Tourmaline Oil: Nice Firm However It Seems Pretty Valued Proper Now (OTCMKTS:TRMLF)

onurdongel

Most traders who’ve publicity to the oil and gasoline business are targeted totally on the well-known oil majors, comparable to Exxon Mobil (XOM), Chevron (CVX) and ConocoPhillips (COP). Tourmaline Oil (OTCPK:TRMLF), the most important producer of pure gasoline in Canada, passes below the radar of the overwhelming majority of traders. Nevertheless, it is a disgrace, because the Canadian gasoline producer has some vital aggressive benefits, which render the inventory a gorgeous candidate for individuals who count on increased gasoline costs sooner or later. On this article, we are going to analyze the important thing traits of Tourmaline Oil. Whereas the inventory deserves to be on the radar of traders who’re assured that gasoline costs will enhance within the upcoming years, the inventory seems pretty valued proper now and therefore traders ought to in all probability anticipate a decrease entry level.

Enterprise overview

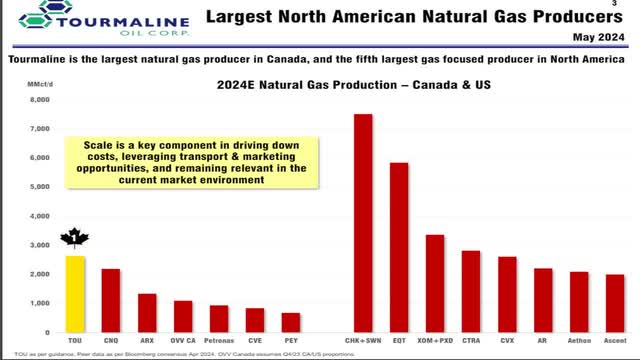

Tourmaline Oil is the most important pure gasoline producer in Canada and the fifth largest pure gasoline producer in North America. It is usually the fourth largest Canadian gasoline processing midstream operator.

Largest North American Gasoline Producers (Investor Presentation)

Supply: Investor Presentation

Scale is paramount within the pure gasoline business, which is notorious for its dramatic cyclicality and its fierce boom-and-bust cycles. Throughout a downturn, such because the one which happened throughout 2014-2016, the weakest gamers incur materials losses, with a few of them going out of enterprise. Quite the opposite, due to its nice scale and its low-cost reserves, Tourmaline Oil simply endured that downturn of its business. In fact, its earnings plunged in 2015 and the corporate posted a minor loss per share of -$0.12 in 2016 because of depressed gasoline costs, however it simply endured that disaster and emerged stronger within the subsequent restoration.

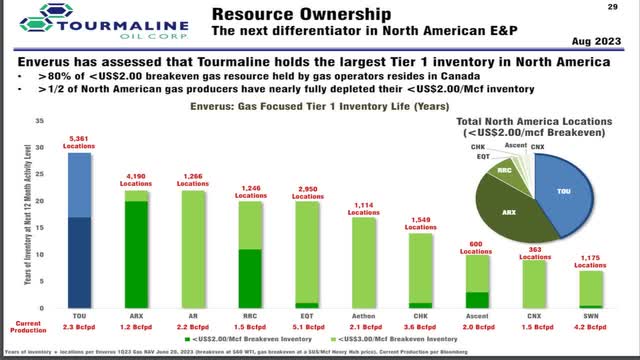

In keeping with Enverus, an oil & gasoline analysis agency, Tourmaline Oil holds the most important Tier 1 stock in North America. Greater than 80% of pure gasoline assets with manufacturing value beneath $2 per Mcf are positioned in Canada. As well as, greater than half of North American gasoline producers have practically depleted their gasoline assets which have value beneath $2 per Mcf.

Tourmaline Oil is the lowest-cost producer (Investor Presentation)

Supply: Investor Presentation

As proven within the above pie chart, Tourmaline Oil holds the most important share of pure gasoline assets, with manufacturing value beneath $2 per Mcf. Being the lowest-cost producer is likely one of the most important aggressive benefits traders ought to search for. That is very true within the pure gasoline business, which entails a commodity, and therefore the price of manufacturing is an important differentiator amongst firms.

Other than having a big scale and a low value of manufacturing, Tourmaline Oil has one other engaging attribute as effectively, particularly promising progress prospects. As proven within the chart beneath, the corporate has practically quadrupled its manufacturing per share over the past decade.

Efficiency Document of Tourmaline Oil (Investor Presentation)

Supply: Investor Presentation

Even higher, as proven within the above chart, Tourmaline Oil has greater than quintupled its reserves per share over the past decade. This definitely bodes effectively for future progress. Certainly, the gasoline producer expects to develop its manufacturing by roughly 22% over the following 4 years, from 585,000 barrels of oil equal per day this yr to 715,000 barrels of oil equal per day in 2028. Given the distinctive efficiency report of Tourmaline Oil, it’s secure to imagine that the corporate will meet or exceed its manufacturing steerage.

