RealReal: Return To GMV Progress Might Spark The Starting Of A Rebound

triocean/iStock through Getty Photographs

Because the inventory market continues to hover close to all-time highs, I proceed to sprinkle small items of my portfolio into small-cap turnaround performs that can have much less correlation to the broader markets if a correction occurs. One of essentially the most attention-grabbing rebound performs right here is The RealReal (NASDAQ:REAL), a luxurious consignment platform that has just lately undergone a serious enterprise transition and is poised to return to development.

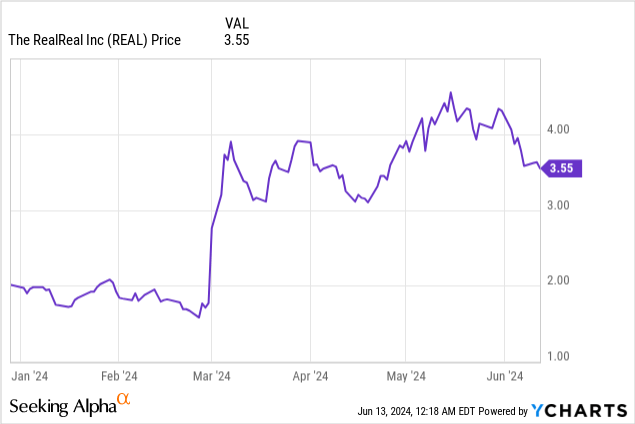

Yr thus far, shares of The RealReal have jumped greater than 80% as the corporate ditched its direct-sales enterprise to deal with consignment and enhance its gross margins. And but, despite robust Q1 outcomes launched final month, the inventory has floundered whereas the rest of the market has rallied. It is a good time, for my part, for buyers to construct a place on this inventory.

Bull case seems vibrant amid low cost valuation

I final wrote a bullish initiation on The RealReal in April, when the inventory was buying and selling slightly below $4. Since then, the inventory has continued to drop whereas Q1 outcomes confirmed a return to constructive GMV development, a pointy double-digit y/y enhance in consignment income, and file gross margins. The RealReal additionally boosted its steering outlook for the complete yr, whereas its Q2 outlook portends to development persevering with and accelerating within the second quarter as nicely.

Amid this backdrop, I am renewing my purchase name on The RealReal.

The very first thing to notice right here: the inventory stays low cost, particularly after its current small correction. At present share costs close to ~$3.50, The RealReal trades at a market cap of simply $378.3 million. After we internet off the $166.0 million of money and $433.4 million of debt on the corporate’s most up-to-date stability sheet, its ensuing enterprise worth is $645.6 million.

In the meantime, for FY25, Wall Road analysts are projecting The RealReal to generate $642.6 million in income, or 9% y/y development. This places the inventory’s valuation at simply 1.0x EV/FY25 income.

Keep in mind that now that The RealReal is specializing in consignment, it has improved its gross margin profile to ~75% (and as consignment income will increase in combine in FY25, I would additionally count on that to extend subsequent yr as nicely). The RealReal is successfully now a companies platform, with margins rivaling tech firms to show it – and from that regard, a ~1x income a number of is kind of opportunistic.

Right here is my full long-term bull case for The RealReal:

- Consignment poised for development in addition to affording the corporate with excessive gross margins. The corporate is ditching its direct-sales enterprise and dramatically shrinking down its stock ranges. Although total GMV is down y/y, consignment gross sales are up. As well as, the income combine shift towards consignment and away from direct gross sales has pushed The RealReal’s gross margin profile above 70%.

- Luxurious alignment. The corporate distinguishes itself from different e-commerce gamers like Poshmark and Amazon.com (AMZN) by focusing particularly on luxurious manufacturers. Lots of the objects listed on The RealReal checklist for $1,000+, giving the corporate a sure cachet that Amazon cannot replicate with its orientation towards worth.

- Capital-light enterprise. Not like the opposite main luxurious e-commerce identify, Farfetch, The RealReal is now a pure companies enterprise, and it isn’t weighed down with a retail arm, like Farfetch’s subsidiary Browns (a bodily retail chain within the UK).

- Debt restructuring. The corporate has additionally just lately renewed all of its credit score agreements. The corporate’s convertible debt notes at the moment are not due till 2029, giving the corporate loads of respiratory room from a liquidity standpoint.

Keep lengthy right here and use the current dip as a shopping for alternative.

Q1 obtain

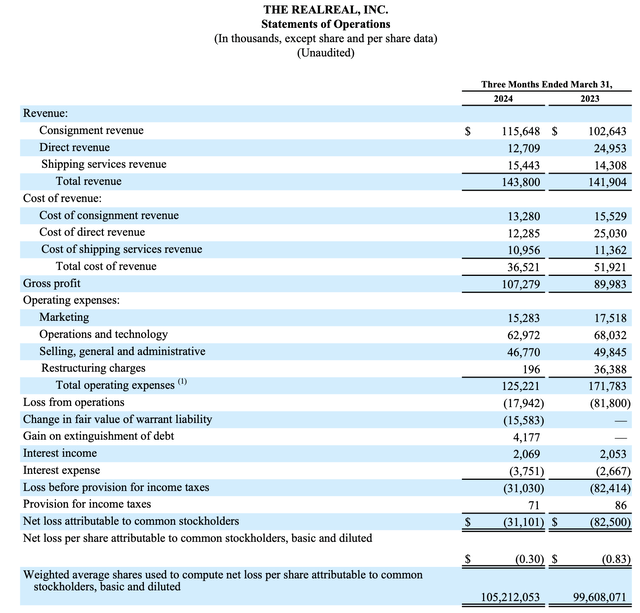

Let’s now undergo The RealReal’s newest quarterly leads to better element. The Q1 earnings abstract is proven beneath:

The RealReal Q1 outcomes (The RealReal Q1 shareholder letter)

Importantly, The RealReal returned to 2% y/y income development to $143.8 million, whereas Wall Road analysts had anticipated $139.2 million in income, or a -2% y/y decline. Underlying consignment income, in the meantime, jumped 13% y/y, in step with the corporate’s shift in focus.

