Israel Aerospace prepared for IPO, awaits authorities approval, CEO says By Reuters

By Steven Scheer

JERUSALEM (Reuters) – State-run Israel Aerospace Industries is prepared for an preliminary public providing in Tel Aviv however awaits the go-ahead from the federal government, IAI chief government Boaz Levy mentioned on Sunday.

A ministerial privatisation committee in November 2020 had authorised a plan the place Israel might promote as much as 49% of IAI, the nation’s largest defence agency, on the Tel Aviv Inventory Alternate, bringing in billions of shekels.

“We’re transferring in the direction of an IPO,” Levy mentioned at an investor convention on the TASE. “Up to now yr our enterprise outcomes have continued IAI’s progress development. We’re at present experiencing phenomenal efficiency.”

He mentioned that in keeping with the federal government’s choice that has already been authorised, there will probably be an IPO of a minority stake in IAI as quickly because the finance and defence ministries “attain a choice that it’s time to do it.”

These ministries declined to remark.

Israeli media have reported that the necessity to attain understanding with IAI’s union, and weak point within the inventory market over the previous two years, had put the IPO on maintain.

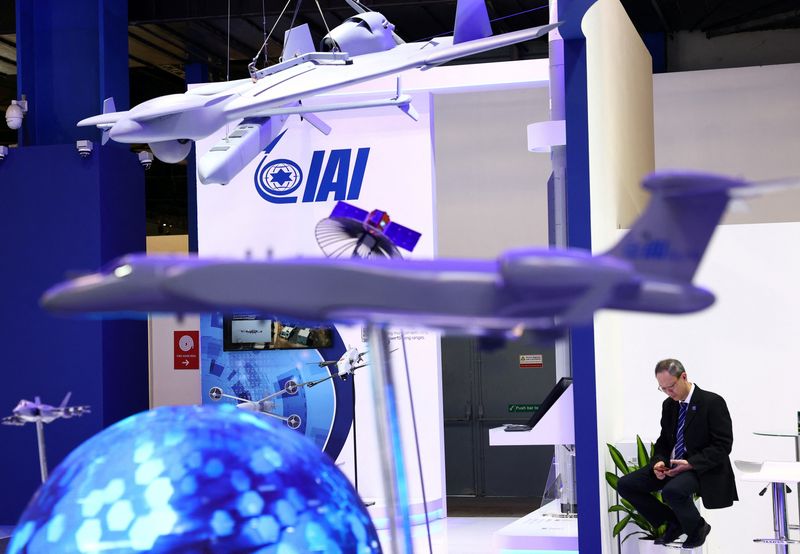

IAI produces defence and civilian merchandise together with plane, air and missile defence, unmanned aerial techniques (UAS), floor robotics, precision-guided weapons, munitions, satellites and techniques for area actions.

Over the primary 9 months of 2024, IAI posted report revenue of $416 million, up 74% on the yr.

Gross sales rose 13% to $4.4 billion amid an increase within the nation’s multi-front navy conflicts, whereas IAI’s backlog of orders grew by greater than $7 billion over the previous yr to $25 billion on the finish of September.

It has 156 million shekels ($43 million) value of bonds traded on the TASE.

In June, IAI paid a dividend of $155 million to Israel’s authorities.

($1 = 3.5995 shekels)