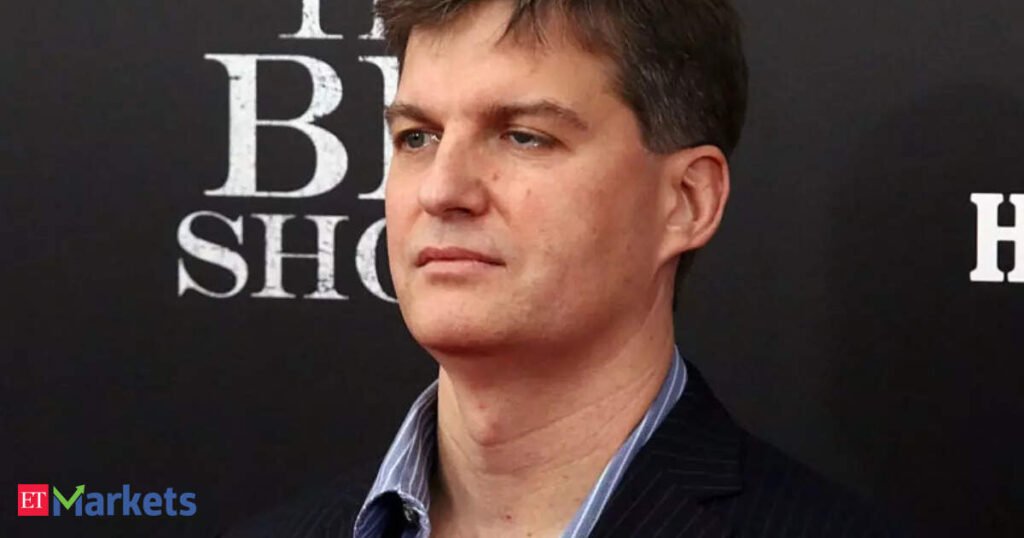

‘Huge Brief’ fame Michael Burry targets Tesla after slamming AI valuations

Burry estimated that Tesla dilutes its shareholders at about 3.6% per yr with no buybacks, and Musk’s record-breaking pay package deal will proceed the dilution.

“Tesla’s market capitalization is ridiculously overvalued at the moment and has been for an excellent very long time,” Burry wrote in his Substack e-newsletter ‘Cassandra Unchained‘ on Sunday.

The pay package deal may get the Tesla CEO as a lot as $1 trillion in inventory over the following decade, supplied Musk, already the world’s richest man, ensures the corporate achieves a sequence of milestones.

Tesla’s inventory traded round 209 instances its ahead earnings as of final shut, effectively above its personal five-year common of 94. The S&P 500, in the meantime, trades at round 22 instances its ahead earnings, based on information compiled by LSEG.

Tesla didn’t instantly reply to a Reuters request for remark.

The bearish view in opposition to Tesla shouldn’t be Burry’s first. Scion Asset Administration disclosed a big bearish wager by way of choices on Tesla in Could 2021.

He later informed CNBC in October 2021 that he was now not betting in opposition to the corporate and that his place was only a commerce.

Burry’s brief place in opposition to subprime mortgage securities through the housing market crash was chronicled in Michael Lewis’s e-book “The Huge Brief” and its movie adaptation.

Not too long ago, Burry has stepped up criticism of know-how heavyweights akin to Nvidia and Palantir Applied sciences, questioning the cloud infrastructure growth and accusing main suppliers of utilizing aggressive accounting to inflate income from their large {hardware} investments.

Burry launched ‘Cassandra Unchained’ in November, saying that the paid e-newsletter had his “full consideration” after he closed his hedge fund Scion Asset Administration and returned capital to buyers.