inventory sell-off after Fed charge lower is wholesome

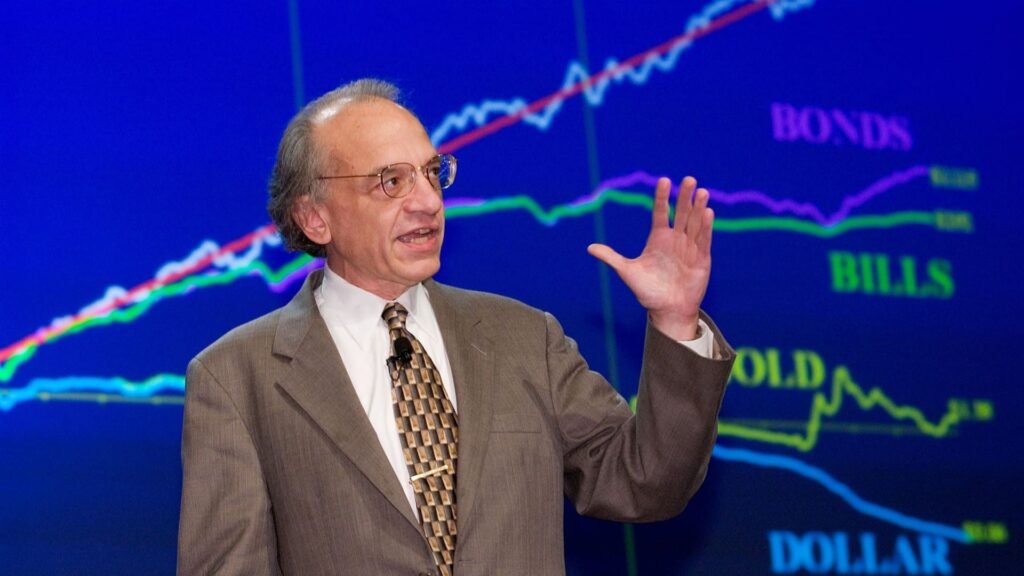

The inventory sell-off on Wall Avenue was “wholesome,” because the Federal Reserve’s cautionary projection on future charge cuts offers buyers a “actuality test,” in keeping with Jeremy Siegel, professor emeritus of finance at College of Pennsylvania’s Wharton College.

The U.S. Federal Reserve lower rates of interest by a quarter share level at its final assembly of the yr, taking its in a single day borrowing charge to a goal vary of 4.25% to 4.5%. In the meantime, the Federal Open Market Committee indicated it in all probability will solely decrease charges twice extra in 2025, fewer than the 4 cuts indicated in its September forecast.

All three main indexes on Wall Avenue sank in response to the revised Fed outlook, as buyers had been betting on the central financial institution to remain extra aggressive in decreasing borrowing prices.

“The market [had been] in nearly a runaway state of affairs… and this introduced them to actuality that we’re simply not going to get as low rates of interest” as buyers have been betting on when the Fed began its easing cycle, Siegel instructed CNBC’s “Squawk Field Asia.”

“The market was overly optimistic…so I’m not shocked on the sell-off,” Siegel stated, including that he expects the Fed to pare again the variety of charge cuts subsequent yr, with only one or two reductions.

There may be additionally “an opportunity of no lower” subsequent yr, he stated, because the FOMC raised its inflation forecast going ahead.

The brand new Fed’s projections present officers anticipate the non-public consumption expenditures worth index, excluding meals and vitality prices, or core PCE, to stay elevated at 2.5% by way of 2025, nonetheless considerably larger than the central financial institution’s 2% goal.

Siegel advised that some FOMC officers might have factored within the inflationary impacts from potential tariffs. President-elect Donald Trump has vowed to implement extra tariffs on China, Canada and Mexico on day one in all his presidency.

However the precise tariffs might not be “wherever as massive because the market fears,” Siegel stated, provided that Trump would probably look to keep away from any pushback from the inventory market.

Market individuals now anticipate the Fed to not lower charges till its June gathering, pricing in a 43.7% probability of a 25 basis-points lower at the moment, in keeping with the CME’s FedWatch device.

Marc Giannoni, Barclays chief U.S. economist, maintained the financial institution’s baseline projection of solely two 25-basis-point charge cuts by Fed subsequent yr, in March and June, whereas absolutely incorporating the consequences of tariff will increase.

Giannoni stated he expects the FOMC to renew incremental charge cuts round mid-2026, after tariff-led inflation pressures dissipate.

Information out earlier this week confirmed U.S. inflation rose at a sooner annual tempo in November, with the patron worth index displaying a 12-month inflation charge of two.7% after rising 0.3% on the month. Excluding risky meals and vitality costs, the core client worth index rose 3.3% on a year-on-year foundation in November.

“It’s a realization and a shock to everybody, together with the Fed, that given how excessive short-term charges have been relative to inflation, that the financial system can stay as sturdy as it’s,” Siegel added.

The Fed has entered a brand new section of financial coverage — the pause section, stated Jack McIntyre, portfolio supervisor at Brandywine International, including that “the longer it persists, the extra probably the markets must equally worth a charge hike versus a charge lower.”

“Coverage uncertainty will make for extra risky monetary markets in 2025,” he added.