Marathon Petroleum: Pullback Creates Alternative Given Share Repurchases

MichaelRLopez/iStock Editorial through Getty Pictures

Whereas shares of Marathon Petroleum (NYSE:MPC) are up considerably over the previous 12 months, they’ve been a poor performer over the previous few months, dropping about 25% from their 52-week excessive, as issues have constructed over the well being of the refining cycle. I final lined MPC in March, downgrading shares from a “robust purchase” to a “purchase.” Whereas shares did briefly rally to my $216 goal, in hindsight, I didn’t downgrade shares strongly sufficient as they’ve fallen by 15%. Given this underperformance and with issues round refiners swirling, now’s an opportune time to revisit MPC. I view this pullback as a possibility.

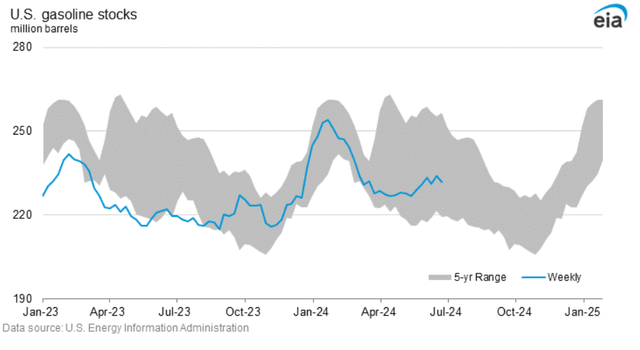

A lot of the strain on shares in latest weeks has come from the softening crack unfold surroundings. As you’ll be able to see beneath, benchmark 321 crack spreads are all the way down to about $25 from $29 three months in the past. As a reminder, this measures how a lot refiners make by turning a barrel of crude oil into gasoline and diesel. This narrowing of the unfold will, all else equal, scale back refiner profitability.

Power Inventory Channel

Now, taking a step again, I believe you will need to keep in mind that $25 continues to be a strong degree for refining margins. Certainly in my prior article, I discussed my view of crack spreads being round $25 this 12 months and within the long-term being within the upper-end of my $15-25 view, quite than the $10-20 seen earlier than COVID. Crack spreads might be very unstable, and that’s the reason I’ve tried to anchor my valuation round MPC based mostly on a long-term normalized degree, which I view as being within the low $20’s.

Power Inventory Channel

Because the chart above reveals, Russia’s invasion of Ukraine prompted a surge in spreads as product markets dislocated and diesel went right into a scarcity. Refiners like MPC made file earnings, enabling huge share repurchases, however this degree of profitability was by no means more likely to be sustained. Certainly, it hasn’t been. With shares buying and selling at mid-single-digit multiples again then, the inventory was by no means pricing in that these earnings ranges could be sustained, which is why shares have generated robust returns over the previous a number of years.

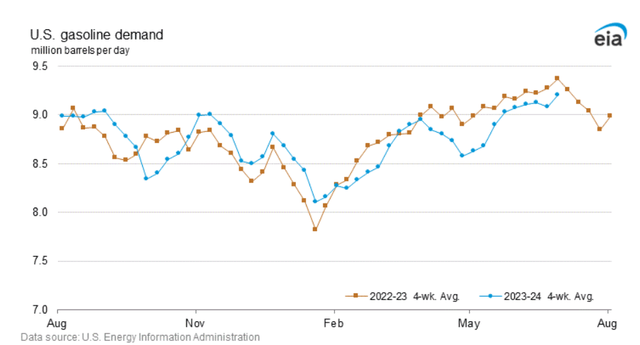

In different phrases, the present degree of crack spreads is in keeping with my expectations, however short-term motion in crack spreads may cause motion in refinery shares, particularly as traders fear that the deterioration can proceed. The first supply of concern is that gasoline inventories are greater than a month in the past. Gasoline inventories are inclined to fall from April by means of September, given the summer season driving season.

