Modine Appears Like A Purchase After Additional Evaluation (NYSE:MOD)

Erik Isakson

Funding Thesis

Modine Manufacturing’s (NYSE:MOD) administration sees the potential to generate roughly $1.1 billion in information heart cooling income inside three years. That may triple its present information heart gross sales and practically double its present whole Local weather Options income. It would additionally put the corporate someplace within the vary of producing $3.3 billion yearly. The unbelievable progress and continued acceleration of information heart cooling gross sales, a strategic acquisition that, I imagine, has given Modine a possible moat or not less than a powerful aggressive benefit, and increasing margins give me confidence that the corporate could be a winner within the information heart cooling house. If Modine can accomplish the kind of income progress that administration speaks about, the inventory could possibly be a fantastic worth at the moment for long-term traders. After ranking MOD a maintain in my final article, I now contemplate Modine a purchase and have opened a starter place within the firm.

Enhancing Monetary Outlook

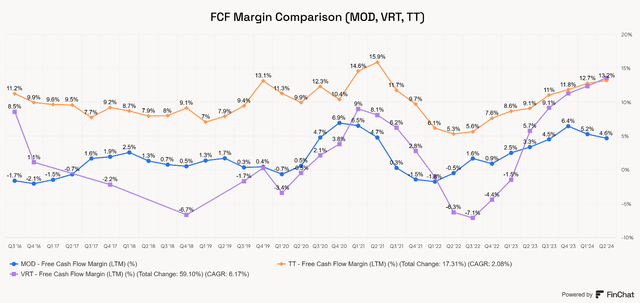

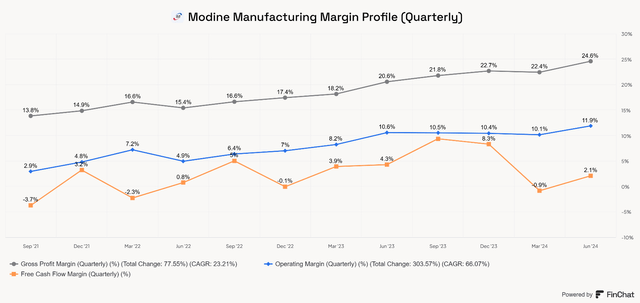

Modine is present process a strategic shift, which it calls its 80/20 precept. MOD’s 80/20 adjustments triggered a significant enchancment in its monetary trajectory. The corporate is divesting from underperforming companies and shifting its focus into larger progress and better margin companies. Phase income has flipped from being pushed largely by Efficiency Know-how to now being pushed by Local weather Options. It is a very optimistic signal for continued margin growth. The Local weather Options enterprise consists of information heart cooling, which generates considerably larger gross and working margins. That is the world of the enterprise I’m specializing in in the interim, as Modine’s administration has talked about that its goal for its information heart cooling enterprise is roughly $1.1 billion in about three years’ time. If this occurs, I imagine Modine can rival the present free money movement margins of Vertiv (VRT) and Trane Applied sciences (TT). FCF margins of 13% may help spectacular shareholder returns.

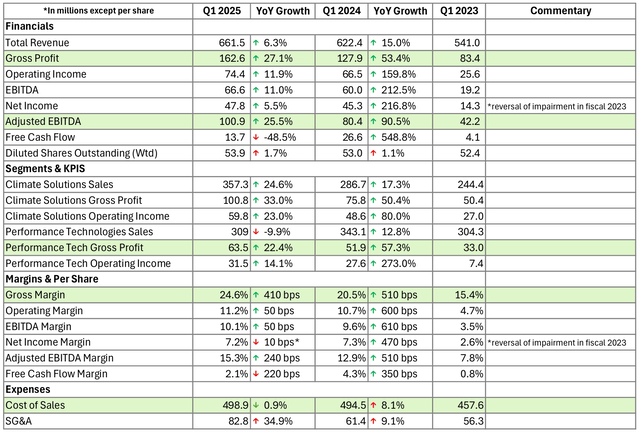

Within the desk beneath, you’ll be able to see that Modine has been in a position to obtain spectacular progress in gross revenue and margin, and adjusted EBITDA and margin. Its Local weather Options (CS) section skilled unbelievable income progress (24.6% YoY in Q1) and gross revenue (33.0% in Q1). The Efficiency Applied sciences (PT) section is being shrunk by promoting off underperforming enterprise, nonetheless, regardless of a decline in PT gross sales, Modine grew PT gross revenue by 22.4%, displaying elevated effectivity from its 80/20 adjustments. Modine expects a flattish income outlook, with larger margins in its PT section and continued acceleration in its CS section.

