U.S. Non-public Home Sector Prints $210 Billion Surplus In July; Higher Markets In August

Klaus Vedfelt

This text goals to look at the US sectoral flows for July 2024 and assess the probably impression on markets as we advance into August 2024. That is essential as a change within the fiscal move charge has an approximate one-month lagged impact on asset markets and is a helpful funding forecasting software. Different macro-fiscal flows can level to occasions months or years forward.

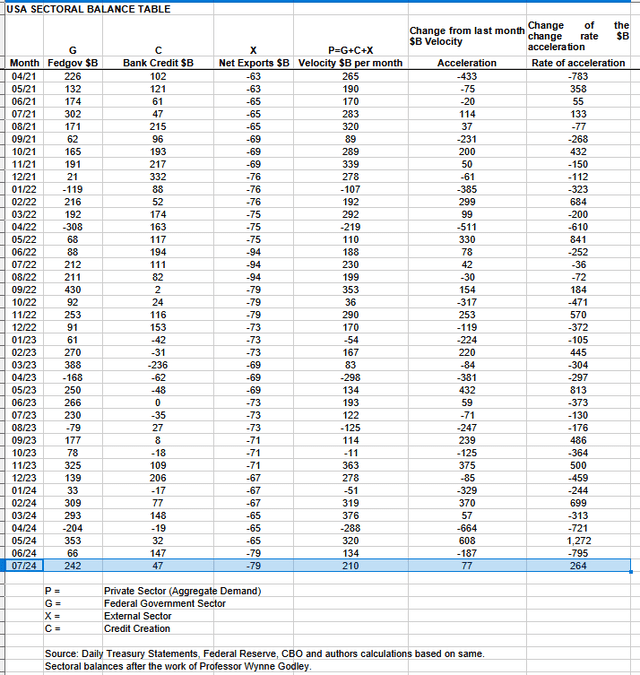

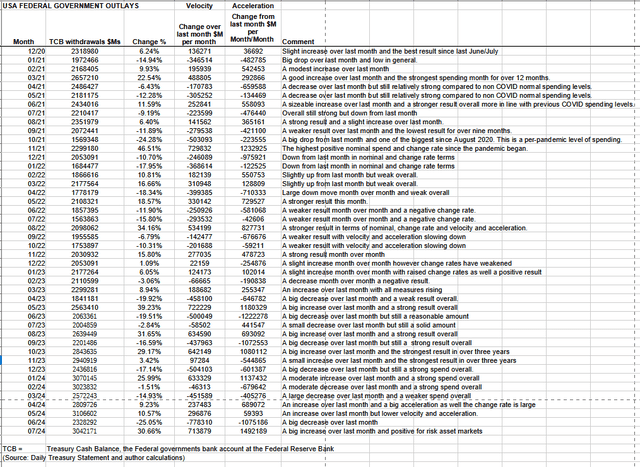

The desk under reveals the sectoral balances for the US, that are produced from the nationwide accounts.

A optimistic personal sector end result for July that simply ended and is supportive of threat asset markets.

Final month ought to have been a flat to weak inventory market primarily based on the weak fiscal flows and certainly that was greater than the case given the massive drop we had, which a V-shaped restoration has adopted up. It was a backside that ought to have been purchased or ridden out. This month, the flows are a lot stronger and the V-shaped restoration and a normal push larger is feasible primarily based on the fiscal move end result for July that knocks on into August.

In July 2024, the personal home sector recorded a surplus of $210B. This can be a optimistic end result for asset markets, as monetary balances within the personal sector have risen by this a lot. Notice that the end result for the previous month was diminished on account of a reporting error of many billions by the treasury division, additional reinforcing the weaker market state of affairs.

From the desk, one can see that the $210 billion personal home sector funds surplus got here from a robust $242 billion injection of funds by the federal authorities (and this consists of the brand new injection channel from the Fed of round $6B from curiosity on reserves that went straight into the banking sector), much less the -$79B billion that flowed out of the personal home sector and into overseas financial institution accounts on the Fed (the exterior sector X) in return for imported items and providers. Financial institution credit score creation contributed $47 billion and far weaker than final month.

