Is Buffett’s Money Hoard A Market Warning?

Juanmonino

Yearly, buyers anxiously await the discharge of Warren Buffett’s annual letter to see what the “Oracle of Omaha” says concerning the markets, the economic system, and the place he’s inserting his cash.

“One of many longest-running traditions in fashionable finance is that yearly, one Saturday morning in late February, the world’s monetary class – from professionals to mere amateurs – sit down as they’ve for the previous 65 or so years – for an hour and skim the most recent Berkshire annual letter written by Warren Buffett. In that letter, the person seen by many because the world’s best investor, wrote down his reflections, observations, aphorisms and different ideas that are intently parsed and analyzed for perception into what he might do subsequent, what he thinks of the present economic system and market local weather, or just for insights into the way to grow to be a greater investor.” – Tyler Durden

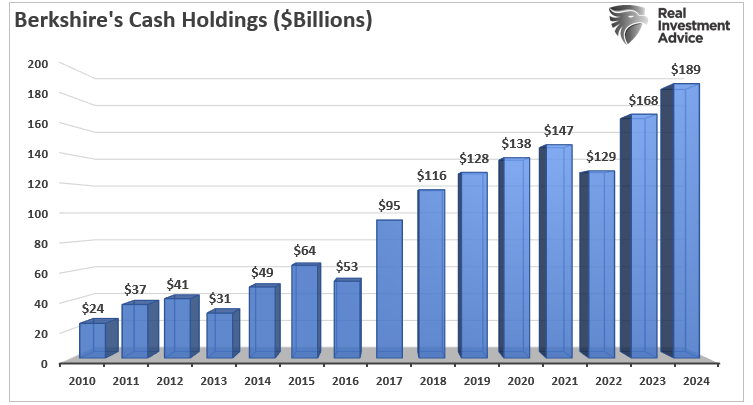

This 12 months’s letter was no completely different, with varied tidbits concerning the present market and investing atmosphere for buyers to digest. The one factor that obtained most of my consideration was his feedback concerning the current surge in money holdings. Buffett’s money and short-term investments (learn T-bills) exceed $189 billion as of Q1, 2024.

To place that into context, that $189 billion money pile alone would make Berkshire (BRK.B) the 58th-largest economic system on the planet, solely barely smaller than Hungary.

There are two crucial messages concerning Buffett’s money hoard. The primary is that as a result of measurement of Berkshire Hathaway, which is approaching a $1 trillion market capitalization, acquisitions should be of considerable measurement. As Warren beforehand famous:

“There stay solely a handful of corporations on this nation able to really shifting the needle at Berkshire, and so they have been endlessly picked over by us and by others. Some we are able to worth; some we are able to’t. And, if we are able to, they should be attractively priced.”

Such was a necessary assertion. One of the crucial clever buyers in historical past means that deploying Buffett’s money hoard in significant measurement is troublesome as a consequence of an incapability to search out moderately priced acquisition targets. With a $189 battle chest, there are many corporations that Berkshire may both purchase outright, use a inventory/money providing, or purchase a controlling stake in. Nonetheless, given the rampant enhance in inventory costs and valuations over the past decade, they don’t seem to be moderately priced.

In different phrases:

“Worth is what you pay, worth is what you get.” – Warren Buffett

The Valuation Dilemma

The issue with the valuation dilemma is that traditionally, such has preceded market repricings.

