Portland Common Electrical: An Enticing Fairness Bond As Fed Charges Fall (NYSE:POR)

blackestockphoto/E+ through Getty Photos

Portland Common Electrical (NYSE:POR) gives a beautiful 4.2% dividend alongside an earnings yield of about 6.5%, the latter referencing Warren Buffet’s “Fairness Bond” technique. Each charges simply prime the 10-year Treasury bond. With a P/E ratio of 15.6, the inventory is buying and selling beneath its historic common, and different metrics mentioned beneath level to potential undervaluation. After evaluating the corporate with friends that met stringent display standards, I argue that POR deserves a glance from traders looking for to shift funds from treasuries or cash market accounts, particularly with the anticipated federal rate of interest minimize in September.

Prepping for Price Cuts

I’ve been completely content material incomes 5.25% (on common) in T-Payments for the previous eighteen months. Brief-term Treasuries have been a beautiful place to park money—they’re exempt from state tax, not like CDs and cash market accounts, and so they’ve supplied their highest yields since earlier than the Nice Monetary Disaster. However with a fee minimize coming in September and extra prone to observe, many traders, myself included, are looking for comparatively low-risk fairness choices that supply enticing revenue.

Larger-yielding sectors equivalent to Shopper Staples, REITs, and Utilities are likely to do nicely during times of fee cuts. In gentle of this, I have been steadily shifting a few of my money place into dividend-paying firms in secure industries with predictable money flows—qualities that may supply resilience throughout financial downturns, which traditionally have coincided with fee cuts. All through the summer time, I have been growing my holdings of Coca-Cola FEMSA (KOF), Brookfield Renewable (BEPC), and Agree Realty (ADC). Now my focus is on figuring out extra alternatives—notably these with favorable valuations, since these sectors are already seeing sturdy good points:

|

5 Years / Sector Rank |

30 Days / Sector Rank |

|

|

Actual Property |

+13.2% / #11 |

+6.6% / #1 |

|

Utilities |

+21.3% / #10 |

+5.4% / #2 |

|

Staples |

+42.9% / #9 |

+5.1% / #3 |

The Preliminary Display screen

Given that the majority utilities supply dividends, I got down to slim the checklist to those who meet the next standards:

- Income and EPS progress which are each constant and aggressive. Screening standards: minimal 5Y CAGRs of 5% and above the trade averages.

- A robust dividend with a historical past of constant progress and a manageable payout ratio. Screening standards: minimal 3% yield, 5Y CAGR of 5%, 10 years of progress, < 70% payout

These filters decreased the pool down to simply three firms: Sempra (SRE), Important Utilities (WTRG), and Portland Common Electrical Firm (POR). Since I have already got a place in Important Utilities, I selected to concentrate on the 2 energy firms:

POR – State-regulated electrical utility primarily serving retail clients within the state of Oregon.

SRE – Extra diversified power merchandise and infrastructure (e.g. electrical energy and LNG exports) with a wider geographic scope (California, Mexico, and different worldwide markets).