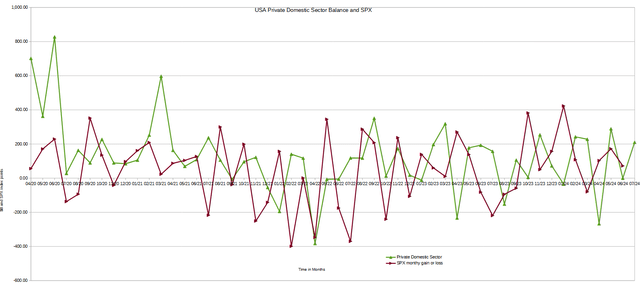

The chart under reveals the sectoral steadiness information plotted in nominal phrases. The calculation is federal authorities spending or G, plus the exterior sector (X and normally a destructive issue) to depart that sum of money left to the personal home sector, or P, an accounting id true by definition.

Final month the chart predicted the SPX can be flat to weak and in actuality, it proved to be very weak with a strong retracement going down that has since grow to be a robust V-shaped restoration. This chart offers a way of route, nevertheless, is just not in a position to present the depth and power of a attainable transfer. The power and depth of the inventory market retracement have been a lot stronger than I anticipated, on condition that for a lot of the 12 months, the inventory market has pushed larger and ignored weak fiscal situations till now.

This month, the information is a lot better. The personal home sector move is in optimistic territory and the V-shaped restoration is prone to proceed, and the month will finish larger than it started.

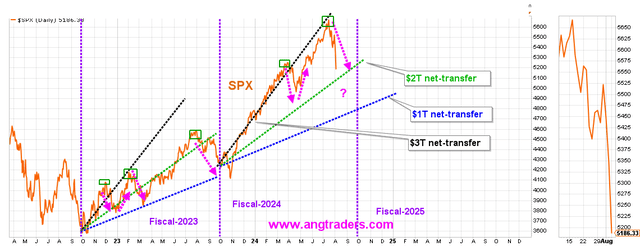

This matter of the inventory market retracement we’ve got seen over current weeks deserves extra consideration and the chart under reveals how as the general power of the fiscal flows from the federal authorities has weakened the inventory market has adjusted its trajectory and reset at a decrease degree.

The SPX has dropped nearer to the common degree for a $2T/12 months net-transfer charge of change. After we mix the Treasury net-transfer with the financial institution credit score and the Fed’s destructive remittances, the switch quantity is ~$2T, so that offers some basic help.

Supply: ANG Merchants on the Away from the Herd Searching for Alpha Funding Group chat.

Because the federal authorities deficit spending has lessened over time, the inventory market has adjusted its upward trajectory to a shallower incline. Whereas federal authorities deficit spending at $3 trillion per 12 months, the inventory market was monitoring the black dotted line. This development continued into additional time during the last 6 months, whilst fiscal flows slowed to solely $2 trillion per 12 months. As with all pure legal guidelines, reminiscent of gravity, actuality asserted itself and markets fell and adjusted down to the touch the $2 trillion deficit spending line proven as a inexperienced dotted line.

The almost certainly state of affairs from right here is that markets now transfer again upward however begin from a decrease base and rise much less steeply consistent with the weaker total fiscal flows that come mainly from the federal authorities. The inventory market would now comply with the inexperienced dotted line, representing a decrease total fiscal injection of cash into the personal sector.

This macro state of affairs can solely change if the fiscal flows improve from one other sector, reminiscent of a increase in financial institution credit score creation or a drop within the present account deficit that enables extra money to move into the personal home sector the place the inventory market is situated.