Modine’s Q1 Monetary and KPI Desk (Writer-generated desk, information from SEC filings and transcripts)

Adjusted EBITDA is a extra acceptable measure of Modine’s latest progress as a result of a reversal of an impairment cost in 2023 and the unwinding of a few of its legacy automotive companies. Adjusted EBITDA margin has expanded from 7.8% in Q1 2023 to fifteen.3% in Q1 2025. The important thing factor to search for in Modine’s operational efficiency would be the magnitude of the shift in income in the direction of information heart cooling options and continued margin growth.

Development in Knowledge Heart Gross sales and Increasing Margins

Regardless of exiting a few of its Efficiency Tech companies, Modine continues to develop whole income on the power of its CS section, pushed by an acceleration in information heart cooling income.

An excellent quantity of Q1 information heart gross sales progress comes from the Scott Springfield Manufacturing (SSM) acquisition; nonetheless, through the Q1 name, administration acknowledged that natural information heart progress practically doubled YoY. Modine acquired SSM to achieve entry to a know-how that it could not present. Now, with the 2 corporations working collectively, the advantages of each ought to kick in. The mixing of SSM and its customized air dealing with items (AHUs) will increase Modine’s capabilities and permit it to higher serve hyperscale information facilities, strengthening its place in a high-growth vertical. It additionally gained Modine entry to new buyer relationships by including a hyperscale buyer, doubtlessly opening the door to new giant information heart prospects now that the corporate has a seat on the desk. These relationships could also be one of the essential aggressive benefits within the information heart cooling market, as important switching prices could also be related to hybrid information heart cooling agreements. Administration has basically instructed us that the 2 corporations mixed can be stronger than every one individually.

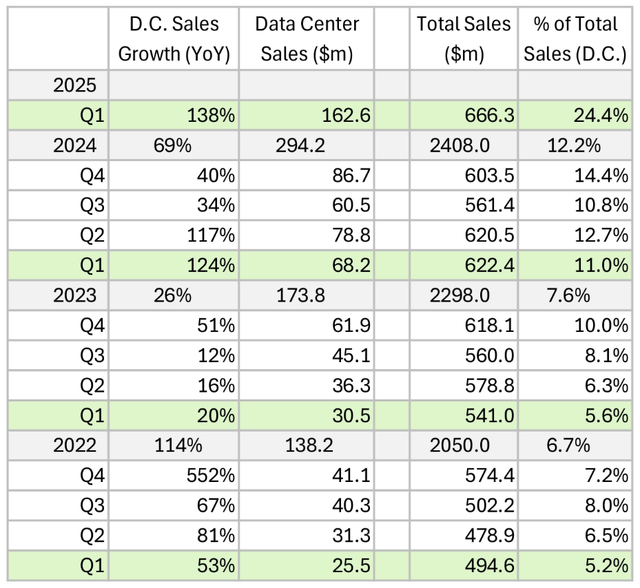

Knowledge heart cooling gross sales have greater than 6x’d since Q1 of 2022, with quarterly gross sales rising at a CAGR of 85.4% over the two-year interval proven beneath. As information heart gross sales have grown, Local weather Options gross margins have improved from 20.6% to twenty-eight.2%, and whole gross margin has expanded from 15.4% to twenty.4%. Knowledge heart gross sales now make up 24.4% of whole income. This determine was solely 5.2% in the identical interval three years in the past.

Modine’s Knowledge Heart Gross sales Development (Writer-generated desk, information from SEC filings and transcripts)

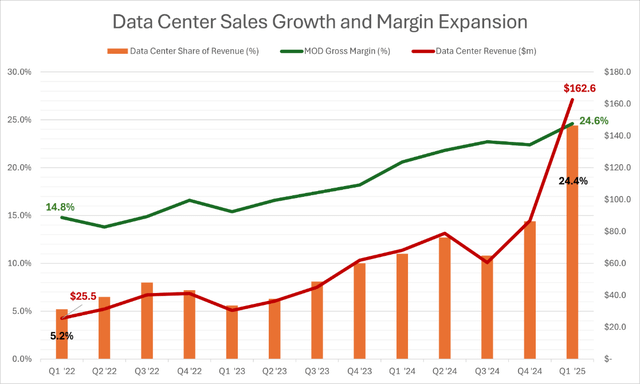

The chart beneath additional illustrates the connection between information heart gross sales and gross margins. As information heart gross sales (crimson line) have grown from $25.5 million to $162.6 million, gross margin (inexperienced line) has considerably expanded and the share of income coming from information heart gross sales (orange bar) has exploded larger.

