Nvidia Is Nonetheless Traditionally Overvalued With Damaging Catalysts Creating (NASDAQ:NVDA)

letizia strizzi/iStock through Getty Photographs

“If everyone listed, the one phrase you might use is chaos, disaster… The markets would fail.”

– John Bogle, Might 2017.

“The AI hype is a traditional instance of an enormous market delusion. It is simply just like the dot com period when everybody was laying large bets the web would change all the things. The narrative was right. However the market guess that narrative would play out so much quicker than it finally did.”

– Rob Arnott As Informed To The FT.

Introduction

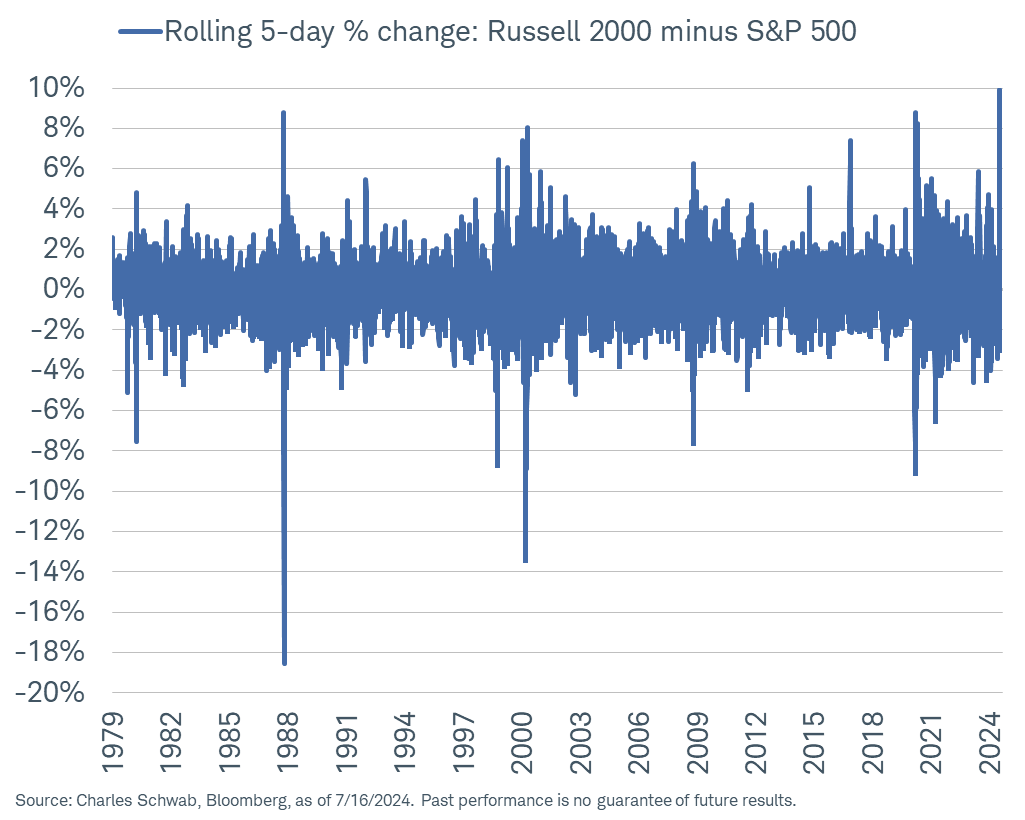

The momentum commerce is faltering, because the Russell 2000 (RTY) has surged essentially the most relative to the S&P 500 Index (SP500) in historical past the previous 5 days ending Tuesday, July sixteenth (this was true for the chart ending on Tuesday, July sixteenth’s shut, nevertheless it stayed true for Wednesday’s shut as nicely).

Russell 2000 Versus S&P 500 (Bloomberg, Charles Schwab)

Moreover, momentum favorites are beginning to fall like dominoes, one after the other. This was evident from worth motion on Wednesday, July seventeenth, 2024, and Thursday, July 18th, to date, with momentum favorites like Eli Lilly (LLY), which is down over 7% right now as I edit this notice, and Nvidia Company (NASDAQ:NVDA, NEOE:NVDA:CA) retreating from their latest highs in the identical aggressive vogue that they visited these highs.

