Pitney Bowes: When Much less Is Extra (NYSE:PBI)

Tony Anderson

Introduction to Pitney Bowes

Pitney Bowes (NYSE:PBI) has a protracted historical past, however its most up-to-date one shouldn’t be very encouraging. The corporate has been round for 104 years, providing Enterprise Service similar to mailing gear, software program, e-commerce applied sciences and cargo companies. The firm even owns its personal financial institution, a tribute to the variety of companies it offers.

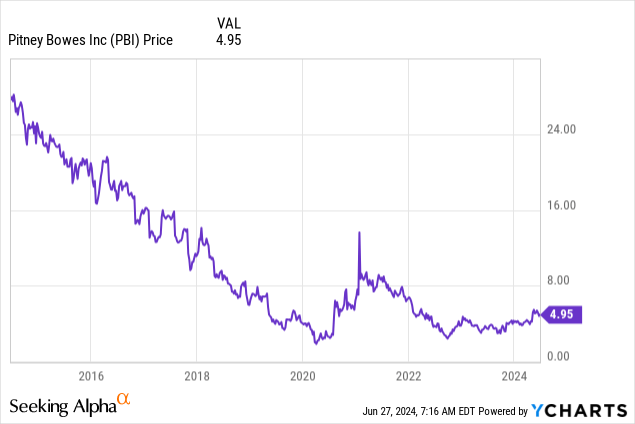

Share value (below)efficiency

Since its peak in 1998, round $66 per share, the corporate has been in a vicious decline. The final ten years have introduced the corporate to beneath $1 billion market capitalization.

(Pitney Bowes 10y return)

Lastly, nevertheless, there’s hope as soon as once more for the corporate to climb again up. Hestia Capital (of Kurt Wolf, additionally closely concerned within the GameStop saga), took an curiosity in radically altering the corporate. It has guess, and it appears to be profitable, within the sense that Hestia Capital now has management of the board, has a deal in place, and has put their favored CEO within the driver’s seat. Yow will discover many articles on Hestia’s proxy battle, each on Looking for Alpha as elsewhere, so I’ll let the previous be the previous. Let’s deal with what this truly means for the corporate within the close to future.

Present Pitney Bowes construction

In the course of the newest earnings name on Could 2nd, the corporate’s financials had been offered in three distinct enterprise models:

SendTech

-

SendTech Options provides bodily and digital mailing and delivery expertise options, financing, companies, provides and different functions for shoppers of all sizes to assist simplify and save on the sending, monitoring and receiving of letters, parcels and flats

Presort

- Presort Companies offers sortation companies that allow shoppers to qualify for USPS workshare reductions in First Class Mail, Advertising Mail, Advertising Mail Flats and Sure Printed Matter

World E-Commerce

-

World Ecommerce offers enterprise to client logistics companies for home and cross-border supply, returns and achievement.

Straight off the bat, the next is obvious:

Two out of the three main segments are worthwhile and rising adjusted EBIT and adjusted EBITDA (extra on this later). One is clearly not, regardless of all efforts.

Let’s analyse the segments one after the other.

SendTech enterprise section

The SendTech enterprise unit is the biggest section by way of income and income. Income was down barely (2%) however adjusted EBIT was up 6% in Q1 year-over-year. This was largely pushed by financial savings in COGS and SG&A.

In January of this yr, a ‘digital supply companies providing’ was moved from the World E-commerce section to the SendTech section. This bolsters the providing.

The SendTech enterprise is a ‘high-margin, recurring income enterprise’ as paraphrased from Pitney Bowes. At first look, it’d appear like a unit not rising and never declining, however truly if you happen to dig into the numbers, you discover a story of two diverging developments.

The brand new SaaS digital providing is rising strongly (40% y-o-y) whereas the extra conventional bodily meter enterprise has been dropping (4% lower y-o-y). Regardless that the SaaS enterprise is simply 15% of whole income for the section ($200m out of $1,3b), it’s nonetheless promising to see this sort of development hidden within the stomach of the beast. Each greenback of additional development coming from that providing is probably going a extra worthwhile greenback, so let’s welcome this evolution.

It shouldn’t be underestimated that Pitney Bowes lately launched the ParcelPoint Sensible Lockers providing. This can be a booming market in Europe, and it’s potential that this pattern hits america as nicely. If that’s the case, they will rapidly capitalize on it. Polish and publicly traded peer InPost does nothing however parcel lockers and is price a surprising 8 billion EUR with 2 billion EUR in annual income and 30% adjusted EBITDA margins. This valuation solely holds up as a result of the corporate continues to be rising quickly.

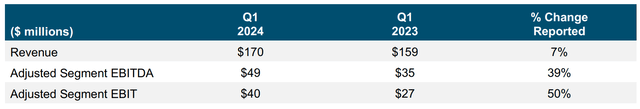

Presort enterprise section

The Presort enterprise is a much less thrilling enterprise in my view. It’s smaller than SendTech each in income and adjusted EBITDA ($170m and $49m for Q1 of this yr), and it appears to me that the secular decline of bodily mail will grow to be a much bigger ache over the approaching years. As defined by the earlier CEO (Jason Dies) on the earnings name, mail volumes have been dropping round 6% to eight% per yr. This pattern is prone to proceed and even speed up. Impressively, the amount decline for Presort is simply 2% in Q1 of this yr and as a result of larger income per piece, the corporate managed to even develop revenues 7% yr over yr. Further course of enhancements and cost-saving initiatives even skyrocketed adjusted EBITDA by 39% year-over-year. The presort enterprise will also be hit fairly arduous if a recession would occur.