Monetary Metrics Comparability

|

CAGR |

SRE |

POR |

|

Income 10Y |

2.3% |

5.7% |

|

Income 5Y |

5.1% |

9.1% |

|

Income 3Y |

4.5% |

12.6% |

|

Income Fwd |

4.2% |

7.9% |

|

EPS 10Y |

7.9% |

3.1% |

|

EPS 5Y |

6.2% |

5.5% |

|

EPS 3Y |

11.4% |

17.2% |

|

EPS FWD |

3.8% |

5.8% |

|

Profitability |

SRE |

POR |

|

Web Revenue 10Y |

10.7% |

5.6% |

|

Web Revenue 5Y |

7.8% |

8.2% |

|

Web Revenue 3Y |

11.1% |

22.0% |

|

Oper. Margin 10Y |

4.3% |

5.5% |

|

Oper. Margin 5Y |

5.5% |

9.3% |

|

Oper. Margin 3Y |

2.5% |

24.5% |

|

ROA 10Y (development) |

ca. 3%; secure |

ca. 3%; secure |

|

ROIC 10Y (development) |

ca. 3%; secure |

ca. 4%; secure |

POR has outperformed SRE in most classes over the previous decade. It has been the extra worthwhile firm when it comes to proportion good points and has barely higher solvency scores. Even higher, POR’s present valuation metrics are extra favorable; SRE’s has seen important share value appreciation over the previous 5 years, outperforming POR on a complete return foundation of 35% to simply 1.5%. Whereas that is glorious for SRE, its Quant issue score for valuation has now fallen to D+, and a number of other metrics, together with P/E Non-GAAP, EV/EBITDA, and the dividend yield, are above their five-year averages. However, POR’s share value has been comparatively flat over the previous three years regardless of the sturdy efficiency outlined above, presenting a possible shopping for alternative. Its general Quant issue score for valuation is B.

Evaluating the Dividends

Each firms have Quant issue grades of A or B for dividend security and consistency, however POR edges out SRE with its longer streak of dividend progress. It has additionally been elevating its dividend at a barely quicker fee lately, and its yield is over a full proportion level greater whereas sustaining a payout ratio beneath 65%.

|

SRE |

POR |

|

|

Years of Progress |

13 |

17 |

|

Ahead Yield |

3.04% |

4.20% |

|

10Y Progress CAGR |

6.8% |

5.7% |

|

5Y Progress CAGR |

5.5% |

5.5% |

|

3Y Progress CAGR |

4.3% |

5.2% |

|

Payout Ratio |

54.7% |

63.5% |

One other measure of revenue potential past the dividend is earnings yield, or EPS / Share Worth. This calculates to round 6.5% for POR, which simply exceeds the yields of the Treasuries and financial savings devices.

On condition that I am seeking to deploy money into firms the place I can earn dependable revenue with the potential for modest capital appreciation, POR matches the profile considerably higher than SRE.

Funding Thesis

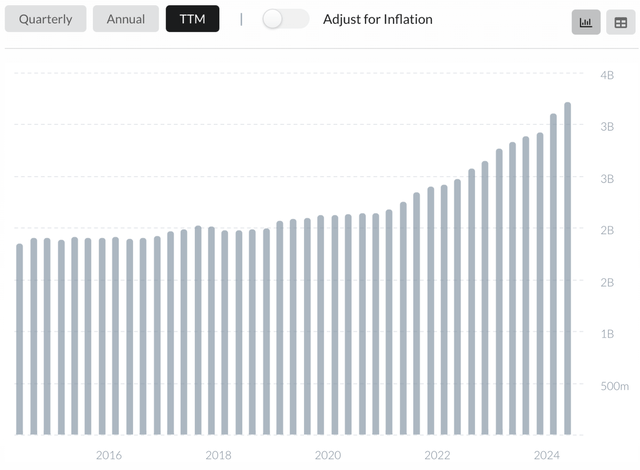

I see POR as providing a beautiful mix of stability and progress. As Oregon’s largest regulated utility, serving simply shy of one million clients, it has seen regular, slowly rising income:

POR: Growing Income Since 2014 (AlphaSpread)

POR’s service space contains the “Silicon Forest,” the place firms like Intel and Microchip Applied sciences are clustered, making it well-positioned to profit from high-growth corners of the Tech, Industrials, and Well being Care sectors. Lately, the corporate has labored to fortify this place through important investments in infrastructure, together with a $6.2 billion plan to increase and modernize its distribution community. POR expects it will drive an 8% annual fee base progress by way of 2028, serving to it meet the rising power calls for of its industrial clients. Such upgrades are essential as the corporate anticipates important load progress spurred by the enlargement of information facilities and different tech-driven manufacturing within the area.

