Macy’s: Margins And Go-Ahead Gross sales Progress Vital To Q2 Outcomes (NYSE:M)

ozgurdonmaz

Shares of Macy’s, Inc. (NYSE:M) have been a stable performer over the previous 12 months, rising 17%; nonetheless, they’ve been on a downward pattern over the previous two months as a proposed M&A transaction didn’t proceed and issues in regards to the client had been constructing. Shares, although, have recovered from a latest low following a robust retail gross sales report and favorable earnings from Walmart (WMT). This places shares in an fascinating place heading into the corporate’s quarterly earnings report on Wednesday, August 21st.

M&A proved to be a headwind

I final coated the corporate in Could, score shares a “purchase,” and since then, they’ve been a disappointment, shedding 11% even because the market has gained 4%. Given my goal worth of $24, this has been a significant underperformance vs. my expectations. I by no means considered an M&A transaction as seemingly, which is why I used to be not stunned to see Macy’s finish discussions with Arkhouse and Brigade Capital. My purchase score has been based mostly on Macy’s personal fundamentals, and my expectation for $500-$550 million of free money movement.

This can be a essential quarter to see if its turnaround stays on monitor, significantly given the choice to not additional pursue a buyout. Given the share worth efficiency, clearly some traders have been putting higher hope in a transaction than me, leading to there being extra “potential deal premium” shares than I anticipated, which made my purchase score too aggressive within the quick time period.

I had been involved in regards to the potential of Arkhouse/Brigade to finance a transaction, particularly on this elevated rate of interest atmosphere, which led me to view M&A chatter as extra of a distraction. In the end, that was Macy’s conclusion as nicely. Macy’s administration, by selecting to go it alone, is implicitly stating its confidence within the turnaround creating extra worth for shareholders. That leaves me optimistic we will see one other sturdy quarter, much like what was reported in Q1.

The efficiency of “remaining” Macy’s is essential

Analysts expect Macy’s to earn $0.30 within the second quarter. I’d observe that Macy’s has beat estimates for 4 straight years. Macy’s administration can also be more likely to be significantly motivated to ship sturdy outcomes to retain shareholder help after the M&A developments of final month. My expectation is for the corporate to ship a bit forward of consensus in consequence, which leaves me optimistic in regards to the shares’ near-term efficiency.

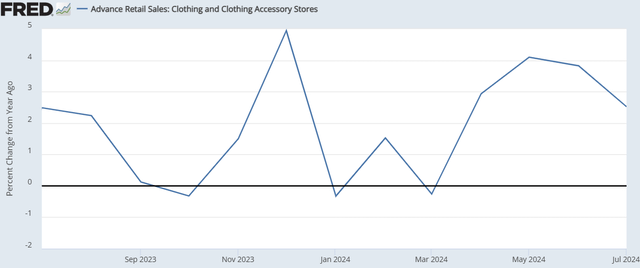

In Q1, Macy’s earned $0.27, with same-store gross sales down 0.3%. Nonetheless, “ongoing” shops noticed 0.1% gross sales progress, and I’m searching for a modest acceleration to ~0.5% right here. Macy’s is engaged in a multiyear transformation that has it closing 150 areas. We clearly wish to see as a lot gross sales as attainable throughout the platform, however as these areas close to their closure, their gross sales efficiency is much less vital. We’d fairly see sturdy gross sales in remaining shops than in closing ones, all else equal. YoY clothes gross sales progress accelerated a bit throughout Q2 vs. Q1, which ought to create a positive backdrop for Macy’s, all else equal.

That’s what we noticed final quarter with a 0.4% wedge, and if something I count on that hole to widen. Accelerating efficiency from remaining shops is essential to proving the corporate is extra sustainably on a rising gross sales trajectory. Moreover, in Q1, Macy’s “first 50” shops noticed 3.4% gross sales progress. These are the areas the place Macy’s is first rolling out its new ideas and flooring plan.

That preliminary efficiency was extraordinarily encouraging and a validation of administration’s efforts. We’ll wish to see an analogous 3+% tempo of progress from these shops in Q2. Moreover, its BlueMercury model stays a standout, and gross sales grew by 4.3% final quarter. Whilst Macy’s malls have struggled, BlueMercury has been a constant supply of gross sales progress. I count on that to proceed.

