Rocket Cash Overview: Is It Price It?

Is Rocket Cash the most effective budgeting app? On this Rocket Cash evaluation, we study its options like budgeting instruments and subscription administration to see if it’s price your time.

Key Takeaways

- Rocket Cash (previously Truebill) is a budgeting app that helps customers observe spending, set budgets, and handle subscriptions with an easy-to-use interface.

- Key options embody automated subscription administration, personalised spending insights, and a invoice negotiation service that may save customers cash, albeit with charges.

- Whereas it affords a free plan, premium options vary from $6 to $12 per 30 days and improve budgeting capabilities and financial savings instruments.

What’s Rocket Cash?

Rocket Cash is a cash administration and budgeting app designed to assist customers take management of their funds. The rocket cash app facilitates monitoring spending, setting budgets, and managing subscriptions, all by a user-friendly interface. Whether or not you’re attempting to avoid wasting for a wet day or just need to observe your spending habits, Rocket Cash free goals to make the method seamless.

Initially referred to as Truebill, Rocket Cash was rebranded in August 2022 after being acquired by Rocket Firms in 2021. This rebranding introduced a bunch of recent options and a refreshed interface that makes monetary administration extra intuitive. With its color-coded spending classes and complete subscription administration instruments, Rocket Cash affords a transparent and arranged option to deal with your private funds.

How Does Rocket Cash Work?

To get began with Rocket Cash, customers should hyperlink at the very least one checking account utilizing the safe service Plaid, which helps most U.S. banks and bank card issuers. The setup course of is fast, taking lower than 10 minutes to create an account and sync your monetary information.

As soon as linked, Rocket Cash consolidates all of your monetary info, providing a real-time, complete view of your balances, payments, and spending patterns to provide the full image by account syncing.

Cease overpaying and begin saving. Strive Rocket Cash’s free plan and see how a lot you possibly can minimize out of your month-to-month payments.

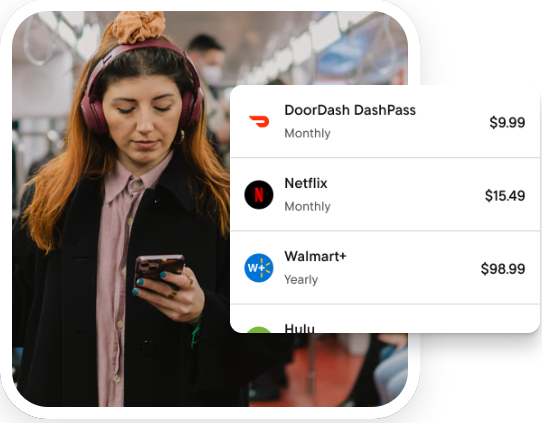

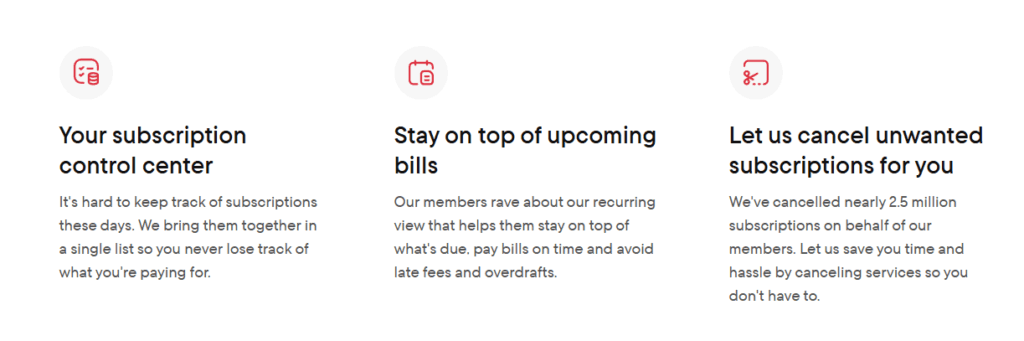

Subscription Administration

Considered one of Rocket Cash’s standout options is its subscription administration device. The app:

- Scans your transactions for recurring costs in about 30 seconds

- Supplies an in depth checklist of your subscriptions

- Is especially helpful for individuals who have a number of subscriptions and need to keep away from undesirable costs

- Permits customers to cancel subscriptions instantly inside the app with only a single faucet, making the method extremely handy.

