S&P 500 4 Beneath 5

ismagilov

The S&P 500’s (SPX) robust first half, with positive factors exceeding 15%, has pushed its valuation even increased. The typical P/E ratio primarily based on present 12 months anticipated earnings now sits at 22.7, whereas the median is sort of 5 factors decrease at 17.8. This hole highlights the focus of excessive valuations among the many largest corporations within the index.

In wanting by way of the person shares within the S&P 500, 4 shares have a decrease earnings a number of (primarily based on estimated earnings for the present 12 months) than the 4.9 share level hole between the common and median a number of of the index’s parts. Beneath, we spotlight charts of every of them and present that in sure instances, low cost doesn’t essentially imply good worth.

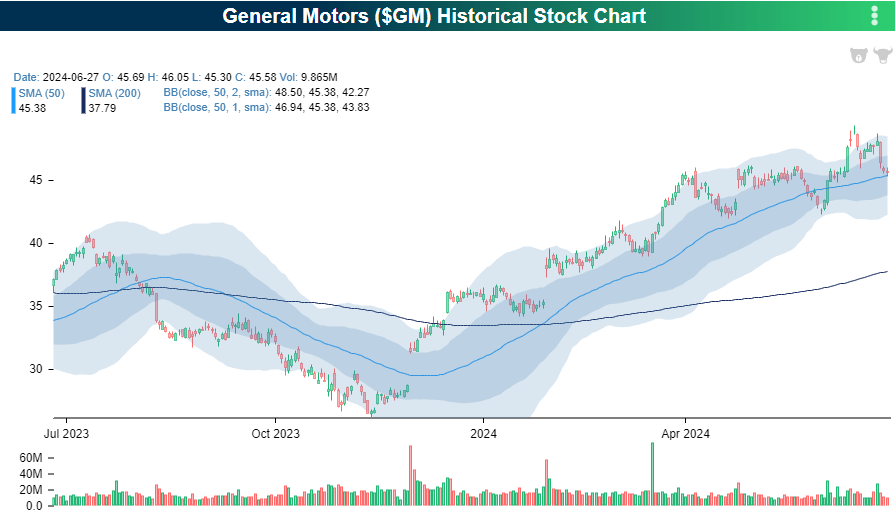

Of the 5 “least expensive” shares within the S&P 500, Basic Motors (GM) has been the perfect performer over the past 12 months, with a achieve of twenty-two.5% on a complete return foundation. Even after the achieve, the inventory trades at 4.86 occasions estimated earnings. For the present 12 months, analysts anticipate GM to develop earnings by 24%, however within the two years after that, earnings are solely anticipated to develop by somewhat greater than 1%, which can be the inventory’s dividend yield.

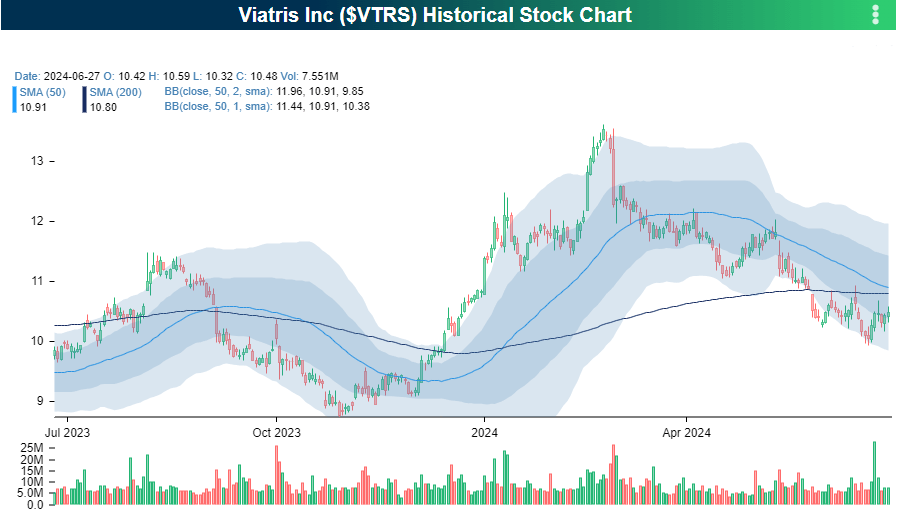

Subsequent on the listing when it comes to efficiency is Viatris (VTRS). VTRS was fashioned in 2020 following the merger of Mylan and Upjohn, which was a division of Pfizer (PFE). The corporate owns a number of brand-name prescriptions, generics, biosimilars, and OTC remedies. VTRS is not a high-growth inventory (earnings are anticipated to say no 7% this 12 months), however with a P/E of three.92 and a yield of 4.49%, shareholders are extra drawn to the inventory due to its earnings traits. With an annual dividend payout of 48 cents and annual earnings of over $2.00 per share, so long as earnings don’t collapse, VTRS shouldn’t have any issues with sustaining its payout.