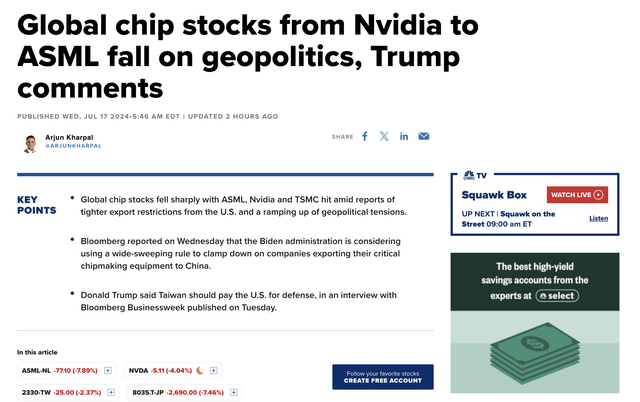

Including to the cloud overhanging semiconductor shares, which had their worst single day efficiency since 2022 on Wednesday, there is pertinent unfavourable information creating on the semiconductor sector and Nvidia itself. The Biden administration seeks to implement a broader mandate on semiconductor exports to China, and the possible Trump administration says that Taiwan has taken chip manufacturing jobs from america, particularly naming Taiwan Semiconductor aka TSMC (TSM) as a beneficiary. Moreover, ASML Holding N.V.(ASML), the chip tools maker, simply reported earnings, they usually obtained 49% of their income from China, so the extra complete export ban will influence Nvidia and its cohorts immediately and not directly.

Semiconductor Headwinds Creating (CNBC, Writer)

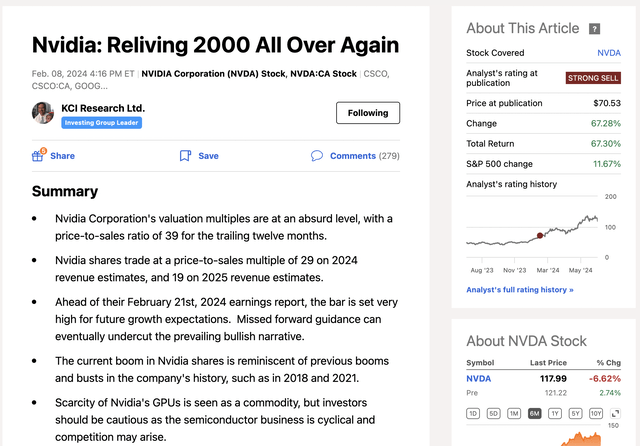

Suffice it to say, I’ve been spectacularly flawed, not less than to date, with my earlier public February eighth, 2024, Looking for Alpha article on Nvidia. There, I hypothesized that we have been dwelling in 2000 another time and NVDA shares have been set to peak. Once more, I emphasize briefly flawed, as epic bubbles have a manner of overshooting even beforehand unbelievable ranges. Nevertheless, that is the danger, and it’s nonetheless the danger right now in NVDA shares, that irrationally can go on so much longer than you assume is feasible.

Writer’s February eighth, 2024 NVDA Snapshot (Writer, Looking for Alpha)

For now, I’ve to personal this incorrect name. Nevertheless, any good analyst, dealer, or investor, will frequently attempt to benefit from the market alternatives which are the fact going through us, even after they make errors. Because the saying goes, when there may be blood within the streets, even when it’s your personal, benefit from the ensuing alternative.

Finally, the speculative blow-off high in Nvidia shares went a lot additional than I ever imagined, one thing I’ll focus on within the subsequent part, to offer perspective. I’ve chronicled this alongside the way in which, but every time, Nvidia shares have stored galloping greater and better, ignoring any conventional valuation bounds like price-to-sales ratio.

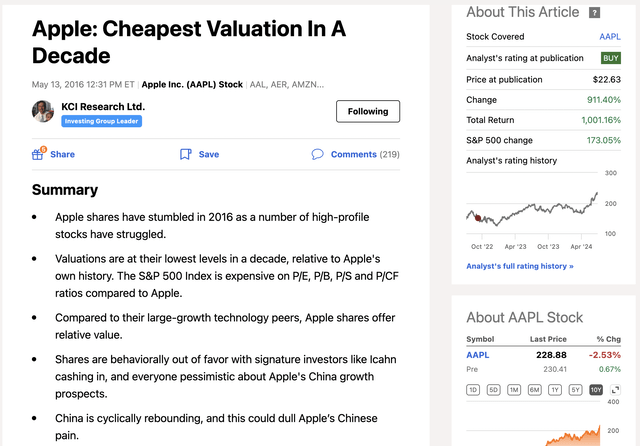

Critics level out that it looks as if I’m a Perm-bear on know-how shares. Nevertheless, that isn’t true, as evidenced by my Might thirteenth, 2016 bullish tackle Apple (AAPL), revealed proper right here on Looking for Alpha.

