HEICO: A Nice Enterprise, However With A Valuation That is Up In The Clouds (NYSE:HEI)

Jetlinerimages

Introduction

HEICO Company (NYSE:HEI) (NYSE:HEI.A) has been the most effective performing shares over time, producing 20%+ CAGRs for long-term shareholders. The corporate operates within the aftermarket components and companies enterprise, specializing in aerospace and protection clients. Whereas the corporate has had a formidable monitor report of M&A, margin enlargement, and continues to a big runway in its finish markets, I view the valuation to be fairly overstretched on the present worth.

HEICO At A Look

HEICO is a producer of components and companies for the aerospace and protection trade. Based in 1957, the corporate has been in enterprise for over 65 years and has performed almost 100 acquisitions since 1990. Like TransDigm (TDG), a reputation I beforehand lined right here, the corporate focuses on each natural and inorganic development.

Investor Presentation

On the natural development facet, the corporate advantages from long-term, secular tailwinds within the aerospace and protection trade, the place the corporate generates excessive margins on service area of interest services and products inside protected markets. Which means that the corporate has excessive obstacles to entry and so the corporate has a aggressive moat the place its margins are protected.

For inorganic development, on account of inner development and acquisitions, the corporate’s web gross sales have grown from $26.2 million in FY’90 to $2.9 billion in FY’23, representing a compound annual development charge of roughly 15%. Usually, HEICO targets smaller deal sizes (tuck-ins) for companies and applied sciences that permit the corporate to broaden the full product choices that the corporate offers or get them into new geographic markets or achieve new clients. As a result of they aim excessive money producing, worthwhile firms whereas not overpaying, acquisitions have been a good way to deploy capital for HEICO.

Income Segmentation

HEICO segments its income into two segments: the Flight Help Group and the Digital Applied sciences Group.

Within the Flight Help Group, HEICO is targeted on offering complete aviation companies and merchandise aimed toward enhancing plane effectivity, security, and upkeep. This group provides a variety of essential elements, repairs, overhauls, and logistics companies important for airways, plane operators, and upkeep, restore, and overhaul amenities worldwide.

Within the Digital Applied sciences Group, HEICO specializes within the design, manufacturing, and distribution of digital, microwave, and electro-optical elements and subsystems. These are sometimes ‘mission-critical‘ merchandise which cater to a wide selection of industries together with protection, aerospace, medical, telecommunications, and different high-reliability sectors. ETG’s choices are necessary in purposes like radar programs, missile steerage, communication networks, and medical imaging.

Traditionally, the Flight Help Group and the Digital Applied sciences Group had a 60/40 cut up when it comes to income segmentation, however the Digital Applied sciences Group has now grown to 44% of revenues.

Background

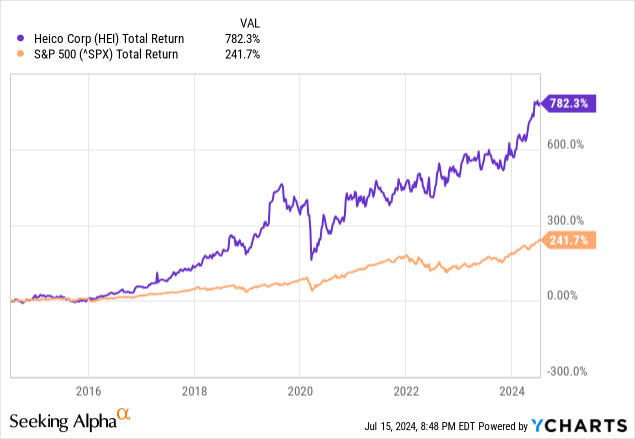

HEICO has been the most effective performing shares over the long-run, typically being referred to as a ‘compounder’ due to how properly it’s been in a position to allocate capital and compound money flows. Together with dividends, shares of HEICO have delivered a complete return of 782%, whereas the general market (S&P 500) has returned 24.3%. HEICO’s spectacular complete return over this era is 242% on a compounded annualized foundation, which is roughly equal to the speed it has grown its money flows over time.

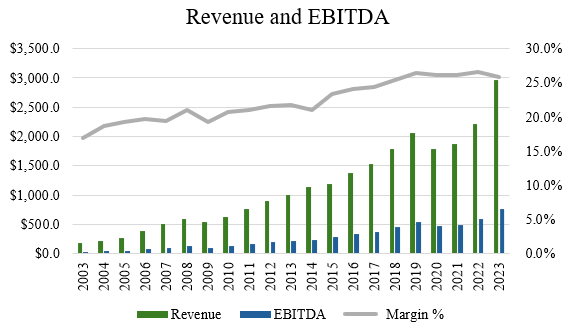

We see this demonstrated on each the highest and backside line. During the last 20 years, the corporate has grown revenues and EBITDA at CAGRs of 15.2% and 17.6%, respectively. Within the final decade, the corporate has grown revenues at 11.4% and EBITDA at 13.4% (supply: S&P Capital IQ). As proven by the steadily rising gray line under, HEICO has been in a position to eke out margin enlargement over time.