Writer-generated desk, information from SEC filings and transcripts

How lengthy will this progress proceed? Capex into information heart new builds and expansions remains to be ongoing. These are giant tasks that take time to plan, fund, approve, and construct, this course of ought to proceed to play out for a number of years not less than. Dominion Vitality (D) just lately stated that new giant information facilities requiring greater than 100 megawatts of electrical energy would withstand seven-year delays because of the lack {of electrical} infrastructure help. Importantly, this is not going to have an effect on tasks already within the pipeline. Dominion serves electrical energy in Virginia, one of many extra essential locations within the USA for information facilities. In my article about NextEra Vitality (NEE) in June, a part of my thesis revolved across the long-term progress pipeline for information heart construct outs. Maybe not coincidentally, NEE says that it expects renewables to develop about 3x over the following seven years as in comparison with the prior seven-year interval. This progress in renewables ought to assist help the power to proceed constructing giant information facilities past the seven-year interval Dominion talked about.

The opposite factor that ought to help the power to construct information facilities regardless of the present and near-term limitations of {the electrical} grid is the adoption of liquid cooling options for information infrastructure. As an illustration, analysis and business articles have mentioned how superior cooling know-how will assist information facilities turn out to be extra environment friendly and that liquid cooling is a vital half of this shift. This demand ought to present a possibility for Modine to proceed constructing on its latest success in constructing an organization with the aptitude to supply a full suite of information heart cooling know-how.

Free Money Circulation Evaluation

In Q1, MOD’s FCF (outlined merely as OCF minus Capex) was $13.7 million, whereas TTM FCF was $113.2 million. Nonetheless, TTM FCF numbers is probably not one of the best measure of the corporate’s earnings potential as a result of MOD has made important investments in progress and accelerated income from its information heart cooling section. Due to this, the money movement assortment from its information heart income could also be considerably delayed for now.

In Q1, OCF was negatively impacted by working capital, with adjustments in accounts receivable (-$18.1 million) and different internet working belongings (-$32.6 million) mixed to lower OCF by $50.7 million. On the flip facet, MOD solely benefitted from $20.6 in different working capital objects, reminiscent of favorable adjustments in stock, accounts payable, and different internet working belongings. I do not prefer to make daring assumptions about working capital except I’ve a extremely agency grasp of an organization’s accounting. Nonetheless, within the case of Modine, I really feel assured in its potential to enhance OCF within the coming quarters as a result of information heart cooling gross sales are accelerating and driving margin growth. Moreover, FCF was impacted by bigger than common capex associated to acquisitions and investments in progress. Capex in Q2 was $26.8 million.

We are able to rely Capex in opposition to MOD’s money flows, however the Capex used to combine Scott Springfield and TMGCore needs to be considered a long-term funding reasonably than a right away expense, regardless of its accounting therapy. Since these are usually not capitalized, they influence earnings and free money movement at the moment. Nonetheless they symbolize long-term progress investments that, below completely different accounting therapy, could be capitalized and expensed over their helpful life interval. Over time, as Capex decreases, earnings and free money movement ought to theoretically enhance, assuming these acquisitions contribute to progress. Fortunately, there are not less than early indicators that the SSM acquisition already is.

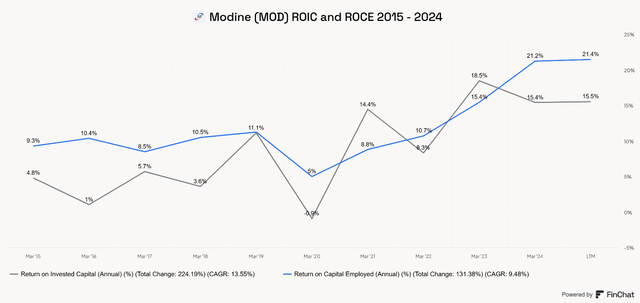

Returns on Invested Capital and Capital Employed

Modine has proven its growing effectivity by means of two crucial measures, ROIC and ROCE. These capital effectivity metrics will go a great distance in indicating if the corporate is enhancing the returns it will get on its investments in acquisitions, Capex, and R&D. The corporate has exhibited wholesome and enhancing ROIC and ROCE, as seen beneath.

