Pure Capital And Biodiversity | Looking for Alpha

SusanneSchulz/E+ through Getty Pictures

The world is going through two monumental and interlinked challenges. One stems from our altering local weather, and the opposite stems from a struggling nature and biodiversity sphere. Whereas the world stays wanting the trajectory required to succeed in web zero CO2 emissions by 2050, it’s concurrently going through the sobering prospect of greater than 1.2 million plant and animal species being threatened with extinction. Fixing these two crises will likely be no small process, and it’s only amplified by the necessity to feed a world inhabitants that’s projected to succeed in 10 billion individuals by 2050. From an investor perspective, these important challenges will result in dangers for some corporations and supply alternatives for those that may ship the options to deal with them. This piece affords views on how buyers can navigate this complicated scenario by figuring out the businesses that may structurally profit and those that will likely be challenged.

Why ought to buyers care in regards to the biodiversity and nature disaster?

Whereas biodiversity lately has turn into prime of thoughts for a lot of regulators and buyers alike, the idea lacks readability for many market individuals. One purpose for that is that in contrast to local weather change, there is no such thing as a one measure that encapsulates the problem. As an alternative, safeguarding biodiversity and nature is a posh process that takes on a unique kind whether or not you might be within the farmlands of most developed nations or within the rainforest of the Amazon.

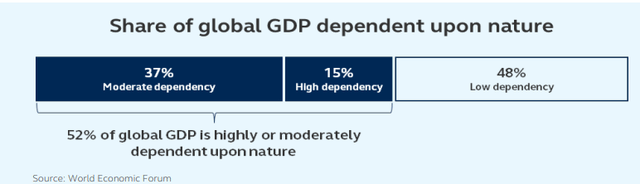

From an investor perspective, what stays clear is that almost all international financial actions are dependent upon nature and functioning ecosystems. Whereas estimates range, The World Financial Discussion board estimates that roughly half of world Gross Home Manufacturing is reasonably or extremely depending on nature or biodiversity, equating to $44 trillion of financial worth. Examples of the dependency contains farmers needing flourishing ecosystems to develop crops, in addition to the development business that is still depending on available pure supplies. Up till lately, companies have largely been capable of depend on an abundance of assets that had been available for extraction. Nonetheless, at present ranges, the world is consuming assets that might require the biocapacity of 1.75 earths. This quantity is predicted to succeed in 2 earths by 2030. Because of this corporations with enterprise fashions that depend upon available pure assets are more likely to face a future with larger shortage and disruptions. For buyers, this can be a threat that must be thought of when investing in corporations which can be reasonably or extremely dependent upon nature, as this will result in larger working prices or disruptions in provide chains.

Meals-producing corporations are on the coronary heart of this dependency. In latest many years, international meals techniques have turn into increasingly difficult and interlinked. As we speak, greater than 80% of the worldwide inhabitants are dependent upon meals imports. This globalization of meals manufacturing has helped decrease international meals costs, nevertheless it has concurrently created dependencies and fragility that resulted in rampant meals inflation following a mix of the COVID pandemic, steady regional droughts, and the battle in Ukraine. Trying to the long run, the place NASA expects rising situations and ecosystems to come back beneath rising strain with the altering local weather, this fragility will possible not go away anytime quickly. On this regard, food-producing corporations have to future-proof their companies to scale back this threat. One avenue may very well be diversification, however a extra impactful method could be to work with suppliers to make sure a better diploma of resilience of their provide chains. Such elevated resilience might come from introducing finest practices by way of expertise or farming strategies, like regenerative agriculture that may assist enhance soil situations and manufacturing yields. From an investor perspective, this can assist mitigate materials dangers for the advantage of long-term worth technology.

Will fixing the disaster result in worth creation?

Prior to now yr, an rising variety of corporations have launched biodiversity methods. Whereas this elevated focus and disclosure is welcomed, questions in regards to the validity, measurability, and hyperlink to monetary materiality stays. For some corporations, the biodiversity and nature disaster will both result in materials earnings dangers or progress alternatives from serving to to unravel it. To capitalize on the structural alternative, will probably be necessary for buyers to have the ability to distinguish when the disaster will likely be a cloth threat, a chance, and when the buyers focus their consideration elsewhere.