Debt

As talked about earlier, the pure gasoline business is characterised by dramatic cycles as a result of large swings of pure gasoline costs. Subsequently, having a powerful stability sheet is paramount on this enterprise, because it allows an organization to endure a possible downturn.

Tourmaline Oil has a rock-solid stability sheet. To make sure, its web curiosity bills devour simply 1% of its working earnings whereas its web debt (as per Buffett’s method: Web debt = Whole liabilities – money – receivables) is standing at $4.0 billion. This quantity is simply 23% of the market capitalization of the inventory and roughly 3 instances the annual earnings of the corporate, and therefore this can be very low. General, Tourmaline Oil has a pristine stability sheet, which offers nice monetary flexibility and resilience throughout the inevitable downturns of the pure gasoline market.

It is usually admirable that Tourmaline Oil has grown its reserves and its manufacturing at such a quick tempo whereas sustaining a rock-solid stability sheet. This can be a testomony to the energy of the enterprise mannequin of the corporate, which ends from the high-quality gasoline assets which might be included within the asset portfolio of the producer.

Dividend

Tourmaline Oil is at the moment providing a ahead annualized common dividend of $0.92, which corresponds to a dividend yield of 1.9%. This yield is far decrease than the 3.4% yield of Exxon Mobil, the 4.2% yield of Chevron and the 3.9% median dividend yield of the power sector. Consequently, most income-oriented traders are prone to dismiss Tourmaline Oil.

Nevertheless, Tourmaline Oil has been providing a fabric particular dividend in each quarter since late 2021. Given the particular dividends it has distributed within the first half of this yr, the entire annualized dividend yield of the inventory is 4.9%. It is usually vital to notice that administration has pledged to maintain directing free money stream in the direction of particular dividends so long as the corporate enjoys favorable gasoline costs. Administration has additionally reassured traders that the common dividend is sustainable even at gasoline costs beneath $2 per Mcf. General, the corporate is prone to preserve providing a gorgeous whole dividend within the absence of a downturn within the power sector.

Danger

From all of the above, it’s evident that Tourmaline Oil does its greatest to enhance its efficiency within the elements which might be below its management. It has been rising its reserve base and its manufacturing persistently over the past decade and has promising progress prospects forward. It additionally has one of many lowest manufacturing prices in its business.

However, traders ought to always remember the excessive cyclicality of the pure gasoline business. The oscillations of pure gasoline costs have brought about the earnings of Tourmaline Oil to fluctuate broadly over time. To make sure, the corporate incurred a 74% plunge in its adjusted earnings per share in 2015 and posted a loss per share of -$0.12 in 2016 because of a collapse in pure gasoline costs in 2015-2016, which resulted from provide glut amid a shale oil growth. Tourmaline Oil additionally incurred a 46% hunch in its adjusted earnings per share between 2018 and 2020 as a result of pandemic.

Due to its high-quality enterprise mannequin and its basically debt-free stability sheet, the corporate has simply endured each downturn in its enterprise and is prone to show resilient in future downturns as effectively. Nonetheless, traders ought to concentrate on the extremely risky enterprise outcomes of the corporate and the resultant volatility in its inventory value. Solely the traders who can abdomen excessive inventory value volatility for a protracted interval ought to put this inventory on their radar.

Valuation

Based mostly on its earnings per share of $3.67 within the final 12 months, Tourmaline Oil is at the moment buying and selling at a trailing price-to-earnings ratio of 13.4x. This earnings a number of is increased than the median earnings a number of of 12.2x of the power sector. On the one hand, Tourmaline Oil in all probability deserves a premium in its valuation for its aforementioned aggressive benefits. However, given the cyclicality of its enterprise, the inventory seems pretty valued round its present value.

It is usually value noting that the power disaster brought on by the battle in Ukraine two years in the past triggered an unprecedented variety of inexperienced power tasks worldwide, as most international locations are doing their greatest to diversify away from fossil fuels. When all these renewable power tasks come on-line, they’re prone to take their toll on the worth of pure gasoline. Whereas the time and magnitude of the impact are unknown, this is a crucial danger issue to think about. Subsequently, traders ought to in all probability purchase Tourmaline Oil solely after they discover it with a large margin of security. A pretty entry level would in all probability be across the robust technical help of $40, which is roughly 18% decrease than the present inventory value and corresponds to a price-to-earnings ratio of 10.9x. Given the aggressive benefits of Tourmaline Oil, the inventory will turn into engaging if it approaches that degree.

Ultimate ideas

Tourmaline Oil passes below the radar of the overwhelming majority of traders, however it enjoys some vital aggressive benefits. It has nice scale, one of many lowest manufacturing prices and one of many highest-quality useful resource portfolios in its business. Consequently, the corporate has exhibited a constant progress report and has dependable progress prospects for a lot of extra years. Nonetheless, because the inventory seems pretty valued proper now, traders ought to in all probability anticipate a extra opportune entry level.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.