QDTE: Weekly Variable Distributions On Nasdaq 100, 10% Yield (BATS:QDTE)

asbe

On the lookout for some excessive yield revenue from the high-flying Nasdaq 100? There are lots of funds on the market which search to create revenue from the Nasdaq through promoting lined name choices.

The Roundhill N-100 0DTE Lined Name Technique ETF (BATS:QDTE) is among the newer ones – it began buying and selling on 3/7/24.

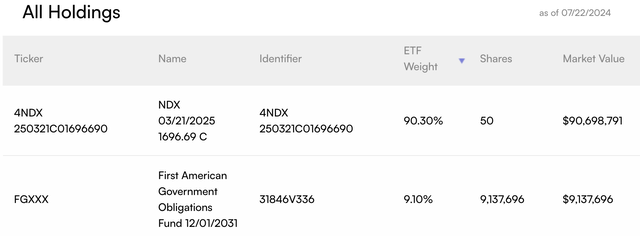

Fund Profile:

Roundhill N-100 0DTE Lined Name Technique ETF seeks to supply present revenue and capital appreciation. The fund seeks to attain its funding targets via the usage of a lined name technique that mixes a protracted place within the Nasdaq-100 Index (“NDX”) with a brief place in NDX name choices. The fund’s brief place consists of NDX name choices having zero days to expiration, often called “0DTE” choices when bought by the fund. The fund is non-diversified. (QDTE website)

QDTE has 1.2M shares excellent, with common day by day buying and selling quantity of ~77K. Its expense ratio is 0.95%:

QDTE website

Roundhill provides 16 ETFs, with numerous focuses, a few of which have attention-grabbing names, similar to WEED, which covers cannabis-related corporations, and NERD, which tracks the Nasdaq CTA World Video Video games Software program Index.

Dividends:

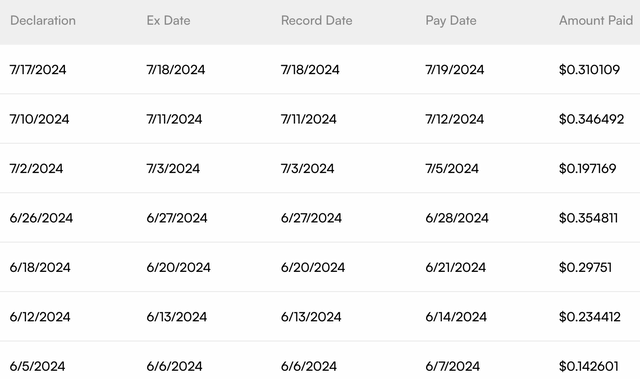

QDTE takes a novel strategy to paying distributions – it pays them on a weekly foundation. Here is an inventory of its most up-to-date payouts in June and July. The distributions differ, in line with the choice premiums QDTE receives.

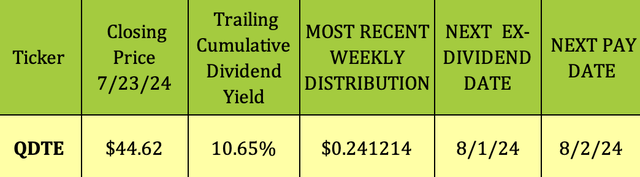

The latest weekly distribution was for $0.241214. The subsequent weekly distribution quantity might be declared on 7/31/24, with an 8/1/24 ex-dividend date, and an 8/2/24 pay date.

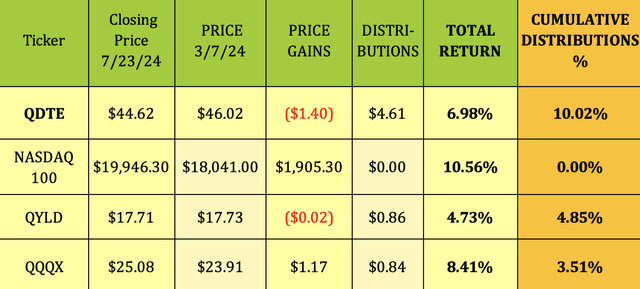

QDTE started buying and selling on 3/7/24 at a value of $46.02. As of seven/23/24, it had misplaced $1.40/unit in value, which was mitigated by the $4.61/share in distributions it has paid out to this point, for a complete return from inception of 6.98%.

Preliminary buyers have recouped 10% of their funding so far. If QDTE had been to keep up this tempo of distributions, it could take buyers a bit over three years to recoup their preliminary funding of $46.02.

Nonetheless, as these are variable distributions, there is not any technique to precisely estimate how lengthy it could take buyers to recoup their complete funding.

