Nvidia Inventory: Love It For The Progress, Commerce It Like A Bubble (Technical Evaluation) (NVDA)

NicolasMcComber

On this article, I’ll share with my readers what the market is lacking about Nvidia Company (NASDAQ:NVDA) and the place precisely the inventory is heading subsequent.

I am simply kidding, in fact.

Nvidia Company has in all probability been one in all probably the most coated shares on the earth prior to now a number of months. There is not an excessive amount of that I or most analysts on Wall Avenue or elsewhere can add to the dialog that hasn’t already been dissected totally.

Whereas I’ll briefly cowl a number of the fundamentals of the corporate under to know whether or not proudly owning NVDA makes any sense in any respect (spoiler alert: it does), the issue with the funding thesis right here is that it depends on aggressive progress materializing over a multi-year interval. The danger is that any bump alongside the best way (i.e., a deflation in progress expectations) may very well be catastrophic for a inventory that trades at a reasonably wealthy ahead EV/EBITDA of 30x — which Looking for Alpha charges an “F” within the valuation grading scale.

Because of this, I believe that NVDA may very well be owned “for the proper (basic) causes.” Nevertheless, it might be too harmful to carry the inventory passively in hopes that, a couple of years from now, the value can have climbed one other leg increased. To mitigate publicity to potential losses that may very well be substantial, I imagine that NVDA ought to be traded from the idea that it’s a bubble that might burst at any second — even when it is not and it does not.

A Fast Phrase on Nvidia’s Fundamentals

The case for proudly owning NVDA, as I perceive it, is that the corporate has reached hypergrowth mode, pushed by what looks like infinite demand for infrastructure that helps AI functions. Within the tech world, Cisco Methods (CSCO) involves thoughts as the same (however arguably much less spectacular) case research.

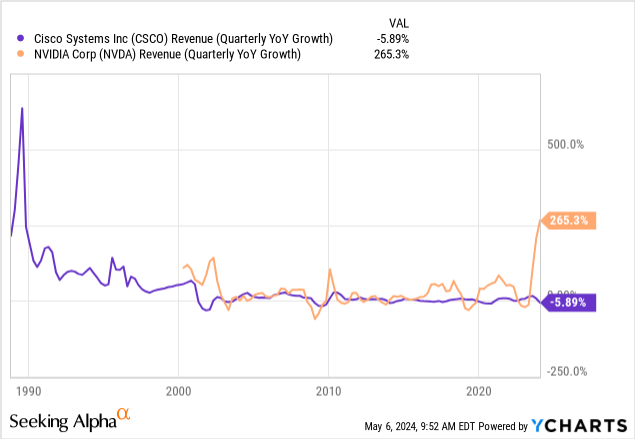

Again within the pre-Web days, Cisco’s revenues have been rising at quarterly peaks that exceeded 500% within the late Nineteen Eighties and over 100% within the early Nineteen Nineties (see chart under). The corporate was regarded as the seller that will lay the groundwork for this new know-how often called the Web (or, as Cisco awkwardly described in its 10-Ks on the time, a key provider of “interworking wants”).

Nvidia appears to be the generative AI equal of the Nineteen Nineties Cisco, however, impressively, rising very quick off a a lot bigger base. Extra particularly, Cisco’s 1995 revenues of $2 billion pales compared to Nvidia’s $61 billion in fiscal 2024. Regardless of Nvidia’s large scale, the administration group sees fiscal Q1 revenues rising by a formidable 234% on the mid-point of the steerage vary, with gross margins probably surpassing 76%.

All this aggressive progress comes at a valuation a number of that doesn’t appear unreasonable, in my opinion. Whereas a ahead P/E of 35x is much from being a discount at face worth, I discover the a number of straightforward to justify given 2025 EPS progress expectations of 93%, for a minuscule implied ahead PEG of solely 0.4x.

Proudly owning the Nvidia Bubble

The primary drawback with the above is that Nvidia must help its progress story for the inventory to maintain thriving. As quickly as the corporate fails to satisfy what at the moment are aggressive top- and bottom-line progress expectations, a poisonous mixture of downward estimate revisions and a pullback in valuation may spell massive hassle for the inventory.

