Oakmark Fund U.S. Fairness Market This autumn 2025 Commentary (OAKMX)

juststock/iStock through Getty Pictures

What goes up should come down.

– Sir Isaac Newton

Lots of the previous Wall Avenue sayings assume developments ultimately must reverse: “Timber don’t develop to the sky”; “Bulls can earn cash, bears can earn cash, however pigs get slaughtered”; “You possibly can’t go broke taking a revenue.” Even the recommendation we constantly provide—to periodically rebalance portfolios—is as a result of a better inventory worth will increase potential loss and reduces potential acquire. However the previous few years have made a mockery of that recommendation, main tens of millions of buyers to conclude that it’s outdated and irrelevant.

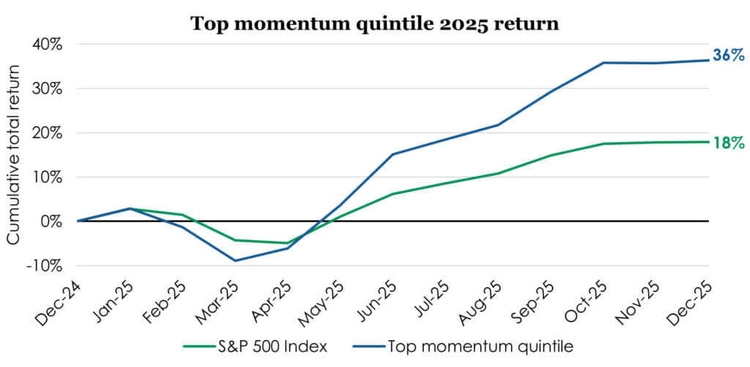

Regardless of producing better-than-average absolute returns, actively managed funds have lately had a tough time beating the S&P 500. It has been particularly tough for managers like us, who give attention to enterprise worth. Though our fairness funds earned double-digit, tax-efficient returns and reached new all-time highs in 2025, most trailed the S&P 500. However a remarkably easy technique produced practically double the S&P return in 2025: Purchase the shares which have already gone up probably the most! Simply purchase these shares, sit again, and rebalance quarterly.

This chart exhibits the outcomes for a portfolio of all mid- and large-cap shares that have been within the prime quintile of trailing nine-month returns.

See disclosure underneath the next associated chart.

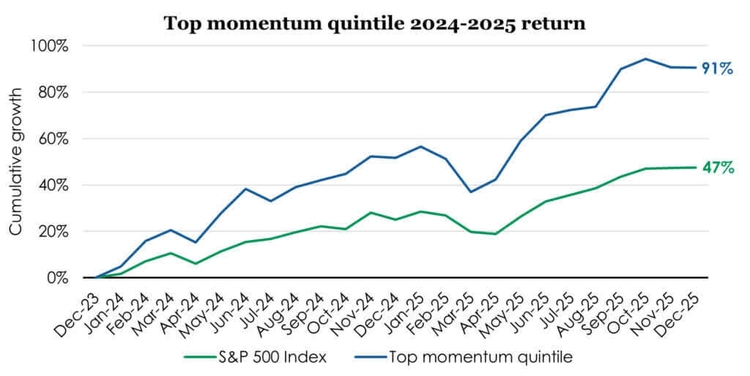

And this comes on the heels of a really comparable 2024. Under is the two-year chart.

Information supply: Morningstar Direct as of 12/31/2025. The universe for this evaluation is all U.S. shares labeled as mid-cap, large-cap, or giant-cap by Morningstar. Momentum is outlined for every particular person inventory because the 9-month trailing return on a 1-month lag. The ‘prime momentum quintile’ portfolio is rebalanced quarterly and market-cap weighted. The portfolio is constructed on a quarterly foundation by solely deciding on shares whose momentum rating fall throughout the prime quintile of the universe. As a way to keep away from hindsight bias, shares are chosen after their 9-month return is realized and are held within the portfolio for 3 months thereafter till the following quarterly rebalance happens. Previous efficiency is not any assure of future outcomes. Charts are for informational functions solely and don’t depict the efficiency of any Harris | Oakmark technique or product.

So, for the previous two years, buyers have been rewarded for believing, “What goes up retains going up.” And buyers like us, who use earnings from high-performing shares to reinvest in cheaper shares, have missed out on the most important positive aspects. As extra buyers bounce aboard the momentum prepare, it’s particularly essential to make use of historic context to grasp latest efficiency. This chart exhibits the highest performing two-year intervals for momentum since 1998.

Supply: Morningstar Direct as of 12/31/2025. Previous efficiency is not any assure of future outcomes.