POR’s concentrate on renewable power additionally supplies a aggressive edge. The corporate ranks first within the nation for buyer participation in renewable packages, and it’s increasing its inexperienced portfolio by way of tasks just like the Clearwater Wind Facility, in partnership with NextEra Vitality (NEE). Such initiatives align with Oregon’s formidable clear power targets, which commit the state to drawing 100% of its electrical energy from renewable sources by the 12 months 2040. POR’s transition plan contains phasing out its remaining coal-fired vegetation whereas ramping up its investments in renewables and battery applied sciences.

Lastly, POR operates in a good regulatory atmosphere. The Oregon Public Utility Fee has constantly backed the corporate’s funding initiatives and fee enhance requests. The OPUC accredited a 14% enhance in POR’s fee base in late 2023, and the corporate has requested a further 7.4% fee hike for 2025. Basically, such regulatory assist provides confidence in POR’s means to ship constant and rising earnings, even because it undertakes important CAPEX.

Worth Goal

POR is at present buying and selling at round 15.6x the FY24 consensus EPS estimate of $3.09 and about 14.8x the FY25 estimate of $3.25. Each are nicely beneath the five-year common ahead P/E of round 18. The desk beneath reveals that a number of trailing valuations are additionally considerably beneath the corporate’s current historic averages:

|

VALUATION |

Present |

5-Yr Avg. |

Distinction |

|

P/E Non-GAAP (TTM) |

15.7 |

18.3 |

-14.1% |

|

P/E GAAP (TTM) |

15.6 |

17.9 |

-16.8% |

|

Dividend Yield (TTM) |

4.04% |

3.65% |

+10.8% |

Primarily based on an anticipated EPS progress of round 5% by way of FY26, Wall Road analysts have a present value goal of $52.20, suggesting the inventory is undervalued by round 8.5%.

My Discounted Money Movement evaluation signifies a good worth of $53.75, utilizing a reduction fee of seven.5% (derived from an anticipated 3.5% ten-year Treasury Word because the risk-free fee plus a 4% threat premium) and assuming near-term EPS progress of 6% with a terminal progress fee of 4%. This evaluation signifies that POR may undervalued by roughly 10.5% based mostly on the FY25 EPS projection.

For what it is price, my Dividend Low cost Mannequin calculation values the corporate extra richly, at $79.00. This elements within the payout ratio and common return on fairness to derive an anticipated progress fee of three.285%. Utilizing the identical risk-free fee and market threat premium charges as within the DCF mannequin, the price of fairness comes out to simply 5.9% on account of POR’s low beta, which has traditionally been round 0.6.

Whereas the DCF evaluation and Wall Road goal fall slightly below my most well-liked margin of security for the sector, I fee POR a Purchase based mostly on the favorable valuation metrics in contrast each to its sector friends and personal historic averages.

Dangers

I see three foremost dangers to the funding thesis outlined above:

- Operational Challenges – Climate disruptions equivalent to wildfires, excessive warmth, and ice storms pose dangers to POR’s operations and profitability. The corporate has confronted a number of such occasions lately which have impacted monetary efficiency.

- Infrastructure Spending – As POR continues to put money into sustaining and upgrading its energy grid, the price of CAPEX might show extra expensive than anticipated if rates of interest stay elevated. This might stress margins and gradual progress.

- Regulatory Dependence – Like its friends, POR is weak to surprising regulatory and compliance adjustments that will impression operations and profitability. Whereas the corporate has traditionally acquired assist from the OPUC, this isn’t assured sooner or later.

These and different dangers are expanded upon within the firm’s most up-to-date 10-Okay.

Abstract

With rate of interest cuts simply across the nook, traders can anticipate continued rotation to sectors that supply greater yields. Portland Common Electrical’s 4% dividend and even bigger earnings yield of 6.5% are each nicely above the 10-year Treasury, and the corporate is priced nicely beneath each its historic valuation averages in addition to these of its closest friends. It has additionally proven strong profitability metrics and sector-appropriate EPS progress over the previous decade. For traders seeking to diversify or pivot from treasuries and cash market accounts, Portland Common Electrical is a powerful candidate.