The Nasdaq 100 has a complete return of 10.56%, based mostly on value, throughout this era. QDTE has outperformed the favored World X Nasdaq 100 Lined Name ETF’s (QYLD) 4.73% return, however has lagged the Nasdaq 100 and the Nuveen Nasdaq 100 Dynamic Overwrite Fund’s (QQQX) 8.41% return.

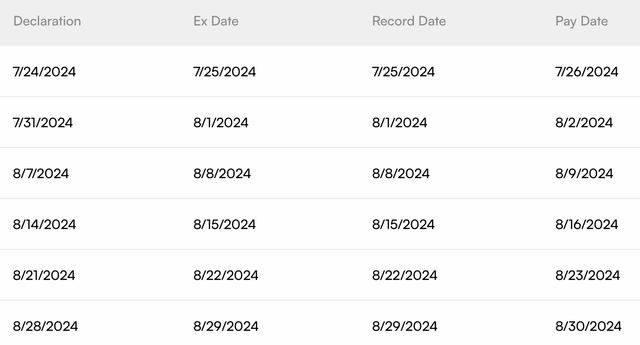

Administration pronounces every weekly distribution the day earlier than it goes ex-dividend, and two days earlier than its pay date. They’ve already posted the weekly dates for the remainder of 2024. Here is a take a look at the dates for the remainder of July and August:

Taxes:

Up to now, it seems that these weekly distributions are estimated to come back from return of capital, ROC, though the location’s 19a notices state that, “The ultimate willpower of the tax character of distributions paid by the Funds in 2024 might be reported to shareholders in January 2025 on Type 1099-DIV.”

ROC provides tax deferral, nevertheless it does cut back your tax foundation, which can affect your taxable revenue should you promote.

Dangers:

The fund lists dangers in pages 4-10 of its abstract prospectus.

Amongst them is the chance that, “The premiums acquired from the choices will not be enough to offset any losses sustained from Innovation-100 Index value declines.”

“The Fund’s use of zero days to expiration, often called “0DTE” choices, presents extra dangers. Because of the brief time till their expiration, 0DTE choices are extra delicate to sudden value actions and market volatility than choices with extra time till expiration.”

Additionally listed are liquidity threat, focus threat, asset class threat, market threat, and several other different dangers.

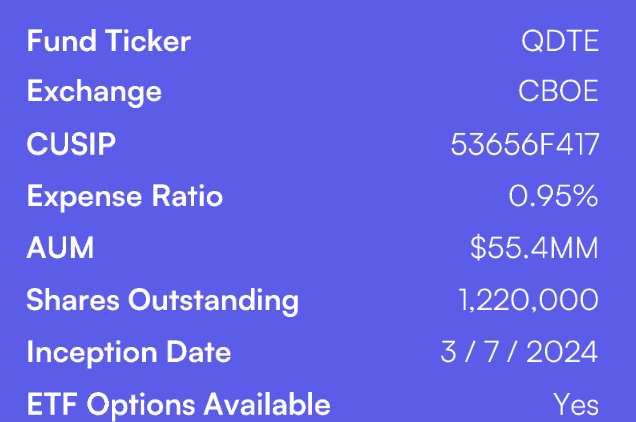

Holdings:

Slightly than proudly owning an index safety outright, the QDTE fund holds a protracted name place on the NDX index, using a “artificial lined name technique.”

“The Fund’s artificial publicity to the return of the Innovation-100 Index is achieved via buying name choices which might be deeply in-the-money. This refers to the truth that on the time the Fund purchases such name choices, the worth of the Innovation-100 Index is already properly above the strike value of the choices contract.” (QDTE prospectus)

At market open, or shortly thereafter, on each enterprise day, the fund typically sells out-of-the-money 0DTE name choices on the Innovation-100 Index that may expire on the finish of the day.

Whereas the decision choices that QDTE sells present revenue through choice premiums, the upside is capped by the strike value of the bought choices. Additionally, if the Innovation-100 Index appreciates in worth past the strike value of the decision choice contracts that the fund has bought to generate revenue, the fund will lose cash on these brief name positions.

The fund additionally holds ~$9.14M within the First American Gov’t Obligations Fund, dated 12/1/2031:

Parting Ideas:

Since its 3/7/24 inception, QDTE has provided a greater return than QYLD, however lags QQQX, and the NASDAQ 100 index. We do not have loads of information to go on as of but. We’ll maintain off shopping for any QDTE till it has an extended observe document.

All tables furnished by Hidden Dividend Shares Plus, until in any other case word