Gladstone Capital: Simply Pause For Now (NASDAQ:GLAD)

PM Photos

Gladstone Capital (NASDAQ:GLAD) is a BDC that has benefited considerably from rising rates of interest. Round 94% of GLAD’s funding portfolio is made up of floating price investments which have seen ever-increasing web funding revenue [NII] for the BDC amidst a rising charges surroundings. Nevertheless, this greater price surroundings is more likely to finish quickly, with some decline in rates of interest more and more possible. Whereas these decrease charges are more likely to have a destructive impression on NII, the dividend seems protected in the meanwhile. Nonetheless, the BDC’s elevated valuation stage sees me score GLAD as a maintain in the meanwhile.

The portfolio and danger administration

Most BDCs present some sort of reporting on inside danger rankings on portfolio investments. Gladstone likewise reviews on inside danger rankings. Nevertheless, in contrast to different BDCs which I’ve lined corresponding to Hercules Capital (HTGC) and Trinity Capital (TRIN), Gladstone doesn’t present detailed reporting on portfolio actions between totally different danger score classes. As an alternative, Gladstone solely reviews on the bottom danger score assigned to any funding, the very best danger score assigned, the typical danger score and the chance weighted common score of the portfolio as an entire.

Whereas that is much less precious than the extra detailed reporting offered by another BDCs, it nonetheless affords essential perception into will increase in portfolio danger. In Gladstone’s newest 10Q report, the chance administration system is defined:

the Adviser makes use of a proprietary danger score system. Whereas the Adviser seeks to reflect the NRSRO techniques, we can’t present any assurance that the Adviser’s danger score system will present the identical danger score as an NRSRO for these securities. The Adviser’s danger score system is used to estimate the likelihood of default on debt securities and the anticipated loss, if there’s a default. The Adviser’s danger score system makes use of a scale of 0 to >10, with >10 being the bottom likelihood of default. It’s the Adviser’s understanding that almost all debt securities of Decrease Center Market corporations don’t exceed the grade of BBB on an NRSRO scale, so there could be no debt securities within the Decrease Center Market that will meet the definition of AAA, AA or A. Subsequently, the Adviser’s scale begins with the designation >10 as the very best danger score which can be equal to a BBB from an NRSRO; nevertheless, no assurance might be given {that a} >10 on the Adviser’s scale is the same as a BBB or Baa2 on an NRSRO scale. The Adviser’s danger score system covers each qualitative and quantitative points of the enterprise and the securities we maintain.”

In its most up-to-date earnings report, the weighted common danger score of the portfolio improved from 7.5 within the earlier quarter to 7.7. It is a promising improvement provided that the persistently high-rate surroundings has lengthy been anticipated to pose a problem to BDCs by way of deteriorating asset high quality, given the challenges some debtors face in assembly their credit score commitments. Fitch has just lately indicated that the BDC sector as an entire has confronted elevated asset high quality dangers in latest quarters.

In keeping with Fitch, the BDC sector as an entire reported a median decline in web asset worth (NAV) of round 0.7% and an business common non-accrual price of round 1.4% at truthful worth. In its most up-to-date quarter, GLAD noticed a 2% improve in NAV, which though not notably excessive is kind of a bit greater than the business common. Nonetheless, the BDC’s non-accrual ranges at round 2.1% of the portfolio is considerably greater than the business common.

The security of the dividend

In latest months, a number of Looking for Alpha analysts have expressed concern over GLAD’s potential to keep up its comfy dividend protection ought to rates of interest decline. The Gaming Dividend just lately noticed that “if rates of interest are minimize and web funding revenue is negatively impacted, there’s an opportunity that the distribution would now not be capable of be supported by GLAD’s portfolio investments.” These legitimate issues come up from the BDC’s robust reliance on floating price investments which have considerably benefited from the high-interest price surroundings.

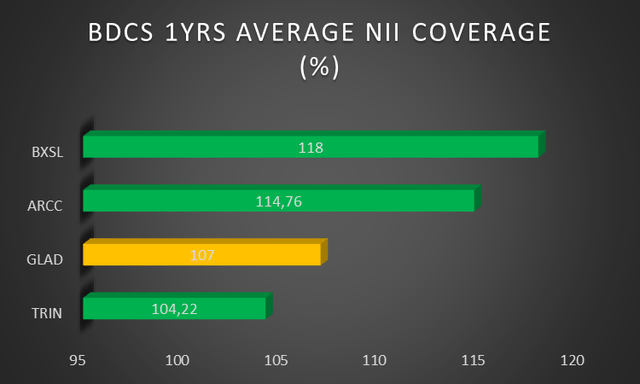

Nevertheless, as The Gaming Dividend additionally appropriately observes, there may be little danger of a dividend minimize within the rapid time period provided that the dividend remains to be comfortably lined by web funding revenue (NII). In its most up-to-date quarter, the BDC reported a dividend totally lined by NII with an NII protection ratio of round 111%. The 1-year common NII protection ratio can also be round 107% indicating that the dividend remains to be properly lined.

Writer created primarily based on information from BDC Universe

Nonetheless, buyers would want to observe price developments carefully as quicker than anticipated price cuts may see a considerable decline in GLAD’s NII provided that greater than 90% of its portfolio consists of floating price investments. The present dividend might not be sustainable ought to rates of interest decline considerably within the months forward. At current, I don’t anticipate a considerable drop in rates of interest within the close to time period, albeit that some rate of interest cuts are more and more anticipated within the months forward. The Secured In a single day Financing Price [SOFR] price, which is the speed utilized by GLAD to hyperlink its portfolio’s rates of interest to, has already declined from a 3-month excessive of round 5.4% on the finish of June to round 5.34%.

Valuation

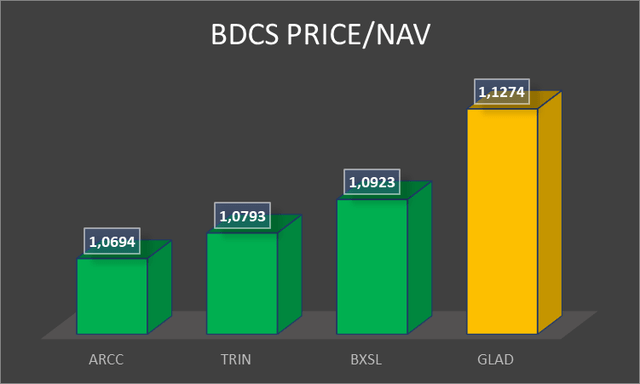

GLAD is at the moment buying and selling at a premium to NAV of slightly below 13%, which is the very best of the BDCs thought of within the peer comp chart under. It is usually broadly according to the BDC’s three-year common premium to NAV of round 12.7%. Nevertheless, for my part, the chance of rate of interest cuts has not been adequately priced into GLAD’s valuation.

Writer created primarily based on information from BDC Universe

The premium to NAV is far greater than that of BDCs whom I consider to be higher positioned to keep up their dividends even within the occasion of price cuts, corresponding to Ares Capital (ARCC). Given this actuality, I at the moment price GLAD as a maintain.

Conclusion

The development in GLAD’s weighted common danger score of its portfolio presents a constructive improvement and alerts that the BDC may properly retain the low non-accrual ranges at the moment reported. Nevertheless, for my part, GLAD instructions a premium to NAV that’s too excessive given the present danger of declining NII as rates of interest come down. Whereas the dividend is unlikely to be minimize within the close to time period, the BDC doesn’t have a big cushion to keep up the dividend ought to charges decline quicker than anticipated. Given these components, I at the moment contemplate GLAD a maintain.