Navigating Earnings Season: Tailwinds Of Tomorrow

Kathrin Ziegler

By Samuel Rines

Welcome to the most recent installment of the “Navigating Earnings Season” weblog collection. On this collection, I dive into the world of earnings reviews from main corporations, spanning giants like J.P. Morgan and Pepsi, in addition to area of interest gamers in numerous sectors. Because the earnings season unfolds, these company outlooks supply real-world insights that usually distinction sharply with the uncertainty emanating from the Federal Open Market Committee (FOMC).

Along with his Jackson Gap speech, Federal Reserve Chair Jerome Powell all however promised charge cuts have been coming. That is cool. However it’s why that issues. Is the financial system struggling below tight financial coverage? Probably not. Are asset markets starting to crack and present indicators of stress, inflicting angst amongst policymakers? Probably not. Is inflation decelerating and the labor market cooling? Sure.

These “preliminary circumstances” matter. The outlook for the financial system and markets could be completely different if one thing have been breaking. Breaking is dangerous. Cooling is a wholly completely different story.

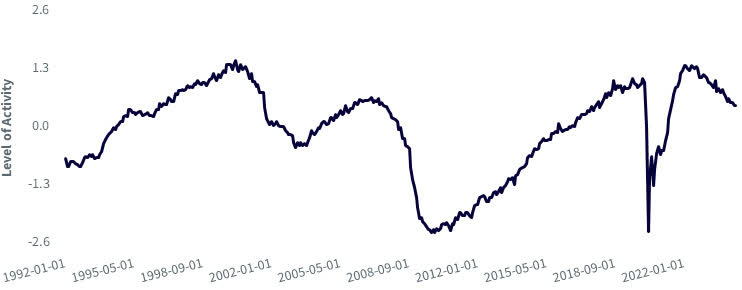

Kansas Metropolis Fed Labor Market Situations Index

Supply: Kansas Metropolis Fed, as of seven/1/24.

Conveniently, the Kansas Metropolis Fed compiles main labor market indicators right into a single, helpful knowledge collection. The labor market has undoubtedly softened from its post-COVID peak. It ought to be famous how shortly the labor market went from Nice Recession weak point to near-all-time tightness. The labor market is cooling, however it isn’t collapsing. These two issues can coexist.

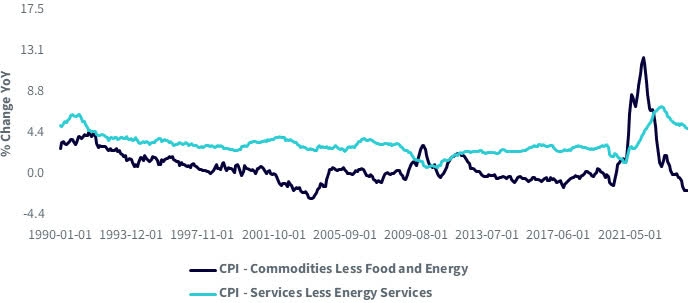

Inflation Two Methods

Supply: Bureau of Labor Statistics, as of seven/1/24.

The inflation story isn’t dissimilar. Inflation pressures haven’t magically collapsed, but-as Chair Powell made clear in his speech-it is all about confidence that the development will proceed. Confidence is completely different from a declaration of mission completed. A part of the arrogance might stem from a dramatic return to regular on the products facet of inflation (commodities much less meals and vitality). Items inflation surged, then fell again to regular ranges of deflation. Companies are usually stickier, however that has begun to fall as effectively.

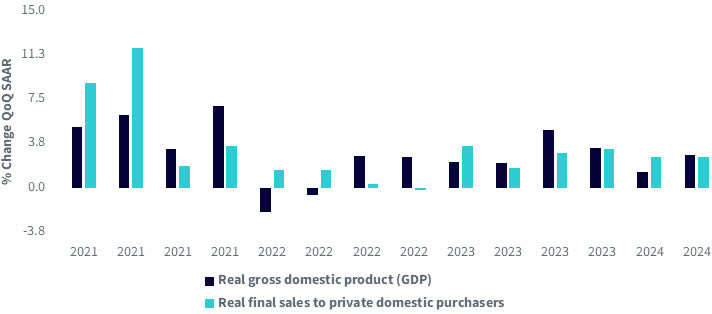

Progress Has Been Good

Supply: Bureau of Financial Evaluation, as of June 2024.