Corporations that preserve wholesome capital effectivity metrics (significantly ROIC and ROCE) usually tend to ship sturdy shareholder returns. Modine has accomplished this, and this could help enhancing free money movement era sooner or later.

FCF Potential

Maybe our greatest comps are Vertiv and Trane Applied sciences. VRT and TT are completely different companies. Trane is established and really numerous, like Modine is. With completely different enterprise segments that make information heart cooling a rising a part of its enterprise however not but a significant income. Vertiv is the sooner rising counterpart to Modine, however differs in that it’s centered primarily on superior cooling techniques options. With the emergence of information heart cooling and liquid cooling as a income for Modine, I see the enterprise aiming to be someplace between Vertiv and Trane, with a diversified mannequin and an growing reliance on information heart cooling.

Each TT and VRT maintain TTM FCF margins simply north of 13%. MOD’s TTM FCF margin is simply 4.6%, with a peak of 6.4% as of the tip of fiscal Q3 of 2024 (12/31/2023). Given the growth of MOD’s gross and working margins and the truth that a secular progress pattern and rightsizing of its enterprise is pushing this growth, I see 13% as an inexpensive goal for FCF margins.

If Modine can get to a 13% FCF margin inside the subsequent few years, that will possible make the inventory fairly low cost proper now. Margin growth could possibly be supported by continued progress in information heart gross sales, decrease integration prices and the synergies or advantages from its latest acquisitions, significantly the Scott Springfield acquisition.

Valuation

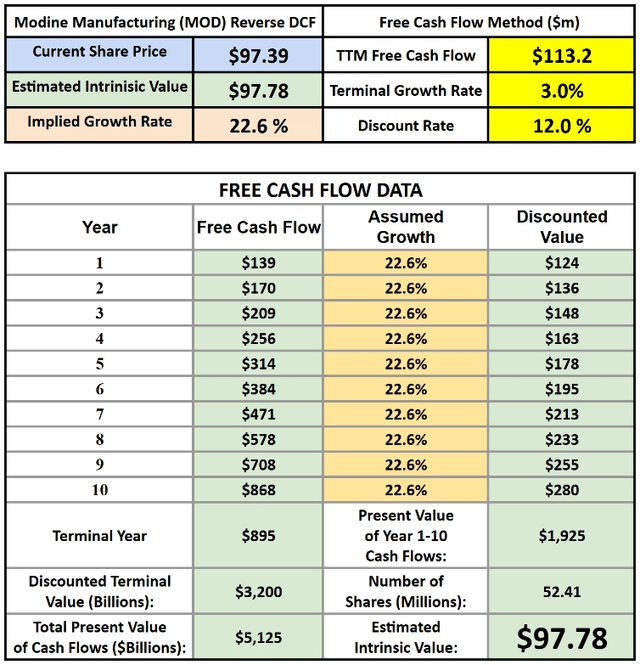

If we use a fundamental reverse DCF calculator and Modine’s TTM FCF of $113.2 million, a terminal progress price of three.0%, and a reduction price of 12.0%, Modine must develop free money movement at 22.6% over a ten-year interval. I selected a 12% low cost or hurdle price as a result of I imagine that will be a market-beating inventory. The terminal price of three% whereas larger than GDP, seems to be cheap because of the potential tailwinds related to information heart cooling and HVAC/R markets.

Reverse DCF – Modine (MOD) (Writer-Generated Reverse DCF)

The straightforward reverse DCF may overstate Modine’s must develop free money movement from its present margins. What if the corporate can proceed to dramatically increase its margins within the subsequent 12 months or two?

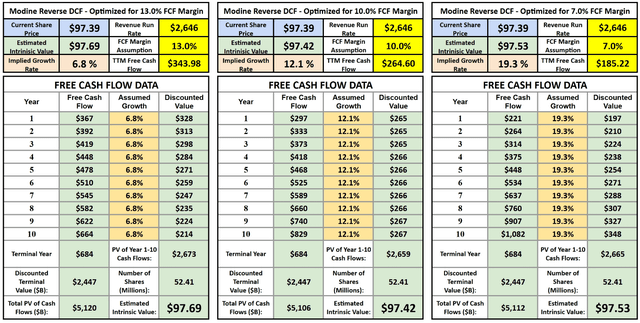

Taking a look at Modine’s latest restructuring for progress and effectivity and the explosion in information heart gross sales, the corporate doesn’t but seem like optimized without spending a dime money movement era. Let’s return to my assumption that Modine has the potential to match the 13.0% FCF margin that TT and VRT maintain.

