Grupo Aeroportuario del Centro Norte: A Purchase Regardless of Headwinds (OTCMKTS:GAERF)

Feverpitched

In Might, I reiterated my purchase ranking for Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (OMAB, GAERF) and connected a $99 value goal to the identify. Nonetheless, the inventory has not carried out because it declined practically 30 %. This, I imagine, was pushed by decrease site visitors recorded and the depreciation of the Mexican pesos. On this report, I analyze probably the most current earnings, spotlight dangers and alternatives, and revisit my valuation case for Grupo Aeroportuario del Centro Norte.

Why Our Grupo Aeroportuario Del Centro Norte Evaluation Issues To You As An Investor?

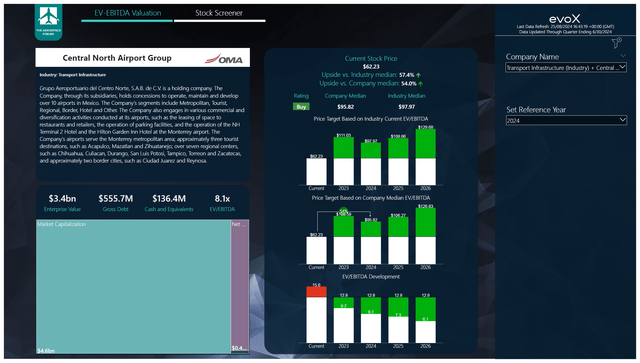

Grupo Aeroportuario Del Centro Norte is one in every of over 100 names that I cowl which profit from an intensive qualitative and quantitative analytical course of. With that analytical rigor, we analyze every firm in our protection portfolio and as a substitute of evaluating names, we developed an analytical mannequin that makes use of a wide selection of enter variables. We use it to supply each identify with a valuation and multi-year inventory value goal cadence primarily based on an EV/EBITDA valuation towards the corporate’s median EV/EBITDA a number of and the peer group a number of.

Other than a multi-year value goal primarily based on these multiples, we additionally rating every inventory with a ranking system that features a mixture of things. These embrace earnings development, historic efficiency towards the broader markets, and anticipated upside of shares towards the long-term historic index development charge of inventory markets. By doing so, the names in our protection profit from a unified method to figuring out rankings and calculating inventory value targets. Thus, we don’t have to match all 100 names in our portfolio to determine which identify is extra enticing.

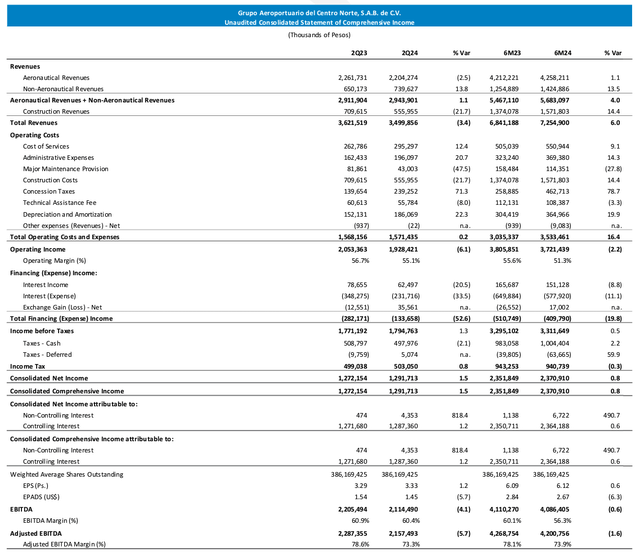

Grupo Aeroportuario Del Centro Norte: Income Strain, Larger Prices However Higher Adjusted Margins

Through the second quarter, complete revenues decreased 3.4% pushed by decrease aeronautical revenues and decrease development prices. Provided that development prices are totally offset in the fee stability, it’s extra significant to contemplate the revenues excluding development prices, which rose 1.1%. Provided that there was a 2.5% lower in passenger site visitors pushed by a 4.3% decline in home passenger site visitors partially offset by a 12.4% development in worldwide passenger site visitors, the income development was not a foul factor. Engine points, as mentioned within the danger part of this report, had been the primary driver of decrease passenger numbers. This isn’t a discount in demand, however a discount within the skill of airways to produce. Whole working bills remained secure as increased concession taxes, administrative bills, value of companies, depreciation, and amortization had been partially offset by decrease upkeep provisions, decrease development prices, and decrease help charges.

Excluding development prices, the working bills elevated 18.3% and working revenue decreased 6.1%. Adjusted EBITDA declined by 5.7% receiving some tailwind from the exclusion of the D&Part of the prices and the adjustment for the surplus concession tax paid. So, Adjusted EBITDA declined, however margins had been up, which leads us to the conclusion that in a somewhat robust atmosphere with restricted top-line development and better prices, we’re nonetheless seeing increased adjusted margins.

What Are The Key Dangers And Alternatives For Grupo Aeroportuario Del Centro Norte?