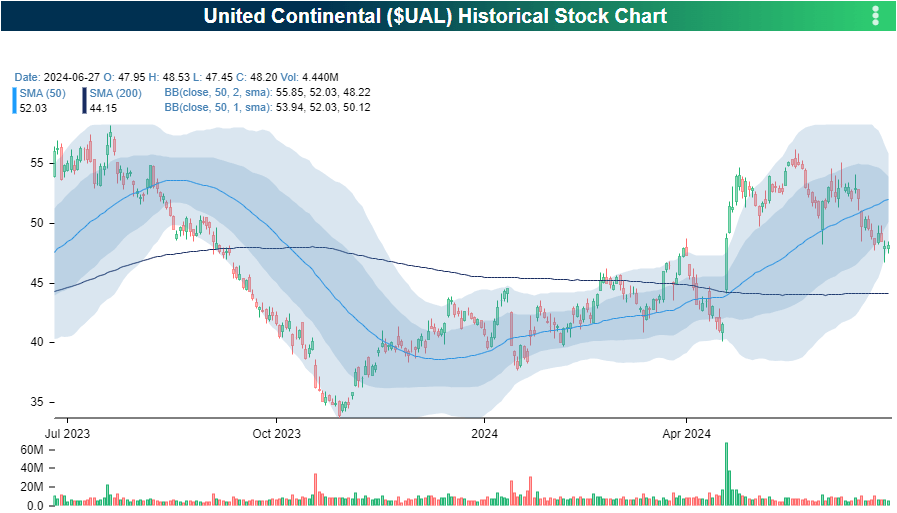

Whereas VTRS and GM have been winners, the opposite two ‘low cost’ shares have solely gotten cheaper over the past 12 months. The primary is United (UAL). Air journey has greater than erased the entire weak spot from Covid, and the TSA is anticipated to see report passenger volumes round this July 4th vacation. Regardless of the robust demand, airline shares have typically struggled in latest months. Over the past 12 months, UAL is down 13.85% taking its P/E right down to 4.8. After tripling final 12 months, earnings are anticipated to develop simply 1% in 2024, however then bounce again to between 10% and 20% for every of the subsequent two years.

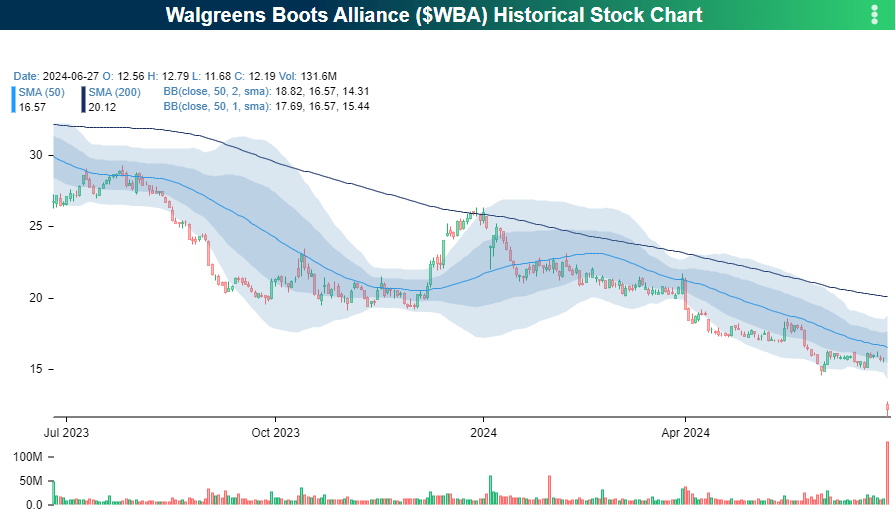

Final and definitely least is Walgreens Boots Alliance (WBA) which has declined greater than 55% over the past 12 months. On the floor, the inventory seems low cost, buying and selling at simply 4.1 occasions anticipated earnings and yielding 8.1%. After this week’s horrific earnings report, these estimates are more likely to come down sharply. The corporate reported weaker-than-expected earnings and lowered steerage for the total 12 months. It added that it plans to shut a ‘vital quantity’ of shops attributable to declining margins and weak profitability. In later feedback, the CEO famous that as much as 1 / 4 of all shops could possibly be affected. In response to the report, the inventory crashed greater than 22% on Thursday and fell every single day this week. And that 8% dividend yield? Whereas there was no point out of it on the decision, WBA already reduce its payout by almost half earlier this 12 months, and after this week’s report, one other reduce cannot be dominated out.

Editor’s Observe: The abstract bullets for this text had been chosen by In search of Alpha editors.