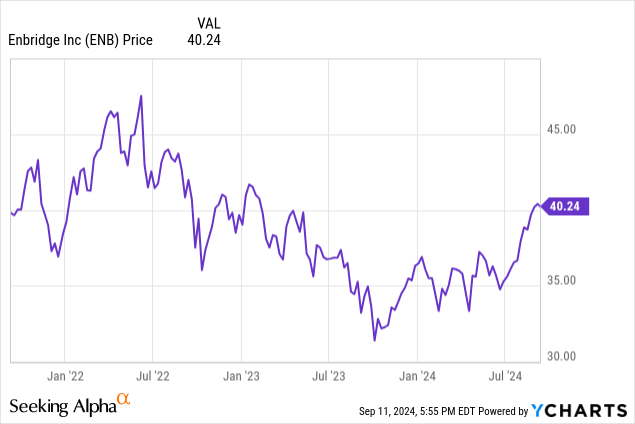

Enbridge’s New Most well-liked Shares Yield 8.65%, However I’m Not (NYSE:ENB)

JHVEPhoto

Introduction

One of many fascinating parts of most well-liked shares in Canada is that among the points (after which predominantly most well-liked fairness issued by bigger firms) have a conversion element. Inside the popular safety spectrum, you typically have two forms of most well-liked shares: Mounted fee and floating fee most well-liked shares. In Canada, even the floating fee most well-liked shares typically see most well-liked dividend charges being locked in for 5 12 months stints (i.e. each 5 years the popular dividend fee will get reset, normally based mostly on a five-year authorities bond plus a mark-up). Nevertheless, in some instances, most well-liked shareholders get the choice to transform the five-year lock-in for a “actual” floating fee most well-liked safety with a quarterly dividend that fluctuates together with the short-term rates of interest. That’s what occurred at Enbridge, which just lately issued a brand new collection of most well-liked inventory with a quarterly most well-liked dividend cost based mostly on the three-month authorities bond fee.

On this article I’ll give attention to the newly issued Collection 4 most well-liked shares of Enbridge (NYSE:ENB) which began buying and selling just some days in the past. From a elementary perspective, nothing has modified since my earlier article was revealed in August, and I’d wish to refer you to that article to learn up on the dividend protection ratio and asset protection ratio of Enbridge’s most well-liked inventory.

Introducing the brand new Collection 4 most well-liked shares

Originally of August, when Enbridge introduced it wasn’t planning on redeeming its Collection 3 most well-liked shares, it opened up the likelihood for Collection 3 most well-liked shareholders to transform their most well-liked securities in a newly created Collection 4 most well-liked safety. The edge to make the conversion occur was 1 million shares: If lower than 1 million of the 24 million Collection 3 most well-liked shares wished to transform into Collection 4, no new class could be created.

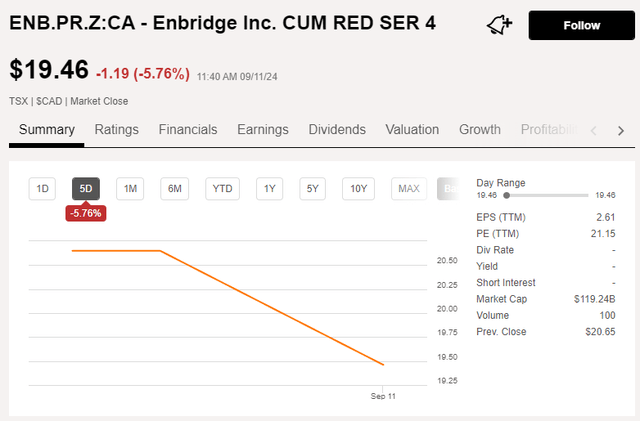

Surprisingly, the corporate obtained purposes from simply over 1.5 million Collection 3 most well-liked shares to transform the inventory into Collection 4 most well-liked shares, in order per the phrases of the prospectus, Enbridge now has to transform these 1.5 million Collection 3 into Collection 4 inventory. This implies there are actually roughly 22.5M shares of the Collection 3 excellent and roughly 1.5 million shares of the newly created Collection 4. That new collection of most well-liked shares began buying and selling with ( TSX:ENB.PR.Z:CA) because the ticker image. Take into accout buying and selling volumes are at the moment fairly gentle however I anticipate the amount to choose up as soon as all shares have been deposited within the respective accounts (there typically are delays). Moreover, as market contributors develop into conscious of a brand new quarterly floating problem, I anticipate the curiosity within the new Collection 4 to choose up.

Looking for Alpha

The newly issued collection of most well-liked inventory is buying and selling at C$19.46, and the corporate introduced the primary floating fee dividend will likely be 42.206 Canadian Greenback cents per share. This represents an annualized dividend yield of roughly 6.75% per share based mostly on the par worth of the safety.