Writer, primarily based on information from S&P Capital IQ

Margin Enchancment

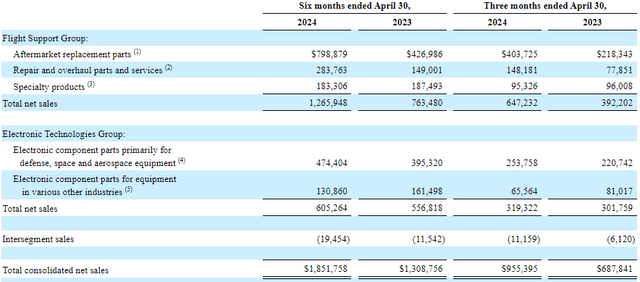

Once we take a look at HEICO’s Q2’24 outcomes, the corporate gross sales of $955 million, up 38.9% yr over yr for a small beat of $4 million, so gross sales had been in step with consensus. EPS got here in at $0.88, beating consensus estimates by 6 cents.

Firm Filings

Once we take a look at what drove outcomes, natural development was up 8%, 12% within the Flight Security Group and 4% within the Digital Applied sciences Group. The natural development was largely attributable to greater demand for aftermarket substitute components, in addition to extra demand for aerospace merchandise.

For my part, the actual spotlight this quarter was on robust margin efficiency in each FSG and ETG, beating consensus by 150bps (supply: S&P Capital IQ). Throughout the quarter, the corporate posted section working margins of 23.0% in FSG and 23.6% in ETG.

Though administration didn’t formally change its outlook for margins, the corporate did spotlight that a lot of its enterprise leaders are identified to supply very conservative estimates saying that “they sandbag their outlook.” Regardless of FSG margins for the primary half of the yr now at 22.5%, administration didn’t wish to elevate FY24 FSG margins above its earlier information of 21-22% for FY’24 as they talked about potential headwinds as combine might normalize from the present power in aftermarket components.

The corporate is concentrating on a long-term FSG margin of ~22%. ETG margins appear poised for additional quarters of ~24%, even when FY’24 doesn’t attain 24%. Administration made certain to deliver its sandbagging jokes full circle, highlighting the emphasis that its enterprise leaders absorb assessing dangers throughout the enterprise. Nonetheless, for my part, I view the corporate’s outlook as conservative and would assign the next likelihood to the corporate beating consensus estimates on the upside.

Enhancing Finish Markets

For the quarter, one of many massive highlights throughout HEICO’s Q2’24 was 21% natural development in aftermarket substitute components inside FSG. On the earnings name, administration estimated the expansion between product penetration and new product gross sales had been roughly equal. My estimation is that with tailwinds from recession-resilient demand in FSG finish markets, I additionally suppose that HEICO is probably going gaining share from opponents within the components enterprise. That is backed up by administration’s commentary that throughput is proscribed within the MRO enterprise, on account of sure components provide constraints. This has been a recurring theme all through industrial aftermarket firms this earnings cycle and is on full show on TransDigm’s earnings calls too.

HEICO additionally appears to be benefiting on the pricing facet, as was famous by administration on the earnings name. They didn’t break down how a lot pricing contributed, however whereas that is nearly actually considerably lower than 1 / 4 of the natural development (name it mid-single digits of the 21% in industrial components), it is a very optimistic tailwind for the enterprise.

Traditionally, due to the character of the corporate’s enterprise mannequin, HEICO has been in a position to move on greater prices to its clients. Administration emphasised that it’s been profitable on this entrance, however present pricing relative to OEM costs is at an all-time low given OEMs’ latest aggressive worth will increase.

I don’t view this to be a worth enhance story, however I shall be watching within the quarters forward to see what the corporate has to say on pricing. To me, having regular demand coming from quantity fairly than worth appears to be extra sustainable. In comparison with a peer like TransDigm, HEICO is sort of actually much less aggressive, given the truth that it hasn’t been within the regulatory highlight almost as a lot.

In ETG, double-digit natural development of aerospace merchandise was spectacular, however in step with the overall theme of better-than-expected gross sales for protection firms this earnings cycle. Nonetheless, administration continues to anticipate lumpiness in protection gross sales however sees a powerful setup into FY’25 given a powerful backlog in protection. Weak spot in non-aerospace and protection markets inside ETG partially offset robust development in protection, largely because of elevated buyer stock channels, so we’d anticipate to see a couple of extra quarters of detrimental comparisons on this market.

