John Wiley: AI Initiatives Encouraging; Analysis Publishing Income Wants Restoration (WLY)

Deejpilot

Funding Thesis: I charge the inventory as a Maintain presently.

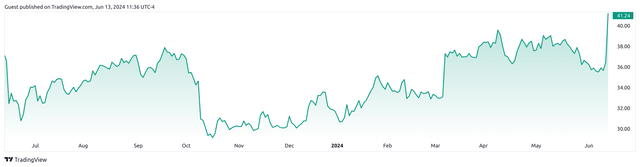

John Wiley & Sons (NYSE:WLY) – an American multinational publishing firm that’s well-known for its “For Dummies” titles – has seen a major rally to $41.24 on the time of writing.

With the corporate now seeing important curiosity from corporations to leverage its content material to coach AI and machine studying fashions together with the corporate having exceeded FY24 earnings steerage, this has resulted in a major increase to the inventory. The aim of this text is to find out the potential progress trajectory for the inventory from right here.

Efficiency

When taking a look at fourth quarter and full 12 months fiscal 2024 outcomes for John Wiley & Sons, adjusted income was up by 4% to $441 million from that of the prior 12 months quarter, whereas adjusted earnings per share was up by 2% to $1.21 over the identical interval.

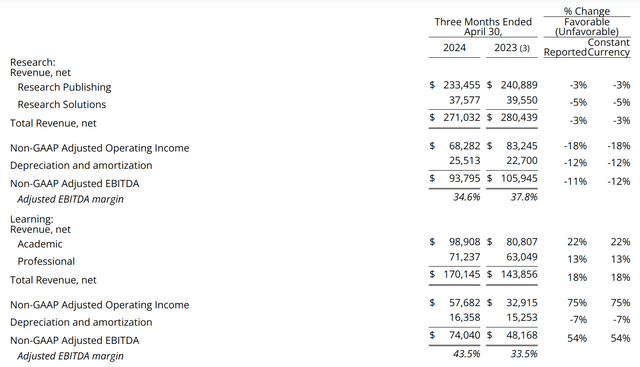

When analysing by phase, we are able to see that complete income for the Analysis phase was down by 3%, whereas that of Studying noticed progress of 18% over the identical interval.

Wiley Press Launch: Fourth Quarter and Fiscal 12 months 2024 Outcomes

The decline in income throughout the Analysis phase was all the way down to numerous what the corporate deems “uncommon challenges” this 12 months, together with timing points stemming from publication delays as a result of COVID, in addition to declines in ancillary print and licensing income. Nevertheless, the corporate additionally states that submissions had been up by 15% on a trailing 12-month foundation (excluding Hindawi) and output is accelerating. On this regard, I take the view that this phase exhibits important potential for restoration going ahead regardless of short-term challenges.

On the Studying phase facet, this phase noticed a return to progress and margin enlargement as a result of a number of beneficial components, together with sturdy progress in digital content material and courseware, progress in undergraduate enrollment in the USA for the primary time because the COVID pandemic, in addition to sturdy publishing demand an curiosity in leveraging the corporate’s studying content material to coach GenAI Massive Language Fashions.

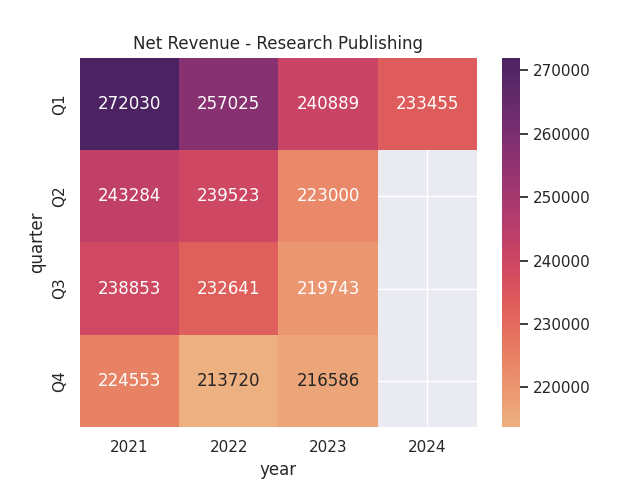

When it comes to web income by quarter for the analysis publishing phase, we are able to see that web income is down by simply over 3% from that of the prior 12 months quarter and has largely seen a downward pattern since Q1 2021.

