V.F. Company: Do not Take Turnaround Success At Face Worth (NYSE:VFC)

anilbolukbas

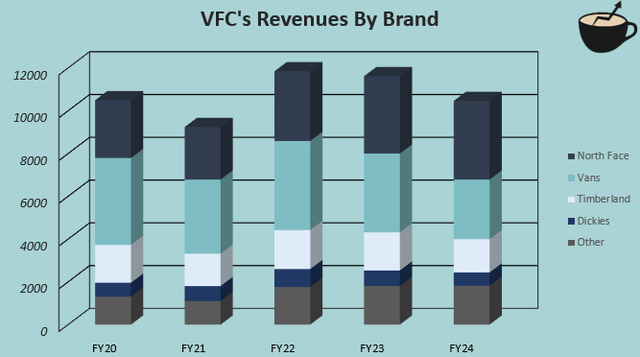

V.F. Company (NYSE:VFC) sells branded attire, footwear, and equipment underneath a portfolio of manufacturers. The manufacturers embody massive, globally acknowledged names such because the North Face, Vans, Timberland, and Dickies, but additionally smaller manufacturers together with Icebreaker, Napapijri, JanSport, and Supreme which was acquired in 2020 for $2.1 billion.

The inventory has misplaced the vast majority of its worth from 2021 ahead, with VFC’s poor model administration and costly M&A technique, resulting in excessive debt and poorly performing manufacturers. An intensive turnaround plan is in movement, however no results have been but seen in This autumn, as revenues declined by -13.4%.

Ten Yr Inventory Chart (Searching for Alpha)

VFC’s Lackluster Model Efficiency Sees No Finish But

VFC has had a weak latest historical past of rising lots of the firm’s key manufacturers. Vans, VFC’s largest model till FY2024, revenues have shrunk from $4063.4 million in FY2020, previous to massive Covid pandemic points to simply $2785.7 million in FY2024 at a CAGR of -9.0%. Timberland, the third largest VFC model, has had a CAGR of -3.1% in the identical interval with Dickies following at a -1.1% CAGR – evidently the corporate is unable to adapt to altering buyer demand with many stagnant manufacturers.

The 2020 acquisition of Supreme can be an instance of VFC’s historical past of poorly led manufacturers. The model added round $500 million to VFC’s gross sales in FY2022, with formidable plans to scale the expansion into $1 billion by way of new shops, model collaborations, and international enlargement with VFC’s massive international distribution community. Since Google Traits exhibits secure international search time period quantity for Supreme, and the corporate recorded goodwill and intangible asset impairment costs totaling $735 million in FY2023 with an extra $313.1 million in FY2024 as a result of model’s weak efficiency. VFC is now reportedly contemplating promoting the enterprise.

Writer’s Calculation Utilizing VFC’s 10-Okay Submitting Information

The North Face model is VFC’s outlier because the stagnant model picture from FY2014 to FY2017 has been circled into a formidable CAGR of 8.0% from FY2020 to FY2024, as the corporate has change into VFC’s largest model. The speedy development from the best-performing model has began to stagnate too although, with -5.3% in year-over-year revenues in This autumn and a 1.7% development in all of FY2024. The This autumn whole income development was -13.4%, exhibiting considered one of VFC’s deepest income declines in latest historical past.

The poor gross sales efficiency has in the end led to declining margins, because the working margin in FY2024 was solely 6.0% after a double-digit long-term stage with a mean of 11.4% from FY2016 to FY2020. Additional declines pose the same risk as nicely, as SG&A scales with inflation and failed development initiatives towards declining gross revenue.

Don’t Take Reinvent Turnaround Plan Success at Face Worth

To fight the poor efficiency, VFC launched the Reinvent turnaround plan within the Q2/FY2024 report press launch. The plan was launched by Bracken Darrell, VFC’s new CEO that was appointed just a few months previous to the plan’s announcement.

Within the plan, VFC targets to enhance leads to North America with a change within the working mannequin, flip across the Vans model with a brand new model president appointment, reduce prices by $300 million from mounted prices, and cut back debt – the modifications replicate a key shift in VFC’s technique, and a transparent give attention to altering Vans’ turnaround.

The $300 million in mounted price reductions appears to be an amazing profitability driver, if efficiently carried out with out worsening organizational efficiency. But, a model turnaround is required for the corporate’s earnings to maintain, as margins have continually taken successful from decrease gross sales, leveraged by VFC’s almost $6 billion in interest-bearing debt.

I don’t imagine that the Reinvent plan’s turnaround targets must be taken at face worth earlier than higher demonstration from manufacturers’ efficiency – a turnaround plan for Vans was already introduced within the 2022 Investor Day for Vans, as was completed for the North Face beforehand. Nonetheless, the Vans model hasn’t but even seen any stabilization a number of quarters later. Communicated development targets for Timberland and Dickies have been missed as nicely, with steady income declines.

The plan is now extra thorough than the plan seen within the 2022 Investor Day, particularly as Bracken Darrell was appointed as a brand new CEO to drive a change within the firm. Bracken Darrell has a formidable resume, being the prior CEO of Logitech Worldwide (LOGI) and dealing in senior roles at Procter & Gamble (PG), Whirlpool (WHR), and Common Electrical (GE). But, main trend manufacturers may be difficult, as sustaining and creating demand requires deep, fixed buyer and pattern information – whereas the brand new CEO is praised for the Outdated Spice model turnaround, the same turnaround of Vans might be more difficult, and certain requires a special kind of branding technique.