Readers are cautioned the popular dividend on the Collection 4 most well-liked shares will likely be reset each quarter, based mostly on the three-month Canada Authorities Treasury invoice plus a mark-up of 238 bps.

Because the share worth chart above reveals, the share worth is now buying and selling at just below C$19.5, which implies the present yield on price is roughly 8.65% based mostly on the popular dividend for the present quarter (payable on Dec. 1).

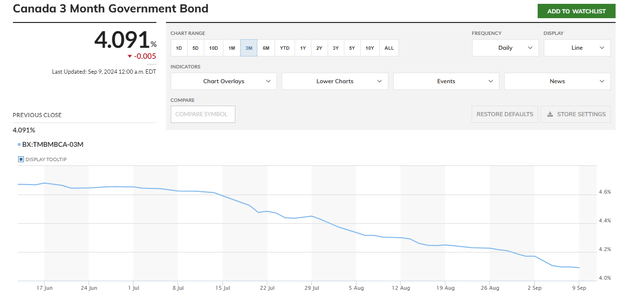

Sounds nice, however be mindful the popular dividend will fluctuate each quarter. And the three-month authorities bond yield has been steadily reducing previously few months (the Financial institution of Canada has been strolling down its benchmark rate of interest, and this clearly had a destructive influence on the short-term rates of interest on the monetary market). As you may see under, the three-month yield has misplaced about 60 bps previously three months.

Marketwatch.com

So whereas the popular dividend for the present quarter is fairly interesting, odds are the subsequent few quarterly dividends will likely be decrease. If I’d use the present three-month authorities bond fee of 4.09% and add the 238 bps mark-up, the quarterly most well-liked dividend could be C$0.404/share for a yield of 8.3%.

That’s nonetheless good. However between now and the top of this 12 months there are two extra coverage rankings. An extra two conferences are scheduled to be held within the first quarter of subsequent 12 months. So the chances of seeing at the very least two extra fee cuts introduced between now and the top of March subsequent 12 months is fairly life like.

So let’s assume the three-month authorities bond yield drops to three.50%. In that case, the quarterly most well-liked dividend would drop to C$0.3675 per quarter for a present yield of seven.55%.

I may have a look at the Collection 4 most well-liked shares from one other perspective. The Collection 3 most well-liked shares reset to a 5.288% yield and contemplating the share worth of the Collection 3 is at the moment C$18.12 (proven under), the present yield is roughly 7.3%.

If that’s what the market likes to see for a five-year lock-in, I can now use this quantity to determine what the minimal required three-month authorities bond yield is to generate an identical return on the Collection 4.

7.3% * C$19.46 = C$1.42 is what’s wanted to make the Collection 4 preferreds yield 7.3%. This represents a yield of 5.68% based mostly on the C$25 principal worth, and after deducting the 238 bps mark-up, the three-month Canada authorities bond yield needs to be 3.3% (on common all through the subsequent 5 years) for the Collection 4 to supply the identical yield because the Collection 3.

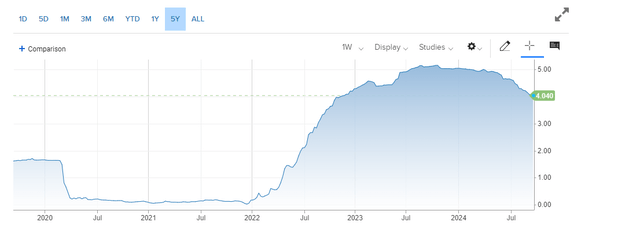

Whereas the 3M yield is at the moment 79 bps increased than the required 3.3% threshold, I wouldn’t financial institution on the present advantageous scenario to proceed. The query now clearly is “by how a lot will rates of interest on the monetary markets lower” and I want I had a solution.

CNBC.com

I don’t assume we’re going again to a zero rate of interest coverage. However even earlier than the 2020 pandemic associated fee cuts occurred, the 3M Canada bond yield was buying and selling round 1.75%, wherein case the yield on the Collection 4 would drop to simply 5.3% based mostly on the present share worth.

Funding thesis

Whereas the Collection 4 most well-liked shares of Enbridge are an ideal automobile to invest on the three-month Canada authorities bond yield staying “increased for longer,” I am passing on shopping for inventory on the present ranges. I’d somewhat favor the visibility and certainty supplied by the Collection 3 the place the brand new most well-liked dividend has been locked in for the subsequent 5 years somewhat than speculating on the short-term rates of interest.

Collection 4 may very well be a “speculative purchase” for anybody searching for publicity to those short-term rates of interest, however I am not on the present worth ranges. Maybe I’ll have one other look once we are nearing the top of the top of the speed reduce cycle.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.