First Interstate BancSystem: Huge Dividend Yield, However Pretty Valued (NASDAQ:FIBK)

We Are

At this time, we put First Interstate BancSystem, Inc. (NASDAQ:FIBK) within the highlight for the primary time. This conventional financial institution holding firm has seen some latest insider shopping for in its inventory. The shares additionally carry a giant dividend yield. An evaluation follows under.

Firm Overview:

This financial institution holding firm has been round since 1971 and is headquartered in Billings, MT. The corporate by means of its 304 branches provides a variety of banking services and products similar to checking, financial savings and time-deposits to particular person in addition to loans. It additionally gives quite a lot of totally different mortgage and different merchandise to small and mid-size firms together with in industrial actual estates, agricultural, and many others. The inventory at the moment trades simply over $30.00 a share and sports activities an approximate market capitalization of $3.1 billion. The financial institution had simply over $30 billion in belongings and $22.9 million in deposits as of the top of the primary half of 2024.

Second Quarter Outcomes:

The financial institution posted its Q2 numbers on July twenty fifth. First Interstate BancSystem, Inc. delivered GAAP earnings of 58 cents a share, three pennies a share above expectations. Web earnings was $60 million in Q2. Revenues did decline almost seven p.c on a year-over-year foundation to $244.3 million, virtually $2 million under the consensus.

July 2024 Firm Presentation

Deposits elevated slight ($60.7 million) through the quarter and internet curiosity margins enhance seven foundation factors sequentially to 3 p.c. Web revenues from non-interest earnings rose 1.2% from the primary quarter to $42.6 million. Web curiosity earnings rose $1.6 million from the prior quarter to $201.7 million.

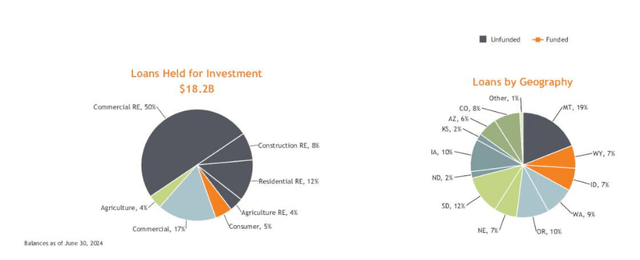

Mortgage Portfolio:

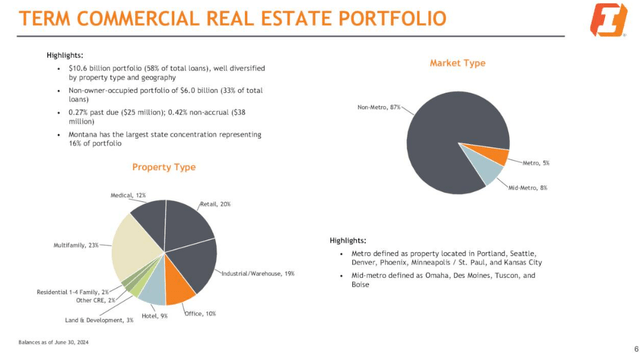

Slightly below 20% of its mortgage e book within the state of Montana. It additionally serves main metro areas similar to Phoenix, Seattle, Denver, Kansas Metropolis and Minneapolis. Now, some 58% of the loans FIBK has saved on its books or $10.6 billion is round industrial actual property or CRE.

Given the rising delinquency charges is a few classes of CRE, particularly workplace collateralized loans the place workplace values are plummeting, that may be a concern. Nevertheless, solely 10% of the mortgage e book in CRE is towards workplace properties, one other 20% is in Retail which has important however lesser challenges in the meanwhile. Now it ought to be famous that roughly 30% of CRE debt is held by regional banks, which additionally generate round 70% of total CRE loans. I might be extra fearful a couple of regional financial institution like Financial institution OZK (OZK) which I posted an in-depth article round in late Might. It seems to have considerably extra publicity than First Interstate BancSystem to the riskier areas of CRE similar to development lending going to construct the huge variety of new skyscrapers going up in Miami for instance.