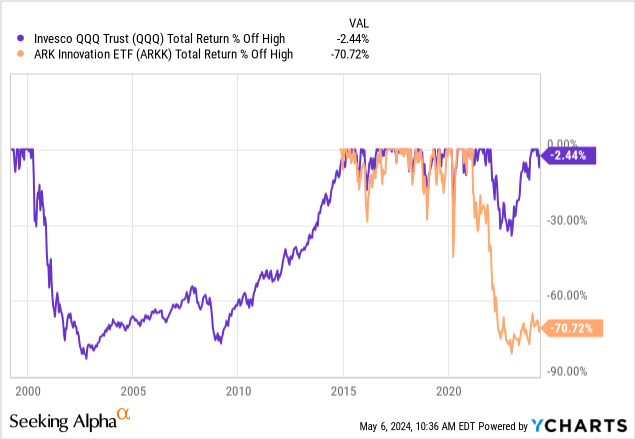

On this hypothetical situation, draw-downs may resemble these 70%-plus meltdowns confronted by basic bubble circumstances all through market historical past: the Japanese market crash of the Nineteen Nineties, the dot-com bubble burst of the early 2000s, and the “know-how of the long run” (ARKK) unwind of 2021 (see drawdown chart under).

I can see NVDA bulls defending the corporate’s progress story, and I admire the argument. Nevertheless, I doubt that that is crucial dialog available. On the finish of the day, the long run is unsure, and I believe {that a} sensible funding determination should take into account the chance and extent of the potential losses.

I see Nvidia becoming one in all two doable eventualities, however probably nothing in between. Both (1) the corporate is within the early-to-mid phases of its hypergrowth part, which justifies immediately’s valuations and gives help for additional share worth will increase, or (2) the inventory, up 1,900% prior to now 5 years, is a bubble that’s ready for the corporate’s first quick sequence of disappointing quarters to burst catastrophically.

Fortunately, even when the second situation above proves to be proper, shareholders can nonetheless earn a living for so long as NVIDIA continues to ship the products. The caveat right here is that buyers must know when to tug the plug, lock within the income, and sidestep the potential free-fall in share worth if or as soon as the expansion story fizzles.

I talked about how to take action after I wrote concerning the ARK Innovation ETF (ARKK). The quick reply is utilizing a moving-average strategy: personal NVDA above it, promote the inventory under it — that straightforward.

As a result of Nvidia inventory’s volatility is sort of excessive, at 61% annualized (a bit much less so prior to now 24 months, at 57%), watching the 200-day transferring common makes extra sense, in my opinion. Counting on a transferring common of shorter length may create an excessive amount of noise, frequent purchase and promote triggers, and pointless trades. I’d additionally (1) monitor the inventory worth’s ebbs and flows on a every day or weekly foundation to keep away from being caught in a “flash flood” and (2) commit comparatively little capital, as I firmly imagine in risk-balancing a portfolio (i.e., increased allocation to lower-risk property, and vice versa).

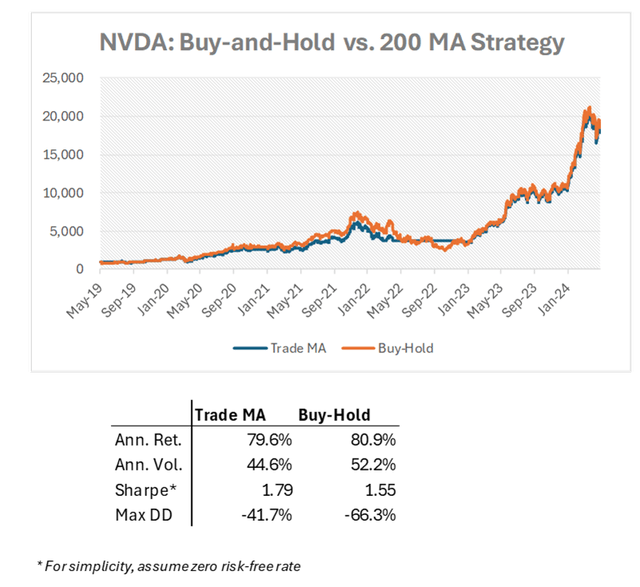

Not surprisingly, the technique above would have produced decrease absolute returns in comparison with merely holding NVDA inventory over the previous 5 years (see chart under). Nevertheless, discover the next:

- The distinction in absolute returns would have been minimal, at 79.6% per 12 months for the moving-average buying and selling technique vs. 80.9% for the buy-and-hold strategy.

- The volatility-adjusted efficiency of the moving-average technique would have been higher at a Sharpe ratio of 1.79 vs. 1.55.

- The utmost drawdown of -42% would have occurred on the backside of the March 2020 COVID-19 bear marketplace for the moving-average technique vs. -66% in October 2022 for the buy-and-hold strategy.

DM Martins Analysis, knowledge from Yahoo Finance

So, even trying again via this astounding success story within the tech area, realizing when to bail out and minimize losses would have paid off for NVDA buyers when dangers (i.e., volatility and draw-downs) are thought-about.

Nonetheless, the actual advantage of adopting the moving-average strategy described above, in my opinion, would come if or when the inventory corrects extra drastically, presumably on account of a “flaw” in NVIDIA’s progress story, following the latest jaw-dropping rally in share worth.