GEO Group: Debt Refinancing Presents Worth And Revenue Alternative (NYSE:GEO)

Darrin Klimek

The GEO Group (NYSE:GEO) is an actual property firm that focuses on partnering with governments to supply correctional and group re-entry services and companies. The corporate eradicated its dividend and switched from a REIT to a C-Corp after a heavy debt load threatened profitability. After a debt change, the corporate started to bounce again and earlier this 12 months, I wrote about GEO Group’s debt yielding 10%. Now, the corporate is embarking on a broad refinancing, and I consider it’s time to modify over to shares.

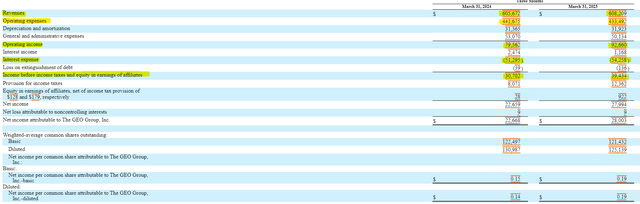

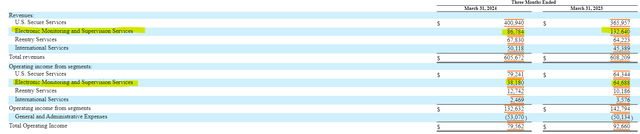

GEO Group’s First Quarter Earnings

GEO Group’s first quarter revenue assertion confirmed some pullback from 2023. Income was primarily flat, however working bills and SG&A bills rose and led to a $13 million drop in working revenue. Curiosity bills fell barely from a 12 months in the past, nevertheless it was not sufficient to cease a $9 million or greater than 20% slide in revenue earlier than taxes. GEO Group did see income development in three out of its 4 segments, with Digital Monitoring down closely on lower-than-expected volumes.

SEC 10-Q

SEC 10-Q

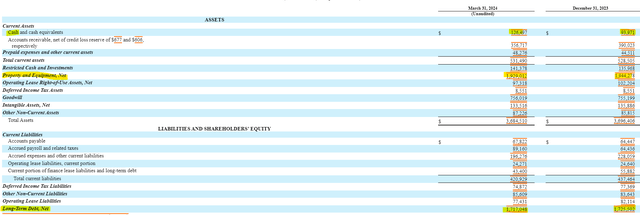

On the steadiness sheet facet, little modified within the first quarter. GEO Group holds about $1.9 billion in internet property in opposition to $1.7 billion in long-term debt. The corporate’s money steadiness rose to $126 million. GEO Group does have roughly $1.3 billion in shareholder fairness, nevertheless it’s essential to notice that just about $900 million of that’s derived from intangible belongings and goodwill.

SEC 10-Q

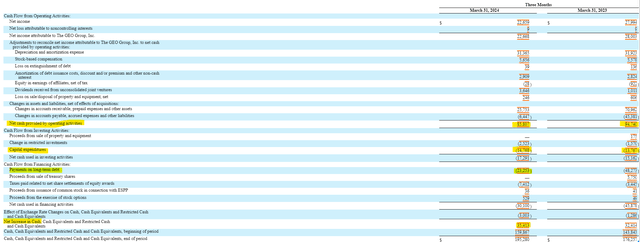

Essentially the most promising monetary assertion from the GEO Group is the money stream assertion. Whereas working money stream dropped to $86 million from $95 million a 12 months in the past, free money stream remained sturdy at $70 million within the first quarter. The corporate’s free money stream allowed it to pay down $23 million in long-term debt and increase its money available. GEO Group is demonstrating that it will probably generate money to deleverage and construct shareholder worth.

SEC 10-Q

The Particulars Behind GEO’s Refinancing

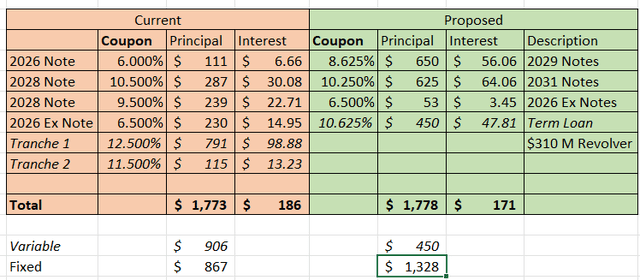

Following the top of the primary quarter, however earlier than the earnings report, GEO entered into an settlement to subject $1.275 billion in senior notes in a personal providing. $650 million of those notes would carry a coupon of 8.625% and mature in 2029 whereas the remaining $625 million would carry a coupon of 10.25% and mature in 2031. The corporate additionally entered right into a $450 million time period mortgage facility with a variable rate of interest dependent upon SOFR.

