URTH: Bettering Macroeconomic Surroundings Will Act As Tailwind (NYSEARCA:URTH)

Richard Drury

ETF Overview

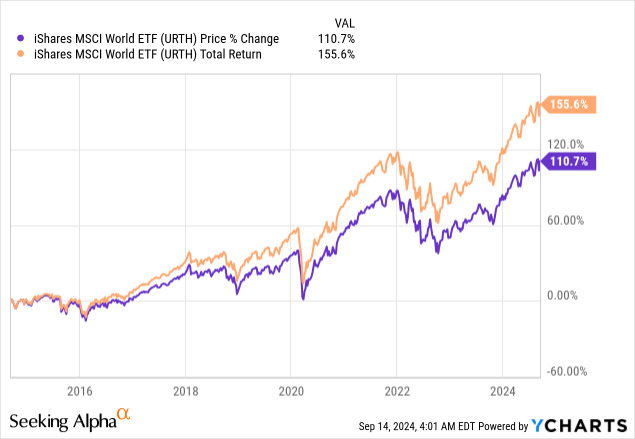

iShares MSCI World ETF (NYSEARCA:URTH) tracks the MSCI World Index and owns about 1,400 equities from developed nations across the globe. The fund has an expense ratio of 0.24%. This ratio will not be low-cost particularly examine to many U.S. equities ETFs. Nonetheless, given the necessity for URTH to handle a portfolio of worldwide shares, this ratio is suitable. URTH’s progress outlook seems to be enhancing because of enhancing macroeconomic setting. As well as, its larger focus to know-how shares can be useful for the fund in the long term. Nonetheless, the fund’s valuation will not be low-cost nor too costly. Subsequently, we predict any pullback will present good alternatives for buyers wanting some worldwide publicity.

YCharts

Fund Evaluation

A better focus of U.S. shares

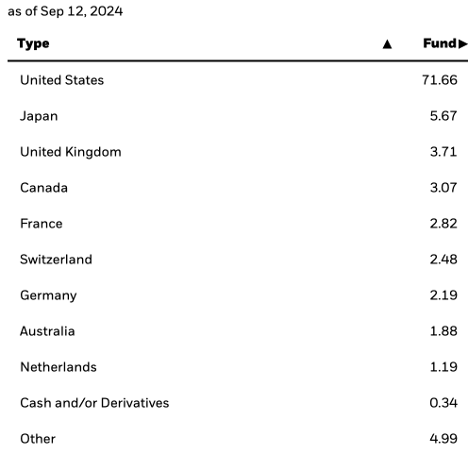

URTH has a portfolio of about 1,400 shares. These shares are chosen from developed markets. As might be seen from the desk beneath, over 70% of the portfolio are made up of shares from the US. These shares embody excessive profile names akin to Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Google (GOOG), Amazon (AMZN), and so on. Whereas some might argue that this excessive publicity to U.S. shares might exhibit larger focus threat, we predict this publicity is definitely useful. As we all know, these high-profile U.S. shares have good aggressive benefits and have main positions of their trade. As well as, they don’t solely derive their revenues and earnings domestically, a big chunk of their earnings and revenues are derived internationally. Subsequently, these are “worldwide” shares with aggressive positions.

iShares

Increased publicity to know-how shares

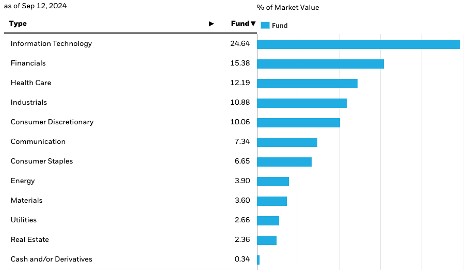

URTH’s portfolio of shares come from a wide range of sectors. Because the chart beneath exhibits, besides data know-how sector which represents 24.6% of the entire portfolio, all different sectors characterize lower than 20% of the entire portfolio. Subsequently, focus threat will not be excessive.

iShares

Though URTH’s publicity to data know-how is almost 1 / 4 of the entire portfolio, we like this publicity. As we all know, data know-how sector is a fast-growing sector and is driving on many technological megatrends that ought to guarantee robust progress for URTH within the subsequent few a long time. These megatrends embody synthetic intelligence, cloud computing, AR/VR, Web of Issues (IoTs), industrial automation, and so on. Subsequently, common annual earnings progress charges of the sector in the long term is often in mid-teens to high-teens (based mostly on S&P 500 data know-how sector previous outcome).

World financial outlook enhancing in 2025 and 2026

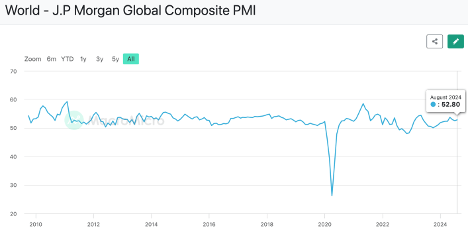

Allow us to consider URTH’s future progress outlook by checking the worldwide composite PMI. For reader’s data, international composite PMI which consists of each providers and manufacturing sectors, is a ahead financial indicator that helps us to judge the power of the worldwide economic system within the close to future. A studying beneath 50 often means the economic system will doubtless contract not less than within the subsequent few months forward. However, a studying above 50 often means the economic system is probably going heading for enlargement.