Writer’s Might thirteenth, 2016 Apple Article. (Writer, Looking for Alpha)

For reference, once I revealed that Looking for Alpha article on Apple in Might 2016, Apple’s price-to-earnings ratio was 10.3, in comparison with the S&P 500’s price-to-earnings ratio of 18.8 at the moment, and Apple’s price-to-sales ratio was 3.9. For comparability, Nvidia’s price-to-earnings ratio for the trailing twelve months right now is 69.0, and its price-to-sales ratio for the trailing twelve months is 36.9.

Finally, beginning valuation is extremely necessary, and Nvidia’s beginning valuation right now is traditionally excessive, particularly in comparison with one thing like Apple in Might 2016.

Nvidia Shares Stay Traditionally Overvalued & 2000 Comparability Stays Legitimate

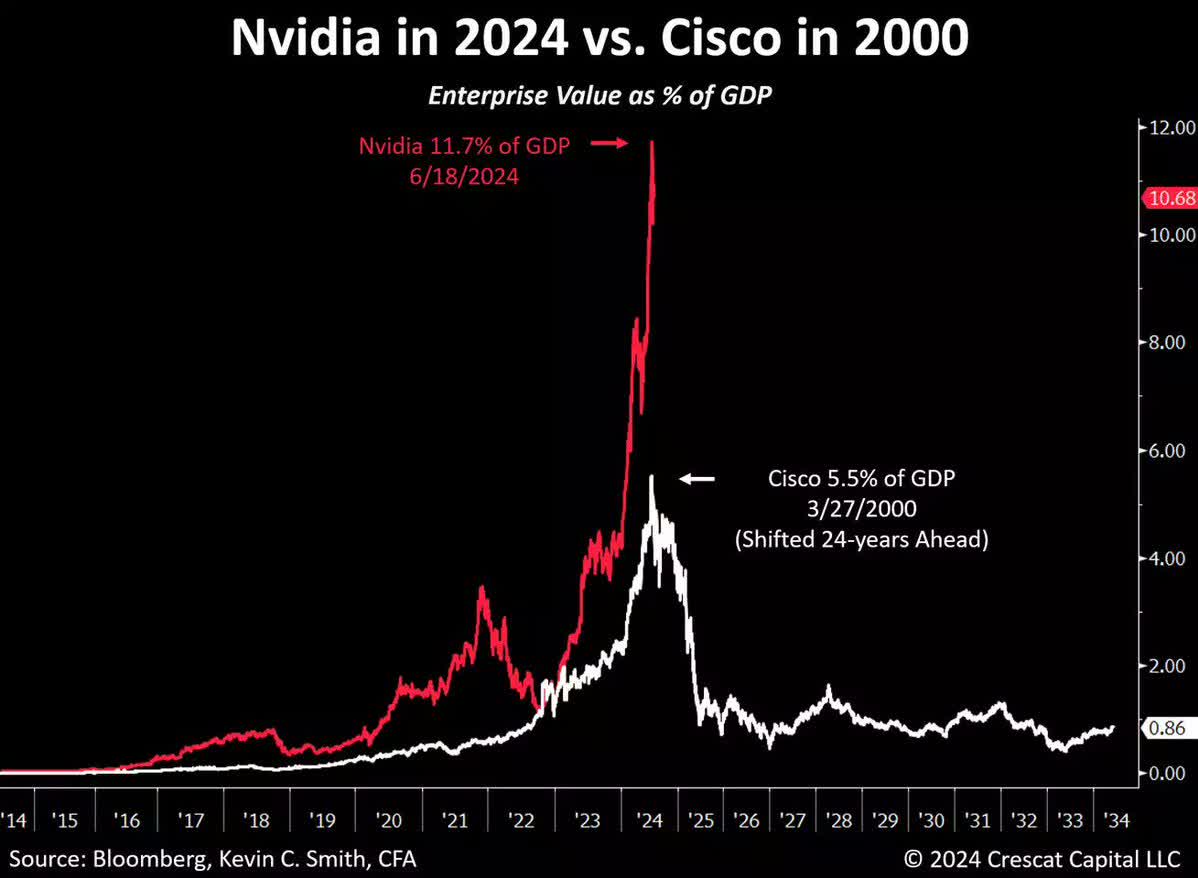

Whereas it has been a bumpy begin to my prediction, I nonetheless assume Nvidia goes to play out like Cisco Techniques (CSCO) in 2000. In reality, there’s a cogent argument that NVDA shares are way more overvalued than Cisco was comparatively in 2000. Constructing on this narrative, taking a look at enterprise worth as a share of GDP, Nvidia has skyrocketed previous Cisco at its June 18th, 2024 peak.