That has not been the case this 12 months, which has elevated worries that product demand is softening, resulting in looser stock circumstances and wider spreads. I’d be aware although that whereas inventories have picked up a bit, they do nonetheless stay on the low-end of the five-year vary, a five-year interval that has been fairly good for the refiners.

A cause for that is that the summer season driving season obtained off to a gradual begin. In Could, gasoline demand was working 3-4% beneath final 12 months’s degree. Since then, it has rebounded to inside about 1% of final 12 months’s degree. Components of California had 3-4x as a lot rain as regular earlier this 12 months, which can have diminished driving. The very fact it’s rebounding means that we aren’t seeing the financial system roll over however simply noticed a interval of transitory weak point.

With driving exercise having rebounded considerably, I’m much less involved about persistently sluggish demand or a spiral greater in inventories, and a resilient demand aspect ought to assist to restrict additional strain on crack spreads. Furthermore, we at the moment are coming into the time of 12 months once we can see supply-side disruptions, which can assist to tighten the market.

Whereas Hurricane Beryl left power infrastructure largely unscathed, Goldman Sachs (GS) famous that an energetic hurricane season (as is forecast) might widen refining margins. The Gulf Coast is house to a lot of the US’s refining infrastructure, in addition to a lot our gasoline export capability. Insofar as hurricanes trigger outages, that might scale back refinery throughput, tightening product market provide and widening spreads.

Whereas there was a cyclical spook within the refining market, we could also be nearing an inflection level. Furthermore, this shouldn’t be sufficient to trigger long-term traders to look previous the favorable secular backdrop I’ve spoken about earlier than. The developed world will not be constructing new refineries; it has been over 40 years for the reason that US constructed a brand new giant refinery. Refining capability is more likely to be an growing bottleneck within the international power provide chain, which is why I view crack spreads as more likely to be persistently wider than pre-COVID.

Furthermore, we must always see MPC earnings speed up in Q2, and even Q1 outcomes weren’t that dangerous, contemplating the place shares are buying and selling right this moment. Within the firm’s first quarter, MPC earned $2.58, which was down from $6.09 final 12 months, given the normalization in crack spreads. As at all times, I consider it finest to worth MPC on a sum-of-the-parts foundation. Apart from its refining operations, MPC additionally has a ~65% stake in MPLX (MPLX). This stake is price simply over $28 billion or about $77 a share. Moreover, MPLX distributed about $550 million to MPC in Q1.

In its refining unit, Marathon’s EBITDA declined to $1.87 billion from $2.16 billion in This fall, primarily because of a $287 million decline within the West Coast. EBITDA was down by $2 billion from final 12 months’s $3.9 billion degree. There are a number of components at work right here. First, refining throughput was down 6% from a 12 months in the past, primarily because of a 15% drop within the West Coast.

Marathon did $648 million of turnaround work at its refineries in Q1, which diminished their working capability. In Q2, turnaround exercise ought to diminish to $200 million, as MPC did a disproportionate quantity of the work throughout the seasonally quieter Q1. Due to these turnarounds, crude capability utilization was 82% in Q1, and it ought to rise to 94% utilization in Q2. All else equal, extra barrels ought to enhance gross margin.

Moreover, refineries have substantial fastened prices. With turnarounds decreasing throughput, that fastened price is unfold throughout fewer barrels, additional tightening working margins. As a result of throughput will rise in Q2, it expects $4.95 in Q2 refining prices from $6.14 in Q1.

Lastly, in Q1, gross refining margins have been $18.99 a barrel, down from $26.15 final 12 months. Whereas crack spreads have narrowed from three months in the past, they’ve been greater throughout the second quarter than they have been within the first, which ought to widen the refining margin. Due to turnarounds, product combine, and hedges, MPC solely realized 92% of spreads in Q1, and we must also see some enchancment right here in Q2. Crack spreads have been a $974 million sequential tailwind in Q1, offset by $1.16 billion of product combine headwinds. We should always see materials enchancment right here in Q2.

