What Does The Financial institution Of England’s Delayed Price Minimize Indicate For U.S.?

Nerthuz

If the Financial institution of England’s resolution on Thursday to go away rates of interest unchanged is a information, the outlook for the beginning date for a US fee minimize could also be additional down the road than typically assumed.

There are many variations between the UK and US economic system, and so sizing up BoE coverage selections with the Federal Reserve is an apples and oranges comparability on a number of fronts. But, it’s onerous to miss the truth that the Outdated Woman of Threadneedle Avenue left its goal fee unchanged, at 5.25% on Thursday (June 20), regardless of a return of UK inflation to the central financial institution’s 2% goal in Might, reported the day earlier than.

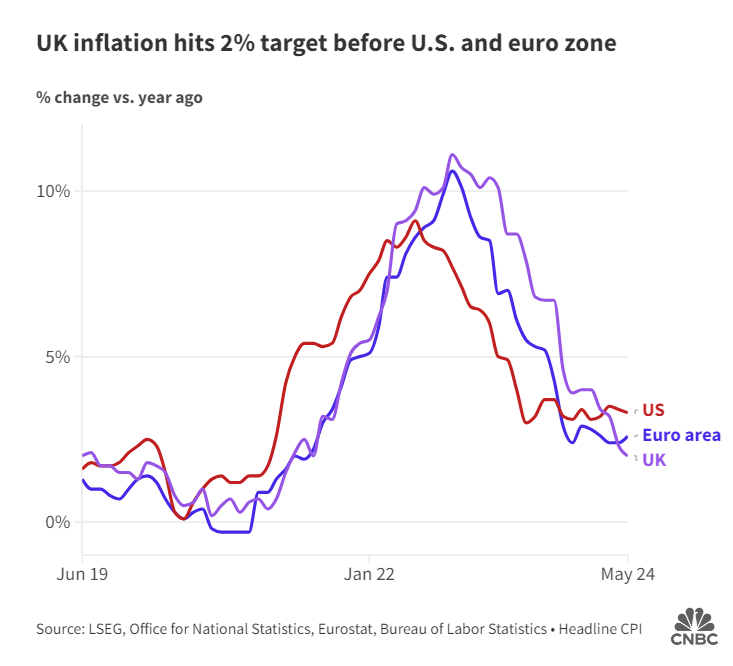

It’s additionally placing that UK inflation is nicely under the equal for the US. Naively extrapolating the distinction as a information to the long run means that the Fed’s fee minimize is nowhere on the near-term horizon – a guesstimate that contrasts with market expectations within the US.

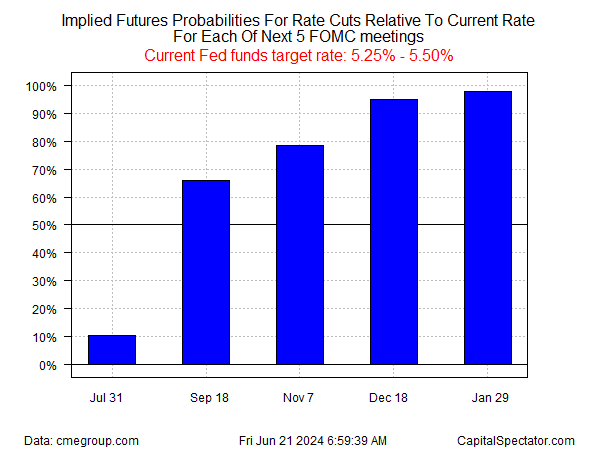

However England isn’t America and the gang evaluates the macro outlook fairly in a different way for the US, and rightly so. Nonetheless, there’s nonetheless room for debate on guesstimates on timing for the primary Fed fee minimize. Fed funds futures are at present estimating an implied 66% chance that the Sep. 18 FOMC assembly will mark the primary announcement of coverage easing. The plain caveat: US buyers have been pricing in average odds for fee cuts for a lot of the previous yr, solely to be disabused of that forecast, time and time once more.

Is that this time completely different? Nobody is aware of, however the BoE’s resolution certainly provides one more reason to remain cautious on anticipating US fee cuts will arrive sooner relatively than later. Certainly, regardless of a transparent signal that UK inflation has returned to focus on, the central financial institution stays reluctant to embrace a dovish pivot.

“It’s excellent news that inflation has returned to our 2 per cent goal,” notes Andrew Bailey, BoE’s governor. “We have to make sure that inflation will keep low and that’s why we’ve determined to carry charges at 5.25 per cent for now.”

The important thing query: Will the Fed be equally cautious? A minimum of one voting member of the FOMC is leaning in that path. Thomas Barkin, president of the Federal Reserve Financial institution of Richmond, instructed reporters yesterday: “My private view is let’s get extra conviction earlier than shifting.”

At a excessive degree, the case for standing pat seems to be a lot stronger for the Fed vs. BoE provided that US inflation – at 3%-plus – continues to be nicely above the two% goal.

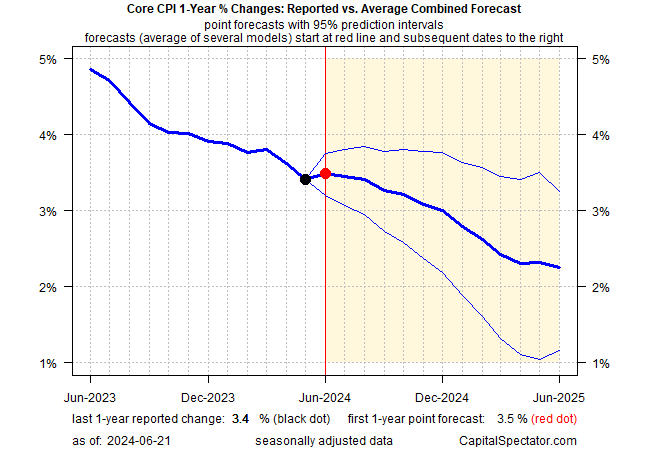

CapitalSpectator.com’s ensemble forecasting mannequin for core CPI means that sticky inflation danger will proceed to fade, however slowly, and so the case for fee cuts based mostly on this forecast nonetheless seems to be muddled.

Federal Reserve Governor Adriana Kugler, nevertheless, threw out some mildly dovish feedback on Tuesday to maintain hope alive for 2024:

“Whereas I stay cautiously optimistic that inflation is coming down, it’s nonetheless too excessive, and it’s shifting down solely slowly. I consider that coverage has extra work to do [but] if the economic system evolves as I’m anticipating, it should probably turn into acceptable to start easing coverage someday later this yr.”

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.