Park Aerospace: A Robust Quarter, However Trying To Get well (NYSE:PKE)

Monty Rakusen/DigitalVision by way of Getty Photos

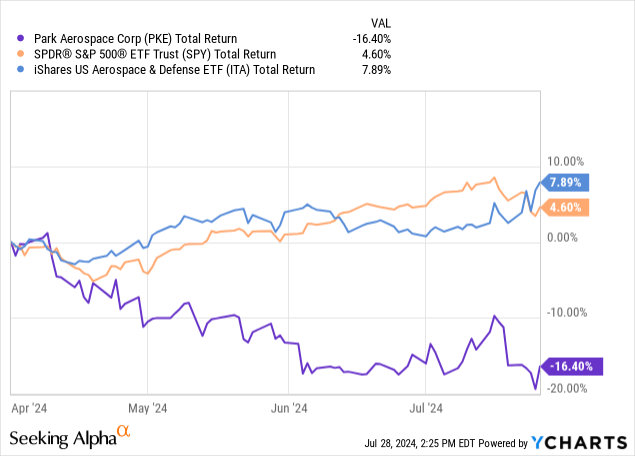

Once I final lined the aerospace and protection provider Park Aerospace (NYSE:PKE) in April, I used to be fairly bullish on the outlook for development, whilst shares weren’t far off 52-week highs. I’ve been consuming my very own cooking, so to converse, shopping for small tranches even close to these highs, in addition to at decrease factors because the shares have misplaced floor within the intervening interval.

With the disappointing efficiency within the shares, I consider it’s a good level to return and re-examine the general funding thesis and take into account what to do going ahead.

Park Aerospace Fiscal Q1 2025 Overview and Outlook

For Q1 of fiscal 2025 (protecting mainly March by means of Could 2024; technically the quarter ended 6/2/2024), outcomes got here in lighter than anticipated, due primarily to storm harm at their plant in Kansas within the last weeks of the quarter. Whereas manufacturing tools itself was not broken, roofing and HVAC items have been sufficiently broken to carry a brief halt to manufacturing, and a few orders that may have in any other case been shipped in Q1 needed to be pushed into Q2. As a secondary affect, Park Aerospace has disclosed that it elects to hold comparatively minimal insurance coverage protection, with larger deductibles, and covers extra associated bills each time they could happen out of its personal obtainable money, main on this occasion to a $1.1 million cost within the quarter as a result of storm harm. As the corporate has been traditionally ample in money and debt free, this can be a calculated threat that administration is keen to take.

When it comes to the place the precise outcomes got here out for the interval, revenues have been $14.0 million, with 29% gross margins, and earnings from operations (earlier than the prices from storm harm, curiosity earnings, or taxes) have been $2.1 million. After accounting for these components, web earnings was $1.0 million, or $0.05 per share, versus $0.09 per share in Q1 of fiscal 2024. The storm is much and away the foremost offender for the quarter’s figures not trying good when taken in isolation, nevertheless $1.8 million in missed shipments on account of the storm must be acknowledged income in Q2, and issues are basically again and working as soon as once more as regular.

So whereas the storm definitely damage outcomes inside the interval and took a chunk out of money as a result of firm’s method to insurance coverage, the elemental query is concerning the long-term outlook.

For context, the most important single contributor to Park Aerospace’s high line is its position within the broader provide chain for a selected set of jet engines utilized by Airbus (OTCPK:EADSY) for its single-aisle A320 and associated household of plane. These engines, the LEAP 1-A sequence, are manufactured by CFM, a 50/50 three way partnership between the French firm Safran (OTCPK:SAFRY) and the American firm GE Aerospace (GE). Relying on what configuration the Airbus consumer needs to have, Airbus might also set up engines manufactured by Pratt & Whitney, now a subsidiary of RTX Corp. (RTX), nevertheless the LEAP 1-A engines at the moment are the extra frequent configuration. On a facet be aware, the Wall Avenue Journal not too long ago reported that Airbus is open to the opportunity of utilizing Rolls-Royce engines sooner or later for the A320 jets, however as issues stand now, Rolls-Royce is just not but instantly competing for this enterprise with CFM and RTX.

Park has very restricted presence with Boeing (BA) business plane, so that is all to say that Park Aerospace’s fortunes rise and fall to a pretty big diploma with Airbus gross sales of the A320 plane, though there are purchasers inside the protection business, area and different business producers as nicely. Particularly, the Chinese language producer COMAC is makes use of a unique configuration of the LEAP engines, the 1-C, for its slim physique C919 plane that’s trying to interrupt up the Airbus and Boeing duopoly, and Park is a part of that program. For Q1 2025, protection accounted for 40% of income, enterprise plane was 13%, and business plane, largely the LEAP 1-A engines, was 47%, ratios which have held pretty constant because the passing of the Covid-19 disaster in fiscal 2021.

(supply: Park Aerospace Q1 2025 investor presentation, slide 13 of 34)

So what does the trajectory appear like for the LEAP 1-A engines? Airbus has been on a blistering tempo total for the A320 plane, maybe boosted by the standard issues suffered by Boeing. For a number of quarters, Airbus had a acknowledged purpose of reaching 75 items of the A320 per thirty days in 2026, though by means of 2023 the speed was within the mid-40s, and I consider it has been pushed again to 2027 on account of supply-chain constraints.

