StoneCo: Unjustified Dip In 2024 Makes It A Purchase (NASDAQ:STNE)

Jasmina007

Funding thesis

Traders of StoneCo (NASDAQ:STNE) are experiencing ache in 2024, because the inventory has misplaced a few quarter of its worth for the reason that starting of the 12 months. The selloff was principally brought on by the ‘disappointing’ newest earnings launch. Nevertheless, my evaluation suggests that STNE’s Q1 efficiency was sturdy throughout all essential metrics, and antagonistic actions in overseas trade charges had been the one dragging issue. Regardless of overseas trade headwinds, the corporate’s profitability is increasing quickly. Furthermore, the administration has a strong long-term outlook, and I imagine this optimism is backed by just a few important basic elements. The valuation could be very engaging as nicely. All in all, I assign STNE a “Purchase” ranking.

Firm data

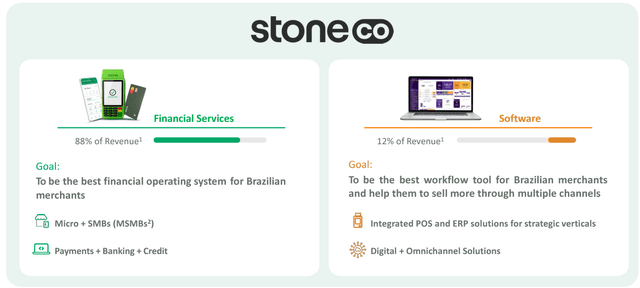

StoneCo is a Brazilian fintech firm principally specializing in micro, small, and medium companies [MSMBs]. STNE operates through two enterprise segments: Monetary Companies and Software program.

STNE’s newest presentation for institutional

By the Monetary Companies phase, STNE gives funds, digital banking, and credit score options. By the Software program phase, the corporate sells POS and ERP options for various retail and companies verticals, Buyer Relationship Administration [CRM], engagement instruments, e-commerce and Order Administration System [OMS] options, amongst others, targeted on each SMBs and enormous shoppers. The corporate gives its options underneath three totally different model names: Linx, Stone and Ton.

STNE’s newest presentation for institutional

Financials

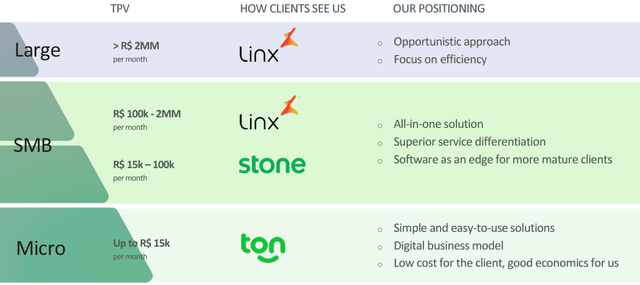

Lengthy-term traits in monetary efficiency are essential to me as they assist in understanding the power of the enterprise mannequin and consistency within the administration’s efficiency. From this angle, StoneCo’s enterprise mannequin seems sturdy and well-executed by the administration.

Income grew with a 38% CAGR between 2016 and 2023. The gross margin demonstrated constant growth because the enterprise scaled up, and the working margin greater than doubled. Free money circulation [FCF] has been constantly constructive during the last three years.

Writer’s calculations

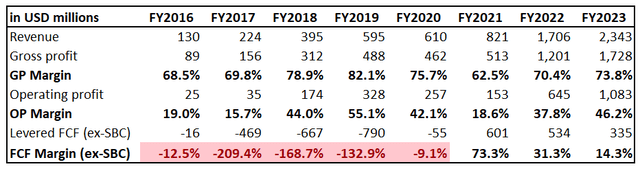

On account of constantly enhancing profitability and increasing FCF, StoneCo has a wholesome stability sheet with round a billion-dollar excellent money place and reasonable debt ranges. Liquidity ratios are additionally sturdy. General, the stability sheet is robust sufficient to place StoneCo nicely for future progress.

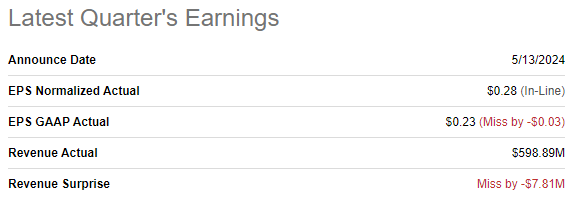

In search of Alpha

The newest quarterly earnings had been launched on Could 13. The corporate missed each income and EPS estimates. The inventory worth fell by greater than ten p.c after the disappointing earnings launch. It was the second consecutive quarter the place the corporate missed consensus income estimates.

