MarineMax Inventory: Staying The Course Regardless of Turbulent Waters (NYSE:HZO)

Thomas Barwick/DigitalVision through Getty Pictures

Through the years, I’ve discovered that persistence is extremely necessary with regards to investing. That is very true throughout tough instances. Not often are you able to count on to generate robust upside instantly after shopping for shares of a enterprise. However throughout the time through which subpar efficiency reigns supreme, the psychological toll that it will probably take will be tough to take care of. A great instance of a agency that has woefully underperformed my expectations however that I nonetheless really feel very bullish about is MarineMax (NYSE:HZO).

For these not acquainted with the corporate, administration claims that MarineMax is the most important leisure boat and yacht retailer on the planet. As of the top of its 2023 fiscal 12 months, the enterprise had 130 areas globally, together with 81 retail dealership areas. It additionally owns and operates 66 Marina and storage areas. Again in March of final 12 months, I discovered myself drawn to the enterprise. Due to how low-cost the inventory was, I ended up score it a ‘robust purchase’ to mirror my view that buyers ought to count on shares to outperform the broader marketplace for the foreseeable future. However the precise reverse has to date occurred. Shares are literally down 8.4% since then, which is much worse than the 33.8% rise seen by the S&P 500 over the identical window of time.

Digging into the image, we are able to see that administration has continued to extend income throughout a tough atmosphere. Having stated that, this has come at a reasonably hefty value of considerably lowered margins. Within the close to time period, it is doubtless this development will proceed. However even with the ache that the corporate has skilled, shares look very enticing, each on an absolute foundation and relative to comparable enterprises. As a consequence of this, and regardless of underperformance, I’ve determined to maintain the agency rated a ‘robust purchase’ for now.

Rising gross sales, falling earnings

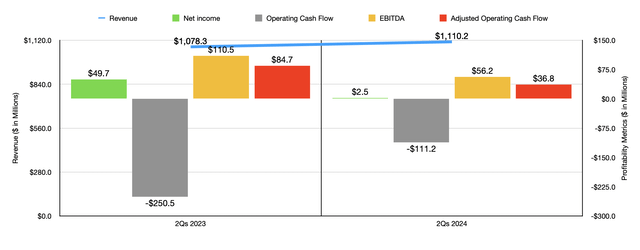

From a share worth perspective, issues haven’t been notably nice for MarineMax or its buyers. However the precise basic knowledge itself has been a real blended bag. Contemplate, as an illustration, monetary outcomes protecting the first half of the 2024 fiscal 12 months in comparison with the identical time of 2023. Regardless that administration acknowledged that the present marketplace for leisure boats is tough, income managed to climb from $1.07 billion final 12 months to $1.11 billion this 12 months. This improve of about 3% was made potential due to a 3% rise in comparable retailer gross sales. Administration attributed that largely from new and used boat income versus different issues like companies. Nonetheless, the corporate did profit to the tune of $0.4 million from acquisitions that it has made throughout this timeframe.

Creator – SEC EDGAR Knowledge

Whereas it is all the time nice to see income improve, this has dedicated a reasonably steep value. The enterprise went from $49.7 million in internet earnings within the first half of 2023 to solely $2.5 million in earnings the identical time this 12 months. This was pushed by a number of components. The agency’s gross revenue, as an illustration, fell by $21.9 million, with the gross revenue margin contracting from 36% to 33% in response to decrease new and used boat margins as the corporate ‘aggressively’ drove gross sales in what administration described as a ‘softer retail atmosphere’. However this wasn’t all. Promoting, normal, and administrative prices, jumped by $29.6 million, largely attributable to inflationary pressures and the aforementioned acquisitions. Add on high of this that greater rates of interest and better debt balances pushed curiosity expense up by $14.9 million, and it is simple to see on the backside line for the corporate has been painful.

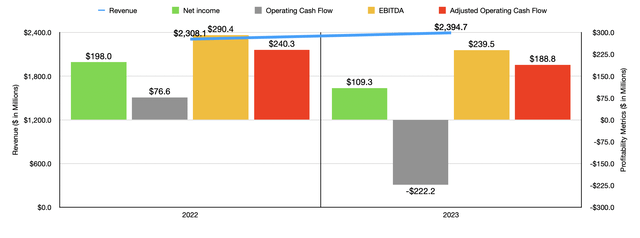

Creator – SEC EDGAR Knowledge

Different profitability metrics have adopted a really comparable path. Working money stream was the one exception. It went from detrimental $250.5 million to detrimental $111.2 million. But when we alter for adjustments in working capital, we’d get a decline from $84.7 million to $36.8 million. In the meantime, EBITDA for the enterprise was lower by practically half from $110.5 million to $56.2 million. Within the chart above, you may also see monetary outcomes for 2023 relative to 2022. As soon as once more, we see a rise in income, however a decline in earnings and money flows. With outcomes like these, it is no marvel the market has been cautious.