For people preferring a hands-off method to handle subscriptions, Rocket Cash’s subscription administration device is a game-changer. It successfully identifies and helps remove undesirable subscriptions, giving customers higher management over their monetary panorama.

Budgeting Instruments

Rocket Cash’s budgeting instruments are designed to assist customers get monetary savings and obtain their monetary targets. The perfect budgeting app routinely averages your month-to-month revenue to set price range baselines, which could be personalized to raised align along with your private finance wants. Nevertheless, to create limitless budgets and totally customise classes, you’ll must improve to the premium model. Budgeting apps may improve your expertise by offering further options.

One of many key entry options is the app’s capability to routinely screens your budgets by offering alerts for overspending in particular classes. This real-time monitoring is made doable by seamless integration along with your financial institution accounts and checking account, providing the identical options for an correct and up-to-date image of your monetary well being.

Regardless of its many benefits, Rocket Cash’s budgeting instruments are usually not with out flaws. Transactions might often be miscategorized, which might have an effect on the accuracy of your budgets. Nevertheless, the app’s intuitive interface and easy navigation make it a favourite amongst customers who recognize its ease of use.

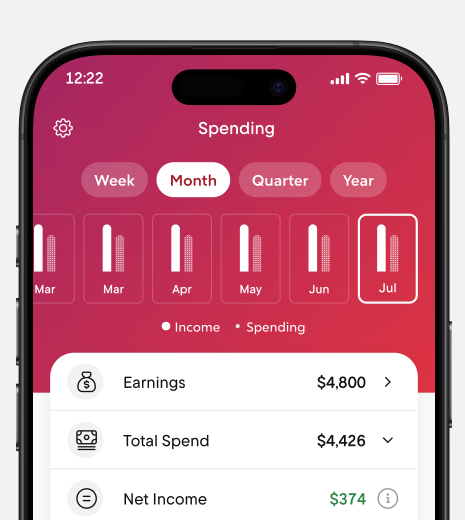

Spending Insights

Rocket Cash goes past fundamental budgeting by providing personalised monetary insights. These insights assist customers consider their spending habits and establish prime spending classes, together with their spending class. This characteristic is especially helpful for these seeking to make knowledgeable choices about how they spend their funds and get monetary savings in the long term.

Moreover, Rocket Cash affords refunds on financial institution overdrafts or late charges, including one other layer of economic advantages for customers. These spending insights and monetary perks make Rocket Mortgage Cash a worthwhile device for anybody critical about bettering their monetary well being.

Invoice Negotiation Service

Rocket Cash’s invoice negotiation service is designed to assist customers save on their current payments by negotiating higher charges with suppliers. The app flags payments for potential financial savings, resembling switching to a less expensive cellular phone or cable plan. Whereas this service can result in important financial savings, it comes with a price starting from 35% to 60% of the financial savings achieved.

It’s vital to notice that customers don’t maintain all of the financial savings from invoice negotiations, which can solely apply to the primary yr’s financial savings. Regardless of this, the potential for yr’s financial savings—resembling $175 saved over the following yr—makes this characteristic price contemplating.

Sensible Financial savings Account

Rocket Cash affords an automatic financial savings characteristic by its Sensible Financial savings device, which:

- Helps customers get monetary savings effortlessly

- Strikes cash to a financial savings account based mostly on person habits

- Makes it simpler to succeed in monetary targets with out fixed consideration

Customers can set particular financial savings targets and enter month-to-month financial savings contributions in Rocket Cash’s monetary targets part to assist them save extra spend much less. This automated method to monetary planning and saving ensures that customers can obtain their cash targets with minimal effort.

