USRT ETF: Do Not Ignore The Threat Of Recession (NYSEARCA:USRT)

Dragon Claws

Introduction

We wrote an article on iShares Core U.S. REIT ETF (NYSEARCA:USRT) again in February final 12 months. At the moment, we famous that the elevated price atmosphere will weigh on USRT’s fund value and the affect of a potential weakening of the financial system can have on the fund. Since our final article, the speed has remained elevated and the financial system seemed to be resilient by means of the primary half of 2024. Nevertheless, the macroeconomic atmosphere is now a lot totally different than final 12 months. It’s time for us to investigate USRT once more and supply our insights and suggestions.

Funding Thesis

USRT invests in a portfolio of U.S. REITs. It has an affordable expense ratio of 0.08%. That is decrease than the expense ratio of 0.13% of Vanguard Actual Property ETF (VNQ). USRT has underperformed the broader market in the previous few years. USRT’s fund value is often inversely correlated to the speed. Nevertheless, additionally it is delicate to totally different financial cycles. The fund has traditionally declined tougher than the broader market in financial recessions. Given the rising unemployment price, and declining providers ISM information, we expect buyers ought to stay cautious and keep on the sidelines.

YCharts

Fund Evaluation

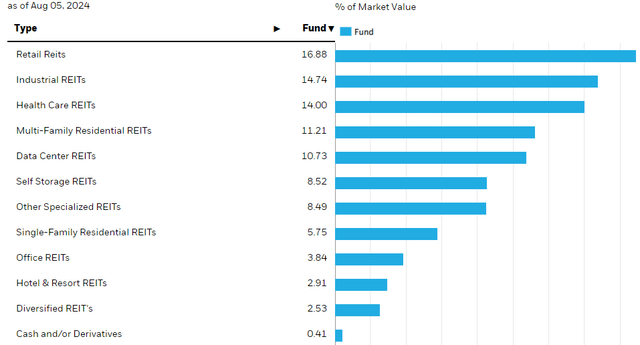

A balanced portfolio

USRT has a balanced portfolio, with no single REIT representing over 10% of its portfolio. The fund additionally has a balanced portfolio, with no single subsector representing over 20% of its portfolio. As will be seen from the chart under, USRT has little publicity to troubling workplace REITs as this subsector solely represents about 3.8% of the portfolio. In distinction, it has good exposures to larger development sectors similar to industrial, and information heart REITs. Because the chart under reveals, industrial and information heart REITs symbolize about 14.7% and 10.7% of USRT’s whole portfolio. As we all know, industrial REITs proceed to learn from the expansion in e-commerce. Equally, information heart REITs profit from rising demand in cloud computing and synthetic intelligence. Due to this fact, this portfolio combine seems to be favorable.

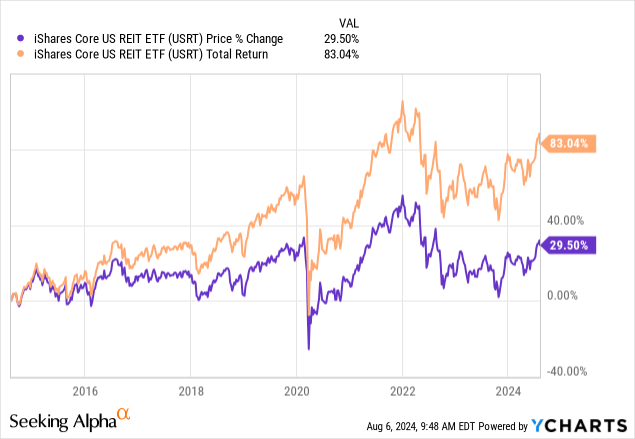

USRT has gone nowhere previously 3 years

Allow us to assessment how USRT carried out previously few years. Just like the broader inventory market that reached the height in direction of the top of 2021, USRT additionally reached its cyclical peak round that point. Sadly, skyrocketed inflation has prompted the Federal Reserve to aggressively hike the speed in 2022. As a consequence, USRT’s fund value declined sharply in the identical 12 months. Its fund value has rebounded, however nonetheless a distance away from the excessive reached at first of 2022.

