JQC: The Fund’s Present Portfolio Positioning Seems Regarding (NYSE:JQC)

PM Photographs

The Nuveen Credit score Methods Revenue Fund (NYSE:JQC) is a closed-end fund, or CEF, that income-focused buyers should purchase as a technique of attaining their objective of incomes a excessive degree of present revenue from the belongings in their portfolios. The fund does pretty effectively on this respect, because it boasts a really enticing 11.47% yield on the present worth. This yield compares fairly effectively with most different funds that make use of an identical technique. That is proven right here:

|

Fund Identify |

Morningstar Classification |

Present Yield |

|

Nuveen Credit score Methods Revenue Fund |

Mounted Revenue-Taxable-Senior Loans |

11.47% |

|

Ares Dynamic Credit score Allocation Fund (ARDC) |

Mounted Revenue-Taxable-Senior Loans |

9.49% |

|

BlackRock Debt Methods Fund (DSU) |

Mounted Revenue-Taxable-Senior Loans |

10.81% |

|

abrdn Revenue Credit score Methods Fund (ACP) |

Mounted Revenue-Taxable-Senior Loans |

18.52% |

|

Blackstone Lengthy-Brief Credit score Revenue Fund (BGX) |

Mounted Revenue-Taxable-Senior Loans |

10.08% |

|

PIMCO Revenue Technique Fund II (PFN) |

Mounted Revenue-Taxable-Multi-Sector |

12.03% |

For the needs of establishing this peer comparability, I tried to give attention to these funds that dynamically allocate between fixed-rate and floating-rate debt securities. These funds are a greater comparability for the Nuveen Credit score Methods Revenue Fund than pure floating-rate funds. They’re additionally more likely to carry out a bit higher than pure floating-rate funds in a falling interest-rate surroundings, as most individuals imagine will quickly be carried out in the USA.

Nonetheless, as I’ve identified prior to now, any fund that invests in debt securities may not be the perfect holding when and if the Federal Reserve begins to cut back rates of interest. That is principally as a result of very actual risk that inflation will return within the occasion of a price minimize. Equities are usually higher at defending the buying energy of cash from inflation than fixed-income securities.

It is because of this that I’ve slowly begun decreasing my private publicity to debt-focused closed-end funds in favor of some higher fairness funds that we’ve mentioned on this column over the previous yr. In spite of everything, the Federal Reserve appears decided to cut back rates of interest someday in 2024 even when the inflation information doesn’t fully assist such a transfer. As well as, each of the most important presidential candidates are making marketing campaign guarantees that Federal Reserve officers have beforehand mentioned will result in inflation. Thus, it’s attainable that inflation shall be a really actual downside over the approaching years, and so a portfolio ought to steadiness revenue and buying energy preservation.

As common readers could keep in mind, we beforehand mentioned the Nuveen Credit score Methods Revenue Fund in early Could of final yr. The market surroundings in the present day is a bit completely different from the one which we noticed at the moment, a minimum of in the case of the debt markets. In Could, buyers have been usually accepting that rates of interest would stay at pretty excessive ranges for an prolonged time frame. Bond costs had declined for a lot of the first 4 months of the yr, whereas floating-rate securities have been fairly enticing to anybody who desired a excessive degree of present revenue. At present, the debt market is completely different, as everyone seems to be now satisfied that the Federal Reserve will minimize rates of interest in September. Over the previous month, we’ve seen the worth of fixed-rate debt devices soar whereas bond yields have declined. As such, we’d anticipate that the Nuveen Credit score Methods Revenue Fund has delivered a reasonably robust efficiency since our final dialogue.

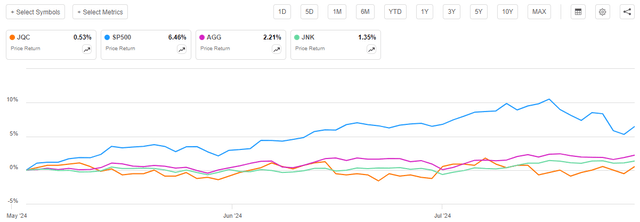

Nonetheless, this isn’t the case, because the fund’s share worth has solely risen by 0.53% for the reason that earlier article was revealed:

Looking for Alpha

As we are able to clearly see, the fund’s share efficiency was fairly a bit worse than both the home investment-grade bond index (AGG) or the home junk bond index (JNK). It additionally considerably underperformed the S&P 500 Index (SP500), however we don’t usually anticipate a debt fund to outperform widespread shares for any vital size of time. Briefly, although, this fund’s efficiency over the past three months definitely seems fairly disappointing.