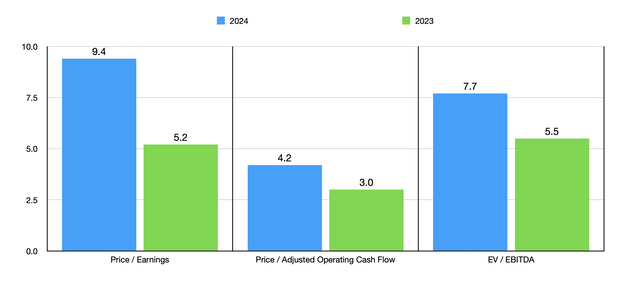

Even with this draw back, shares look attractively priced. For this present fiscal 12 months, administration expects earnings per share of between $2.20 and $3.20. That could be a fairly important revision from preliminary steering of between $3.20 and $3.70. Besides, that ought to translate to internet earnings of about $60.2 million. Along with this, EBITDA is forecasted to be between $155 million and $190 million. That is additionally decrease than the preliminary steering of $190 million to $215 million. If we use the midpoint of steering offered by administration, this could translate to adjusted working money stream of about $136 million.

Creator – SEC EDGAR Knowledge

Utilizing these figures, I valued the corporate as illustrated within the chart above. The corporate went from wanting extremely low-cost to only low-cost. Besides, these buying and selling multiples are extremely interesting in this type of atmosphere. Along with being low-cost on an absolute foundation, shares are additionally low-cost relative to the shares of different comparable firms. Within the desk beneath, I in contrast MarineMax to 5 comparable companies. On a worth to earnings foundation, solely one of many 5 firms was cheaper than it. On a worth to working money stream foundation, our prospect ended up being the most cost effective. Solely once we use the EV to EBITDA strategy does the enjoying area even to some extent, with three of the 5 firms being cheaper than it on this foundation.

| Firm | Worth / Earnings | Worth / Working Money Move | EV / EBITDA |

| MarineMax | 9.4 | 4.2 | 7.7 |

| Brunswick (BC) | 15.2 | 9.5 | 8.7 |

| MasterCraft Boat Holdings (MCFT) | 6.1 | 4.7 | 3.2 |

| Marine Merchandise Company (MPX) | 12.1 | 9.0 | 8.1 |

| Malibuu Boats (MBUU) | 13.9 | 6.1 | 7.2 |

| BRP Group (DOOO) | 9.8 | 4.4 | 6.0 |

After I see basic efficiency worsen, I all the time ask myself what the trigger is. On this case, we have now maybe the most effective type of deterioration. I say this as a result of administration is making a acutely aware choice to try to maintain gross sales elevated. On the finish of the day, all this implies is that margins are compressing due to weak trade circumstances. Industries undergo booms and busts. And proper now appears to be a bust. The excellent news is that that is unlikely to final perpetually. I say this as a result of, in line with the Nationwide Marine Producers Affiliation, which represents about 85% of the leisure boat, marine engine, and accent producers within the US, an estimated 85 million People go boating annually.

Such a big market is certain to proceed rising as inhabitants grows. However this doesn’t suggest that the image will clear up shortly. Final 12 months, as an illustration, the variety of energy boats offered on the retail stage got here in at 258,000. This 12 months, we’re anticipated to see an analogous quantity. This weak point, which might be down as a lot as 3% from the prior 12 months, is being pushed largely by the influence of excessive rates of interest and a decrease stage of shopper confidence. However in all honesty, I do not imagine that we’d like a swift restoration to justify a bullish outlook. As I discussed already, shares of the corporate are attractively priced. Even administration thinks so. In March of this 12 months, as an illustration, the corporate introduced a $100 million share buyback program to interchange the prior authorization that the corporate had. Though I sometimes want investments in development initiatives and I imagine that there may very well be some enticing belongings given how weak the present atmosphere is, shopping for again inventory at such low ranges seems logical.

Takeaway

From all that I can inform, MarineMax goes by a little bit of a hunch. Even so, it is spectacular that administration has been profitable in maintaining income climbing, even when solely modestly. Sooner or later, circumstances will enhance. And when that does happen, the upside for shareholders may very well be fairly robust. Given this line of pondering, I’ve no downside maintaining the corporate rated a ‘robust purchase’ proper now.