SVXY: Purchase Volatility After A -40% Drawdown (BATS:SVXY)

DNY59

Thesis

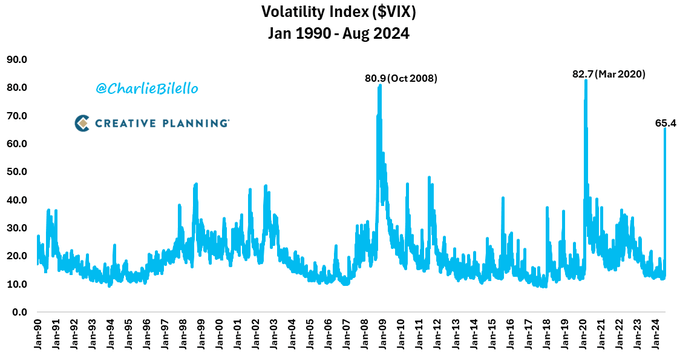

The previous couple of days have been attention-grabbing to say the least. Monday, August 5, 2024, opened with one of many highest ranges on document for the VIX index, specifically at a degree over 60:

Volatility (Artistic Planning)

We’ve solely seen figures this elevated throughout Covid in 2020, and through the Nice Monetary Disaster of 2008. There are lots of causes behind the spike, however extra importantly, a convergence of things brought about a market broad scare over the weekend. The concern brought about the unwind of the yen carry commerce, thus creating the ‘excellent storm’.

Whereas a spike this massive could be very uncommon, a transfer to a better volatility atmosphere was not surprising. The market has been extraordinarily calm and complacent previously 12 months, with the arrival of volatility promoting funds, which monetized the upward transfer in shares by way of bets of continued low vol. When massive pockets of the market attempt to unwind the identical commerce, uncommon occasions are inclined to occur, and extra importantly, massive losses for sure devices happen.

On this article, we’re going to talk about the ProShares Brief VIX Brief-Time period Futures ETF (BATS:SVXY), its massive -40% drawdown this week, and our view on this ETF as a part of a ‘quick vol’ cohort of funds.

What does SVXY Composition change really do

Allow us to begin with the ETF’s acknowledged goal:

ProShares Brief VIX Brief-Time period Futures ETF seeks day by day funding outcomes, earlier than charges and bills, that correspond to one-half the inverse (-0.5x) of the day by day efficiency of the S&P 500 VIX Brief-Time period Futures Index.

It is vitally necessary to recollect two issues right here:

- the ETF relies on the S&P 500 VIX Brief-Time period Futures Index

- the fund goals to offer half the inverse efficiency of the index

To translate the above in English, if VIX futures transfer decrease the ETF features, whereas situations of spikes in VIX futures trigger important loses to the ETF.

Allow us to see subsequent how the Index is constructed:

The S&P 500® VIX Brief-Time period Futures Index makes use of costs of the subsequent two near-term VIX® futures contracts to duplicate a place that rolls the closest month VIX futures to the subsequent month each day in equal fractional quantities. This leads to a relentless one-month rolling lengthy place in first and second month VIX futures contracts.

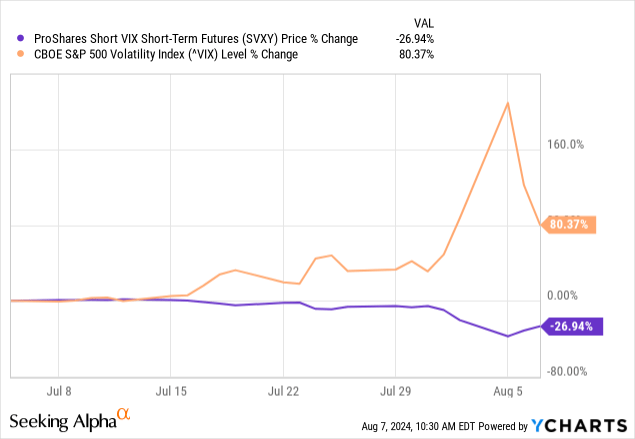

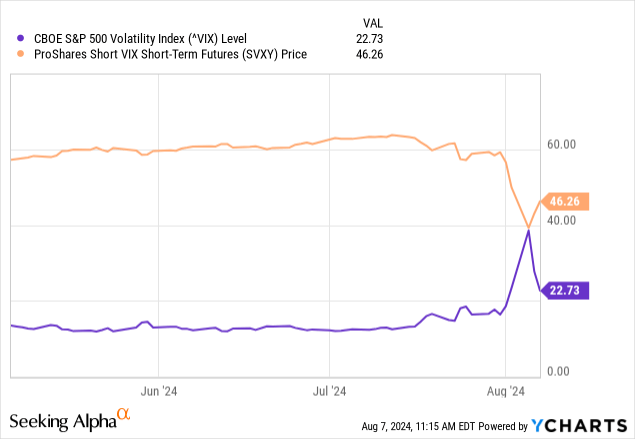

The Index consists of lengthy positions within the two entrance finish futures contracts on the VIX. This method dampens spikes to a sure extent, since spot costs will all the time be extra risky than a curve method. We are able to see that by benchmarking SVXY with the VIX previously month:

Prior to now month, the VIX has moved up by 80%, whereas SVXY has moved down by solely -26%. If the 2 entrance finish futures contracts moved precisely the identical because the VIX we’d have anticipated a -40% transfer in SVXY (bear in mind it goals to offer a -0.5x transfer). The futures contracts, nonetheless, didn’t transfer as a lot, thus dampening the impact of the VIX spike.

This fund construct favors SVXY from a drawdown perspective, because it avoids full wipe-outs when it comes to black swan occasions.

Composition change

Kindly word that SVXY has been out there for almost a decade, and adjusted its composition after a ‘close to demise’ occasion in 2018 when it was almost worn out following a spike within the VIX. Previous to the composition change, the fund represented a -1x publicity to the entrance month finish contract, thus having rather more volatility. After a VIX spike that nearly worn out the ETF, its monetary composition was modified to keep away from one other collapse. As we noticed this week, the present method works very nicely, the place a black swan occasion within the VIX brought about a -40% drawdown solely, with the ETF down a modest -16% for the 12 months.

The ‘quick vol’ ETF cohort

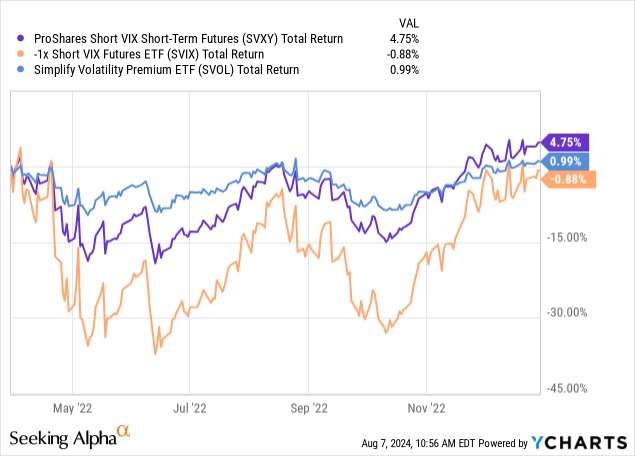

There are a variety of ETFs which fall within the ‘quick vol’ cohort, however we’re going to evaluate SVXY to the biggest two others:

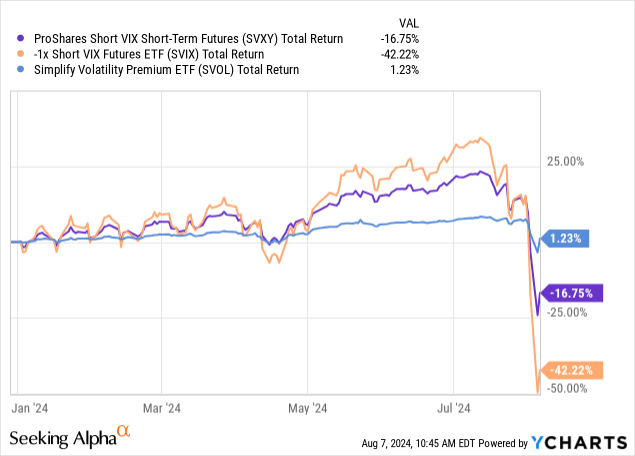

The utilized cohort consists of the -1x Brief VIX Futures ETF (SVIX) and the Simplify Volatility Premium ETF (SVOL). Whereas we’ve got not reviewed the above funds intimately, SVIX is a -1x tackle entrance month VIX futures, whereas SVOL is a extra complicated fund that has belongings layered in outdoors of volatility (volatility which itself is hedged by way of a time period construction).

The outcomes previously 12 months, nonetheless, converse volumes. SVIX is essentially the most risky of the cohort, with SVOL the least risky, and nonetheless optimistic on a 12 months so far foundation when taking a look at its whole return. SVXY falls someplace within the center, with the fund posting excellent outcomes when volatility is low, whereas its drawdowns are usually not cataclysmic.

