Snap: This Rally Is not Sustainable (NYSE:SNAP)

Wachiwit

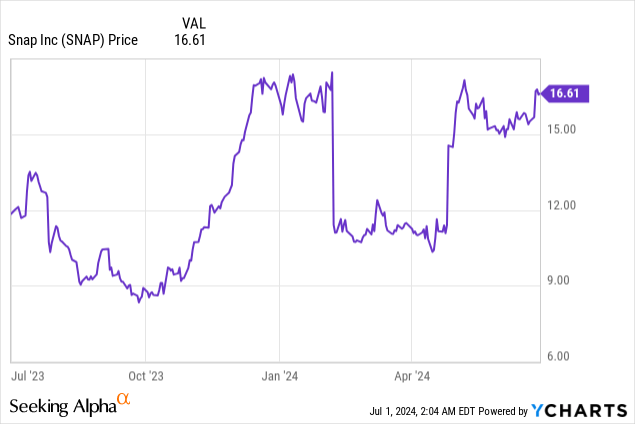

Below stress for many of the yr, Snap (NYSE:SNAP) has made a stunning and up to date turnaround. The social media firm, as soon as finest recognized for its disappearing chat messages, has achieved substantial re-acceleration in income development after buyers had lengthy thought Snap’s finest days had been behind it.

Snap’s inventory has been remarkably unstable this yr: the corporate fell sharply after This autumn outcomes and a weakened development profile, and rallied again to recuperate all of these losses in its Q1 earnings print. The inventory has stabilized within the excessive teenagers and is roughly ~flat yr so far. Now assessing Snap amid the volatility, nevertheless, I proceed to see few causes to stay invested on this inventory for the long run.

Acceleration in income development could also be short-lived if consumer development would not decide up tempo

I final wrote a bearish opinion on Snap in March, when the inventory was buying and selling within the low teenagers. Whereas I acknowledge that my bearish name was untimely, and I actually did not foresee the income acceleration in Q1, for my part, the core problems with this firm nonetheless stay ever-present.

Whereas Snap continues to develop DAUs, it isn’t rising within the U.S. nor in Europe, that are its highest-revenue producing areas. Add that to the truth that income development can also be outstripping each DAU development and impressions development, and we’ve a system for an unsustainable development sample. Sure, Snap might profit within the short-term from driving up costs on adverts and driving higher engagement with its advertisers, however its long-run development will probably be finally predicated on what number of customers it may well appeal to and retain. With this in thoughts, I am reiterating my promote ranking on Snap.

Outdoors of sluggish development within the high-ARPU North American area, listed below are all the different key causes to be cautious of Snap:

- Social media is fad-driven. Extra to the purpose above, Snap is all the time liable to a more recent and extra in-the-moment platform (like TikTok) taking up eyeball share and stealing customers away, maybe completely. Snap would not have the identical messaging/connecting-with-old-friends enchantment that Fb and Instagram do, placing it liable to obsolescence.

- Huge infrastructure prices. Snap’s investments in machine studying have dramatically elevated its server prices, which have taken successful to gross margins and general profitability. It has launched a brand new metric, infrastructure value per DAU, which is just below $1 – nearly the ARPU itself of a consumer within the “Remainder of World” area.

- Web debt. In contrast to many mid-large cap tech friends, Snap is definitely in a web debt place. Snap is investing in plenty of initiatives, together with augmented actuality, digital actuality, new app options, and an upgraded advertiser platform: it could be spreading its assets too skinny.

Whereas improved income development is actually a constructive that I will not ignore, it is troublesome for me to see Snap rallying past this level as it really works an uphill battle to maintain high-teens income development amid sluggish consumer development.

Valuation checkup

Furthermore, amid Snap’s newest rally, we will not make the argument that Snap is reasonable – which was one factor the inventory had going for it after it crashed in February.

At present share costs close to $17, Snap trades at a market cap of $27.59 billion. After we web off the $2.91 billion of money and $3.30 billion of convertible debt on Snap’s most up-to-date stability sheet, the corporate’s ensuing enterprise worth is $27.98 billion.

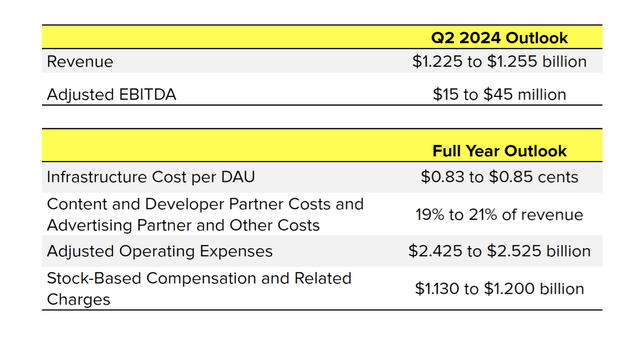

The massive catalyst that moved Snap’s inventory skyward was its newest outlook, which referred to as for 18% income development in Q2 (sustaining the re-accelerated development tempo it set in Q1). For the total yr, the corporate has not guided to income or adjusted EBITDA, however consensus is looking for $5.37 billion in income: or 25% development, which is larger than development charges in both Q1 or the corporate’s steering in Q2.

Snap outlook (Snap Q1 shareholder letter)

However, if we take consensus at face worth, Snap trades at 5.2x EV/FY25 income.

And if we assume an 9% adjusted EBITDA margin on this income profile (which represents 5 factors of y/y margin growth, in step with Q1 actuals and what Q2 steering implies in y/y margin growth), we get adjusted EBITDA of $483.3 million (roughly ~tripling y/y) and a a number of of 58x EV/FY25 adjusted EBITDA.