We’re more likely to see MPC report a significant acceleration in Q2 outcomes, given extra throughput, wider gross margins, and decrease working prices. At present, analysts are trying for $4.73 in Q2 EPS. Whereas quarterly outcomes are arduous to foretell to a penny, I see upside to nearer to $5.00, relying on its tax price and the precise tempo of share repurchases, which decide the common quarterly share depend used to calculate EPS.

In Q1, MPC did $2.2 billion of share repurchases alongside $299 million of dividends. Moreover, $0.8 billion was repurchased in April. Alongside Q1 outcomes, MPC introduced a $5 billion buyback authorization for $8.8 billion whole. These repurchases have been very highly effective with its share depend down 19% over the previous 12 months. MPC additionally carries $7.2 billion of money and $6.8 billion of debt, excluding MPLX. I’d proceed to count on greater than 100% of free money move to be returned to shareholders given its extra money place.

Now, in fact any funding has dangers, and as now we have seen MPC shares might be unstable. There are a number of dangers I’d spotlight. First, practically half of its present worth from its $77 stake in MPLX shares. As MPLX shares transfer, the worth of this stake can change. MPLX has been a strong performer with a wholesome stability sheet and steady, fee-based money flows; I’ve written positively on it beforehand and am snug with its valuation.

I count on sentiment round refining spreads to maneuver shares far more than its MPLX stake, as evidenced by the actual fact MPLX shares have rallied barely since March at the same time as MPC has bought off. The most important threat could be a narrowing of crack spreads. Within the close to time period, if this hurricane season proves to be a lot calmer than anticipated, we might not see as many outages, which might make my name for a bottoming in crack spreads untimely and depart some strain on shares.

That mentioned, I’m centered much less on one quarter’s crack spreads than the longer-term development. The main threat is for my part that refining margins are more likely to be considerably greater structurally than pre-COVID. Now, both extra refining provide or much less demand for refined merchandise might weaken spreads. I’m much less involved on provide. Refineries take a number of years to construct, so we all know new capability is about to be restricted. Given the associated fee and regulatory surroundings, I battle to see a case for brand new refineries within the developed world being constructed. The provision aspect is more likely to keep constrained.

As such, I consider the most important threat is weaker demand. Now, if international gasoline and diesel demand begin to persistently fall, this might scale back spreads. I nonetheless view this as a really long-term threat given EM nations proceed to develop, and EV adoption has been considerably slower. The extra doubtless trigger over the subsequent two years could be a recession. Recessions usually scale back gas demand and crack spreads. As such, I’d proceed to intently monitor financial exercise. I view a recession as unlikely, particularly with the Fed seemingly inching in the direction of reducing charges. Nonetheless, if we have been to see one, I’d not count on MPC to carry out as effectively. General, I view these dangers as manageable.

Given the place shares commerce right this moment and its MPLX stake, its refining unit is being valued at $31 billion. In a $20-25 crack unfold surroundings, MPC has about $7.5-80 billion of free money move capability, so it’s buying and selling practically 4x free money move.

Together with its MPLX dividends, I consider MPC can sustainably return $10 billion in money to shareholders, and we are going to doubtless see it do extra because it spends down some money. That interprets to a 16% capital return yield, which I view as extraordinarily compelling, and with its share worth decrease, its buyback turn into much more accretive. Given the cyclicality and long-term push in the direction of renewables, I conservatively have valued MPC’s refining arm at simply 6x free money move or about $45 billion.

That results in a sum of the components valuation of $201, which nonetheless leaves shares with a 13% free money move yield. Moreover, over the subsequent twelve months, we must always see at the least 10% share depend discount, which might push honest worth previous $220. That factors to over 35% upside in MPC. This sell-off has created a possibility for long-term traders, with hurricanes additionally probably a near-term catalyst. As such, I’m upgrading shares to a “robust purchase” once more.