Westport Gasoline Techniques: No Seen Path To Profitability – Maintain (NASDAQ:WPRT)

Scharfsinn86

Word:

I’ve coated Westport Gasoline Techniques Inc. (NASDAQ:WPRT) beforehand, so buyers ought to view this as an replace to my earlier articles on the corporate.

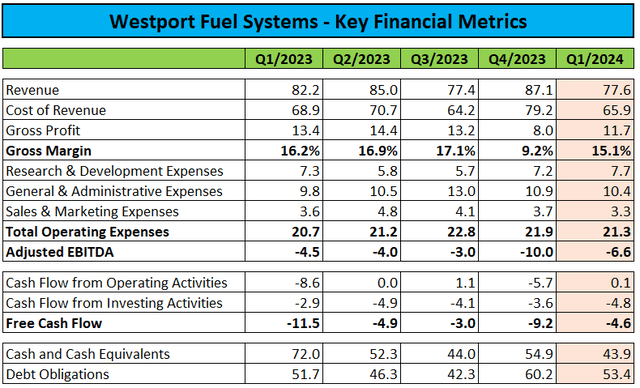

Final month, Westport Gasoline Techniques Inc. or “Westport” reported disappointing first quarter 2024 outcomes with revenues and earnings falling effectively in need of consensus expectations.

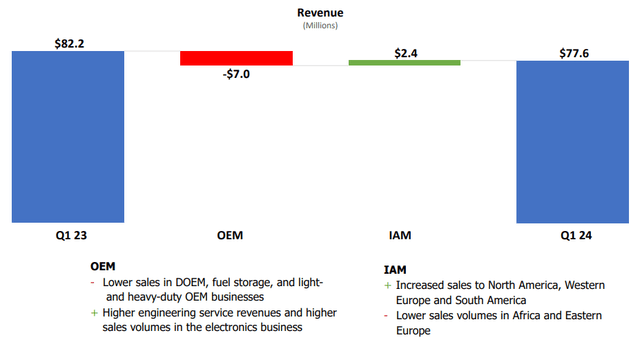

On a year-over-year foundation, revenues decreased by 6%, primarily pushed by decrease gross sales volumes within the firm’s delayed OEM, gas storage, light-duty OEM, and heavy-duty OEM companies.

This was partially offset by elevated gross sales quantity in electronics merchandise and better Unbiased Aftermarket revenues.

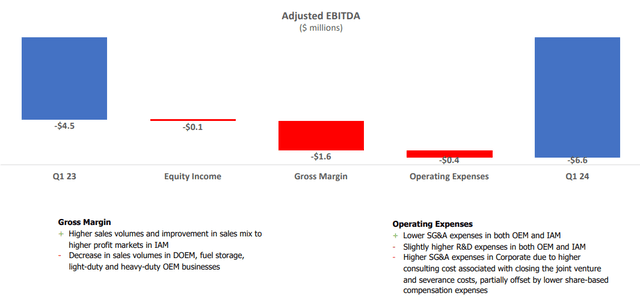

As well as, a mix of decrease gross margins and better working bills impacted Adjusted EBITDA:

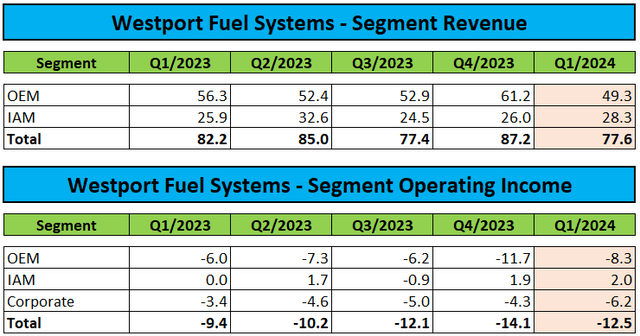

The corporate’s Q1 phase efficiency exhibited the same old sample of the smaller Unbiased Aftermarket (“IAM”) enterprise working at a modest revenue whereas the bigger Authentic Tools Producer (“OEM”) phase continues to undergo materials losses:

Firm Press Launch and Regulatory Filings

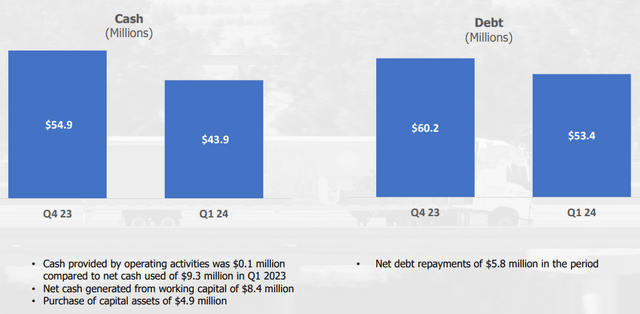

On a extra constructive notice, money circulation from operations improved considerably on a year-over-year foundation resulting from favorable working capital actions:

Nevertheless, materials capital expenditures resulted in one other quarter of adverse free money circulation. Westport completed Q1 with $43.9 million in money and money equivalents, in addition to $54.9 million in debt obligations.

