The Highest Yielding Shares In The S&P 500

honglouwawa

There are at present 21 shares within the S&P 500 which have dividend yields above 5%, and there at the moment are 61 shares within the index which have a dividend yield that is greater than the 3.87% that the 10-Yr Treasury Notice is at present yielding.

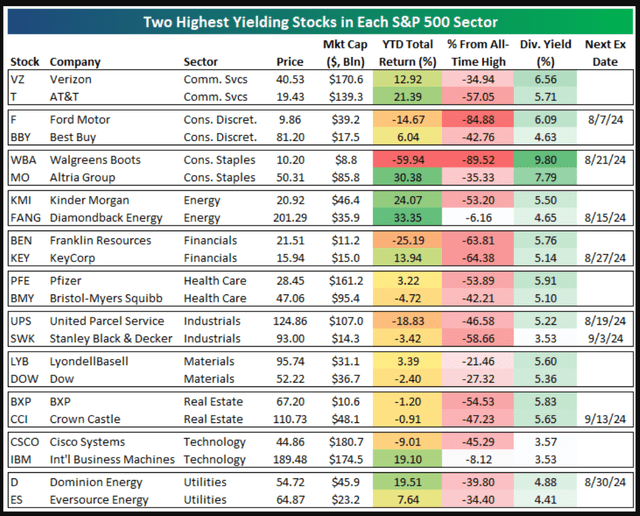

At present, we needed to focus on the two shares in every S&P 500 sector with the best dividend yields. Under we spotlight the 2 highest yielders in every sector together with the corporate’s market cap, its year-to-date complete return, distance from its all-time excessive, and subsequent dividend ex-date (if it has been introduced). Whether or not or not these dividends are protected is a distinct story (sure, we’re speaking about you… Walgreens), however we hope it is a good start line for additional analysis!

The sector that stands out probably the most is Shopper Staples as a result of the 2 highest yielders within the complete S&P come from this sector. Walgreens Boots (WBA) at present has a dividend yield of 9.8%, whereas tobacco/nicotine-producer Altria (MO) has a yield of seven.8%. WBA already reduce its dividend in half as soon as this 12 months, and it nonetheless yields almost 10% as a result of its share value is down 60% year-to-date! Even nonetheless, WBA is ready to not less than make its subsequent $0.25/share quarterly fee after its 8/21 ex-date, every week from now. Altria, however, is yielding 7.8% though its shares have posted a complete return of 30.4% YTD.

The one sector that does not have not less than one inventory yielding greater than the 10-year US Treasury is Know-how. As proven within the desk, Cisco (CSCO) and IBM are the highest-yielding S&P 500 Tech shares, with yields of simply over 3.5%.

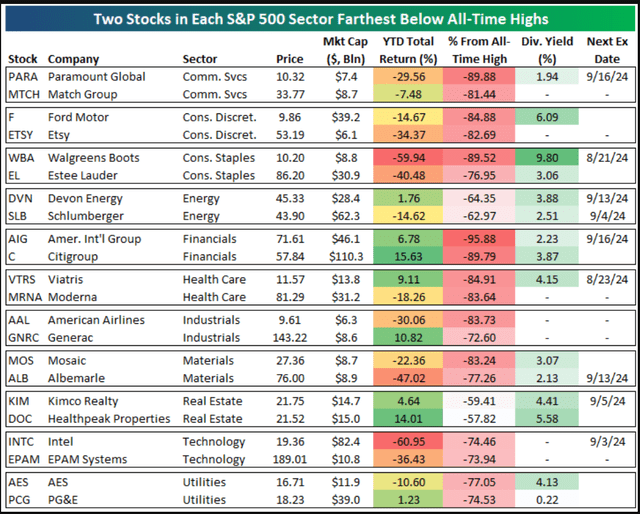

Along with highlighting the 2 highest-yielding shares in every S&P 500 sector, beneath is a have a look at the 2 shares in every sector which can be down probably the most from their all-time share-price highs. On common, these 20 shares are down 78% from their all-time highs.

Two shares within the Monetary sector that stay a shell of their former selves from earlier than the Monetary Disaster are the 2 which can be down probably the most from all-time highs: AIG and Citigroup (C).

Editor’s Notice: The abstract bullets for this text had been chosen by Searching for Alpha editors.