World Web Lease: I am Sticking With The 8.5% Yielding Most well-liked Shares (NYSE:GNL)

Supatman

Introduction

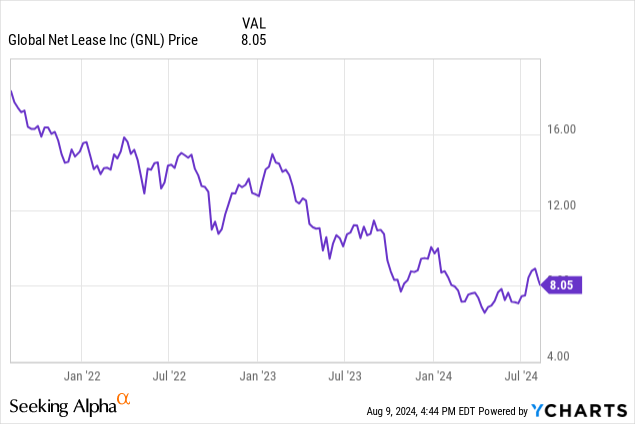

I’ve owned the popular shares of World Web Lease (NYSE:GNL) for a number of years now as they supplied a pleasant and dependable quarterly revenue to my funding portfolio. Nonetheless, because the scenario within the REIT panorama has modified dramatically due to the upper rate of interest setting, I actually wished to have one other take a look at the popular shares to make sure there might be no abrupt ending to the constant money movement.

This text will talk about World Web Lease from the attitude of a most well-liked shareholder (I used to be a most well-liked shareholder of American Finance Belief, which was renamed to The Necessity Retail REIT earlier than it merged with GNL). On account of steadiness sheet considerations, I’ve no real interest in the REIT’s widespread inventory presently.

Whereas the popular shares get pleasure from wonderful protection, the deleveraging ought to proceed

Once I take a look at a most well-liked inventory challenge, I concentrate on two vital components: The steadiness sheet and the popular dividend protection ratio.

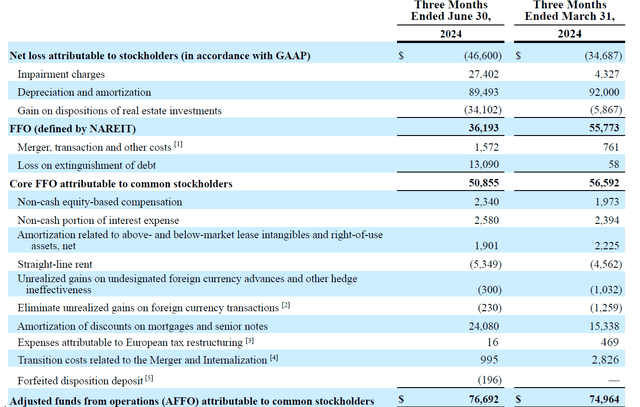

For the latter, the FFO and AFFO often present an excellent start line. The place to begin of the FFO calculation is the $46.6M internet loss attributable to World Web Lease’s widespread shareholders. Subsequently, the impairment fees and depreciation and amortization bills need to be added again to the equation, whereas the acquire on the disposition of property needs to be deducted. This leads to an FFO of $36.2M and a core FFO of virtually $51M.

GNL Investor Relations

To maneuver from the FFO to the AFFO calculation, there are many changes that have to be made, as you possibly can see above. The primary aspect is including again the amortisation of reductions on mortgages and senior notes, which provides simply over $24M to the AFFO calculation. And when all is claimed and completed, the complete AFFO generated within the second quarter was roughly $76.7M.

It’s vital to understand this already consists of the popular dividends. As you possibly can see beneath within the revenue assertion, the $46.6M internet loss start line consists of virtually $11M in most well-liked dividends. This implies the pre-dividend AFFO was roughly $88M, and the REIT wanted simply round 12.5% of its pre-dividend AFFO to cowl the popular dividends. So so far as the popular dividend protection ratio is worried, I’m greater than high-quality with a sub-15% payout ratio.