YCharts

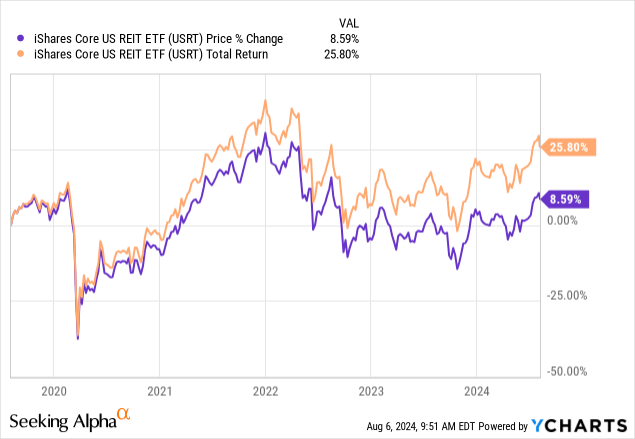

As will be seen from the chart under, even with dividends, the whole return continues to be detrimental 10.9% because the starting of 2022. In distinction, the S&P 500 index has delivered a complete return of 13.4% in the identical interval.

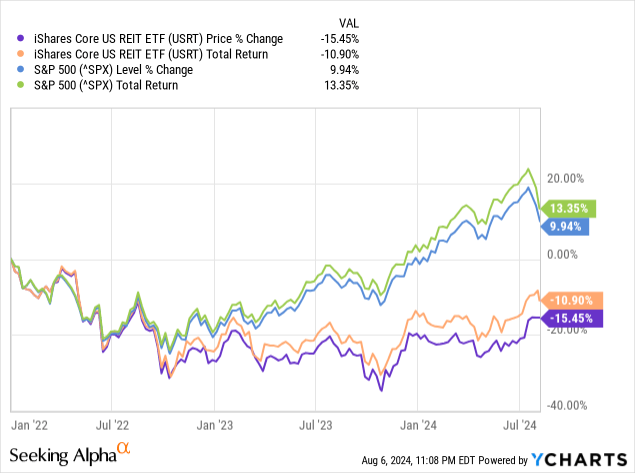

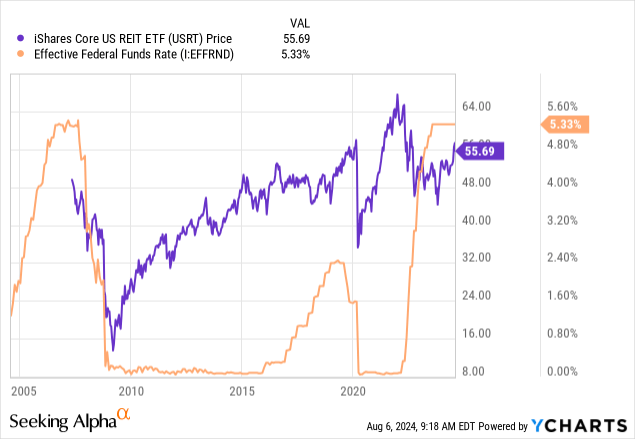

USRT usually has an inverse correlation to alter in price

One main purpose of USRT’s underperformance to the S&P 500 index between 2022 and 2024 is the elevated price atmosphere. As we all know, skyrocketed inflation in 2022 has prompted the Federal Reserve to lift the speed aggressively. Since it’s fairly troublesome to tame inflation, the Federal Reserve has stored its price elevated for fairly a a while now. This has prompted super strain on REITs in USRT’s portfolio. As we all know, REITs are inclined to have larger money owed and better charges means larger curiosity bills and better refinancing prices. Due to this fact, it isn’t stunning to see USRT’s fund value below strain on this elevated price atmosphere.

As will be seen from the chart under, USRT’s fund value are inclined to have an inverse correlation to the Fed fund price. In a low price atmosphere, USRT’s fund value have a tendency to maneuver up, and in a rising price atmosphere, its fund value will be compressed and even declined. This was the case in 2022.