The dot-com bubble was simply the strongest two years for momentum, however the previous two years are the following highest. And in case you add 2023, the previous three years cumulatively got here very near the dot-com period. Previous to this, the following strongest interval for momentum was after the collapse of the dot-com bubble. That’s when the non-technology shares that have been left behind in 1998 and 1999 loved a multi-year restoration. I’m hoping that’s foreshadowing as a result of that was an exceptionally favorable time for Oakmark efficiency!

Trying on the previous 20 years, proven as 4 intervals of 5 years every, it turns into even clearer that the present interval is an outlier.

Supply: Morningstar Direct as of 12/31/2025. Previous efficiency is not any assure of future outcomes.

The bizarre momentum of the previous few years has additionally brought about the unfold between the “haves” and “have-nots” to continue to grow. As a result of the heaviest weighted shares within the S&P 500 have been largely within the constructive momentum class, the hole between the S&P 500 a number of and the a number of of the typical inventory has widened. Because the finish of 2022, the S&P 500 P/E a number of has elevated by 5 factors, from 17 to 22 occasions earnings, or 31%. However the a number of of the typical inventory has solely elevated by one a number of level, or 7%. After we take a look at the efficiency of common shares in comparison with inventory market averages, we see alternative.

Little or no of the Oakmark Fund (OAKMX) is invested within the shares which might be most closely weighted within the S&P 500, the identical shares which have pushed the S&P’s P/E ratio greater. The Oakmark Fund’s P/E ratio of 13 occasions is, because it sometimes has been traditionally, effectively beneath that of the typical inventory. However, due to how low the typical inventory P/E is immediately in comparison with the S&P 500, Oakmark has hardly ever had such a low relative P/E ratio.

We consider that the Oakmark Fund is a gorgeous standalone portfolio. (In fact, we all the time consider that!) With the Oakmark Fund buying and selling at about 13 occasions anticipated earnings, its threat profile is kind of totally different from the S&P 500. And we discover that thrilling. Teachers say that the one approach to enhance anticipated return on an funding is to tackle extra threat. We’ve all the time disagreed. Since its inception, Oakmark has returned greater than its threat degree advised. We attribute this to our constant funding model of shopping for at a reduction to honest worth as a way to concurrently enhance upside and reduce draw back. We consider that Oakmark’s low P/E immediately relative to the S&P 500 will increase the chance that document continues.

Maybe extra essential, our portfolio has by no means seemed so not like the S&P 500. The make-up of the S&P 500 has modified dramatically in simply the previous few years. It has develop into greater priced and extra concentrated than at any time in latest historical past. Oakmark’s largest holding is lower than 3% of its portfolio whereas the S&P 500’s largest is over 7%. Lower than 5% of the Oakmark portfolio is in expertise shares whereas the S&P has roughly 35%. That’s greater than Oakmark holds in any single business.

Due to the S&P’s unusually excessive concentrations, Oakmark’s correlation to the index is at its lowest degree because the dot-com bubble. The mathematics of portfolio development exhibits that threat declines when the property composing a portfolio are much less correlated to one another. (For example, contemplate the danger discount from proudly owning each an oil producer and an oil shopper relatively than two of both.) As we speak, Oakmark gives extra portfolio diversification profit than it has at any level this century—each as a result of it’s extra diversified than the S&P 500 and since its correlation is traditionally low.

We now not view the S&P 500 as a low threat, “purchase and maintain” funding. We consider, and the information verify, that the S&P 500 has develop into a lot riskier and due to this fact extra akin to a concentrated development fund. Because of this, we predict buyers ought to re-examine whether or not their publicity to the S&P 500 is in line with assembly their long-term monetary objectives. For these buyers who’ve nearly all of their property listed to the S&P 500, we consider there’s an uncommon alternative to each enhance anticipated return and decrease threat by changing a number of the S&P 500 publicity with a fund just like the Oakmark Fund.

Perhaps “this time is totally different,” and “pigs gained’t get slaughtered,” and “timber will develop to the sky.” But when, as we consider, “what goes up nonetheless should come down,” then Oakmark could be very well-positioned for 2026 and past.

With the brand new 12 months simply starting, all of us at Harris | Oakmark wish to take this chance to thanks for trusting us to speculate your financial savings. It’s a privilege we don’t take with no consideration and a duty we don’t take evenly. All of us want you a cheerful, wholesome and affluent 2026.

William C. Nygren, CFA

Portfolio Supervisor

Editor’s Word: The abstract bullets for this text have been chosen by In search of Alpha editors.