Business Mortgage Backed Securities (CMBS) Delinquency Charges (Trepp)

Now, as an article right here on Looking for Alpha in August identified, First Interstate BancSystem have to make intensive use of the BTFP (Financial institution Time period Funding Program) credit score facility because of the unrealized losses on its bond portfolio. This comparatively excessive value of funding was made out there by the Federal Reserve after the second, third and fourth largest financial institution failures in U.S. historical past within the first half of 2023. FIBK nonetheless has simply over $2.4 billion from that facility that might be paid within the coming quarters.

Mortgage balances elevated by $32.2 million within the quarter. Development loans fell whereas Business and Industrial loans rose by simply over $130 million. The CFO was pointed in noting solely .65% of the financial institution’s mortgage e book was on ‘Metro Workplace‘ properties. Frequent fairness Tier 1 capital elevated by 16 foundation factors to 11.53%. The financial institution’s capital construction and mortgage loss reserves appear to be they’re fine condition.

July 2024 Firm Presentation

July 2024 Firm Presentation

Analyst Commentary & Insider Shopping for:

The present view from the analyst neighborhood skews detrimental. Since second quarter outcomes hit the wires, D.A. Davidson, Barclays ($31 value goal, up from $29 beforehand), Wells Fargo ($30 value goal, up from $25 beforehand) and KBW ($31 value goal, up from $29 beforehand) maintained Maintain rankings, however most boosted their value targets. Stephens ($36 value goal, up from $32 beforehand) and Piper Sandler ($37 value goal) reissued Purchase rankings on FIBK.

The financial institution’s CEO did add a internet $125,000 to his holdings in late July and early August. The final insider buy within the inventory was in June of 2023 by the identical particular person and the inventory did achieve some 25% over the subsequent six months. Solely two p.c of the excellent float within the inventory is at the moment held quick.

Conclusion:

First Interstate BancSystem made $2.48 a share on 989 million of income in FY2023. The present analyst agency consensus has income falling a bit in FY2023 to $2.32 a share on $994 million in gross sales. In FY2025 they see income rebounding to $2.53 a share on income progress of six p.c.

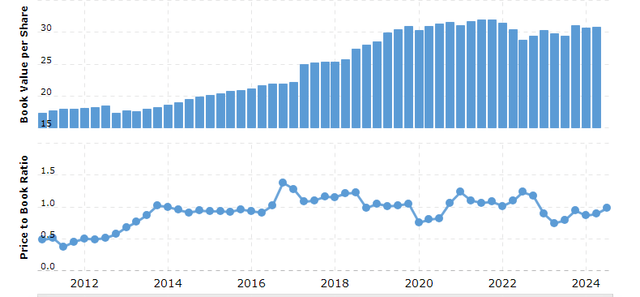

The inventory trades at roughly 13 instances ahead earnings. It is a cheap valuation contemplating the shares even have a 6.2% annual dividend yield. It ought to be famous that based mostly on this 12 months’s projected EPS, FIBK’s dividend payout ratio is over 80%. That means, there’s unlikely to be significant progress in quarterly dividend payouts within the coming years.

Outdoors the dividend yield, the inventory’s valuation just isn’t compelling on condition that EPS in FY2025 is projected to be not that a lot above FY2023 and income ought to fall barely this fiscal 12 months. I additionally proceed to imagine the worst is but to come back for the industrial actual property sector so far as delinquency and default charges rising effectively into 2025. This persevering with development will stay a headwind to regional banks. Lastly, the corporate’s e book worth per share (A great way to worth banks) has been very stagnant for years as might be seen under.

Due to this fact, I’m passing on any funding advice round First Interstate BancSystem presently. Now if the shares moved again right down to the $23 to $25 vary throughout a continued sell-off within the total market, and there was no notable deterioration within the financial institution’s mortgage e book, I might choose up some shares at these ranges.