Nonetheless, as I identified in my final article on this fund:

A easy have a look at a closed-end fund’s worth efficiency doesn’t essentially present an correct image of how buyers within the fund did throughout a given interval. It’s because these funds are likely to pay out all of their internet funding earnings to the shareholders, reasonably than counting on the capital appreciation of their share worth to supply a return. That is the explanation why the yields of those funds are usually a lot greater than the yield of index funds or most different market belongings.

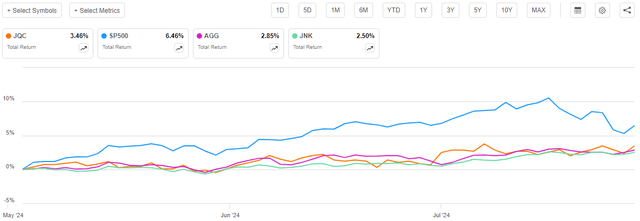

Once we embody all of the distributions that have been paid out by the Nuveen Credit score Methods Revenue Fund in addition to the indices over the roughly three-month interval in query, we get this different chart:

Looking for Alpha

This definitely makes the Nuveen Credit score Methods Revenue Fund look a bit higher than the share worth efficiency chart advised. The truth that the fund has such a excessive yield saved it, because the distributions have been adequate to elevate the fund’s whole return above that of the 2 bond indices. As soon as once more, its efficiency did lag the S&P 500 Index, however that’s to be anticipated as a result of nature of the belongings through which this fund invests. General, it seems as if the fund’s efficiency was in all probability adequate to fulfill income-focused buyers who’re all for a debt fund. Buyers for whom maximizing returns is a core focus ought to in all probability follow equities, nonetheless.

As the general market surroundings has modified for each fixed-rate and floating-rate debt going ahead, it’s a good time to revisit Nuveen Credit score Methods Revenue Fund and see what adjustments should be made to our thesis.

About The Fund

Based on the fund’s web site, the Nuveen Credit score Methods Revenue Fund has the first goal of offering its buyers with a really excessive degree of present revenue. This makes lots of sense given the fund’s technique, which is defined intimately on the web site:

The Fund’s main funding goal is excessive present revenue; and its secondary goal is whole return.

The Fund primarily invests in senior loans, excessive yield company debt, and collateralized mortgage obligation debt. The Fund could make investments with out limitation in devices rated under funding grade however not more than 30% in investments rated CCC/Caa or decrease on the time of funding (or unrated however judged to be of comparable high quality). The Fund could make investments as much as 25% of its Managed Property in collateralized mortgage obligation debt securities. The Fund makes use of leverage.

This quote states that the Nuveen Credit score Methods Revenue Fund can put money into each leveraged loans and junk bonds. As I identified in a earlier article, leveraged mortgage costs are usually virtually completely flat in most market circumstances:

As we are able to see, the floating price word index has been virtually completely flat over the trailing ten-year interval. That is despite the very fact that there have been some adjustments in rates of interest through the interval. Specifically, the Federal Reserve tried to boost the federal funds price in 2018 and once more in 2022. The Federal Reserve additionally minimize rates of interest severely in 2020 in an effort to assist the economic system by means of the COVID-19 lockdowns that put many individuals into unemployment and shut down nearly all of small companies in the USA. None of those rate of interest adjustments had any impact on the worth of floating-rate debt securities, as we are able to clearly see from the truth that the worth chart of the asset class is nearly completely flat over the interval.

As the worth of leveraged loans and different floating-rate securities tends to be very steady, the one return that they actually present to buyers is their coupon funds, which function present revenue.

Within the case of junk bonds, in addition they present all of their internet funding returns within the type of coupon funds. They’ll transfer in worth earlier than maturity, although, so it’s attainable to acquire capital positive factors from them.

Briefly, primarily based on these asset lessons and their return profiles, the first and secondary targets of the Nuveen Credit score Methods Revenue Fund make lots of sense.

