The Commerce Desk: Premium Value, For Middling Progress? I will Cross, Here is Why (NASDAQ:TTD)

Shutthiphong Chandaeng

Funding Thesis

The Commerce Desk (NASDAQ:TTD) is ready to report its Q2 2024 outcomes, the next Thursday, 8 August, after hours.

I will reduce to the chase, TTD is priced at 30x subsequent yr’s EBITDA. This makes it arguably essentially the most costly promoting inventory. And if we put apart its long-term narrative about a number of tailwinds, its fundamentals at present level to an organization that’s rising at mid-20s% and no more.

In sum, I do not consider this inventory affords buyers a passable risk-reward. Being requested to pay $100 per share for TTD is an excessive amount of for me.

Speedy Recap

In June, I stated,

Whereas I acknowledge that there’s a lot to love in its prospects, I finally do not consider there’s sufficient margin of error in its valuation. Or higher put, I consider there are higher alternatives elsewhere.

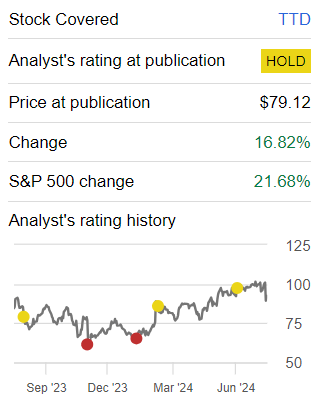

Writer’s work on the TTD

The Commerce Desk is a inventory that I’ve largely rated as a maintain prior to now 12 months. And through this era, as I famous in my quote, the inventory has underperformed the S&P500 as there have been higher alternatives elsewhere.

Trying forward over the following yr, I am not satisfied that its prospects are all that attractive. Here is why.

The Commerce Desk’s Prospects Are Blended

I will describe what The Commerce Desk does, adopted by its bullish drivers, earlier than discussing some well timed unfavorable components.

The Commerce Desk permits advertisers to purchase and handle digital promoting house with precision and effectivity. Their platform helps advertisers choose the place to position adverts, analyze information to focus on particular audiences, and optimize campaigns for higher outcomes. Specializing in Related TV and retail media, The Commerce Desk goals to make promoting extra personalised and efficient for manufacturers.

Within the close to time period, The Commerce Desk is positioned to proceed outpacing the broader digital promoting business. This development is pushed by the growing adoption of UID2, which reinforces using first-party information and the worth of the open web. The corporate’s partnerships with main business gamers like Disney (DIS) and Roku (ROKU) within the Related TV house broaden alternatives for advertisers to succeed in audiences with premium content material, highlighting the corporate’s potential for sustained success.

Moreover, The Commerce Desk’s dedication to transparency and leveraging superior know-how for higher decision-making positions it properly inside the practically $1 trillion promoting market. The rise of subscription corporations incorporating promoting to diversify income streams, as seen with Netflix’s (NFLX) ad-supported tier, additional bolsters The Commerce Desk’s prospects.

That is the constructive narrative. Now let me put forth the next side.

On the again of Alphabet’s (GOOG)(GOOGL) earnings outcomes, the market has decidedly skewed away from promoting corporations. Alphabet’s promoting was up 11% y/y, which was quite center of the street. Despite the fact that Alphabet famous the energy of promoting, I consider that this quite pedestrian development charge is a read-through to The Commerce Desk too. My level is that regardless of it being an election yr and lots of above-noted tailwinds, the basics do not look like all that sturdy. Or higher put, as sturdy as anticipated.

Given this balanced background, let’s now talk about its fundamentals in additional element.