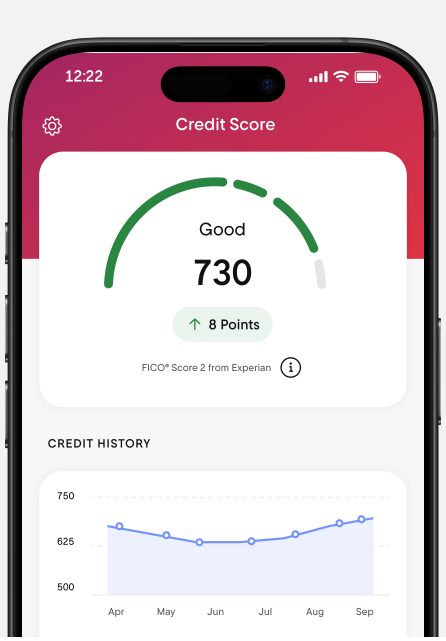

Credit score Rating Monitoring

Rocket Cash additionally affords a credit score report monitoring characteristic, offering customers with common updates on their credit score well being. This characteristic permits customers to watch modifications of their credit score rating over time, serving to them keep knowledgeable and make higher monetary choices.

Be part of the hundreds of thousands already utilizing Rocket Cash to price range smarter, cancel unused subscriptions, and attain their cash targets quicker.

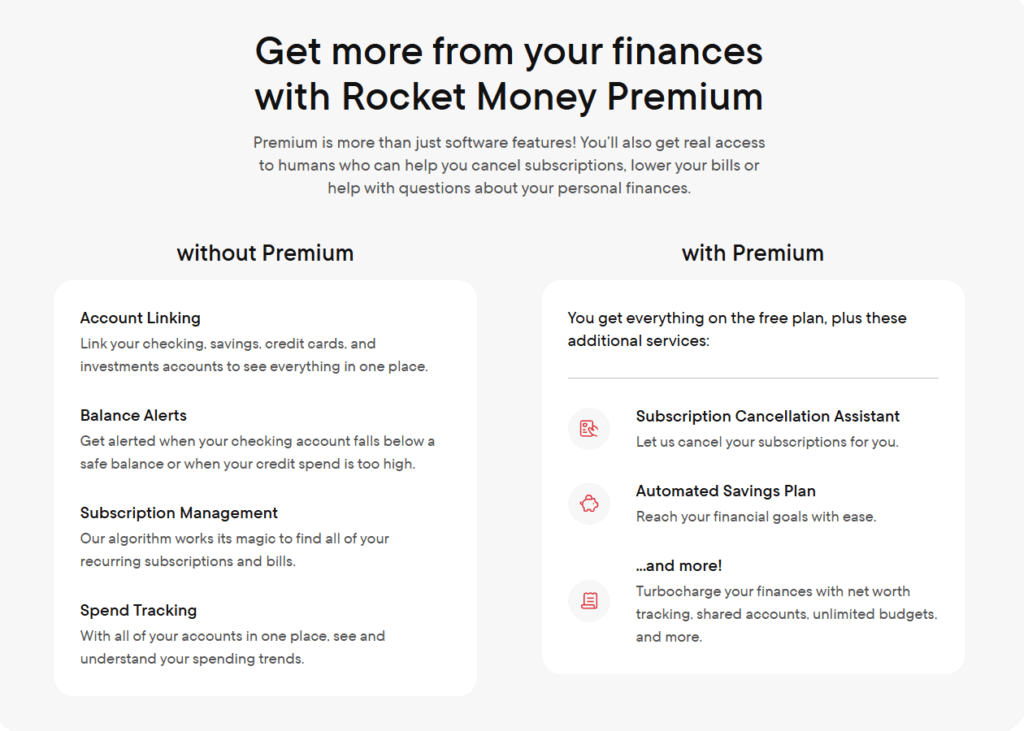

Rocket Cash Value

Rocket Cash affords a versatile price construction that features a free plan with restricted options and a premium subscription starting from $6 to $12 per 30 days. The free model offers fundamental budgeting capabilities and transaction visibility however lacks the superior instruments wanted for a complete budgeting expertise.

The premium membership unlocks further functionalities like limitless customized price range classes and automatic financial savings choices. Customers may entry a seven-day free trial to discover Rocket Cash’s premium options earlier than committing.

Is Rocket Cash Secure?