Because the chart beneath illustrates, international PMI has been on a rising pattern for 2 straight years since reaching the cyclical low in late 2023. The most recent studying of 52.8 in August 2024 is a slight enchancment from July’s 52.5 and a lot better than final yr’s 50.6. Subsequently, we predict the worldwide economic system is heading for additional enlargement in 2025.

MacroMicro

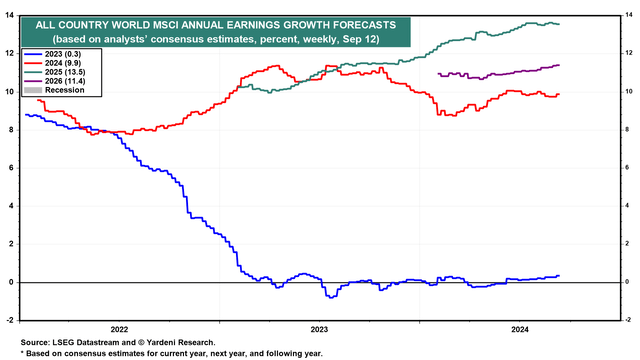

This enhancing macroeconomic outlook can be according to consensus earnings progress estimate for shares in URTH’s portfolio. As might be seen from the chart beneath, 2024 earnings progress is anticipated to be 9.9%, a lot better than final yr’s earnings progress price of 0.35%. Even higher than that’s the consensus earnings progress forecast for URTH in 2025 and 2026, that are anticipated to achieve 13.5% and 11.4% respectively. Subsequently, we see URTH benefiting from higher macroeconomic setting in 2025 and 2026.

Yardeni Analysis

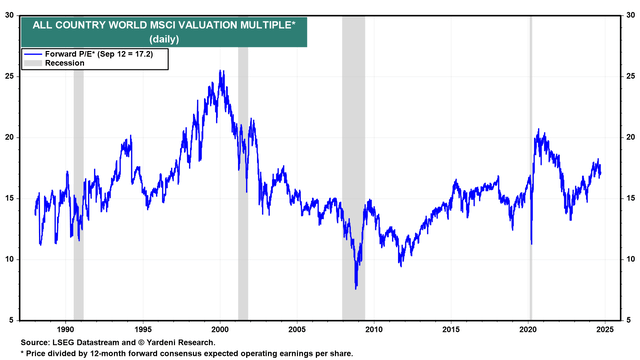

Increased valuation however not too costly

URTH is at present buying and selling at a ahead P/E ratio of 17.2x. This ratio is barely larger than the valuation vary in 2018/2019 however nonetheless beneath the near-term peak of 20x reached in 2020/2021. Subsequently, URTH’s valuation will not be low-cost, however not too costly both.

Yardeni Analysis

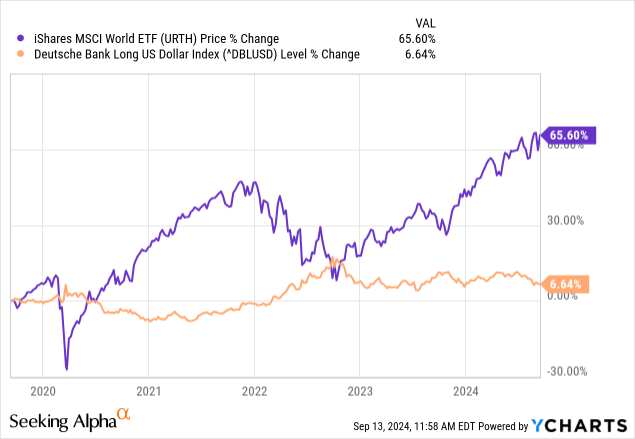

Threat to think about: Forex Threat

Since URTH contains shares from across the globe, foreign money threat must be thought of. As might be seen from the chart beneath, the power and weak point of the U.S. greenback may cause URTH’s fund value to fluctuate, and so they usually have an inverse correlation. Luckily, as inflation cools off, the Federal Reserve is probably going beginning a brand new price minimize cycle. It will usually end in weaker U.S. greenback. A weaker U.S. greenback must also act as a catalyst to URTH’s fund value.

YCharts

Investor Takeaway

URTH will doubtless profit from its publicity to know-how shares in the long term. Though URTH’s valuation will not be low-cost, however its progress outlook is enhancing. Subsequently, we predict any pullback will supply good alternative particularly for buyers wanting extra worldwide publicity.

Extra Disclosure: This isn’t monetary recommendation and that every one monetary investments carry dangers. Buyers are anticipated to hunt monetary recommendation from professionals earlier than making any funding.