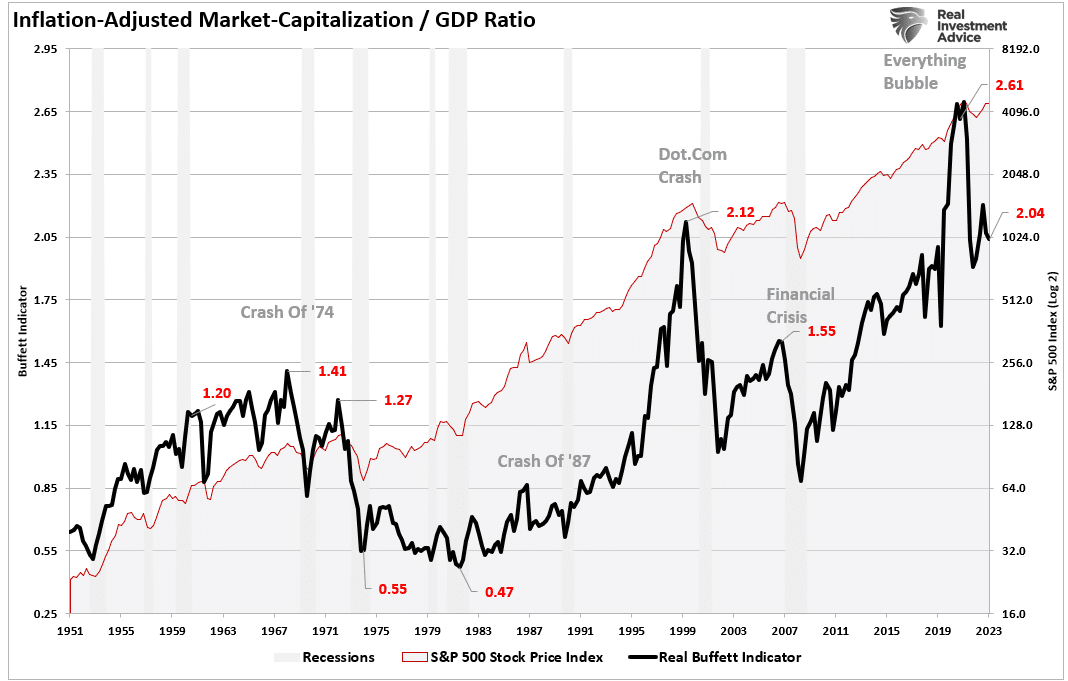

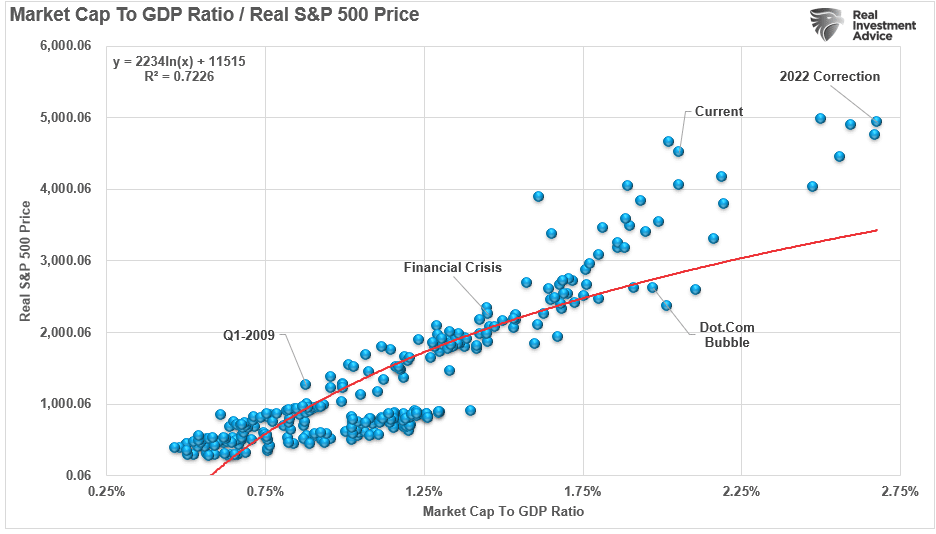

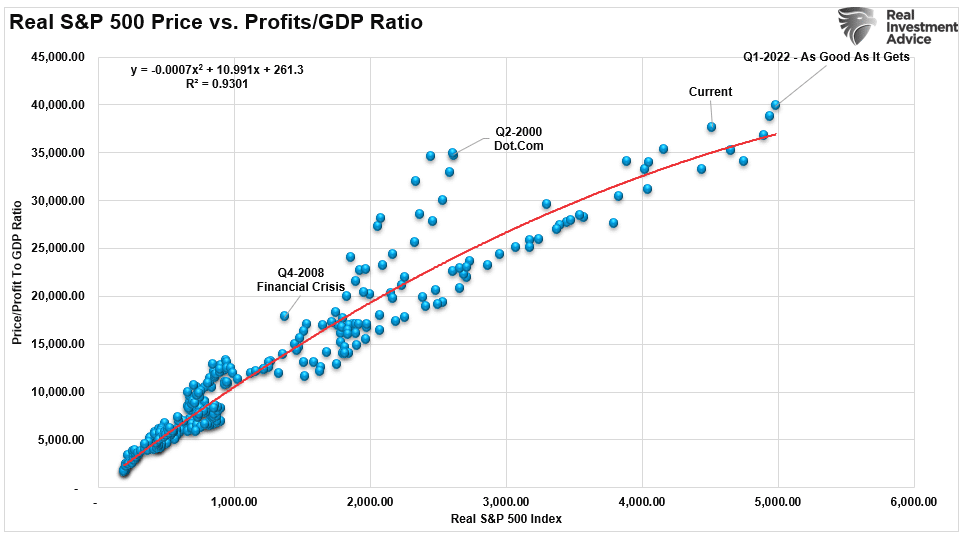

Considered one of Warren Buffett’s favourite valuation measures is the market capitalization-to-GDP ratio. I’ve modified it barely to make use of inflation-adjusted numbers. This measure is straightforward: shares mustn’t commerce above the worth of the economic system. The reason being as a result of financial exercise gives revenues and earnings to companies.

As mentioned in “Inventory Markets Are Indifferent From The whole lot,” the present atmosphere is something however opportunistic for a worth investor like Warren Buffett. To wit:

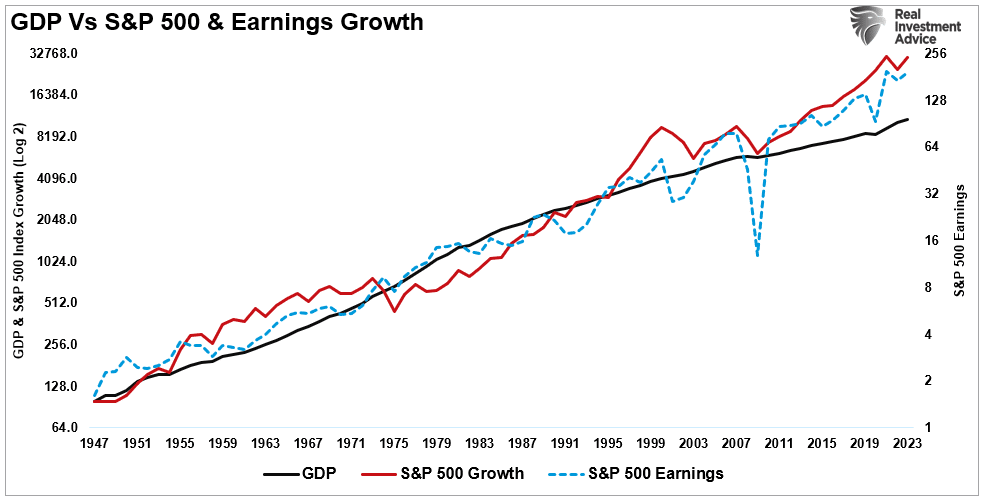

“Whereas inventory costs can deviate from quick exercise, reversions to precise financial development finally happen. Such is as a result of company earnings are a operate of consumptive spending, company investments, imports, and exports. The market disconnect from underlying financial exercise is because of psychology. Such is especially the case over the past decade, as successive rounds of financial interventions led buyers to consider ‘this time is completely different.’”

There’s a correlation between financial exercise and the rise and fall of fairness costs. For instance, in 2000 and once more in 2008, company earnings contracted by 54% and 88%, respectively, as financial development declined. Such was regardless of requires unending earnings development earlier than each earlier contractions.

As earnings upset, inventory costs adjusted by practically 50% to realign valuations with weaker-than-expected present earnings and slower future earnings development. So, whereas inventory markets are as soon as once more indifferent from actuality, previous earnings contractions suggests such deviations are usually not sustainable.

With the present market capitalization to GDP ratio knowledge exterior the historic vary as financial development slows, you’ll be able to perceive Berkshire’s dilemma of deploying money.

The danger of overpaying for property comes all the way down to sustaining present profitability.

