Resideo: Modest Outlook Amid Present Macro Problem Stabilisation Anticipated In 2025

andresr

Synopsis

Resideo (NYSE:REZI) specialises within the growth and manufacturing of technology-driven merchandise and options that present water and vitality administration, consolation, security, and safety.

For REZI’s most up-to-date 2Q24, its income declined modestly, pushed by elements similar to decrease gross sales volumes, unfavourable worth impacts in its ADI section, and challenges within the European market. Regardless of the income decline, its adjusted margins expanded, and it was pushed by its Merchandise and Options section.

Trying forward, the main indicator of remodelling exercise forecasts a difficult 2024 for house owner spending on enhancements and repairs. Nevertheless, after that, 2025 is anticipated to show higher, and the year-over-year decline will enhance to a extra modest decline of 0.5%. As well as, housing begins additionally decline in July 2024, which displays a difficult residential market as a result of excessive rates of interest and decreased housing affordability. The combined outlook throughout North America and Europe additional reinforces the necessity for warning. Given the smooth outlook, I’m reiterating my maintain ranking.

Recap of Earlier Protection

Beforehand, I really helpful a maintain ranking for REZI, which stems from a couple of elements. In 2023, its income declined by 8.96% as a result of quantity strain. As well as, its margins, that are gross margin, working earnings margin, and web earnings margin, contracted as nicely due to the quantity strain.

Looking forward to 2024, the outlook for REZI is anticipated to be smooth as a result of weak macroeconomic circumstances. Residential restore and remodelling exercise and residential new development begins are anticipated to stay smooth, with residential restore and remodelling exercise anticipated to stay regular or lower barely, whereas residential new development begins are solely anticipated to extend by low single digits.

Residential Transform Outlook with Stabilisation Anticipated by 2025

Harvard Joint Heart for Housing Research

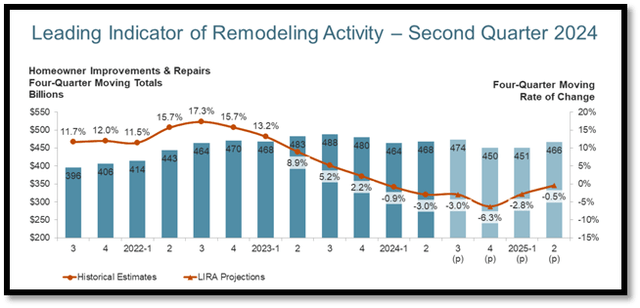

The second quarter 2024 Main Indicator of Remodelling Exercise [LIRA] chart was launched by the Remodelling Futures Program on the Joint Centre for Housing Research of Harvard College [JCHS] on July 18, 2024. In accordance with this system, house owner spending on enhancements and repairs is anticipated to see an uptick within the first half of 2025.

Trying on the above chart, it signifies that after a modest downturn, the spending on renovations and upkeep for owner-occupied houses is anticipated to lower by a modest 0.5% year-over-year for 2Q25 vs. 2Q24 -3%. The driving force behind the softness seen in residential remodelling exercise since 2Q23 was primarily attributable to macroeconomic uncertainty and continued weak spot in house gross sales and constructing materials gross sales.

Nevertheless, the Remodelling Futures Program highlighted that spending drivers are starting to stabilise. Because of this, it’s anticipated that it will result in a steadier and extra sustainable tempo of house upgrades and repairs following the pandemic-induced surge.

Earlier than the anticipated uptick in 2025, the LIRA forecasts that remodelling exercise will stay weak in 2024. Particularly, a year-over-year decline of three% is projected for 3Q24, with 4Q24 anticipated to be the weakest at -6.3%. After this era, the slowdown in house remodelling is anticipated to be comparatively gentle, with spending ranges stabilising near earlier years.

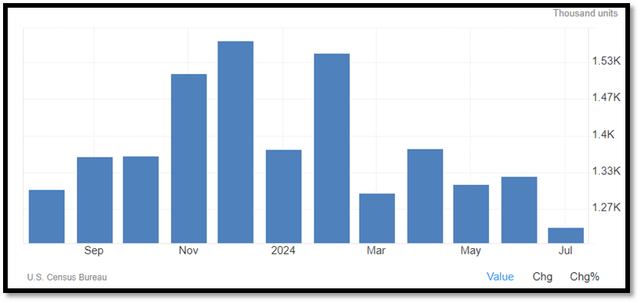

Smooth US Housing Begin Outlook

In July 2024, housing begins within the US decreased 6.8% to an annualised fee of 1.238 million. For comparability, June 2024 reported a 1.1% enhance, and this additionally represents the most important drop since March to the bottom stage since 2020. The lower was as a result of a 14.1% fall in constructing begins with one unit.