In search of Alpha

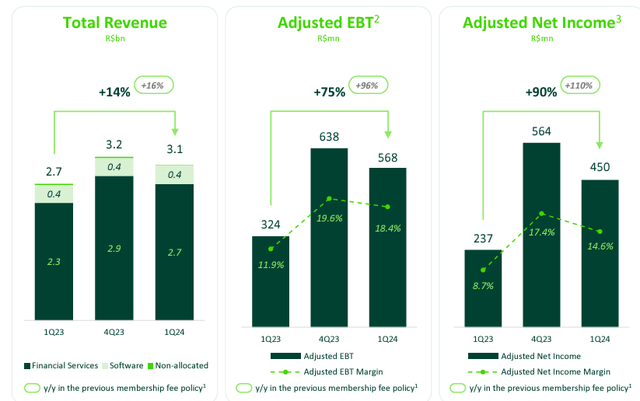

Then again, from the perspective of monetary efficiency, the quarter was stable. Income grew YoY by 9% and the adjusted EPS expanded from $0.15 to $0.28. The EPS power was achieved as a result of working leverage, as key profitability metrics improved YoY. In operational forex income progress seemed a lot better with a 14% YoY enhance.

STNE’s newest earnings presentation

Key working metrics additionally demonstrated sturdy dynamics. The MSMBs funds shoppers base grew by 33% YoY and the entire fee quantity [TPV] grew by 24% YoY. The take price improved by 15 foundation factors.

From the larger image perspective, there are just a few robust causes to be bullish about StoneCo.

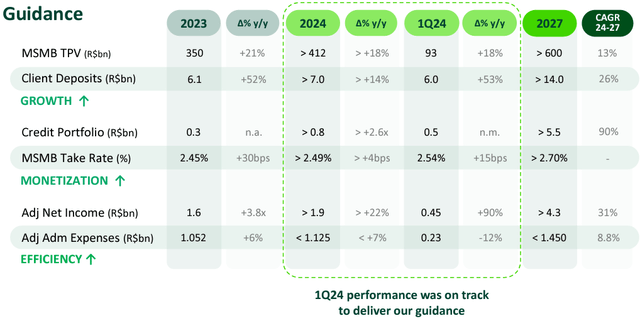

As I stated earlier than, long-term traits within the firm’s monetary efficiency clearly point out the power of the enterprise mannequin. The current, virtually 100%, EPS progress signifies large potential to train working leverage. The administration plans to ship a 31% CAGR for adjusted internet earnings between 2024 and 2027. This might be fueled by sturdy TPV and consumer deposit base growth along with strict monetary self-discipline.

STNE’s newest earnings presentation

The TPV closely is determined by the broader financial system’s general well being. In line with Statista, the Brazilian financial system [real GDP] is anticipated to develop with round 2% CAGR by 2029. It is a stable issue that may seemingly help STNE’s TPV progress.

Brazil additionally demonstrates a transparent secular development of speedy decline in money utilization, which signifies that the demand for fintech companies will extremely seemingly stay sturdy and as an rising participant within the trade, STNE is poised to profit.

Final however not least, Brazil’s e-commerce trade is flourishing, which is one other constructive catalyst for digital funds. In line with Mordor Intelligence, the nation’s e-commerce market will compound with virtually 19% CAGR by 2029. That is one other sturdy progress catalyst for STNE.