The final time that we mentioned the fund, we noticed that it had nearly all of its belongings invested in senior loans. That is nonetheless the case, and it seems that the fund may be rising its publicity to those belongings. The fund’s third-quarter 2024 holdings report states that the fund was holding the next asset allocation as of April 30, 2024:

|

Asset Sort |

% of Property |

|

Variable Charge Senior Mortgage Pursuits |

80.3% |

|

Company Bonds |

20.8% |

|

Asset-Backed and Mortgage-Backed Securities |

3.9% |

|

Frequent Shares |

1.2% |

|

Warrants |

0.0% |

|

Cash Market Fund |

5.9% |

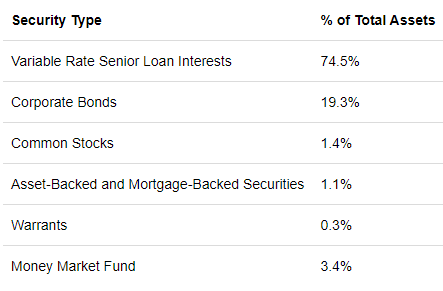

The asset allocation chart that we had within the earlier article confirmed the fund’s belongings as of January 31, 2024. Here’s a reprint of it for straightforward comparability to the above:

Creator’s Article Revealed on Looking for Alpha

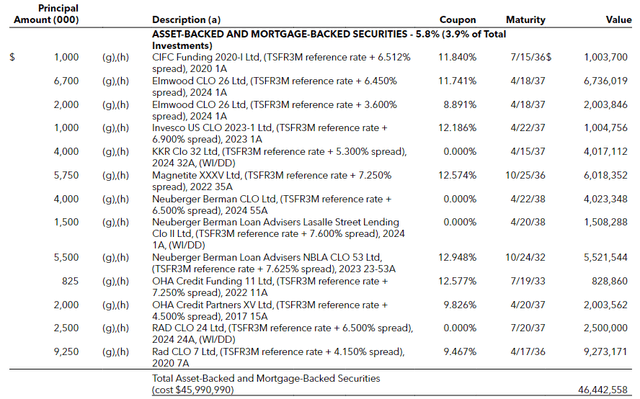

We will see that the fund’s allocation to variable price senior mortgage pursuits and asset-backed and mortgage-backed securities elevated pretty considerably in comparison with what the fund had again on the finish of January. This represents a reasonably substantial enhance within the proportion of floating-rate securities in its portfolio, which is partly as a result of the asset-backed and mortgage-backed securities consist fully of floating-rate belongings:

JQC Q3 2024 Holdings Report

This chart reveals all of the asset-backed and mortgage-backed securities that the fund was holding as of April 30, 2024. We will clearly see that they’re all floating-rate belongings as a result of all of them have a coupon price that’s TSFR3M (three-month secured in a single day financing price) plus some proportion. The coupon fee adjustments periodically to match no matter that math equation works out to. In a current article, I confirmed that the secured in a single day financing price sometimes strikes with the efficient federal funds price. Thus, when the federal funds price decreases, the three-month secured in a single day financing price can even lower (albeit a bit slower as a result of it’s utilizing the three-month common price). This may trigger the coupon funds made to the fund to lower if the Federal Reserve cuts rates of interest. The identical factor will occur with the variable price senior mortgage pursuits that represent nearly all of this fund’s holdings.

Thus, the fund’s revenue will decline when the Federal Reserve cuts rates of interest. The floating-rate securities is not going to ship capital positive factors to offset this. It’s only fixed-rate securities, such because the junk bonds that this fund holds, that may do this. Because of this it’s usually finest to carry floating-rate securities when rates of interest are rising and fixed-rate securities when charges are falling. This fund has been rising its allocation to floating-rate securities to date this yr, which is the other of what it must be doing given the dedication of the Federal Reserve’s officers to chop rates of interest.