It is clear that Snap’s valuations are counting on plenty of future wins, together with a realization of advantages and moderation from the corporate’s present infrastructure investments. In my opinion, I am not assured that the corporate can maintain its development trajectory, particularly since current COVID-era traits have proven us that advertiser demand may be extremely fickle.

Q1 obtain

This being stated, we actually should acknowledge the strengths that Snap has exhibited in its Q1 outcomes. The Q1 earnings abstract is proven beneath:

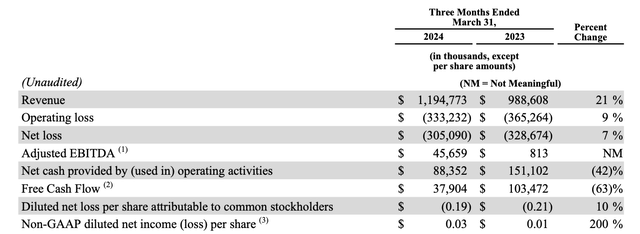

Snap Q1 abstract (Snap Q1 shareholder letter)

Income soared 21% y/y to $1.19 billion, effectively forward of Wall Road’s expectations of $1.12 billion (+13% y/y) and accelerating sharply over 5% y/y development in This autumn.

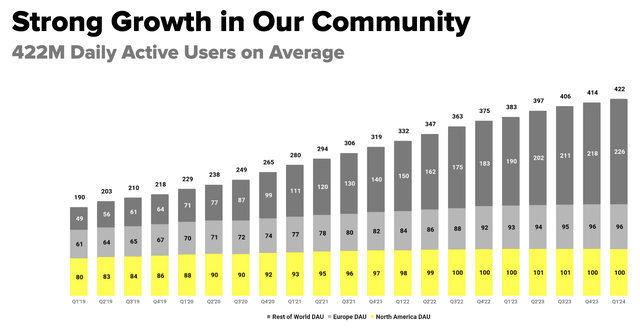

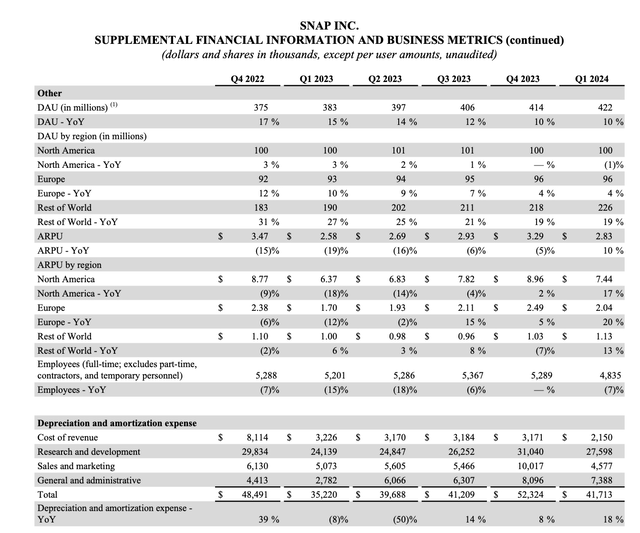

That being stated, nevertheless, I nonetheless do not see Snap as having solved its core downside. The chart beneath reveals that whereas Snap added 8 million DAUs within the quarter to finish at 422 million (+10% y/y), customers in North America and Europe remained secure at 100 million and 96 million, respectively. North American customers additionally stay beneath the height of 101 million achieved in mid-2023.

Snap DAU traits (Snap Q1 shareholder letter)

Why that is extremely necessary is the truth that a North American DAU generates $7.44 in ARPU as of Q1 – which is greater than 6x the $1.13 {that a} “Remainder of World” consumer generates. Oversaturation within the North American market, in addition to Europe (~2x the ARPU of a “Remainder of World” consumer) will stifle Snap’s skill to develop.

Snap trended metrics (Snap Q1 shareholder letter)

We additionally level out that Snap reported solely 7% y/y development in impressions delivered, which can also be beneath 10% y/y development in DAUs and 21% y/y development in income: which signifies to me that engagement per DAU is falling. Snap’s spectacular income outcomes are being pushed by improved promoting efficiency and pricing, which aren’t long-term components we will financial institution on.

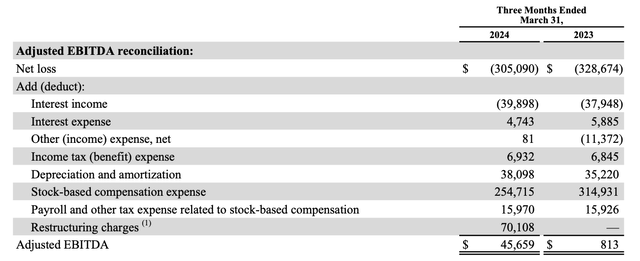

We’re impressed, nevertheless, with Snap’s surge of profitability regardless of its heavier infrastructure investments. Adjusted EBITDA within the quarter leaped to $45.7 million, or a 4% adjusted EBITDA margin, versus breakeven within the year-ago quarter.

Snap adjusted EBITDA (Snap Q1 shareholder letter)

Its outlook additionally requires $15-$45 million in adjusted EBITDA in Q2, or a ~2% midpoint margin versus -4% within the year-ago quarter.

Key takeaways

In my opinion, Snap very a lot stays a “present me” inventory with rather a lot to show. With out consumer development within the U.S. or Europe, the corporate may have a tricky time sustaining income efficiency, and elevated adjusted EBITDA multiples additionally hold me on the sidelines. Proceed to look at this inventory, however for my part this rally will fade sharply.