Valuation evaluation

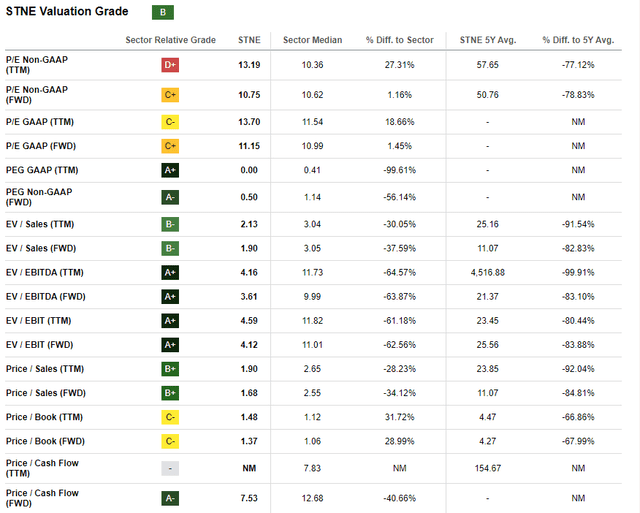

The inventory worth elevated by 13% during the last twelve months, considerably outperforming the iShares MSCI Brazil ETF (EWZ). Nevertheless, this 12 months is hard for STNE’s buyers because the inventory misplaced round 21% of its worth YTD. A lot of the valuation ratios look low in comparison with the sector median and historic averages, making a stable “B” valuation grade from In search of Alpha Quant well-deserved.

In search of Alpha

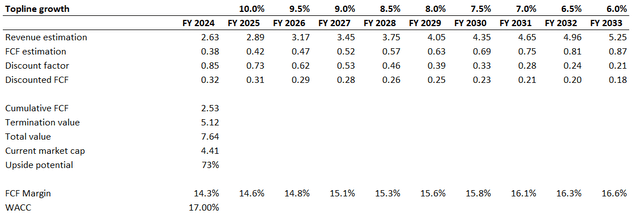

To cross-check what valuation ratios say, I’m simulating the discounted money circulation [DCF] mannequin. Because of the dangers which I focus on within the subsequent part, I exploit an elevated 17% WACC advisable by Gurufocus. Consensus income estimates undertaking round 9-10% income CAGR for the subsequent three years. I take a ten% income progress for FY 2025 and undertaking a 50 foundation factors yearly deceleration as comparative figures develop and the penetration of fintech deepens in Brazil. I exploit FY 2023’s FCF margin of 14.3% and count on a conservative 25 foundation factors yearly enchancment.

Writer’s calculations

Regardless of utilizing conservative income progress assumptions, STNE’s truthful worth is 73% larger in comparison with the present market cap. I think about the upside potential to be compelling.

Dangers to contemplate

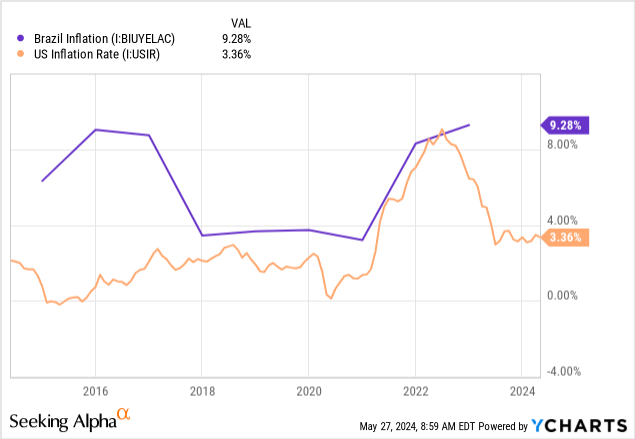

STNE operates in Brazil, which suggests a number of important dangers for buyers. As an rising nation, Brazil continues to be creating its political establishments. This will likely result in sudden modifications in laws, which might adversely have an effect on STNE’s operations. Brazil is a big exporter of assorted commodities. Costs for many commodities are unstable, which will increase the volatility of the nation’s forex, the Brazilian Actual.

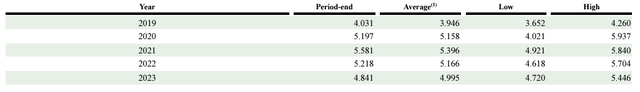

Stone’s newest 20-F report

Since inflation in Brazil is mostly larger in comparison with the U.S., the native forex loses its worth quicker than USD over time. Since STNE operates in Brazilian Actual, long-term traits in overseas trade charges are more likely to be antagonistic for the corporate.

Traders’ sentiment round STNE is way weaker in comparison with MELI. Whereas MELI already virtually absolutely recovered in direction of 2021 highs, STNE is nowhere close to its peak ranges of 2021. Due to this fact, buyers in search of for publicity to rising Brazilian fintech would possibly proceed betting on MELI as an alternative of STNE. This may also be a stable headwind for the share worth progress.

In search of Alpha

Backside line

To conclude, STNE is a “Purchase”. The valuation could be very engaging and outweighs all of the dangers and uncertainties for my part. The corporate demonstrates spectacular profitability growth and progress throughout all key enterprise metrics, which is able to seemingly assist in sustaining constant income progress for longer.