Progress has held up effectively. There have been bumps alongside the best way, however development has not fallen off a cliff. GDP is beneficial, however closing gross sales is an effective test. Last gross sales strips the volatility of inventories and internet exports from the calculation, and the non-public model goes a step additional and eliminates the modifications in authorities spending as effectively. Intriguingly, the standard of composition of development over the previous 18 months has been excessive, as evidenced by the regular development in closing gross sales.

All of that’s to say, the speed cuts are coming with out panic. The economy-as a whole-is wonderful. There have been headwinds. Manufacturing and housing have been quite dismal within the wake of rate of interest will increase. However these are additionally set to profit from the shift to a much less restrictive stance from the FOMC. The headwinds of yesterday might effectively grow to be the tailwinds of tomorrow. We are going to see.

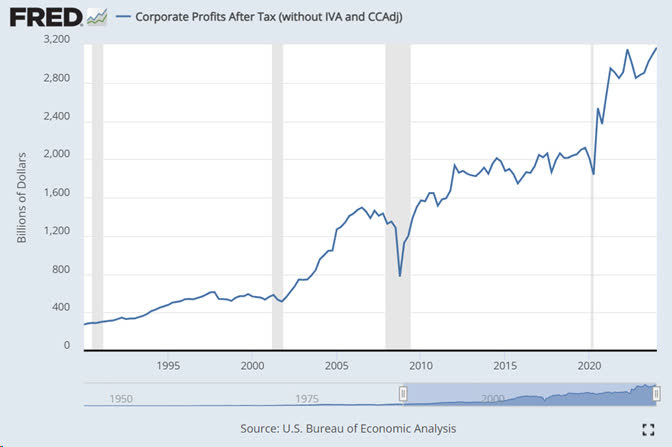

Supply: Federal Reserve Financial Information (FRED), as of March 2024. Excluding stock valuation changes and capital consumption changes permits for a greater view of earnings throughout industries. See the Bureau of Financial Evaluation web site for extra particulars.

There are questions nobody desires to ask. What if company America navigated this cycle effectively and the traditionally elevated multiples replicate administration competence as a substitute of investor euphoria? What if charge cuts usually are not stoking a bubble-they are extending a nominal GDP and wage mini-boom? What if traders ought to be worried-not by finances deficits or the autumn of the greenback, however 1) that the U.S. financial system has plowed by means of each hurdle; 2) the promised recession by no means materialized; and three) COVID-19 resulted in higher provide chains and a extra diversified financial system?

When trying to the longer term, there are all the time causes to be fearful. Possibly it isn’t that dangerous. Possibly it is even good. Possibly it is nice. The long run ought to be embraced, not feared. There are many headwinds for the U.S. financial system. However these could be the tailwinds of tomorrow.

Samuel Rines, Macro Strategist, Mannequin Portfolios

Sam Rines serves as a Macro Strategist, Mannequin Portfolios at WisdomTree extending the agency’s customized mannequin portfolio administration capabilities. Previous to WisdomTree, Samuel was a Managing Director of CORBU, a analysis agency we struck up a relationship with to ship mannequin portfolios. Samuel is a worldwide macro knowledgeable centered on the funding implications of politics and coverage. His PolyMacro analysis has been extensively adopted by giant household places of work, institutional traders and the media. Previous to becoming a member of CORBU, Samuel was the Chief Economist and Funding Strategist at Avalon Advisors. Earlier than becoming a member of Avalon, Samuel was a portfolio supervisor at Chilton Capital Administration, the place he launched the Chilton ESG Fairness Technique and an extended/quick know-how portfolio. Samuel began his profession because the cross-asset analyst for a small hedge fund. He’s the writer of the e book “After Regular: Making Sense of the World Economic system “.