World E-commerce enterprise section

Up to now so good you’re pondering. How can this inventory be down 80% over 10 years whenever you’re portray this rosy image? Effectively, lots has occurred. One may say there was a plethora of transactions each shopping for and promoting off items of the enterprise and strategic errors have been made.

The World E-commerce division resides proof of this. The precursor for GEC (World E-commerce) was an organization known as Newgistics, which Pitney Bowes acquired in 2017 for $475 million. That’s a staggering quantity whenever you discover out the market capitalization of Pitney Bowes is presently just under double that.

The GEC section not solely has by no means been capable of flip a revenue, it additionally pushed the corporate into have CAPEX with the by no means ending promise that scale would, ultimately, flip the enterprise worthwhile. Hestia has explicitly known as this a strategic mistake. The GEC enterprise is presently below strategic evaluate and this evaluate has been accelerated because the new CEO, Mr Rosenzweig, has been appointed. Extra on that later.

For the primary quarter of the yr, the GEC section did $333m in income, so akin to SendTech, however it solely managed to eke out $3m in gross margin (1%).

For 2023, it contributed $78m in damaging adjusted EBITDA to the corporate’s financials. In adjusted EBIT phrases, it’s even $136m, giving the excessive investments executed up to now. The revenues have been declining for a few years and the economies of scale haven’t been achieved. Maybe as half of a bigger group, the GEC section may be very helpful, however for Pitney Bowes it’s now clear to everybody that they may eliminate it, both by a sale or by shutting it down.

Turnaround Plan Hestia: Enter Mr. Rosenzweig

This brings us to the brand new plan proposed by Hestia and to be executed by CEO Mr. Rosenzweig. From their press launch on Could twenty second:

The initiatives embrace:

Price Rationalization – Constructing on beforehand introduced effectivity measures that totaled roughly $85 million, Pitney Bowes has retained a nationally acknowledged advisor to assist a value rationalization evaluate. Preliminary evaluation has recognized an extra $60 million to $100 million in potential annualized financial savings throughout the group, other than the World Ecommerce (“GEC”) enterprise.

GEC Accelerated Assessment – Pitney Bowes is working to expeditiously conclude a strategic evaluate of the section. The Board, whose members have important transaction expertise, is rising its involvement within the evaluate to drive the near-term completion of a evaluate that’s supposed to boost shareholder worth.

Money Optimization – Pitney Bowes is working to cut back its go-forward required money wants by roughly $200 million. The Firm intends to attain this aim by enhancing its liquidity forecasting and administration in any respect ranges, taking motion on GEC and optimizing the stability sheet of Pitney Bowes Financial institution (the “Financial institution”). Along with releasing up money for the Firm, the Financial institution optimization work will enhance its return on fairness.

Stability Sheet Deleveraging – Pitney Bowes is taking required actions to capitalize on the advantages linked to the three aforementioned initiatives. Within the near-term, management intends to deleverage the company stability sheet and prioritize the paydown of high-cost debt.

Nonetheless, because the writing of this text, one other press launch hit the market and I’ve needed to revise some price financial savings to be even bigger! Let’s attempt to work out what this implies for Pitney Bowes.

-

Round $140 million in extra annual price cuts are recognized (taking the common of the supplied vary, up from $80 million recognized earlier).

-

GEC shall be bought. This may instantly increase profitability by $136m in adjusted EBIT and save $30m in annual Capex.

-

They are going to unencumber $200 million in money.

And the entire above will then be plowed into deleveraging the stability sheet by paying down debt. Please observe that curiosity bills quantity to $164m on an annual foundation.

If the entire above is alleged and executed, the brand new PBI shall be:

-

Doing round $2b in annual income

-

Accumulating round 50% or $1b in gross margin

-

Accumulating round 26% or $520m in EBIT

-

Paying round $70m in unallocated Company Bills (after taking out the $140m in prices)

So this implies you find yourself with $450m in adjusted EBIT. In fact, with $164m in curiosity expense, there’s solely round $286m in revenue left. Whenever you put a 13 EV/E on that, you get to $3,7b in enterprise worth.

With the financial savings they make, they might purchase again virtually the whole Notes due in March 2028 ($274m) on which they’re paying 11% curiosity. That is a right away increase to the underside line of round $30m on an annual foundation, with zero execution threat. This could maintain snowballing as they pay down debt.

Dangers to the thesis

The most important threat to the thesis is a deep recession. Historical past has proven that mail will get hit significantly arduous when a recession hits. The presently nonetheless extremely indebted firm shouldn’t be nicely positioned to undergo a troublesome interval.

One other threat would, after all, be a complete failure of disposing the GEC enterprise or experiencing very excessive one-off prices that may spook the market. The funding thesis depends closely on the truth that GEC must be shut down and that the market is just not pricing the alternatives accurately.

Funding abstract

When all is alleged and executed, it seems to be to me that the margin of security is excessive sufficient to take a place. If administration does what they promise and the economic system retains buzzing alongside, 12 months from now, this firm must be doing round $300m in annual income with some wonderful development alternatives forward.

The present (seventh of July 2024) market cap & enterprise worth for Pitney Bowes are (in line with Yahoo Finance):

- Market Cap $1.14b

- Enterprise Worth $3.07b

I’d safely assume any EV/E starting from 12 to 14 relying on the joy about these alternatives is warranted. On the midpoint of 13, we get a $3.9 billion enterprise worth. By then, there ought to have been not less than $300m in debt repaid due to the mixture of upper income and releasing up money in Pitney Bowes financial institution, which additionally helps the ultimate valuation. This may result in:

- Market Cap $2.27b

- Enterprise Worth $3.9b

Which is almost a double of at this time’s value to $12.6 per share.