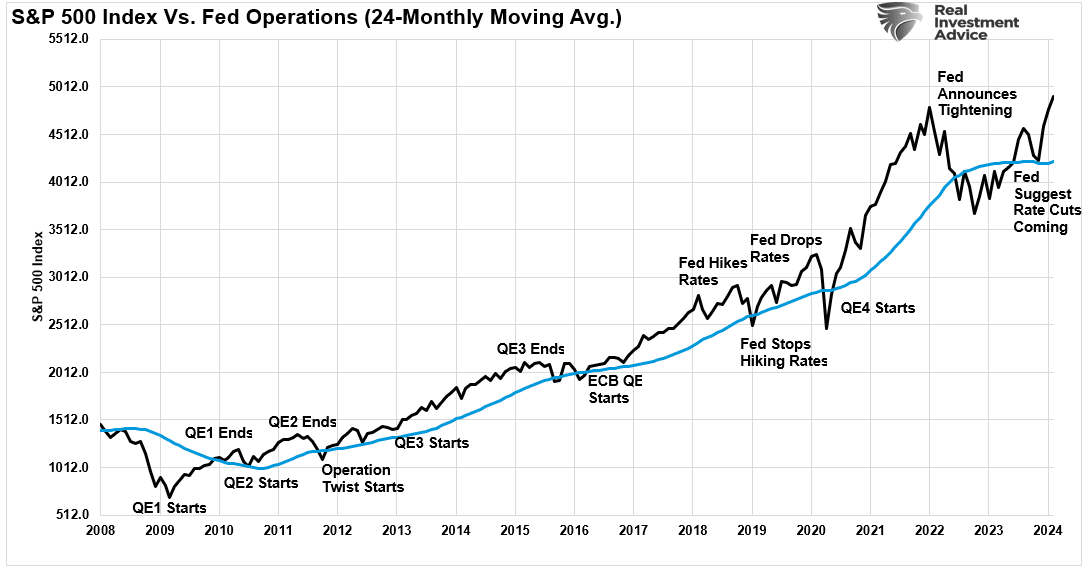

Berkshire’s challenge of discovering “moderately priced” acquisitions is not only one among being overly choosy about alternatives. After greater than a decade of financial infusions and nil rates of interest, most corporations are priced effectively past what financial dynamics can assist.

The second message from Buffett’s money hoard was extra of a warning.

Buffett’s Money Trying For A Crash?

“Sometimes, markets and/or the economic system will trigger shares and bonds of some massive and basically sound companies to be strikingly mispriced. Certainly, markets can – and can – unpredictably seize up or vanish as they did for 4 months in 1914 and some days in 2001. In the event you consider American buyers are actually extra steady than previously, assume again to September 2008. Pace of communication and the wonders of know-how facilitates on the spot worldwide paralysis, and now we have come a great distance since smoke alerts. Such on the spot panics received’t occur usually – however they’ll occur.

Berkshire’s capability to right away reply to market seizures with each large sums and certainty of efficiency might supply us an occasional large-scale alternative. Although the inventory market is massively bigger than it was in our early years, at present’s energetic contributors are neither extra emotionally steady nor higher taught than after I was at school. For no matter causes, markets now exhibit much more casino-like conduct than after I was younger. The on line casino now resides in lots of houses and day by day tempts the occupants.

One funding rule at Berkshire has not and won’t change: By no means threat everlasting lack of capital. Because of the American tailwind and the ability of compound curiosity, the sector wherein we function has been – and will probably be – rewarding should you make a few good choices throughout a lifetime and keep away from critical errors.” – Warren Buffett

In different phrases, he holds such excessive money ranges to reap the benefits of market dislocations. Such is what occurred in 2008 when the distinguished “white shoe” funding agency of Goldman Sachs got here begging with “hat in hand” for a bailout to keep away from chapter. Buffett was glad to oblige by offering a large infusion of capital at profitable phrases. Throughout a disaster, those that “have the gold make the principles.”