For OMA, there are a number of dangers and alternatives. Beginning with the dangers, the regulatory atmosphere in Mexico may look risky and that would both lead to strain on outcomes or key buyers on the sidelines. In October, the Mexican authorities determined to enhance the concession tax for non-government operators from 5 to 9 % of gross revenues, and that clearly has an influence on outcomes. For OMA, that applies to the aeronautical revenues solely. On the similar time, we be aware that at the moment there may be an extra concession tax being paid, which was 4 % for the second quarter, and beginning in 2026 that extra concession tax will reverse by most tariffs. The Mexican authorities can also be on the lookout for decrease use charges, which might lower the fee for vacationers, because the use charges are a part of the dealing with prices paid on tickets.

How this precisely will play out is unknown. I imagine that airport operators will adapt to it and stay enticing for funding. Nonetheless, within the worst-case state of affairs, this can be a manner for the Mexican authorities to supply itself with extra liquidity and pressure airport operators out of their concessions, after which the concession may very well be taken over by government-controlled entities.

The second danger is the danger of opposed climate influence on journey infrastructure and flights. Whereas opposed climate is a danger that many corporations face, it ought to be stored in thoughts even when there may be enough insurance coverage protection and pressure majeure clauses in place to catch off related dangers.

Presently, the home passenger numbers in Mexico are underneath strain as a result of grounding of airplanes geared up with the GTF engines from RTX. In a earlier piece, I mentioned the influence on Volaris, and on the time of writing 35 airplanes with troubled engines are nonetheless grounded whereas Viva Aerobus additionally has round 25% of its fleet grounded. That gives near-term strain however with wholesome prospects for home site visitors in Mexico that may present a possibility as soon as these airplanes are put again into service once more.

The largest alternative for OMA is the nearshoring pattern. OMA operates the airport of Monterrey, which is within the middle of nearshoring in Mexico and also needs to add vital development to its diversification enterprise equivalent to actual property, warehousing, and cargo and logistics. The chance for that nearshoring pattern clearly is that whereas corporations are attempting to maneuver away from China for manufacturing, any international financial cooldown may additionally halt investments to comprehend new amenities in Mexico.

We also needs to be conscious of the danger of forex fluctuations. Usually, a depreciation of the Mexican peso versus the greenback (MXN:USD) has a optimistic influence impact on worldwide charges which can be collected in USD in addition to the US-denominated money balances and transformed to pesos. The conversion of US-denominated debt and prices will increase the debt and prices when transformed. That can also be one of many foremost contributing components to the inventory value decline not too long ago.

OMA Inventory Affords Alternative For Basically Pushed Share Worth Restoration

The Aerospace Discussion board

To find out multi-year value targets, The Aerospace Discussion board has developed a inventory screener. It makes use of a mix of analyst consensus on EBITDA, CapEx, and free money movement together with the latest stability sheet information, money movement statements, and my assumptions on debt reimbursement, share repurchases, and dividends. Every quarter, we revisit these assumptions and replace accordingly and if want be, we complement our estimates if key objects equivalent to, for instance, acquisitions should not mirrored in estimates but. The estimates should not primarily based on any steering offered by the businesses we cowl, however by a powerful mixture of consensus and my estimates.

Estimates for EBITDA have come down by round 10% for 2024-2026, and that largely displays the depreciation of the MXN towards the USD. Pushed by an unsure grasp schedule improvement plan and tariffs, the free money movement estimates have come down by round 20%, which once more, partially, displays pressures when changing the estimated pesos quantities again to USD balances. Nonetheless, our inventory screener nonetheless returns a purchase ranking with a value goal of $95 as a substitute of $99. That will nonetheless suggest a 54% upside, and even when we might assign half of the upside to account for the dangers which can be at the moment being confronted, there nonetheless is a 27% upside.

How To Purchase OMA Inventory?

Grupo Aeroportuario Del Centro Norte inventory could be purchased underneath the ticker GAERF which displays the strange share. Nonetheless, there may be barely any quantity and liquidity in GAERF and the inventory trades OTC. So, that would present some accessibility points or points to purchasing and promoting at desired portions and costs. Subsequently, shopping for OMAB listed on the NASDAQ and representing 8 strange shares may be extra interesting because it supplies considerably higher volumes. Whereas I don’t see any clear purpose to take action, one may additionally elect to purchase the inventory straight from the Bolsa Mexicana de Valores (BMV: OMA B).

Conclusion: OMA Faces Some Operational And Regulatory Uncertainties

With the engine points confronted by some airways that function in some OMA airports, we now have seen home site visitors declines. Whereas we at the moment are across the peak of the variety of airplanes that will likely be grounded globally, this can be a strain that may seemingly stay for some time. On a optimistic be aware, these points ought to get higher and never worse and should not reflective of demand, and we additionally see that worldwide site visitors continues to develop, which additionally supplies considerable dollar-denominated money flows. Whereas there are also uncertainties concerning the utmost tariffs in future years, I additionally do assume we must always needless to say its airport in Monterey, OMA remains to be positioned extraordinarily properly to capitalize on nearshoring developments. These will drive the aviation companies and supply development alternatives for OMA’s diversification companies equivalent to warehouses, actual property, cargo, and logistics. So, with all of that in thoughts, I proceed to charge Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. inventory a purchase.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.