In relation to security, Rocket Cash employs AES 256-bit encryption to safe private information. This ensures that person information is encrypted each in transit and at relaxation, stopping unauthorized entry. Moreover, Rocket Cash makes use of industry-standard safety protocols to additional improve information safety.

The app makes use of Plaid to securely join financial institution accounts, transmitting banking credentials securely and enhancing person belief. Rocket Cash additionally ensures as much as $250,000 in FDIC insurance coverage for the financial savings accounts it manages, offering an additional layer of safety for customers.

Importantly, Rocket Cash doesn’t retailer person login credentials, additional guaranteeing information protected.

Who Ought to Use Rocket Cash?

Rocket Cash is right for a variety of budgeters seeking to handle their funds extra successfully. The cash app simplifies monetary administration by offering a complete overview of spending and financial savings. Customers may profit from the app’s subscription administration options, which assist negotiate varied payments resembling cellular phone and cable, making it a worthwhile device for a radical cash evaluation. Moreover, rocket cash’s options improve the general person expertise.

General, when you’re looking for a complete budgeting app and a device for efficient subscription administration, Rocket Cash is price contemplating.

Alternate options to Rocket Cash

Whereas Rocket Cash is a sturdy budgeting device, there are different apps price contemplating. Monarch Cash and You Want a Price range (YNAB) are two well-liked options. Monarch Cash affords visible finance shows that assist customers handle their budgets successfully. Learn our Monarch Cash evaluation.

YNAB, then again, permits customers full management and guide monitoring of their funds. Each apps present distinct options that cater to totally different budgeting wants, making them viable options to Rocket Cash.

Consumer Evaluations and Scores

Rocket Cash has obtained a mean ranking of roughly 4 stars throughout varied platforms, with the Apple App Retailer ranking being 4.3 stars. Customers discover the app user-friendly, with a clear design that makes budgeting simpler.

Nevertheless, some customers have criticized the Invoice Negotiation device for its excessive charges and inflated financial savings estimates. Regardless of these criticisms, the general person suggestions is optimistic, making Rocket Cash a dependable selection for a lot of.

Abstract

Rocket Cash affords a complete suite of instruments for managing private funds, from budgeting and subscription administration to invoice negotiation and credit score rating monitoring. The app’s user-friendly interface and safe information practices make it a compelling possibility for anybody seeking to take management of their monetary well being.

Whether or not you’re a seasoned budgeter or simply beginning, Rocket Cash offers the options and adaptability wanted to realize your monetary targets. Give it a attempt to see the way it can rework your method to managing cash.

Able to see the place your cash’s actually going? Join Rocket Cash and uncover your true spending image at present.

FAQs

Rocket Cash has a free plan with fundamental options, however if you’d like extra, the premium subscription prices between $6 to $12 a month.

Completely, Rocket Cash is protected to make use of because it makes use of AES 256-bit encryption and doesn’t retailer your login data. You may really feel safe whereas managing your funds!

Completely, you possibly can simply cancel subscriptions proper within the Rocket Cash app with only a faucet! It’s tremendous easy and helpful.

Sure, Rocket Cash has a seven-day free trial for its premium options, so you possibly can test it out risk-free!

High U.S. Brokers of 2025

★ ★ ★ ★ ★

Options:

✅ U.S. shares, ETFs, choices, and cryptos

✅ Now 23 million customers

✅ Money mgt account and bank card

Signal-up Bonus:

Free inventory as much as $200 with new account, plus as much as $1,500 extra in free inventory from referrals

★ ★ ★ ★ ★

Options:

✅ Free Stage 2 Nasdaq quotes

✅ Entry to U.S. and Hong Kong markets

✅ Instructional instruments

Signal-up Bonus:

Deposit $100, get $20 in NVDA inventory; Deposit $2,000, get $50 in NVDA inventory; Deposit $10,000, get $300 in NVDA inventory; Deposit $50,000, get $1,000 in NVDA inventory

★ ★ ★ ★ ☆

Options:

✅ Entry 150+ international inventory exchanges

✅ IBKR Lite & Professional tiers for all

✅ SmartRouting™ and deep analytics