Nvidia Versus Cisco (Bloomberg, Crescat, Kevin C. Smith)

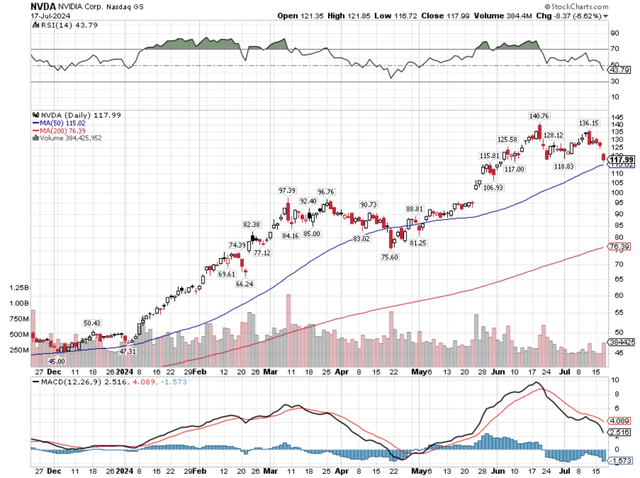

Shorter-term worth motion for Nvidia appears to be like like a high is certainly forming in NVDA shares, with momentum now beginning to break to the draw back.

NVDA Shorter-Time period Value Motion (Writer, StockCharts)

Citigroup (C) made the remark that the amount weighted common share worth of Nvidia is now decrease than the place it was on Might twenty fourth, which was Nvidia’s final earnings date.

Stated one other manner, quantity weighted purchasers of NVDA shares on common are down since Might twenty fourth, when the inventory worth was truly a lot decrease again then.

The subsequent demarcation line of curiosity is NVDA’s 50-day shifting common at $115.02. Breaking this shifting common would open a door to a check of the 200-day shifting common, which is way decrease.

Closing Ideas: The 2000 Analogy Is Nonetheless Legitimate, Caveat Emptor, & Ache & Struggling Is Practically A Requirement For Outperformance

Scratch your head, take a snapshot in time, and bear in mind this madness that we’re mired in proper now, and benefit from the historic alternative.

Seemingly every day, one thing mesmerizing occurs within the markets. Stated one other manner, it’s unbelievable worth motion on high of unbelievable worth motion that makes all the things not regular really feel considerably regular, in an setting the place asset costs are something however regular.

People who lived via the markets in 1998-2003, this sense now’s exactly how the markets felt again then. What I imply is, with unbelievable worth motion, and the latest volatility within the Invesco QQQ Belief (QQQ), which had its worst day relative to the iShares Russell 2000 ETF (IWN) in 22 years on Thursday, July eleventh. It then had its worst absolute day since 2022, yesterday, on Wednesday, July seventeenth. That is bringing again shades of worth motion from January 2000.

As many bear in mind, the Nasdaq Composite (COMP:IND) famously cracked in March 2000, earlier than an virtually double-top within the SPDR S&P 500 Index ETF (SPY) in October 2000.

May Nvidia be main the markets decrease after it led the markets greater? On the short-term chart proven earlier, it definitely appears to be like prefer it. On the longer-term chart, nevertheless, the latest decline is only a blip, not less than for proper now, in Nvidia shares.

NVDA Longer-Time period (Writer, StockCharts)

What an exquisite inventory chart and an exquisite American firm.

How may I not purchase this on the lengthy facet someplace alongside the way in which? Simply wanting on the inventory worth chart, I really feel like a dunce, and my 30 plus years of market participation and schooling has all been for naught.

The silver lining, although, is there may be now alternative on the opposite facet.

Clearly, Nvidia is a superb firm, and the founder and CEO of Nvidia, Jensen Huang, has a backstory that’s a tremendous story, too. In reality, I like Jensen Huang, notably his viewpoint about needing ache and struggling to foster resilience.

Right here is considered one of his direct quotes on the subject.