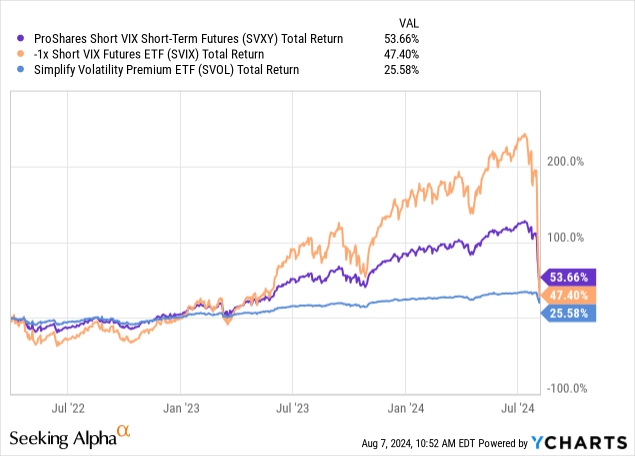

Allow us to widen out the historic interval used for our whole return evaluation:

Since March 2022, SVXY and SVIX have posted the same whole return, albeit with an enormous volatility, when taking a look at SVIX. SVOL, then again, has been extra subdued, principally following the S&P 500 whole return to a big extent.

As an investor, you’ll want to acknowledge the robustness of SVXY right here. The fund is a brief vol fund which simply went via one of many worst VIX days previously twenty years, but continues to be up considerably on a 3 12 months look-back. The roll-down in futures is fairly clear to all buyers in a peaceful market, however allow us to zoom within the efficiency throughout 2022, after we really had a bear market in equities, and a volatility atmosphere which noticed the VIX alternate between 20 and 30:

In the course of the 2022 bear market, SVXY was really roughly flat for the 12 months, with a low -15% drawdown. The above theme persists throughout 2022 as nicely, the place SVOL is the least risky one, whereas SVIX had an enormous -30% drawdown.

Perceive the market atmosphere and the fund

SVXY has confirmed itself as a sturdy software throughout calm occasions in addition to throughout run-off the mill bear markets like 2022. When volatility strikes up, SVXY loses worth, however ultimately the fund catches up as entrance month futures roll within the new increased degree volatility atmosphere. In these two market environments, the fund does its job – offering outsized returns in calm markets and normalized drawdowns in ‘regular’ bear markets.

Nonetheless, an investor wants to recollect it is a quick place on vol futures; thus sudden losses are usually not going to expertise a ‘V’ formed restoration when VIX normalizes. Simply have a look at the present worth for SVXY within the context of the VIX – as we’re writing this text the VIX has moved to beneath 24, but SVXY could be very far off its worth from final week:

Even when the VIX strikes to fifteen tomorrow, don’t count on SVXY to maneuver to its prior worth of $60/share. The ETF makes cash in time, because of the decay and the futures ‘roll’ impact.

Main danger issue for SVXY

We simply skilled the first danger issue for the ETF, specifically a sudden spike within the VIX. The fund does high quality in an atmosphere the place volatility strikes gently increased, however experiences a loss when there are spikes in volatility, similar to on August 5, 2024.

By definition, the VIX can not keep very elevated (above 35) for lengthy intervals of time as a result of the capital markets will cease functioning. Subsequently, SVXY is topic to sudden important losses solely in distinct occasions, low chance occasions similar to we skilled. Because the VIX curve normalizes (even at a better degree), the ETF will earn money from the roll impact. Subsequently, the perfect time to buy SVXY is correct after such an outsized spike as a result of the market dynamics are set to flatten the vol futures curve ultimately (even when at a better degree). SVXY will earn money even when the VIX trades at above 20 ranges going ahead. The crux for the fund is the shortage of different large spikes within the VIX, which might dent the ETF NAV.

Conclusion

SVXY is a brief volatility exchange-traded fund. The fund goals to offer a -0.5x return in opposition to the day by day efficiency of the S&P 500 VIX Brief-Time period Futures Index, an index which consists of the 2 entrance month VIX futures contracts. The ETF has detrimental performances when the VIX spikes all of a sudden, whereas mild strikes increased are absorbed by way of modest drawdowns. We noticed this monetary engineering embedded within the fund’s efficiency in 2022 when it was roughly flat throughout a bear market 12 months. SVXY experiences deep drawdown solely when the VIX spikes unexpectedly, similar to it did on Monday, August 5, 2024.

The ETF skilled a -40% drawdown following this occasion, however is down solely -16% for 2024. Because the VIX normalizes (or higher mentioned doesn’t expertise spikes), the ETF goes to grind increased. Absent an atmosphere of fixed VIX spikes, the ETF is a ‘Purchase’ following such a black swan occasion since it would profit from the volatility degree normalization, even when the VIX stays above 20 going ahead.

A retail investor contemplating a mushy touchdown as a base case ought to discover SVXY enticing, since its drawdown was the results of a confluence of concern elements which shouldn’t repeat themselves. Even a light bear market ought to see the fund do nicely so long as the VIX grinds increased in a gentle vogue slightly than by way of spikes. Don’t count on a ‘V’ formed restoration within the SVXY worth even when the VIX strikes again to fifteen tomorrow, however do count on a gradual grind increased on the again of a normalization in volatility.