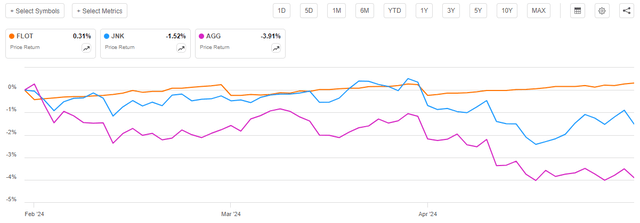

With that mentioned, the one data that we’ve out there to us concerning the fund’s portfolio adjustments corresponds to the interval extending from late January to late April 2024. Throughout that interval, it made lots of sense to unload fixed-rate bonds and purchase floating-rate securities. Check out the efficiency chart:

Looking for Alpha

We will see right here that floating-rate bonds held their worth simply advantageous over the three-month interval in query. That’s exactly what we’d anticipate given these securities’ common stability. In the meantime, each home investment-grade bonds and home junk bonds underperformed. Thus, the fund’s rising weight in direction of floating-rate belongings made sense throughout this era.

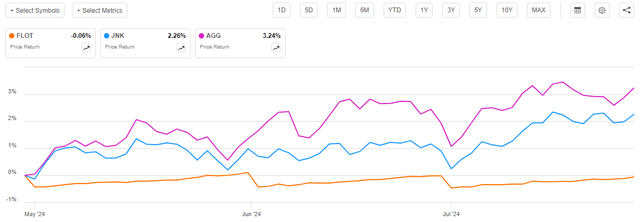

It’s, sadly, unsure if the fund’s administration has reversed course for the reason that finish of April. Right here is similar chart from April 30, 2024, till the current:

Looking for Alpha

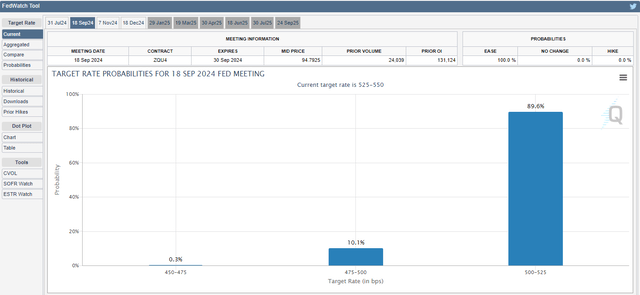

We will instantly see that the fund would have been finest served by promoting off the floating-rate belongings and shopping for fixed-rate bonds over the previous three months. That is principally as a consequence of buyers’ expectations of near-term rate of interest cuts. As of proper now, the market is totally sure that the Federal Reserve will minimize rates of interest in September:

Chicago Mercantile Trade

We will see right here that the market has assigned an 89.6% chance to a 25-basis level minimize on the September assembly and a ten.1% chance to a 50-basis level minimize on the September assembly. This appears exceptionally optimistic given the potential political ramifications of chopping so near the presidential election (see right here), nevertheless it does appear virtually sure that there shall be a minimum of one rate of interest minimize by the top of the yr.

Thus, we would like this fund to be doing precisely the other concerning portfolio place because it was doing over the January 31, 2024, to April 30, 2024, interval. We is not going to know for certain if the fund did this till it releases its annual report in September, and the September launch date of its annual report will in all probability be after the Federal Reserve’s assembly on September 18. This creates some timing dangers for buyers, as we’re unsure whether or not the fund is taking the suitable steps to place itself for no matter our particular person expectations could also be for the September assembly.

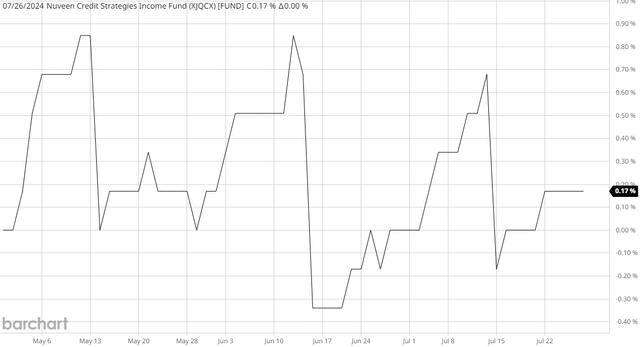

With that mentioned, the fund’s internet asset worth has been principally flat since April 30, 2024:

Barchart

As we are able to see, the fund’s internet asset worth has appreciated by 0.17% since April 30, 2024. This implies that it’s in all probability persevering with to carry a portfolio that consists primarily of floating-rate securities. This principally signifies that the fund has paid out any capital positive factors that it managed to earn over this era, together with all of its funding revenue. That appears unlikely to be true if the fund benefited a lot from the appreciation in bond costs that occurred throughout this era. It doesn’t essentially imply that the fund has not been repositioning itself for a interval of falling rates of interest, nevertheless it in all probability signifies that the portfolio remains to be very closely weighted to floating-rate securities.