Figures sourced from historic quarterly Press Releases for John Wiley & Sons. Heatmap generated by creator.

From a stability sheet standpoint, we are able to see that the corporate has seen a rise in its long-term debt to complete property ratio as in comparison with the prior 12 months quarter.

| Apr 23 | Apr 24 | |

| Lengthy-term debt | 743,292 | 767,096 |

| Whole property | 3,108,810 | 2,725,495 |

| Lengthy-term debt to complete property ratio | 23.91% | 28.15% |

Supply: Figures sourced from Wiley Press Launch: Fourth Quarter and Fiscal 12 months 2024 Outcomes. Lengthy-term debt to complete property ratio calculated by creator.

Moreover, money and money equivalents noticed a lower from $106.7 million to $83.2 million over the identical interval.

From this standpoint, we see that whereas web income throughout Analysis Publishing phase has come below strain and we’ve seen a rise in long-term debt – the inventory has in the end seen a spike on the premise of future progress prospects.

Wanting Ahead and Dangers

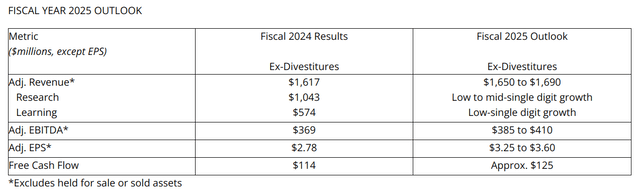

With Analysis Publishing being the most important phase by way of web income, John Wiley & Sons anticipates that this phase might drive progress in adjusted income for Fiscal 2025 – on the premise of progress throughout open entry and institutional fashions, in addition to new enterprise in Analysis Options, together with sturdy progress in digital courseware and assessments in Studying.

Wiley Press Launch: Fourth Quarter and Fiscal 12 months 2024 Outcomes

In my opinion, the truth that the corporate is teaming up with main know-how corporations to leverage its content material for synthetic intelligence is encouraging. What’s going to in the end decide whether or not this initiative is profitable is the diploma to which the corporate can efficiently combine this know-how into the Analysis Publishing facet of its enterprise.

For example, the corporate is at the moment trying to combine AI into its scholarly publishing options with the purpose of in the end bettering the creator expertise – resembling permitting editors to find acceptable peer reviewers, or permitting analysis authors to make use of AI for brainstorming functions, in addition to permitting peer reviewers to establish manuscript enhancements.

With 58% of instructors or college students already utilizing AI in classroom-based settings, the know-how holds important promise. One potential danger on this regard is the inherent scepticism that academia could place on AI as a know-how – given the necessity to shield in opposition to points resembling plagiarism and in the end uphold educational integrity in scholarly submissions – AI could create the potential for this to be abused.

From this standpoint, the corporate’s potential to supply AI-based options throughout its Analysis Publishing platforms must be balanced with safeguards to permit confidence in using these instruments within the educational world – Wiley is taking steps to stability these dangers with human intelligence and in the end use generative AI in an moral method. Whereas there are excessive hopes for Wiley’s use of AI – I take the view that we’ll in the end have to see proof of a rebound in web revenues throughout the Analysis Publishing phase to justify continued upside within the inventory over the longer-term.

