IBM Checks Its 2013 All-Time-Excessive, FOMC Launch Wednesday, FedEx Stories This Week

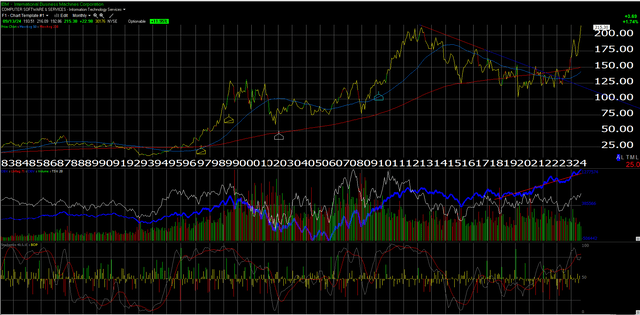

It’s a must to pull up the month-to-month chart of IBM (IBM) to see the collection of all-time highs put in place in April 2013 with the final all-time excessive being $215.90 in April 2013. The inventory traded above $215.90 at the moment, Friday, September thirteenth, 2024, however couldn’t shut above the all-time excessive from 12 years in the past, nevertheless it’s probably only a matter of time.

This weblog’s technician @GarySMorrow over at X has up to date on IBM’s progress within the final 24 months.

If you happen to return to the Eighties and evaluation IBM’s historical past, the inventory typically falls out of favor for 10-12 years, then breaks out, rallies sharply for a lot of years after which falls again into the backwater of long-term underperformance.

This weblog began following the inventory within the mid-Nineties after it dug itself out of the black gap that was Huge Iron’s downfall within the late Eighties, by the mid-Nineties when the server networks prevailed. Lou Gerstner obtained IBM going once more within the mid-Nineties, shopping for Lotus 1-2-3, after Microsoft’s (MSFT) Excel ran it over.

It’s nonetheless a small place, however IBM was added this week. I go away the technical evaluation to others, however a 12-year breakout and IBM’s historic efficiency after lengthy intervals of underperformance is price noting to readers.

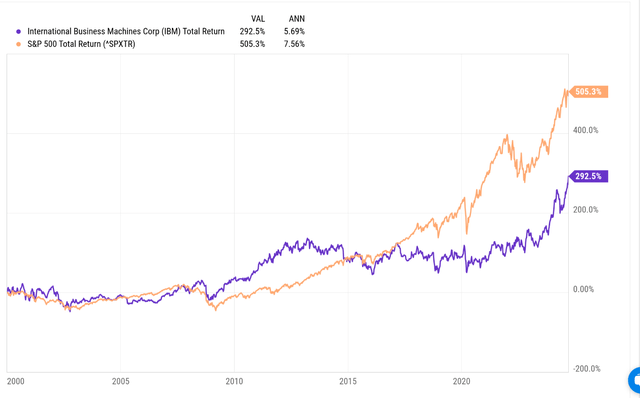

IBM vs. the S&P 500 (whole return): 2000 to 9.13.2024:

Efficiency chart supply: YCharts

S&P 500 knowledge

- The ahead 4-quarter estimate (FFQE) fell $0.80 this previous week to $259.80 from $260.60.

- The P/E on the ahead estimate is 21.6x vs. 20.75x as of final Friday.

- The S&P 500 earnings yield fell to three.62% from final week’s 4.82% and the beginning of the quarter’s 4.69%.

We’re within the “canine days” of the quarter when it comes to earnings revisions, so anticipate that the following 3 weeks are usually unfavourable, and the FFQE will probably tick decrease every week from right here.

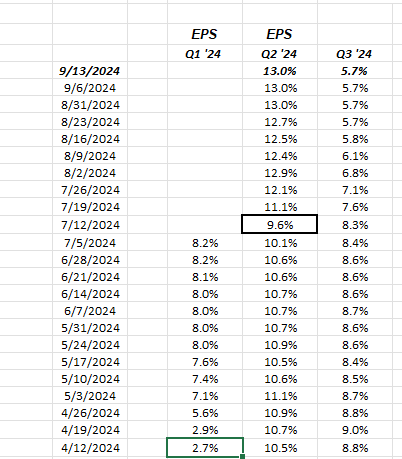

How does anticipated Q3 ’24 earnings look?

Supply: LSEG knowledge

This deserves an extended article however notice how the Q1 ’24 S&P 500 EPS development fee bottomed in early April ’24 after which the Q2 ’24 S&P 500 EPS development fee bottomed once more in early July ’24, so readers ought to moderately anticipate that Q3 ’24 S&P 500 EPS development will backside across the first 10 days of October ’24 after which work greater.

S&P 500 EPS anticipated development for Q3 ’24 will most likely be half of what we noticed in Q2 ’24 at the least because the early estimates look. Whereas Q2 ’24 EPS development is peaking close to 13%, anticipated Q3 ’24 EPS development will most likely be near 8-8.5%, given the traditional upside shock.

This weblog will do a protracted article on anticipated Q3 ’24 EPS and income for the S&P 500 in the direction of the top of this present quarter.

FedEx reviews this coming week

FedEx (FDX) reviews their fiscal Q1 ’25 after the closing bell subsequent Thursday, September 19, ’24. A separate earnings preview can be forthcoming on FDX, however I did need to notice for readers that the corporate is an AI beneficiary, and in addition is in the course of downsizing FedEx Specific, Floor, and Freight into one single FedEx reporting unit.

Raj Subramaniam – now CEO after Fred Smith has ascended to the Government Chairman place – has been fast to maneuver FedEx into some long-needed restructuring round FedEx Specific.

Extra to come back this week (that can for certain put you to sleep). Right here’s a few of this weblog’s earlier FedEx write-ups from final June ’24, right here and right here.

Abstract/conclusion

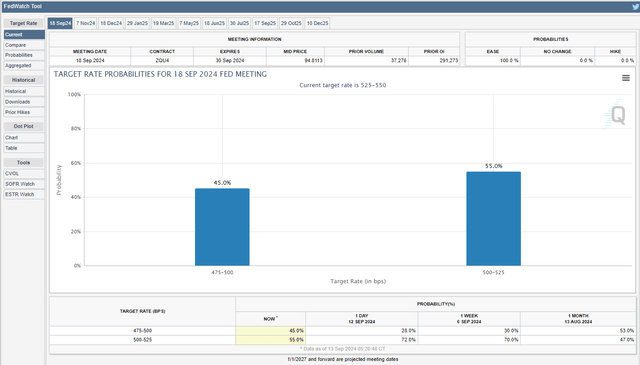

The Fed assembly this week will get all the eye, because the Chicago Merc’s fed funds futures web page reveals a 55% probability of a 25 bp fee minimize on Wednesday, however nonetheless a forty five% probability of a 50 bp minimize.

Personally, with GDP development at 3% within the 2nd quarter, and Atlanta Nowcast anticipating 2.5% GDP development for Q3 ’24, 50 bps appears a bit of a lot, until you think about the still-sizable bond positions within the regional banking system which might be nonetheless underwater and the $1 trillion curiosity price on US debt.

The weaker demand for the 30-year public sale on Thursday, September twelfth would possibly portend some curve steepening after Wednesday’s FOMC announcement.

None of that is recommendation, or a suggestion, however solely an opinion. Previous efficiency is not any assure of future outcomes. Investing can and does contain lack of principal, even for brief intervals of time. Readers ought to gauge their very own consolation with portfolio volatility and regulate accordingly.

Thanks for studying.

Editor’s Word: The abstract bullets for this text had been chosen by Searching for Alpha editors.