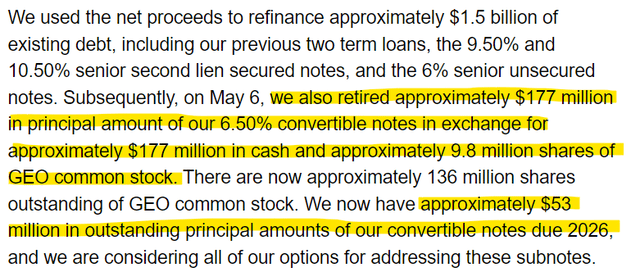

The funds from these proceeds could be used to repay the 2026 and each 2028 notes, together with the 2 tranche loans. The one debt being carried over after the refinancing is the 6.5% exchangeable notes due in 2026 and administration reported on the earnings name that a few of them had been purchased again within the first quarter.

Earnings Name Transcript

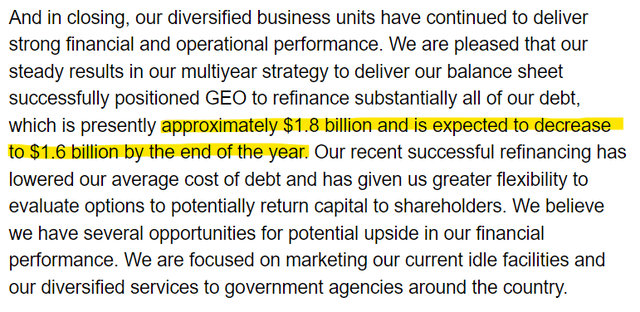

Primarily based on the data supplied within the refinancing launch and the earnings name, it seems that GEO Group’s debt gained’t change materially, however its curiosity expense will drop barely. Whereas the inventory value didn’t present numerous pleasure relating to this transfer, administration reiterated its dedication to lowering debt and estimated a further $200 million could be paid off this 12 months.

Creator Calculations

Earnings Name Transcript

Why the Debt Refinancing Issues to Shareholders

Whereas a debt deal could also be seen as boring by traders, GEO Group administration identified through the convention name that they now have the pliability to contemplate returning capital to shareholders. This may be achieved by shopping for again shares or reinstating the dividend. The prior debt construction had strict limits on such transactions. Buyers ought to see the potential of share buybacks or dividends together with the dedication to deleverage as a twin worth and revenue alternative for proudly owning GEO Group inventory.

Earnings Name Transcript

Dangers to GEO Group

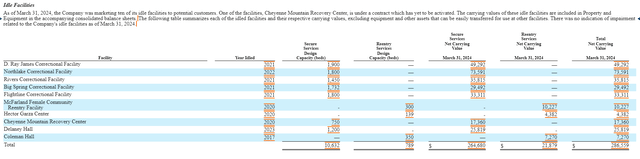

GEO Group’s enterprise mannequin facilities round partnerships with models of presidency, whether or not native, state, or federal. Due to this construction, there’s at all times political danger. Privately owned prisons had been a sizzling political subject previous to the pandemic, and the upcoming election might influence Geo Group’s enterprise. There may be additionally the truth that $286 million price of belongings are idled, after the idling of Delaney Corridor final 12 months.

SEC 10-Q

Whereas political dangers are a sensible risk, traders needs to be aware of our society’s want for detention services and GEO Group’s digital monitoring and group re-entry companies, each of which might be complimentary if the political local weather adjustments in opposition to one in favor of the opposite. As for the idled services, administration acknowledged on the primary quarter convention name that they’re actively working to market their services to new authorities companions.

Conclusion

GEO Group has come a far method from the corporate that needed to pull a distressed debt change. Since then, the corporate has targeted on producing constructive free money flows and deleveraging. The fruits of their labor just lately paid off with a debt refinancing that pushed main maturities again to 2029 and 2031, locked extra debt into a hard and fast price, and decreased curiosity bills. The addition of choices to purchase again inventory or pay dividends is equally engaging. Whereas no revenue is assured, traders holding money from their just lately retired debt might need to think about buying shares for the worth and revenue alternative forward.