If there was a disappointment three months in the past, it was that Macy’s did extra discounting in Q1, which led to a 80bp contraction in gross margins to 39.2%. Macy’s blamed this on the climate and had expressed confidence in margin enchancment given higher attire merchandise on cabinets. You will need to see that margins are a minimum of secure in Q2 to validate that the corporate has not needed to depend on elevated promotional exercise relative to Q1 to help gross sales.

Final quarter, stock rose 1.7% to $4.7 billion. Macy’s has introduced down stock significantly from post-COVID highs, and I’d now count on stock to extra carefully monitor gross sales exercise. I count on inventories to rise by 0-2% this quarter. A bigger improve than that will be disappointing and be a possible warning signal that product is shifting extra slowly.

Lastly, final quarter bank card income fell by 28% from final 12 months to $117 million as delinquencies and credit score prices have risen, sustaining broader trade developments. Whereas I count on YoY declines to proceed, I search for income developments to stabilize sequentially as delinquency momentum has improved, based mostly on most financial institution earnings reviews.

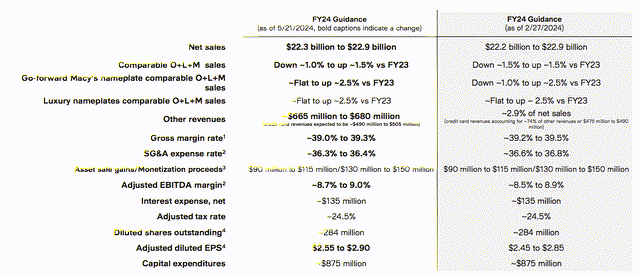

Alongside Q1 earnings, administration up to date steering, typically elevating the low-end of gross sales expectations whereas additionally decreasing margin expectations a bit. I’m searching for an analogous method this quarter. If Macy’s can proceed to point out momentum in its first 50 shops, there needs to be the potential to tighten steering. Given how a lot of the corporate’s earnings energy happens in This fall, and with macroeconomic uncertainty, I don’t count on wholesale modifications. Nonetheless, I see the potential to lift the low-end of income steering by about $100 million whereas additionally holding margins flat.

The buyer outlook can be carefully watched

As I mentioned in Could, I’m snug with the general energy of the patron. Shoppers are now not “over-spending” on attire. Moreover, the labor market stays stable with unemployment low. Inflation additionally continues to reasonable, which is relieving some strain on disposable revenue. Whereas I’m not arguing for strong, 3+% consumption progress, that is an atmosphere the place client spending can proceed to rise modestly.

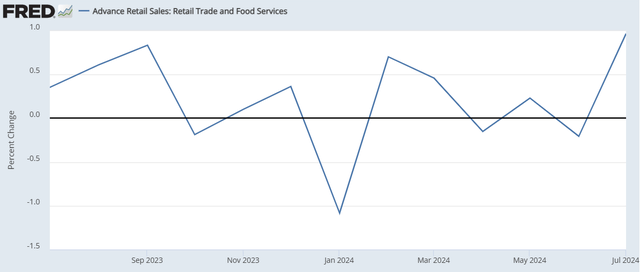

Certainly, final month, retail gross sales rose at their quickest tempo in over a 12 months, decreasing recession worries after a combined few months. Given how vital the vacation season is, administration commentary in regards to the go-forward state of the patron is especially vital. I count on Macy’s to speak a secure client atmosphere. Clearly, worth is top-of-mind after a number of years of inflation, however with a stable labor market, spending ought to proceed.

Conclusion

Macy’s has been executing nicely on its turnaround, and Q2 outcomes are an particularly essential second for administration to ship, given a buyout is now definitively off the desk. My expectation is that the corporate will do exactly that this quarter. If it delivers, I consider shares can reply positively because it has a virtually 11% free money movement yield. Given $500+ million of free money movement capability, administration might also start to debate a cloth buyback as a possible 2025 merchandise to help shares.

Given my view that this turnaround ought to depart Macy’s with 0-2% potential progress, I view an 8% free money movement yield as applicable. I nonetheless view $22-24 because the honest worth for the enterprise. Provided that M&A appeared to be lifting shares greater than I appreciated, I view $22 as a extra cheap worth goal. Nonetheless, I stay a purchaser, and I consider shares are seemingly nicely positioned into earnings due to a possible beat in addition to higher sentiment across the client.