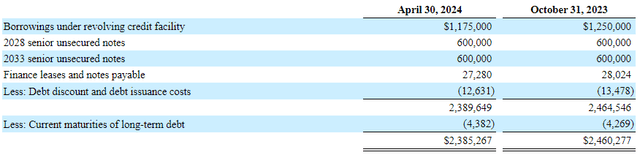

Versatile Stability Sheet

From a stability sheet perspective, HEICO has a modest quantity of leverage in its capital construction. At quarter finish, the corporate had $204 million in money towards $2.39 billion in long-term debt, for web debt of $2.19 billion. On trailing twelve-month EBITDA of $893 million, the corporate has a Web Debt to EBITDA ratio of two.45x.

Firm Filings

Whereas which will appear excessive, in comparison with non-public firms or their closest peer TransDigm, the leverage appears to be fairly cheap. It’s additionally decrease than the place it was in October 2023 at 3.04x. Put up the Wencor acquisition (a $2.1 billion deal introduced in Could 2023), administration expects to be on monitor to get their leverage all the way down to 2.0x inside the subsequent 1 to 1.5 years.

Traditionally, in contrast to TransDigm which aggressive in taking up debt, HEICO has used debt, however has been extra aggressive in paying off that debt once they haven’t made a sequence of acquisitions (many of the latest debt was taken on for the Wencor deal). As an acquisitive firm, subsequent to money circulation, HEICO’s stability sheet is an important to watch to make sure that the corporate can maintain extra leverage for brand new offers.

Concerning dangers to the funding thesis, the primary one can be on valuation (which I’ll focus on shortly). As for the trade and company-specific dangers, HEICO is delicate to the tempo of the air journey restoration post-COVID-19, provide chain disruptions and materials lead occasions, and a capability to rent the required human capital to assist development goals and alternatives. There’s additionally a threat that HEICO overleverages and will not have the ability to combine new acquisitions efficiently, however primarily based on their debt administration and monitor report in M&A, I view this threat to be pretty low.

Valuation and Wrap Up

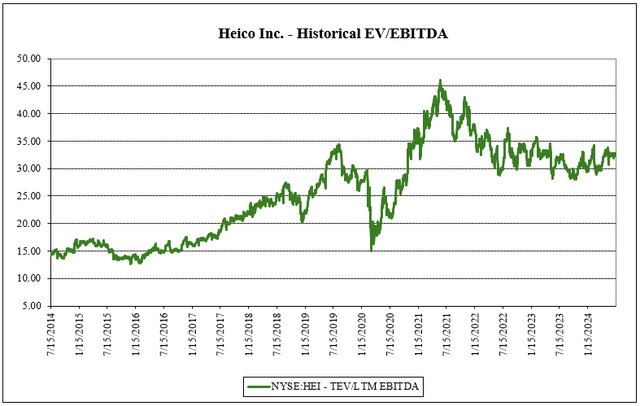

HEICO’s at all times been a fairly costly inventory. Traditionally, the corporate has traded inside a variety of 12.6x and 46.0x EV/EBITDA, and over time that a number of has crept upwards to the 32.6x a number of it’s right this moment (supply: S&P Capital IQ). With the present a number of of 32.6x above the historic ten-year common of 25.5x EV/EBITDA, HEICO appears to be fairly costly.

Writer, primarily based on information from S&P Capital IQ

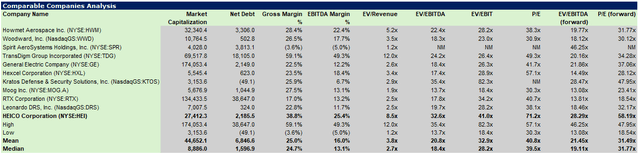

Is that this valuation justified? One solution to determine this out is to take a look at the ahead multiples and examine them to HEICO’s friends. When observing HEICO’s ahead multiples, the corporate trades at 28.3x EV/EBITDA and 58.2x, numbers that intuitively appear very costly. In comparison with friends, HEICO’s valuation multiples are above comparable firms, with the common ahead multiples of the peer group at 21.6x and 31.5x (supply: S&P Capital IQ). This appears to be because of the truth that the corporate maintains decrease leverage and has higher gross margins and EBITDA margins in comparison with its opponents.

Writer, primarily based on information from S&P Capital IQ

Primarily based on consensus estimates for EPS, HEICO is predicted to develop earnings per share at +22.8%, +17.6%, +15.0%, +12.4%, and +12.4% for all through 2024-2028, respectively. For an organization, that may seemingly develop its earnings per share within the mid-teens long-term, paying a 31.5x may be justified; nonetheless, I imagine that shares are more than likely priced for perfection. So whereas the outlook seems to be stable and the corporate has been an amazing performer through the years, I’d seemingly keep away from shares for now. At round 22-25x EV/EBITDA (nearer to friends and in step with its historic common multiples), I’d contemplate shopping for shares. This is able to suggest a worth vary between $152 and $175. Till then, I charge shares as a ‘maintain.’