Please notice that the corporate’s just lately established Excessive Stress Direct Injection (“HPDI”) three way partnership with key buyer AB Volvo or “Volvo” (OTCPK:VLVLY, OTCPK:VOLAF, OTCPK:VOLVF) may have a fabric influence on Westport’s monetary place, outcomes of operations, and money flows going ahead.

The three way partnership will function as an unbiased entity with Westport contributing sure HPDI™ property and actions together with associated mounted property, mental property, and enterprise, into the three way partnership. Volvo Group has acquired a forty five% curiosity within the three way partnership for about US$28 million, plus as much as an extra US$45 million as an earn-out relying on the next efficiency of the three way partnership.

Whereas Westport acquired a $28.4 million money cost upon closing, the requirement to fund the three way partnership on a professional rata foundation will offset the liquidity profit considerably.

Throughout the quarter, the corporate incurred $1.5 million in one-time bills associated to severance and prices related to the institution of the three way partnership.

Going ahead, Westport will now not consolidate the money-losing HPDI enterprise which ought to end in decreased OEM revenues, improved phase gross margins and considerably decreased losses from operations, in addition to materially decrease money outflows.

Consequently, liquidity shouldn’t be a problem till a minimum of 2026, notably when contemplating new administration’s ongoing cost-cutting efforts as additionally outlined within the earnings press launch:

Regardless of income briefly falling in need of our expectations within the first quarter, we have initiated cost-saving measures and have demonstrated a marked enchancment in our money from operations. Recognizing the numerous duties that lie forward, we stay steadfastly devoted to our priorities for 2024.

By strategic headcount reductions throughout the group, we’re aggressively streamlining our workforce to bolster operational agility.

Our price discount measures additionally give attention to initiating adjustments to our manufacturing strains to optimize manufacturing price reductions and enhance effectivity. These actions aren’t solely enhancing our general effectivity but additionally fostering a tradition of accountability and collaboration.

In our pursuit of profitability, price reducing just isn’t merely a precedence—it’s an crucial. We acknowledge that sustainable progress hinges on our capability to tightly handle bills. Subsequently, whereas we’re dedicated to driving top-line progress and operational efficiencies, our foremost focus stays on decreasing prices at each alternative.

Nevertheless, misplaced HPDI revenues might be partially offset by the gradual ramp of enormous LPG system provide contracts with an anticipated income contribution of €255 million over the subsequent 4 years.

On the convention name, administration additionally commented on the Chinese language market, however it definitely did not sound like OEM companion Weichai would pursue a industrial launch within the close to future:

We stay optimistic on the Chinese language pure gasoline automobile market, which expanded to effectively over 100,000 industrial automobiles in 2023. And we proceed to collaborate with our OEM companion within the Chinese language market to supply an inexpensive, low-carbon answer sooner or later. The events are at the moment discussing this work and the obligations of every get together going ahead. The engine growth program continues to evolve and transfer ahead.

Throughout the questions-and-answers session, a variety of analysts tried to get further colour on a possible date for the industrial launch in China, however administration did not have a lot of a solution:

We haven’t any orders proper now from Weichai for manufacturing. We have been transport them growth components for trials.

We’re persevering with the event work and, we’re optimistic that we are going to get the – get by the event applications and into manufacturing in some unspecified time in the future. However we do not have orders at this time.

Consequently, I might count on the phrases of the prevailing large-scale provide settlement with the Weichai Westport three way partnership to be modified once more earlier than the tip of this 12 months.

Backside Line

Westport Gasoline Techniques reported disappointing first quarter outcomes, with each revenues and profitability coming in under expectations.

Subsequent to quarter-end, the corporate and Volvo lastly launched their new HPDI three way partnership, which triggered a $28.4 million money cost to Westport.

Together with ongoing cost-cutting efforts, the ensuing liquidity enhance needs to be enough to hold the corporate effectively into 2026 and doubtlessly even past.

Nevertheless, with no seen path to profitability or free money circulation era, I do not see any motive to provoke or add to present positions at this level.

Consequently, I’m reiterating my “Maintain” score on the shares.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.