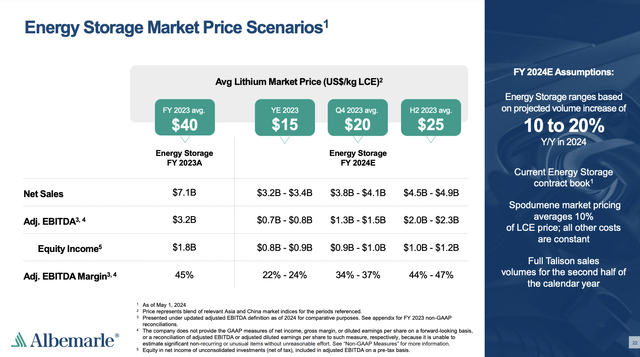

This volatility is regular, as the corporate’s gross sales are extremely depending on lithium costs. As we are able to see under, in an setting of $40 per kg of LCE, the corporate generates $7.1 billion in income. At $15 per kg of LCE, that quantity drops to $3.3 billion (midpoint)

That mentioned, Albemarle at present trades at a blended P/E ratio of simply 8.5x. It was solely barely cheaper through the Nice Monetary Disaster.

A return to a 17.2x a number of by incorporation of present subdued expectations might pave the street for a restoration to $131, roughly 34% above the present worth.

As such, I nonetheless follow a Sturdy Purchase score, as even a slight enchancment within the provide/demand scenario might gas an earnings restoration.

In different phrases, the chance/reward down right here is unbelievable – the volatility is not.

Though I can’t make the case that ALB is a must-own inventory, I’ve to say that if I have been lengthy, I’d keep lengthy, as present big-picture developments trace at a bottoming course of.

Going into 2Q24 earnings, I am in search of extra intel concerning its future progress plans and Chinese language stock de-stocking.

Evidently, if you happen to’re normally an investor in much less risky dividend (progress) shares, please watch out right here. ALB is probably not best for you.

Therefore, given my elevated publicity to risky power commodities, I made a decision to chorus from including extra volatility to my portfolio.

Takeaway

I have been a giant fan of Albemarle, however the market has been brutal, and the inventory has dropped 25% since my April name.

Whereas the long-term outlook for lithium stays robust, the short-term volatility has been difficult.

Lithium costs have plunged, erasing post-COVID positive factors, and Albemarle’s earnings have taken an enormous hit.

Nevertheless, the corporate’s stable reserves, strategic progress tasks, and monetary well being present a powerful basis for a restoration.

At its present low valuation, I nonetheless see ALB as a powerful purchase with glorious long-term potential, regardless of the tough journey forward.

Nevertheless, whereas its Sturdy Purchase score displays its potential, it’s not a “must-own” inventory as a result of dangers that include it.

Professionals & Cons

Professionals:

- Sturdy Lengthy-Time period Outlook: Albemarle is well-positioned to profit from the worldwide transition to electrical automobiles, with a 2.5x enhance in lithium demand anticipated from 2024 to 2030. Progress is slower than initially anticipated, however nonetheless anticipated to trigger provide shortages.

- Stable Monetary Well being: With an investment-grade credit standing, $3.7 billion in liquidity, and a low payout ratio, Albemarle is financially robust.

- Progress Initiatives: Key tasks in Australia and China put the inventory in a great place to spice up output – in case it sticks to those plans.

- Excessive-High quality Reserves: The corporate’s high-grade lithium reserves present robust margins and draw back safety.

- Enticing Valuation: Buying and selling at a P/E ratio of simply 8.5x, Albemarle is considerably undervalued, providing a compelling threat/reward profile.

Cons:

- Risky Lithium Costs: The latest plunge in lithium costs has hit Albemarle’s earnings arduous, and market volatility stays a significant concern.

- Quick-Time period Uncertainty: Ongoing stock points and manufacturing will increase are pressuring costs, creating near-term headwinds.

- Market Sentiment: The inventory has considerably underperformed, falling 25% since April. It should take quite a bit to carry again confidence.

- Dividend Progress Dangers: Whereas the present dividend is protected, additional declines in lithium costs might gradual future dividend progress.