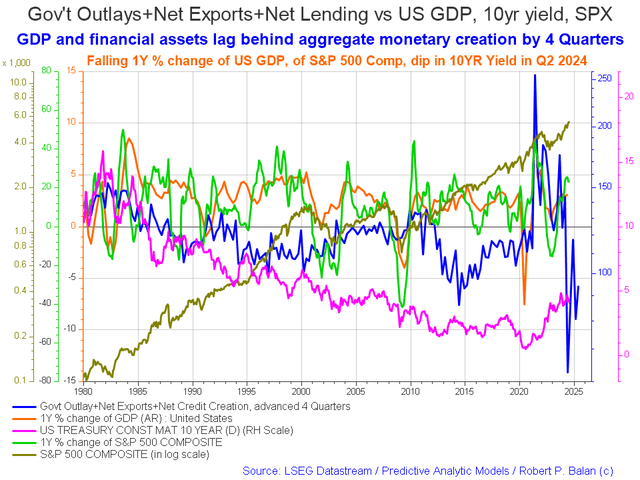

The next chart emerges when one graphs the change charge of the data within the US sectoral balances desk above and adjusts for impression time lags. This is sort of a long-range market radar set.

The chart above reveals that US fiscal flows [blue line] are spiking up from now and into the top of 2025, which tends to push asset markets up and offers a robust undercurrent upwards, and goes some technique to clarify why markets have gone so effectively this 12 months although the fiscal flows from month to month have solely been reasonable at finest.

The desk under reveals the whole federal authorities withdrawals from their account on the Federal Reserve Financial institution. A withdrawal by the federal authorities is a receipt/credit score for the personal sector and subsequently a optimistic for asset markets.

The desk reveals that whole outlays elevated properly over the earlier month and are transferring within the $3 trillion-plus vary once more. Massive month-over-month will increase like this one have massive financial velocity and acceleration results on asset markets in a optimistic approach and we’re seeing this thus far this month.

The federal authorities has one other main tax assortment occasion arising in the course of September. This month has the good thing about a big treasury curiosity cost in the course of the month after which one other smaller one on the finish of the month.

These flows produce a neighborhood seasonal backside in the course of August and rise till in regards to the twentieth of September.

The following Fed assembly is in the course of subsequent month, when almost certainly charges will likely be paused or a small increase would possibly come. Whereas there will likely be no Fedspeak this month to excite markets, the world central bankers are assembly in Jackson Gap in the course of this month and the official statements that come out of that assembly will be simply as essential as official fed conferences.

On the bigger world macroeconomic aspect, we’ve got the G5 chart under. The chart reveals the extent of cash creation by the highest 5 world governments (the G5) in a change charge format, together with a bunch of different indexes. This chart offers a way of essential inflection factors and route.

The chart reveals that the purple G5 fiscal move line usually rises upward into 2025 and offers a robust monetary undercurrent for asset markets going ahead. This mixed with the stronger national-level fiscal move background offers a agency floor for nationwide asset markets to advance.

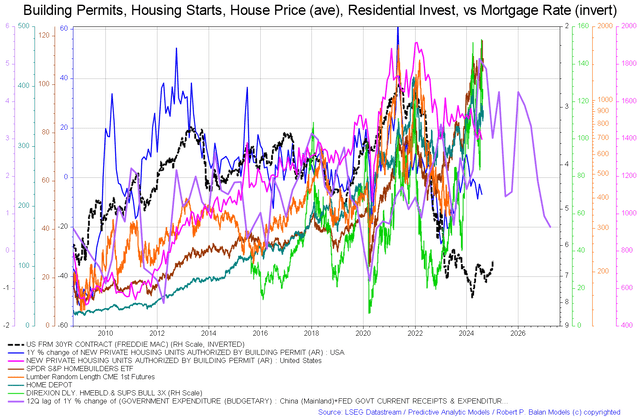

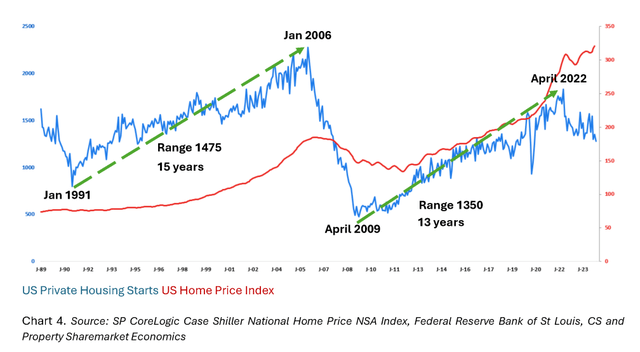

Curiously, the chart reveals the all-important purple line declining after 2025, which hyperlinks in with the forecast for a serious boom-bust within the housing market inside a 12 months of that point. The blue line on the primary chart on this article factors to the identical phenomenon.