We famous within the earlier part that the agricultural and meals business stays one of the vital uncovered to biodiversity and nature. Rising crops is inherently dependent upon correctly functioning ecosystems, and the historic enhancements in agricultural actions has meant that farmers have been capable of feed 3.7x as many individuals during the last 100 years, whereas solely increasing cropland by 40%. That is an astonishing accomplishment, nevertheless it has had some opposed results on biodiversity. What stays clear is that the historic path for rising meals output can’t be utilized to feed the anticipated 10 billion individuals by 2050 with no detrimental affect on the atmosphere. Due to this, agriculture is on the one hand in danger, whereas additionally it is one of many industries that may make the most important distinction. On this complicated intersection between the social concern of feeding a rising international inhabitants cost-efficiently, whereas not compromising environmental issues, one of the vital promising avenues for enchancment comes from the adoption of expertise. Traditionally, agriculture has been one of many least digitalized industries. Nonetheless, in developed markets, this has been altering in latest many years.

An instance of that is precision agriculture, the place information and imaginative and prescient expertise, together with cameras and sensors, allow fields to now not be handled uniformly, however as a substitute based mostly on the optimum or custom-made resolution for his or her particular wants. From a biodiversity perspective, because of this herbicides will be sprayed with a excessive diploma of accuracy solely on weeds, quite than uniformly throughout your complete discipline. Moreover, this method allows fertilizers to be utilized in additional optimum portions the place wanted. These practices can cut back the utilization and spillage into nature dramatically, with materials advantages for the native ecosystems. This ends in materials value effectivity enhancements for farmers, which results in a big potential for worth technology for the businesses delivering such options.

Along with the agriculture business, the sturdy items and the development industries additionally stay extremely dependent upon nature. For these two industries, this dependency stems from the extraction of assets and supplies from nature which can be used to fabricate and assemble bodily merchandise. Over the previous century, this extractive relationship with nature has repeatedly expanded with inhabitants and revenue progress, whereas benefiting from available assets that may very well be sourced at comparatively low marginal prices. This has resulted in materials advantages for the worldwide inhabitants, nevertheless it has additionally meant, as famous earlier, that the consumption of assets is unsustainable and headed in direction of being 2x the biocapacity of this planet. From an investor perspective, because of this the businesses which can be dependent upon these available assets possible face extra threat sooner or later. If the equation is to turn into balanced, then the world must decouple financial progress from environmental degradation. Attaining it will require a large number of options, starting from elevated recycling, optimization of manufacturing, and using regenerative supplies. To realize this, progressive corporations might want to play a key position by each innovating and scaling up options that may improve the effectivity of how we produce and devour assets. On this regard, industrial and expertise corporations will possible be on the coronary heart of constructing this doable. For industrial corporations, the important thing will likely be to automate and improve efficiencies in manufacturing to decrease waste, in addition to bringing in new applied sciences to digitalize manufacturing and provide chains. Know-how corporations will additional assist enhance processes throughout industries, together with building, the place buildings will be designed to have decrease useful resource utilization and waste. Such enhancements will likely be necessary to decrease the useful resource depth of financial progress, whereas it should additionally possible result in alternatives for worth creation from larger effectivity and decrease prices.

The place will we go from right here?

Delivering options to deal with the biodiversity and nature disaster can result in alternatives for some corporations. Nonetheless, many corporations will possible additionally face materials dangers sooner or later. These dangers can take the type of elevated regulation that restrict enterprise actions or dependencies, resulting in disruptions in non-resilient techniques. The danger of regulation will not be new for many corporations, however because the world has turn into more and more centered on the biodiversity and nature disaster, the magnitude could improve sooner or later. This was seen each within the EU’s biodiversity technique for 2030 in addition to within the initiatives on the UN Biodiversity Convention. Up to now, regulation has primarily centered round setting minimal requirements for environmental safety or limiting dangerous actions, though it will possible change within the years forward.

Human actions and adjustments in local weather are actively threatening biodiversity. From a rising inhabitants to elevated useful resource use and emissions, the globe is embarking on a important transition interval. These challenges will result in dangers for some corporations and supply alternatives for those that may ship the options to deal with them. Subsequently, we’re in search of companies which can be turning into higher and accounting for the evolving world that may drive upside to earnings progress over the long run.

Danger Issues

Previous efficiency isn’t any assure of future outcomes. Investing includes threat, together with doable lack of principal. Fairness markets are topic to many elements, together with financial situations, authorities laws, market sentiment, native and worldwide political occasions, and environmental and technological points which will affect return and volatility. Worldwide investing includes larger dangers similar to foreign money fluctuations, political/social instability, and differing accounting requirements.

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.