Greatness shouldn’t be intelligence. Greatness comes from character. And character isn’t shaped out of good folks, it’s shaped out of people that suffered.

Jensen Huang.

The subsequent quote is especially close to and expensive to my coronary heart, as I imagine in it immensely, so in a manner, I really feel a bond with Jensen Huang on this subject.

Sadly, resilience issues in success, (and) I don’t know the best way to train it to you aside from I hope struggling occurs to you.

Jensen Huang.

Learn that final quote once more that Jensen gave in his March 2024 tackle at Stanford, which is music to my coronary heart as a result of Jensen Huang is saying you must undergo ache and struggling to have resilience to finally have success.

And, oh boy, you’re in luck, expensive reader, as a result of Mr. Market can absolutely dish out his share of ache and struggling.

In reality, I wrote concerning the significance of resilience all the way in which again in October 2018, the article I wrote about resilience is linked right here, with a snapshot of that publish proven beneath.

Writer’s October twenty ninth, 2018 Submit (Writer)

On the time I wrote that weblog publish, we have been in the midst of an amazing quantity of ache and struggling. Nevertheless, that character that this ache and struggling constructed, that resilience, finally paid off remarkably.

Let me tie all the things collectively now. So let’s recap and get to the concluding ideas and takeaways.

-

The fairness market, and extra particularly, the Invesco QQQ Belief ETF has misplaced its thoughts.

-

Nvidia, who has a CEO whose view on resilience I like tremendously, and who has constructed an organization to be happy with, has seen its valuation double Cisco’s peak valuation relative to the GDP of the U.S. that Cisco achieved at its peak in 2000.

-

Ache and struggling is sort of a prerequisite to construct character and have success.

-

Ache and struggling builds character, and most significantly it builds resilience.

-

Paradoxically, the paradox is that having a rational thoughts concerning the echo bubble we’re firmly in now in 2024, which is a follow-up to the 2021 bubble, with the echo bubble occurring now in comparatively high-quality shares which have traded to ludicrous valuations, has brought on quite a lot of ache and struggling, spurring resilience, and creating super absolute and relative alternative.

On July ninth, 2024, Keybank (KEY) raised its worth goal on Nvidia from a $130 to $180, which might be an $1800 share worth for Nvidia pre-split, and on July twelfth, Benchmark raised their worth goal for Nvidia shares to $170.

This is similar Nvidia that has the next traits.

-

Nvidia, at a market capitalization of $2.9 trillion at yesterday’s shut, is buying and selling for roughly 24 occasions this yr’s income estimate of $120.5 billion. That is tough to imagine given the large market capitalization the place Nvidia is buying and selling like a small know-how start-up, and this ludicrous price-to-sales valuation is a perform of the river of fund flows from worth insensitive and valuation insensitive traders. Learn that once more, a price-to-sales ratio of 24 for this yr! Keep in mind Scott McNealy’s demarcation line of a price-to-sales ratio of 10 being an not possible hurdle to surpass for future shareholder returns.

-

In line with roughly 50 analysts, Nvidia is anticipated to see consensus gross sales progress of roughly 34.8% subsequent yr (down from this yr’s gross sales progress of 97.8%) to gross sales of $161.5 billion. Nonetheless good, nonetheless wholesome, however the legislation of enormous numbers is beginning to catch as much as even this market darling. Thus, on subsequent yr’s price-to-sales forecast, Nvidia is buying and selling at a price-to-sales a number of of 18!

-

Stanley Druckenmiller, one of many best traders in historical past, an investor who constructed his Nvidia stake initially in 2022, and added to it in each quarter of 2023, exited a bulk of his Nvidia place within the first quarter of 2024. He was out of the remaining shares within the second quarter at pre-split worth of roughly $840, or $84 publish break up, with Nvidia shares closing at $117.99 yesterday.

-

Remarkably, and the markets have a historical past of rhyming, nevertheless, on June 18th, 2024, Nvidia, like Cisco in March 2000, handed Microsoft (MSFT) to develop into the most important market capitalization inventory.

-

For perspective, when Cisco handed Microsoft on March twenty fourth, 2000 to briefly develop into the most important market capitalization inventory, its intraday market-cap excessive was $575.93 billion. When Nvidia handed Microsoft on a closing foundation to make it the most important market capitalization inventory on June 18th, 2024, Nvidia’s market-cap exceeded $3.3 trillion, at an aforementioned price-to-sales a number of of 27.