Park’s CEO, Brian Shore, shared his perspective on the newest incomes name. Mr. Shore can get fairly wordy, so the next has been closely condensed and edited [his full comments are available in the transcript]:

the A320 plane household, that is the large kahuna. . . Airbus has this large backlog. We’re updating this quantity 7,137. . .the CFM LEAP-1A’s market share of agency engine orders, A320neo household of plane to 63.5% as of Could 31. . . That 63.5% LEAP-1A market share interprets into 1,143 LEAP-1A engines per yr. What’s that wor[th] to Park? . . . They at the moment are, take heed to this, 8,156 agency LEAP-1A engine orders. . . So CFM, they will make all these engines. . . So what does that imply to Park? I imply, I haven’t got to estimate going again to the take a look at the juggernaut slide, perhaps $250 million. . . These engines are ours. These engines might be produced. So we are able to get actually hung up on what quarter it’s. . . However to us, the important thing factor is that these engines might be produced and produced with Park supplies.

Even if you happen to can quibble with a few of the figures and uncertainties, the general confidence that the LEAP-1A enterprise might be a powerful driver of Park’s outcomes for a really very long time to return is about as excessive a stage of certainty there will be sooner or later. I believe there’s little doubt that these volumes will rise from the present manufacturing ranges, even when not as aggressively as Airbus would love.

PKE Inventory Valuation

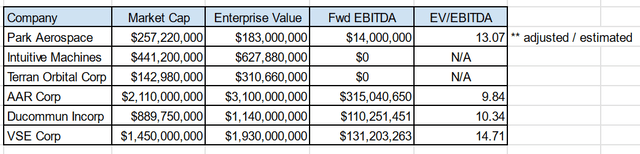

With the unlucky efficiency for in Q1 impacting earnings on a trailing twelve-month foundation, coming in at simply $0.33 over the past 12 months. Consequently, the P/E ratio on that trailing foundation is quite eye-watering 38x. As an alternative of trying again, although, contemplating the ahead potential ought to put issues into clearer perspective. There aren’t any analyst forecasts on earnings, however administration gives historic adjusted EBITDA together with steering. For fiscal 2024 (12 months ended 3/3/2024), adjusted EBITDA was $11.0 million, versus steering for fiscal 2025 to be between $13 and $15 million. On the present market cap of $257 million, money available of $74 million and no debt, Park has an enterprise worth is round $183 million.

That converts to an EV / adjusted EBITDA on a trailing foundation is 16.6x, however drops to 13.1x on a ahead foundation when taking the mid-point of adjusted EBITDA steering of $14 million. With the EV having dropped with the retreat within the share worth whereas adjusted EBITDA is slated to strengthen appears to be like to be a profitable mixture at first look. I’ve not been profitable to find what I take into account one sector peer that’s of an analogous measurement with optimistic EBITDA or earnings that makes for a very good comparability, because the handful of ones which are much less $1 billion in market cap are largely unprofitable at this stage.

Aerospace sector choose EV / EBITDA multiples (Writer’s spreadsheet (knowledge from Looking for Alpha))

The valuation is pretty center of the highway right here as far its sector is worried, assuming Park reaches the midpoint EBITDA of $14 million this fiscal yr. However along with simply the face worth of the EV / EBITDA a number of, what I like about this set-up from a valuation standpoint is four-fold:

- Park is small however mighty – even with a tough current quarter, it maintains self-discipline and generated earnings, and has been investing into its future capability on account of all of the indicators pointing to development in time.

- With the current pullback within the shares, traders can purchase into the present outcomes and future development profile at a really cheap valuation.

- The corporate has no overhang from debt. Whereas different firms need to play the monetary engineering recreation once in a while to take care of their debt maturities, none of Park’s money flows goes to curiosity expense.

- Lastly, Park balances rewarding its shareholders with a dividend that proper now yields nearly 4% with out sacrificing the steadiness sheet or neglecting to speculate correctly again into its enterprise

The riskiest facet confronting Park Aerospace, in my opinion, is that to a sure diploma it is development relies upon largely on Airbus efficiently ramping up its manufacturing. Nevertheless, the power of Airbus to pump out extra jets within the coming years may nicely be constrained by the tempo its suppliers are in a position to keep – in different phrases, if Airbus can solely realistically go as quick as its slowest provider, then so too may Park be restricted by inefficiencies elsewhere within the provide chain which are far past its capability to manage. In impact, the expansion narrative, whereas tantalizing, might be perpetually “simply across the nook” and by no means fairly really arrive.

There are different dangers to contemplate as nicely. Spending on protection has big selection of variables, from the geopolitics of the conditions in Ukraine to the Center East to the South China Sea and what path these tensions will go, to the unknown affect of a brand new US presidential administration and new Congress to be seated in January and finances priorities for protection spending. Park may definitely be adversely impacted by selections within the Nationwide Protection Authorization Act, relying on what the Congress finally approves and the way that filters all the way down to the precise defense-related initiatives that Park provides.

Concluding Ideas

Despite the dangers, I consider the general steadiness of threat to reward in the intervening time continues to favor reward, from the mix of valuation, dividend yield, and development profile that I anticipate to develop. No development is 100% assured, in fact, although I believe that the anticipated development on this case is clearly correct when it comes to path, if not exact in the way it will finally play out. Alternatively, development will be its personal problem, and for Park to have the ability to meet demand the higher demand might be a turbulent experience.

Personally, I have been lengthy shares in Park Aerospace, initiating a small place in January 2020. I’ve continued so as to add to my place over the past 4 years with out promoting any shares, together with purchases close to the 52-week excessive again in April, but additionally because the shares have pulled again over the past 5 months. Since I’ve not but collected a full place in Park, I anticipate that I’ll proceed so as to add considerably extra aggressively whereas shares are beneath $13.