Whereas housing costs proceed to rise, they’re doing so on thinner and thinner volumes, which makes the worth construction fragile and the place an absence of patrons and skinny volumes could cause massive adjustments in home costs. This can be a comparable course of to a inventory worth buying and selling larger on low volumes after which dropping quick when an enormous promote order and an absence of patrons occurs.

The issue with the housing market being fragile is the borrowing that’s leveraged towards it. When actual property asset costs fall and financial institution asset-to-equity ratios are exceeded, it begins an automated financial institution run as loans are known as in to satisfy monetary rules. This occurred within the 2006-09 international monetary disaster. The actual property market could be very massive and leverages numerous personal debt, and that’s the reason such a scenario represents a systemic threat.

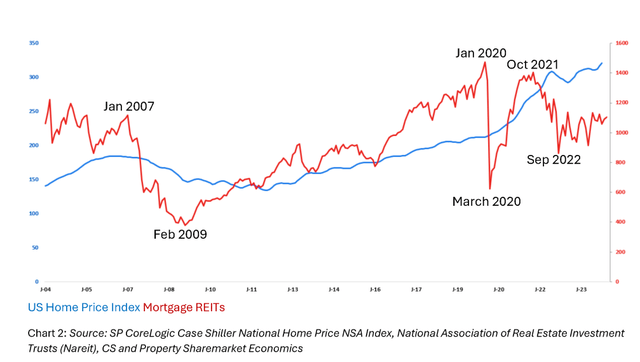

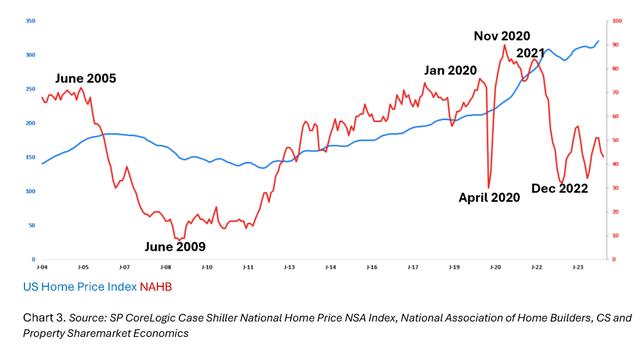

Beneath is a collection of charts that doc how the basics behind home costs are decaying even whereas the worth of land nonetheless climbs.

Property Share Markets Economics

Whereas the blue land worth index nonetheless climbs, mortgage REITS peaked and fell for this actual property cycle years in the past and are actually buying and selling sideways and when the height and crash come will almost certainly see once more their 2009 lows. mREITS is certainly a sector to keep away from for a few years to return.

Property Share Markets Economics

The house builders index has fallen and is making decrease highs and just like the mREIT index is prone to see the 2009 GFC lows within the subsequent few years.

Property Share Markets Economics

US personal housing begins have peaked for this cycle and are working their approach decrease because the steam goes out of the markets. The upper worth of land makes it much less and fewer enticing to construct a house, even whereas the inhabitants grows bigger. The result’s a home and land worth squeeze upwards as extra folks compete for a decrease provide of recent housing and find yourself paying extra for much less. Winners will likely be cursed with destructive fairness, or worse, a mortgage foreclosures and no residence when the financial institution calls within the mortgage within the cycle downturn after 2026.

Tactically, there was a dip to purchase on account of the June tax assortment knock-on impact into July. The power of the V-shaped restoration reveals that threat asset markets have much more to provide earlier than peaking out and markets are prone to carry on rising into September, the expectation is that markets will usually rise into 2025 as effectively with solely minor seasonal dips alongside the best way.