Income Progress Charges May Ship Mid-20s CAGR

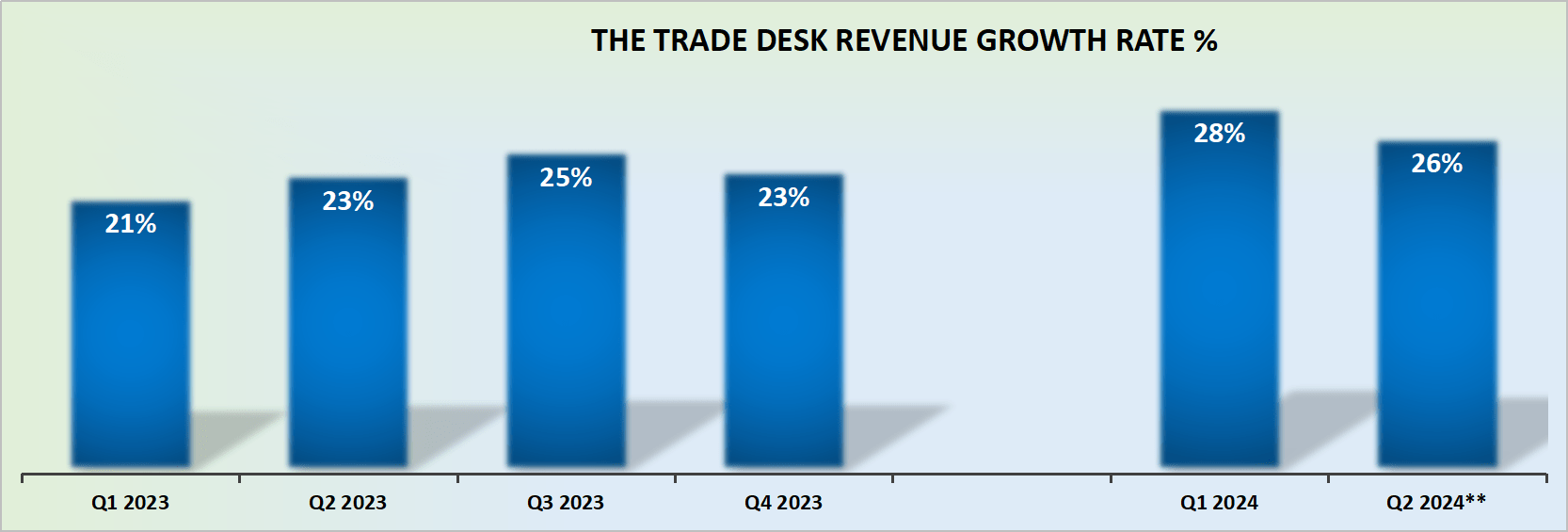

TTD income development charges

The Commerce Desk has demonstrated that it could actually ship premium development over a few years. Premium development is a +20% compounded annual development charge (”CAGR”), that buyers can rely on. Progress that’s regular, predictable, and robust. One of these development instructions a premium on its inventory. However earlier than we get forward of ourselves, let’s analyze The Commerce Desk’s outlook for the rest of 2024 and into 2025.

As its comparables are actually quite simpler, buyers can count on The Commerce Desk to ship at the least 20% CAGR. And but, the issue right here is that The Commerce Desk is unlikely to return to rising at +30% any time quickly.

So, placing apart its narrative of its very lengthy tailwinds, it is a firm barely delivering $2.5 billion in revenues, and its development charges have already moderated.

As a reference level, AppLovin (APP) is delivering virtually twice this income and robust development charges and it is priced considerably cheaper too. Accordingly, this brings up the next consideration, after some time, valuation issues.

TTD Inventory Valuation — 30x Subsequent Yr’s EBITDA

Listed here are my back-of-envelope calculations. We all know that The Commerce Desk is on a path for $400 million of EBITDA in H1 2024. We additionally know that This autumn of every yr is a seasonally sturdy quarter for promoting shares, so we should consider that side too.

Therefore, I consider that The Commerce Desk will obtain at the least $1 billion of EBITDA in 2024, and may even exceed expectations by reaching $1.1 billion.

That query although, is whether or not the market is ready to get sufficient conviction of The Commerce Desk being on a path in the direction of $1.5 billion of EBITDA in 2025?

Because it stands proper now, The Commerce Desk is considerably costlier than AppLovin, Meta (META), and Alphabet. Does this make for a compelling sufficient risk-reward wager? I am not assured sufficient to make this assertion.

The Backside Line

Whereas The Commerce Desk has many constructive points, similar to its superior know-how and robust partnerships, paying 30x subsequent yr’s EBITDA is a poor risk-reward.

The corporate is priced considerably greater than its friends like AppLovin, Meta, and Alphabet, regardless of its income development moderating to mid-20s%.

This excessive valuation leaves little margin for error, particularly contemplating the broader market’s lukewarm sentiment in the direction of promoting shares following Alphabet’s modest 11% y/y development in promoting revenues. Given these elements, investing in The Commerce Desk at such a excessive a number of appears too dangerous, with higher alternatives obtainable elsewhere out there, for instance, AppLovin.