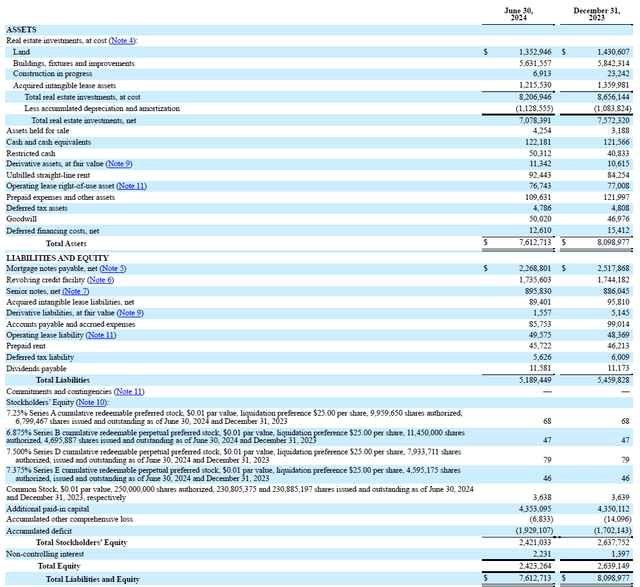

The scenario on the steadiness sheet is a complete completely different recreation. As you possibly can see beneath, the overall asset base is simply over $7.6B, of which nearly $5.2B is funded by liabilities. The e-book worth of the property was $7.08B whereas the $173M in money and restricted money vs. the $4.9B in gross monetary debt (excluding lease liabilities) leads to a internet debt of round $4.73B (and $4.82B if I’d embody the intangible lease liabilities excluding the working lease liabilities). In comparison with the $7.08B e-book worth, the LTV ratio is roughly 67%.

GNL Investor Relations

After all, it could be improper to make use of the e-book worth of the true property. Not like in different nations, US-domiciled REITs really need to depreciate their actual property property, and because the steadiness sheet above reveals, the $7.08B e-book worth already consists of $1.13B in amassed depreciation. If I’d use the acquisition price of the true property property, the LTV ratio can be round 57.6%. That’s nonetheless fairly excessive, and the following step is to determine what the “truthful worth” of the property can be, because the market worth won’t ever be precisely the identical because the e-book worth or acquisition price.

As disclosed by the REIT (and proven beneath) the Q1 NOI was roughly $167.8M, which is roughly $671M per yr. The corporate additionally introduced a leasing unfold of 4.3% within the second quarter of the yr, so I’ll use a ahead NOI of $685M per yr for World Web Lease’s property adjusted for occupancy, the absolutely occupied NOI can be round $725M.

This implies the e-book worth of the property represents a yield of 10.2% (outlined as occupancy-adjusted NOI versus the e-book worth) whereas the acquisition price represents a yield of 8.9%. The corporate was capable of promote property at a median cap price of seven.3%, so I feel it’s truthful to make use of a 7.5-8% cap price for GNL’s asset foundation. Utilizing 7.75% (I wish to be conservative), the property would have a good worth of $9.35B through which case the LTV ratio can be simply round 50%, a excessive however nonetheless acceptable proportion.

The calculation of the truthful worth can be vital for the asset protection ratio of the popular shares. There are at present 4 collection of most well-liked shares excellent, for a complete of $600M. Which means that with a complete of $2.42B in fairness on the steadiness sheet, there’s in extra of $1.8B in widespread fairness which ranks junior to the popular capital.

That’s based mostly on the e-book worth of the property. If I’d use a good worth of $9.35B, the implied fairness worth can be nearer to $4.7B, of which $600M can be most well-liked fairness (with a typical fairness cushion of in extra of $4B).

Though I used to be reluctant proper after the merger with The Necessity Retail REIT closed, the popular fairness now will get the thumbs up from me as each the asset protection ratio in addition to the popular dividend protection ratio meet my necessities.

The phrases of the popular shares

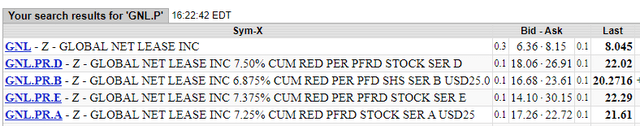

After the merger was accomplished, the REIT had (and nonetheless has) 4 collection of most well-liked shares excellent.

Stockwatch

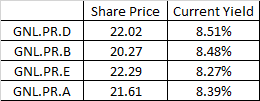

Based mostly on the closing costs as of Friday, this leads to the present overview of the yield (be aware, I am utilizing the identical order because the rating above).

Creator Desk

I’ve an extended place within the Sequence D (GNL.PR.D) and Sequence E (NYSE:GNL.PR.E) and based mostly on the desk above, it may make sense to swap E for D if/when the chance arises (and if it is smart after taking transaction charges into consideration).

Funding thesis

Whereas I initially wasn’t within the widespread shares of World Web Lease, I’m now feeling more and more assured the REIT will be capable to handle its steadiness sheet in a manner that can alleviate the standard considerations (the REIT now expects to promote $650-800M in property this yr, up from $400-600M). And, after all, a stronger steadiness sheet reduces the refinancing threat.

It can stay vital to maintain the occupancy ratio excessive and to ensure all tenants proceed to pay their hire, however as 59% of the portfolio is leased to investment-grade tenants, the hire assortment price ought to stay excessive.

I’ve an extended place within the Sequence D and Sequence E of the popular shares. And whereas I initially solely meant to carry my present place, I may very well additional improve the place dimension as my major considerations are being alleviated with the asset sale program. That being stated, I can also select to purchase the Sequence A and/or B most well-liked shares if their respective yields are larger.