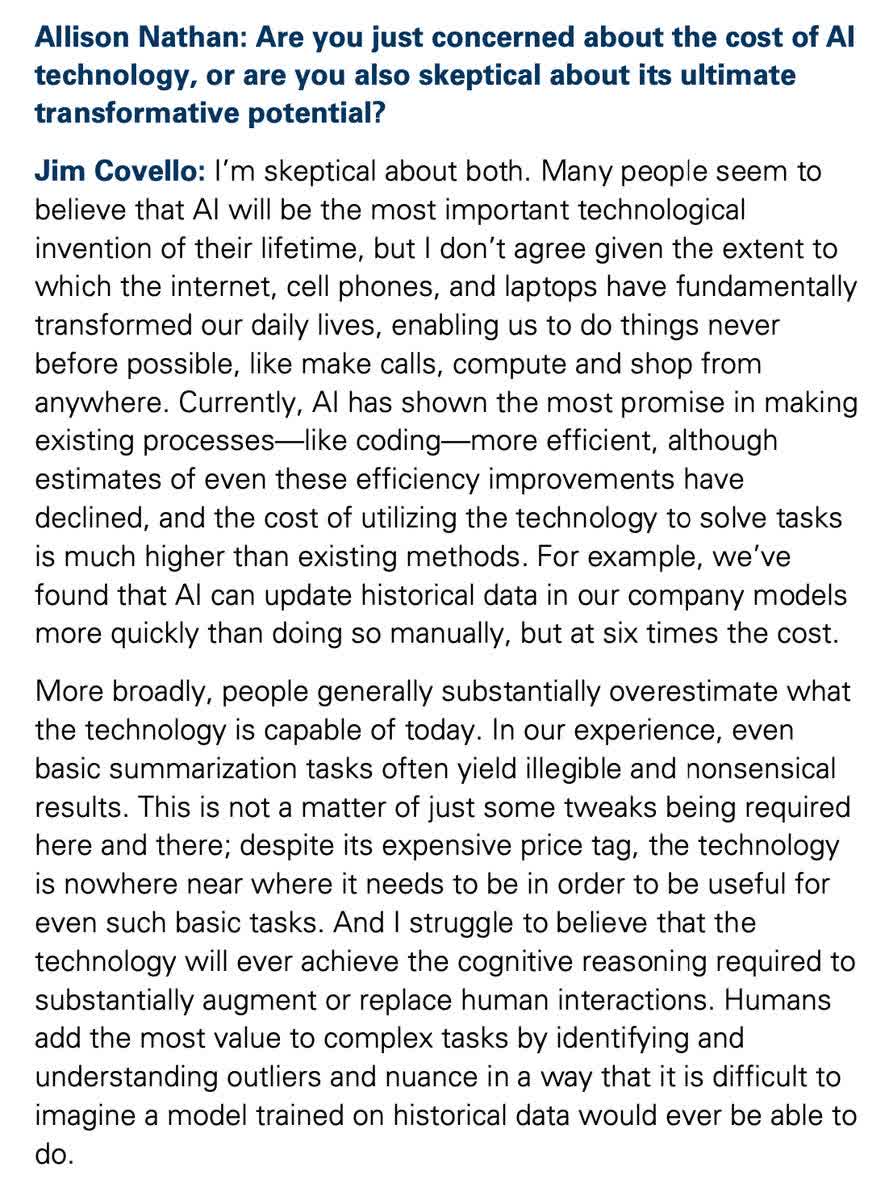

The cherry on high of the sundae right here is that Goldman Sachs (GS) got here out in the previous few days reiterating one thing that Julian Garran, a accomplice at MacroStrategy, has been saying. Particularly, that AI, 18 months after its heralded introduction to the world, and roughly 14 months after the Nvidia Might 2023 kick-off, has but to supply one transformative utility. Take into consideration that for a minute. Right here is an excerpt beneath and the hyperlink to the report.

Excerpt From Goldman Sachs On AI. (Goldman Sachs)

Wrapping up, you probably have time, learn the report, and in the event you don’t, learn the excerpt above.

I’ll translate for you, too, as follows.

TL:DR – Value motion within the broader inventory market is a replay of 2000 and worth motion in AI shares is a historic bubble.

May it maintain going? Sure, that’s the danger. Nevertheless, there are constructing indicators up to now week that the air is beginning to be set free of the balloon.

Thanks on your readership,

WTK.