Now, let’s conduct a valuation train, pretending that Modine is already optimized for a free money movement. I imagine 7% to 13% is an acceptable vary for MOD’s medium-term FCF margin. If we assume that the corporate was already optimized for FCF margin and that the margin remained regular for ten years, we are able to estimate the income progress price required for MOD inventory to be pretty valued utilizing a reverse discounted money movement mannequin. I need to stress that this isn’t an correct measure of intrinsic worth, simply an estimate of what could be required below extra optimum profitability.

If FCF margin have been already 13%, given its twelve-month income run price of $2,646 million in income, Modine could be producing $344 million in FCF and solely must develop income at a 6.8% CAGR to be buying and selling at its estimated intrinsic worth. If Modine have been optimized for 10.0% FCF margins, the required income progress price could be 12.1% yearly, and at 7.0% FCF margin, Modine must develop revenues at a 19.2% CAGR. Every mannequin makes use of a 12.0% low cost price and three% terminal progress price.

I must explicitly state that this mannequin makes assumptions that would look ridiculous in both route sooner or later, and needs to be thought-about a device to judge the potential valuation of Modine below optimum profitability that has but to be attained.

3-Situation Optimized Reverse DCF – Modine (MOD) (Writer-Generated Reverse DCF)

Combining the 2 fashions used factors to, Modine as a possible market-beating performer within the coming years. As a result of I imagine margins will proceed increasing dramatically within the coming years and income will develop from right here, I believe the potential lies someplace between the standard reverse DCF mannequin used and the 3-scenario optimized without spending a dime money movement reverse DCF mannequin I created.

Given the growth of margins that Modine is seeing with the explosion in information heart cooling gross sales, it appears cheap to imagine margins proceed to increase. The query is, how broad can they increase? Which will rely upon Modine’s potential to create or preserve a moat.

Modine’s Moat

My willingness to place religion into the long-term funding thesis for Modine depends on the corporate’s potential to create a moat. In MOD’s case, aggressive benefits may come from giant buyer relationships, patented know-how, and switching prices. MOD is experiencing fast progress from its superior cooling division, led by unbelievable progress in its information heart cooling enterprise and bolstered by the acquisition of SSM.

It is exhausting to find out if Modine truly has the potential to develop a moat in liquid cooling. I do not suppose this can be a winner-take-all business, however it’s essential to find out if MOD has the potential to not less than acquire and preserve a number one place within the superior cooling market.

The market has a number of key gamers, reminiscent of LiquidStack (with investments from TT) and Vertiv, in addition to a bunch of different rivals, a few of whom lack the superior capabilities of these talked about above. The market can also be experiencing large capital inflows from large tech. This bodes effectively for the liquid cooling business and Modine, however it additionally may invite elevated competitors. Due to this, it is vital for Modine to carry some sort of moat to keep up its main place out there.

To me, a moat is such a powerful aggressive benefit that it may be sustained over time, even when attacked by different corporations. The sources of aggressive benefits for Modine may come from the quantity of R&D required to enter the liquid cooling market. This might restrict entry into the house for brand spanking new rivals and discourage bigger, diversified HVAC/R corporations from getting straight concerned within the course of. One other aggressive benefit may come from relationships with information heart suppliers or one or two hyperscale corporations actively spending large quantities of cash to construct their information heart capabilities. Switching from one cooling supplier to a different might require steep switching prices in the best way of expense and downtime.

Conclusion and Dangers

I imagine Modine has sturdy aggressive benefits in all the types cited above, however I must study extra about how sustainable this can be. That is what prompted me to take a starter place within the firm following its latest pullback beneath $100 per share.

The dangers to my thesis are that the information heart cooling market lacks sustainable progress if high-performance computing functions fail to ship satisfactory returns on funding for hyperscalers. Nonetheless, it seems that these investments are being made and won’t decelerate for a number of years. As soon as these investments are in place, I imagine Modine’s progress inflection can have taken place.

I perceive the chance that MOD’s inventory value may pull again additional as market sentiment might bitter from right here, particularly contemplating the slowing of progress charges seen in Nvidia (NVDA) and the belief that generative AI shares aren’t going to develop linearly.

Nonetheless, after digging deeper into MOD’s funding thesis, I see higher potential for the corporate to proceed increasing margins and rising free money movement, and I imagine the market might not absolutely notice this potential proper now. I price the inventory a purchase for long-term investing methods and would contemplate upgrading to a powerful purchase if the share value falls additional with out my funding thesis being compromised.