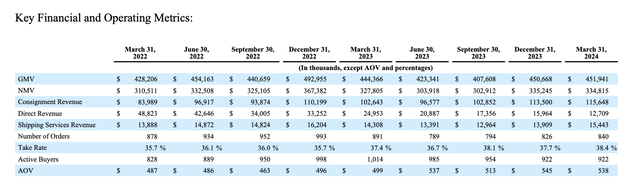

Underlying GMV additionally confirmed 2% y/y development to $451.9 million, even regardless of the intentional shrinkage of the direct gross sales enterprise. It is necessary to acknowledge that GMV accelerated from a -9% y/y decline in This fall. We word as nicely that on a nominal foundation, GMV additionally grew, even supposing This fall tends to be the most important quarter for any retail firm (encompassing the core Black Friday and Christmas buying durations). It is a testomony to The RealReal’s robust gross sales execution amid its enterprise mannequin transition.

The RealReal key trended metrics (The RealReal Q1 shareholder letter)

The corporate continues to discover new avenues and classes for development as nicely. Requested about this on the Q&A portion of the Q1 earnings name, President Rati Levesque commented on a burgeoning space of alternative in drop transport:

Sure, we’re at all times new channels for provide. So I believe that is the necessary half right here, drop transport an instance of that. Persevering with to convey belief to our shoppers and focus there, whether or not that is drop ship or watches, whether or not it is worldwide, half different partnerships as nicely. I would say we’re tremendous early days with drop-ship.

We’re proud of the launch, however – and we’re persevering with to be optimistic on the place we’re going. We’re actually fascinated with this as a brand new channel technique. So for watches, for instance, and the way can we broaden that market into males’s watches. So once more, tremendous early phases. I do not wish to share an excessive amount of on what – how that is been performing, however we’ll positively maintain you posted. However once more, actually the main target is new channels, new provide channels on the whole, as we get again to development right here.”

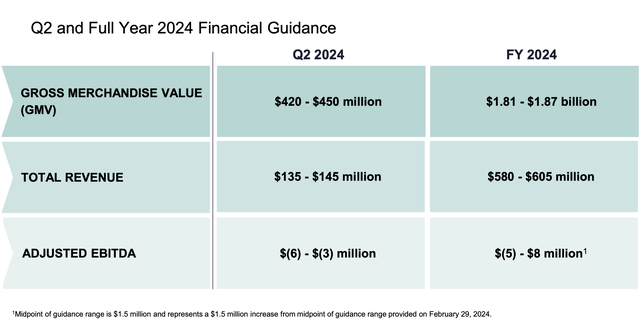

Administration expects the return to development to hold solidly into Q2. Its steering for Q2 has GMV at a variety of $420-$450 million, versus $423.3 million within the year-ago quarter. On the midpoint of its steering vary, GMV is anticipated to speed up barely to three% y/y development (and as much as 6% development on the excessive finish of the vary).

The RealReal Q2 outlook (The RealReal Q1 shareholder letter)

Importantly as nicely, gross margins expanded 1100bps y/y to a file of 74.6% within the quarter, helped by the rise in consignment combine and -49% y/y income decline in lower-margin direct gross sales (which had a GAAP gross margin that hovered close to 0%).

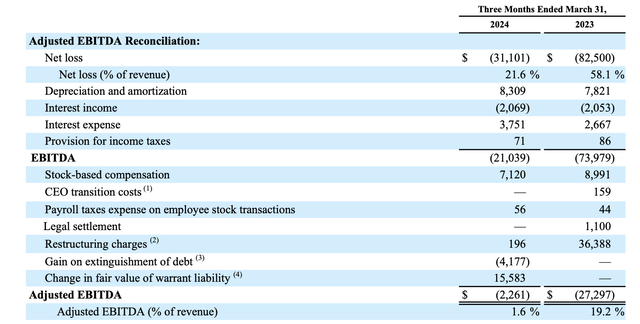

Accordingly, adjusted EBITDA additionally improved 18 factors y/y to a near-breakeven -1.6% margin in Q1, whereas nominal adjusted EBITDA losses shrunk by greater than 90% to only -$2.3 million.

The RealReal Q1 adjusted EBITDA (The RealReal Q1 shareholder letter)

The corporate’s outlook midpoint implies not less than breaking even on adjusted EBITDA in FY24, and with a better consignment combine in FY25, the corporate ought to flip a revenue.

Key takeaways

With constructive GMV development metrics plus a quickly increasing gross margin, The RealReal appears to have discovered the proverbial mild on the finish of the tunnel. Although macro dangers nonetheless stay (particularly in China, which is the world’s largest luxurious shopper market), I would say The RealReal at ~1x FY25 income is buying and selling cheaply sufficient to warrant a small place.