YCharts

REIT is a cyclical delicate sector

Apart from USRT’s sensitivity to charges, in our earlier article, we highlighted that USRT’s fund value can be delicate to modifications within the financial system. If the financial system is in enlargement part, USRT has usually achieved effectively. It’s because when the financial system is increasing, demand will be superb and REITs can have extra room to lift rental charges. Nevertheless, if the financial system is heading for a recession, issues shall be fairly totally different. Occupancy charges usually decline, and rental earnings can diminish resulting from weak demand. Due to this fact, USRT’s fund value is often being influenced by these two forces: the energy of the financial system, and the speed.

Is the anticipated price reduce excellent news for USRT?

The market has been speculating that the Federal Reserve will quickly start a brand new price reduce cycle resulting from subsiding inflation. This results in the query: is the anticipated price reduce excellent news to USRT? Maybe, a greater query to ask is whether or not the speed reduce is because of a weakening financial system or just the results of decrease inflation.

It’s true that inflation has cooled down significantly, however we additionally assume that the financial system is weakening. One necessary proof is the rise of unemployment price. As will be seen from the chart under, the unemployment price has risen from the low of three.5% reached in January 2023 to 4.3% in July 2024. The chart additionally means that the rise in unemployment price seems to be accelerating.

Federal Reserve Financial institution of St. Louis

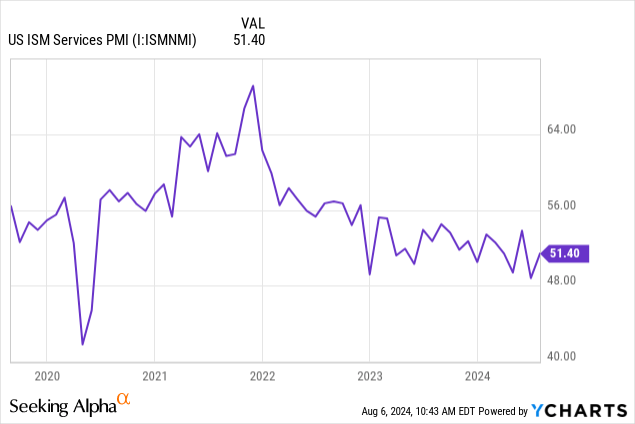

One other proof of a slowdown within the U.S. financial system is the ISM providers PMI. For reader’s data, PMI is a ahead financial indicator. A determine above 50 normally means the financial system is prone to develop, however a determine under 50 suggests the financial system could also be heading for a recession. As we will see from the chart under, regardless of the current rebound, U.S. ISM providers PMI is on a declining pattern since late 2021. This means that an financial recession could also be on the horizon.

YCharts

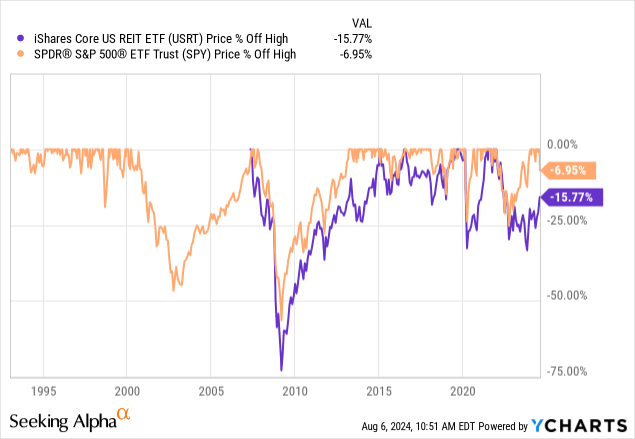

If an financial recession arrives, USRT’s fund value can fall sharply even when the Federal Reserve decides to decrease the speed. In truth, the Federal Reserve has normally lowered the speed due to a weak financial system. For instance, within the price decline cycle in 2009 and 2020, USRT’s fund value didn’t rise despite the fact that USRT’s fund value is commonly inversely correlated to the speed. As well as, as will be seen from the chart under, USRT’s fund value usually dropped a lot tougher than the broader market in earlier recessions.

YCharts

Investor Takeaway

Because the probability of an financial recession is excessive. We don’t assume that is the very best time to personal USRT. We propose buyers to patiently wait on the sidelines.

Further Disclosure: This isn’t monetary recommendation and that each one monetary investments carry dangers. Traders are anticipated to hunt monetary recommendation from professionals earlier than making any funding.