Efficiency continues to indicate no indicators of enhancements but. Vans’ gross sales declined by –26.3% in This autumn, the North Face’s by -5.3%, Timberland’s by -13.7%, and Dickies’ by -15.2%. Different manufacturers have been close to secure with a slight decline. The Vans search time period nonetheless exhibits continued weak spot on Google Traits.

Extra not too long ago, in February, VFC introduced that the corporate goes by way of a strategic portfolio evaluate, and now seeks to probably promote lots of its smaller manufacturers. The evaluate may create upside, however no gross sales have been introduced but.

The Inventory Valuation Costs In Too A lot Enhancements

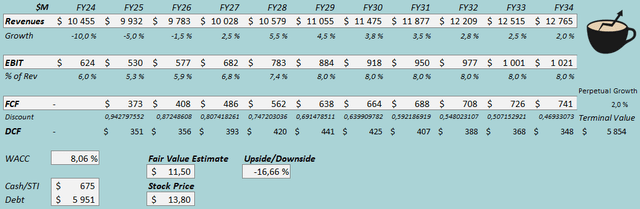

I constructed a reduced money circulation [DCF] mannequin to estimate a tough honest worth for the inventory. Within the mannequin, I issue a semi-successful turnaround, leaving margins greater than at the moment, however not fairly on the long-term stage.

For revenues, I estimate a -5% decline in FY2025, a -1.5% decline in FY2026, however a return into a greater efficiency from FY2027 ahead. From FY2026 to FY2034, I estimate the income CAGR at 3.4%, after which the expansion ends at a perpetual 2%.

As VFC targets $300 million in price financial savings, and as I estimate higher revenues after just a few years, I estimate the EBIT margin to be leveraged from 5.3% in FY2025 into an eventual 8.0%. The corporate has fairly low capex and incremental working capital wants, making the money circulation conversion fairly good.

DCF Mannequin (Writer’s Calculation)

The estimates put VFC’s honest worth estimate at $11.50, 17% under the inventory worth on the time of writing – even when the Reinvent turnaround plan exhibits good quantity of enhancements, the inventory appears to have a reasonable overvaluation. Good upside appears to require a close to full model turnaround, which I don’t imagine that buyers ought to but count on.

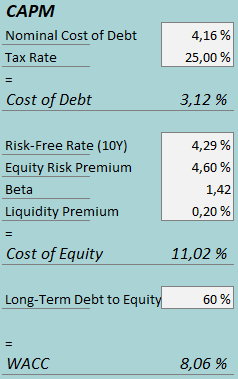

A weighted common price of capital of 8.06% is used within the DCF mannequin. The used WACC is derived from a capital asset pricing mannequin:

CAPM (Writer’s Calculation)

In This autumn, VFC had $61.8 million in curiosity bills, making the corporate’s rate of interest 4.16% with the present quantity of interest-bearing debt. I estimate a long-term debt-to-equity ratio of 60% attributable to VFC’s continued leveraged steadiness sheet, however plans for deleveraging. I imagine that refinancing the debt would now doubtless lead to the next rate of interest, posing a reasonable danger to the price of capital.

To estimate the price of fairness, I take advantage of the USA’ 10-year bond yield of 4.29% because the risk-free charge. The fairness danger premium of 4.60% is Professor Aswath Damodaran’s newest estimate for the USA, up to date on the 5th of January. Searching for Alpha estimates VFC’s beta at 1.42. Lastly, I add a liquidity premium of 0.2%, creating a price of fairness of 11.02% and a WACC of 8.06%.

Notable Upside Danger

The bearish thesis nonetheless has a significant upside danger – if the Vans turnaround seems to be extremely profitable, an increase again into long-term margins and higher development may make the inventory undervalued on the present worth. On the FY2016-FY2020 common working margin of 11.4% from FY2027 ahead, the DCF mannequin would estimate upside of 65%. Nonetheless, indicators of such a turnaround aren’t but seen, and such a situation shouldn’t be priced as doubtless but.

Additionally, the strategic various evaluate may nonetheless nicely pose upside, if VFC is ready to promote notable manufacturers for worth – the Timberland, Dickies, and Supreme manufacturers may get VFC consideration if a possible purchaser is extra assured in main the manufacturers. Hypothesis round potential gross sales are rising, and a sale of a number of of VFC’s manufacturers, in my view, is prone to occur sooner or later. But, the valuation in potential gross sales might be disappointing; gross sales aren’t a particular technique to create upside.

I urge buyers to look at the model efficiency intently within the upcoming quarters, as a full turnaround may nonetheless be very beneficial for shareholders.

Takeaway

VFC’s new CEO has began a major turnaround plan to repair the underperforming manufacturers. Prices are deliberate to be diminished dramatically, and Vans is deliberate to indicate a greater efficiency by way of a management change and operational modifications. But, buyers shouldn’t imagine in a near-full turnaround but – a Vans turnaround has been tried for some time already, and Bracken Darrell doesn’t have a ton of expertise in main trend manufacturers, which may nonetheless show to be a problem. The This autumn efficiency additionally continues to indicate weak spot throughout manufacturers, with even the North Face now exhibiting weak spot after prior turnaround. The valuation appears to take good enhancements as a base situation, which I doubt in the interim. Whereas model gross sales or a turnaround may pose nice upside, the risk-to-reward doesn’t appear good, and I provoke V.F. Company with a Promote.