Thus, it’s tough to find out, however the fund could have the incorrect positioning for the present market surroundings.

Leverage

As is the case with most closed-end funds, the Nuveen Credit score Methods Revenue Fund employs leverage as a technique of boosting the efficient yield that it earns from the belongings in its portfolio. I defined how this works in my final article on this fund:

Briefly, the fund is borrowing cash and utilizing these borrowed funds to buy debt securities. So long as the yield of the bought securities is greater than the rate of interest that the fund has to pay on the borrowed cash then the technique works fairly effectively to spice up the efficient yield of the portfolio. This fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges. As such, this may normally be the case.

Nonetheless, it is very important remember that this technique is way much less efficient in the present day with borrowing charges at 6% than it was two years in the past when borrowing charges have been successfully 0%. It’s because the distinction between the borrowing price and the yield of the bought securities goes to be a lot lower than it was once.

Sadly, the usage of debt on this style is a double-edged sword as a result of leverage boosts each positive factors and losses. As such, we need to be sure that the fund shouldn’t be using an excessive amount of leverage as a result of that may expose us to an excessive amount of threat. I don’t usually wish to see a fund’s leverage exceed a 3rd as a proportion of its belongings because of this.

As of the time of writing, the Nuveen Credit score Methods Revenue Fund has leveraged belongings comprising 38.20% of its general portfolio. That is moderately in step with the 38.03% leverage that the fund had the final time that we mentioned it. This is smart since this fund’s internet asset worth has not modified very a lot, as we already noticed.

Nonetheless, this fund’s leverage is effectively above the one-third of belongings most degree that I ordinarily favor. As I acknowledged final time:

I’m not as involved about this fund’s leverage being over the one-third most as I’d be with an fairness closed-end fund. It’s because a lot of the belongings held by this fund are floating-rate securities and, as we’ve seen the market worth of floating-rate securities doesn’t range very a lot.

Thus, this fund’s belongings do not need the volatility that may ordinarily trigger a excessive degree of leverage to be a priority. Nonetheless, the fund’s leverage is considerably above that of its friends:

|

Fund Identify |

Leverage Ratio |

|

Nuveen Credit score Methods Revenue Fund |

38.20% |

|

Ares Dynamic Credit score Allocation Fund |

37.02% |

|

BlackRock Debt Methods Fund |

21.00% |

|

abrdn Revenue Credit score Methods Fund |

29.22% |

|

Blackstone Lengthy-Brief Credit score Revenue Fund |

31.83% |

|

PIMCO Revenue Technique Fund II |

16.09% |

(All figures from CEF Information.)

As we are able to clearly see, the leverage ratio of the Nuveen Credit score Methods Revenue Fund is sort of a bit greater than these different funds that make use of usually comparable methods. This may recommend that this fund’s leverage is greater than is fascinating. Hopefully, it could actually profit from falling rates of interest and earn some capital positive factors to get this down a bit, however given the obvious composition of its portfolio, this doesn’t appear possible.

Valuation

Shares of the Nuveen Credit score Methods Revenue Fund are at present buying and selling at a 4.24% low cost to internet asset worth. This isn’t practically as enticing because the 5.77% low cost that the shares have had on common over the previous yr. As such, it’d make sense to attend a number of days and see if a extra enticing worth is obtainable by the market.

Conclusion

In conclusion, the Nuveen Credit score Methods Revenue Fund is a debt-focused closed-end fund that focuses its efforts on investing in a mix of fixed-rate and floating-rate debt that varies relying on the circumstances out there. Whereas that is usually proposition, it seems that the fund may be transferring within the incorrect path given the robust risk that there shall be a discount in rates of interest someday within the second half of 2024.

Over the previous three months, fixed-rate bonds have outperformed floating-rate securities as buyers anticipated price cuts, however it’s not sure if the fund adjusted its portfolio to reap the benefits of this. The fund elevated its floating-rate publicity through the three-month interval that resulted in April, which was transfer on the time, however it’s unsure whether or not it has reversed course.