In the newest quarter, the residential housing market stays difficult due to the excessive rate of interest surroundings. Because of this, it negatively impacted housing affordability and constraining housing turnover. As well as, it additionally resulted in decreased discretionary spending on restore and remodelling actions. Trying forward, the outlook for housing begins is smooth, as REZI is anticipating residential new development begins to develop low to mid-single digits.

Blended Outlook Between North America and Europe

Regardless of the challenges, REZI noticed stabilisation in its key channels. In North America, its stock ranges throughout key channels have normalized. Moreover, it additionally noticed some demand enchancment within the HVAC distribution channel and First Alert security merchandise.

Nevertheless, on the European market facet, it has been difficult and is anticipated to stay that approach. This smooth outlook is pushed by a discount in authorities incentives and political uncertainties. Because of this, it has been affecting quantity, notably in fuel combustion and warmth pump merchandise.

2024 Steering

For full yr 2024, REZI guided income to be within the vary of $6.68 billion to $6.76 billion. Its ADI section is anticipated to be between 0% and a pair of% as a result of headwinds in residential centered markets. Shifting on, adjusted EBITDA is forecast to be between $655 million and $695 million. Adjusted EPS is anticipated to be between $2.15 and $2.35. By way of working money circulation, it elevated earlier steerage of $320 million to $375 million for FY2024.

Second Quarter 2024 Earnings Evaluation

For 2Q24, REZI’s income fell 0.8% year-over-year to $1.59 billion. This decline was attributable to decrease gross sales quantity of roughly $16 million, the ADI section’s unfavourable $10 million worth impacts, unfavourable international trade fluctuations of $6 million, and a $33 million gross sales influence from the Genesis enterprise divestiture, which was divested in 4Q23. Nevertheless, Snap One’s income contribution of $45 million and its Product and Options section’s $8 million in pricing enhance helped to offset the decline.

By reportable segments, its ADI International Distribution section income was up 4% year-over-year to $959 million. This progress was pushed primarily by the Snap One acquisition, however partially offset by a decline in audiovisual and video surveillance.

However, its Merchandise and Options section income decreased 7% year-over-year to $630 million, primarily because of the Genesis enterprise divestiture as talked about. Excluding that, income was down solely 2%. REZI’s first alert’s security merchandise reported robust gross sales progress, primarily attributed to its growth into new residential development. However, when in comparison with 2Q23, air product income has stabilised and orders have elevated. This means that channel inventories with distributor shoppers have normalised. Nevertheless, smooth and sluggish exercise within the EMEA area, particularly in vitality objects, offset this progress.

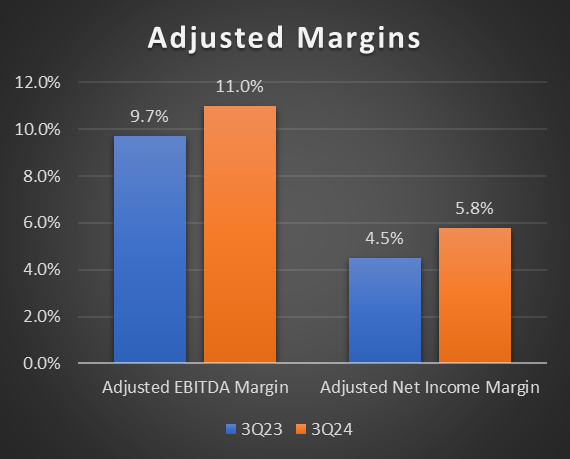

Shifting on to adjusted margins, each its adjusted EBITDA margin and adjusted web earnings margin expanded year-over-year. Its adjusted EBITDA margin expanded to 11% whereas its adjusted web earnings margin expanded from 4.5% to five.8%. Because of this, adjusted diluted EPS elevated from $0.48 to $0.62, representing year-over-year progress of 29.1%.