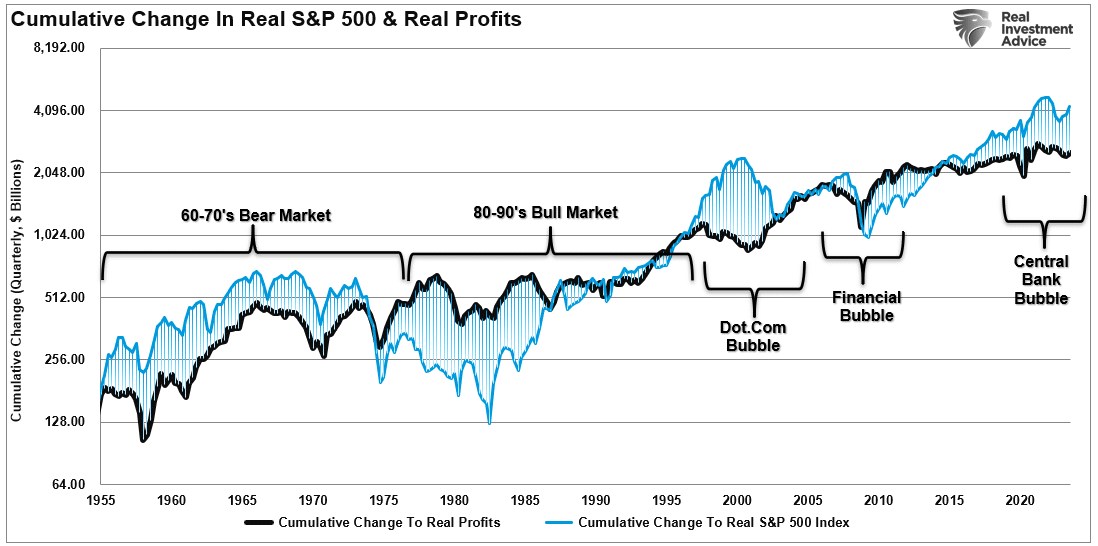

Is there such a chance coming sooner or later? The reply is most probably sure. If we study company income as they relate to financial development, we discover one other measure of extra. The chart beneath measures the cumulative change within the S&P 500 index in comparison with company income. Once more, when buyers pay greater than $1 for $1 price of income, these excesses are finally reversed. The present deviation of the market from underlying profitability means that eventual reversion will probably be fairly unkind to buyers.

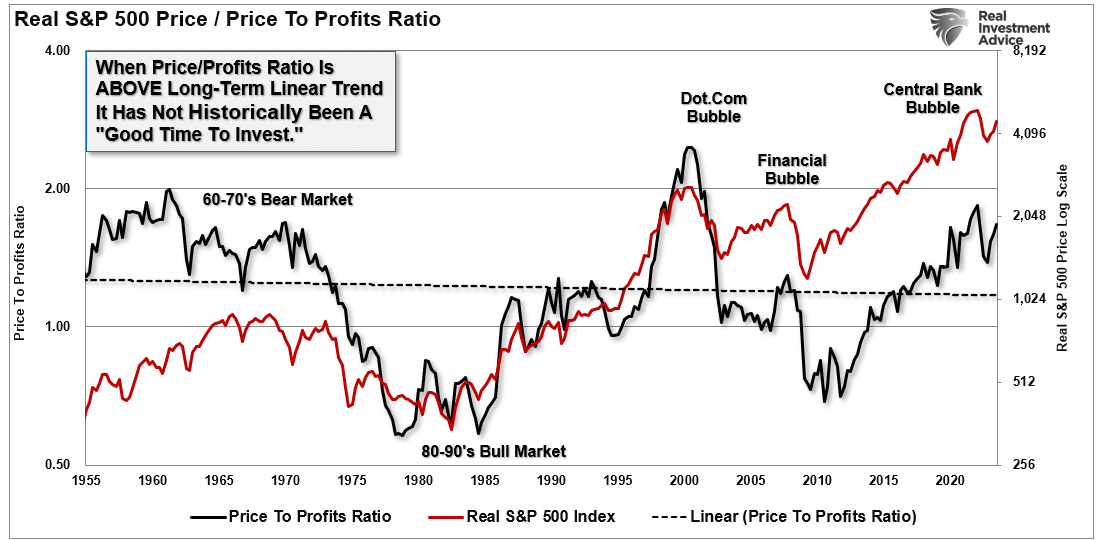

The correlation is extra evident available in the market versus the price-to-corporate income ratio. Once more, since company income are finally a operate of financial development, the correlation just isn’t surprising. Therefore, neither ought to the approaching reversion in each collection. At present, that ratio is approaching ranges that preceded extra important market reversions to realign the markets to profitability.

As famous, the excessive correlation is unsurprising. Traders ought to count on an eventual reversal, with the market on the extra excessive finish of the valuation spectrum. Nonetheless, these reversals can take for much longer to happen than logic would assume.

Traders consider the deviation between fundamentals and fantasy doesn’t matter so long as the Fed helps asset costs. Such a degree stays difficult to argue.

Nonetheless, as is at all times the case, the reversion of excesses will happen. Buffett’s money hoard means that he realizes that such a reversion just isn’t unprecedented. Extra importantly, he desires to capitalize on it when it happens.

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.