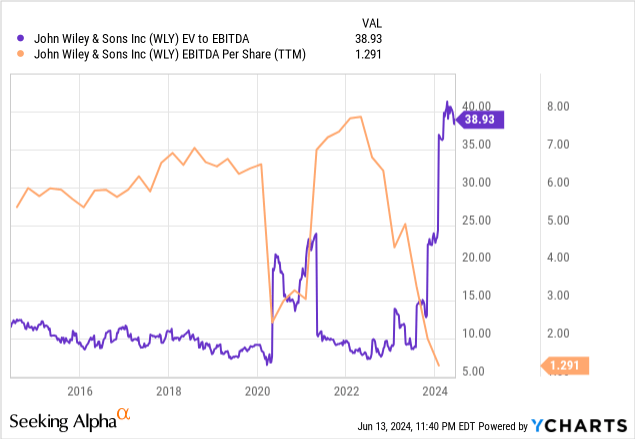

When trying on the firm’s long-term earnings pattern, we see that the corporate’s EV to EBITDA ratio is sort of at a 10-year excessive, whereas EBITDA per share is at a 10-year low.

ycharts.com

From this standpoint, whereas the corporate exhibits an optimistic outlook for earnings progress from right here – I in the end take the view that the latest progress we’ve seen within the inventory stays speculative at this level, and we might want to see proof of a rebound in earnings progress from right here to justify additional upside.

As regards the outlook for the publishing trade going ahead, one potential problem for the trade is that because the trade has turn into more and more digital – so has demand for open entry publishing applied sciences – which is broadly an initiative to make analysis supplies accessible to researchers without charge, with the purpose of encouraging additional analysis.

On condition that John Wiley & Sons works within the educational publishing sphere particularly, the corporate has additionally began to function within the Open Entry sphere by means of its providing of “Gold open entry”, whereby the creator pays a publication cost and features entry to a program of totally open entry journals. This methodology nonetheless faces competitors from Inexperienced open entry, whereby the creator can entry an article freely after an embargo interval of sometimes 6 to 24 months after the article has been revealed. Nevertheless, the drawback is that the creator doesn’t get to maintain copyright of their work and readers should wait earlier than having the ability to entry the ultimate model.

Given rising competitors between Gold and Inexperienced within the open entry area, we might see potential strain on income progress throughout this area going ahead.

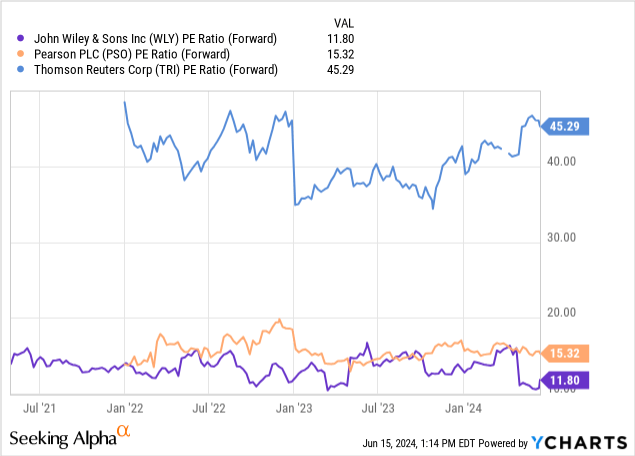

When evaluating the corporate’s ahead P/E ratio to that of rivals Pearson PLC (PSO) and Thomson Reuters Corp (TRI), we are able to see that the corporate is buying and selling at a decrease P/E ratio than its friends.

ycharts.com

This means that the corporate could also be extra attractively valued on an earnings foundation relative to its friends. Nevertheless, my view stays that we might want to see a major rebound in earnings progress to justify upside from right here.

Conclusion

To conclude, John Wiley & Sons has seen encouraging progress in its inventory value on account of the corporate’s AI initiatives. With that being stated, I take the view that the corporate now wants to indicate proof that it might probably in the end develop web income throughout the Analysis Publishing phase in addition to present a rebound in earnings. On this foundation, I charge the inventory as a Maintain presently.