For the quarter, its Merchandise and Options section adjusted EBITDA elevated $19 million, or 14% year-over-year, which resulted in an adjusted EBITDA margin of 24.8%. This represents an enchancment of 4.6% year-over-year, and it’s pushed by robust gross margin and emphasis on working expense management. However, its ADI International Distribution section’s adjusted EBITDA margin decreased modestly to eight.1% as a result of lowering working earnings.

Creator’s Chart

Relative Valuation Mannequin

Creator’s Relative Valuation Mannequin

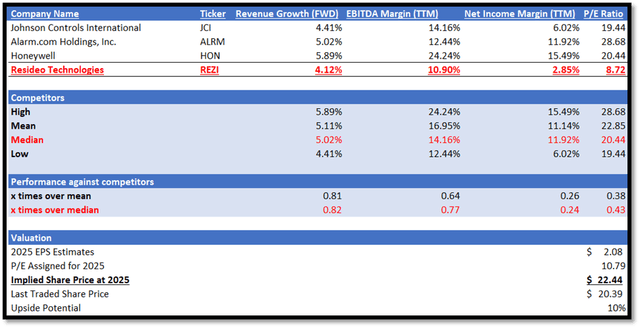

Earlier than we start, a fast recap on REZI. It specialises within the growth and manufacturing of technology-driven merchandise and options that present water and vitality administration, consolation, security, and safety. In my relative valuation mannequin, I’ll evaluate REZI towards its friends by way of progress outlook and profitability margins TTM. For progress outlook, I can be evaluating their ahead income progress fee, which is taken into account to be a forward-looking metric. For revenue margins, I can be evaluating their EBITDA margin TTM and web earnings margin TTM.

Beginning with progress outlook, REZI underperformed its friends median because it has a ahead income progress fee of 4.12%, which is decrease than friends’ median of 5.02%. By way of revenue margins, REZI additionally underperformed its friends’ median. For EBITDA margin TTM, REZI reported 10.90% whereas its friends’ median is 14.16%, representing a niche of three.26%. For web earnings margin TTM, the hole turned wider. REZI reported solely 2.85%, whereas friends’ median is 11.92%.

At present, REZI’s ahead non-GAAP P/E ratio is 8.72x, decrease than friends’ median of 20.44x. Given REZI’s underperformance in each progress outlook and revenue margins towards friends’ median, I argue it’s truthful that REZI trades at a reduction and at a decrease valuation. Nevertheless, when contemplating REZI’s 5-year common P/E is 10.79x, the present a number of of 8.72x appears extreme despite the fact that a reduction is warranted. Subsequently, I can be setting my 2025 goal P/E for REZI at its 5-year common of 10.79x.

For 2024, the market income estimate is $6.72 billion, whereas non-GAAP EPS is $1.71. For 2025, the income estimate is $7.19 billion, whereas non-GAAP EPS is $2.08. Given my forward-looking evaluation as mentioned in addition to REZI’s FY2024 steerage, the market’s estimate is justified. Subsequently, by making use of my 2025 goal P/E to its 2025 EPS estimate, my 2025 goal share worth is $22.44.

Threat and Conclusion

As mentioned, elements similar to total macroeconomic circumstances, rates of interest, residential and non-residential development, and restore and remodelling exercise all have an effect on REZI’s monetary efficiency. Though present macroeconomic circumstances are nonetheless unsure, it has began to point out some indicators of restoration. With inflation easing, the Fed’s has indicated its curiosity to chop rate of interest forward, though no data was supplied for the precise timing. When charges reduce, it would increase total macroeconomic circumstances and enhance the at present smooth outlook on residential development and restore and remodelling exercise.

For 2Q24. REZI’s income declined modestly year-over-year. The decline in income was pushed by decrease gross sales volumes, unfavourable worth impacts in its ADI section, and challenges within the European market. On a brighter observe, its adjusted margins expanded.

In accordance with LIRA, house owner spending on enhancements and repairs is anticipated to proceed declining all through 2024, worsening by the fourth quarter. Nevertheless, the outlook improves in 2025, with the decline anticipated to reasonable. As well as, housing begins took a success in July because it fell 6.8%, reflecting a difficult residential market. REZI forecast residential new development begins to develop in low- to mid-single digits. Whereas REZI’s stock stage in North America has normalised, the European facet stays challenged and is anticipated to stay that approach.